Buod ng kumpanya

| Buod ng Pagsusuri ng HSBC | |

| Itinatag | 1865 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC, LFSA, ASIC (Hindi Napatunayan) |

| Mga Produkto | Mga Bahagi, mga tiwala, mga bond/certificates of deposit (CDs), mga istrakturadong produkto, mga waranti & CBBCs, IPOs, ginto, ESG at pananatiling pamumuhunan, atbp. |

| Mga Serbisyo | Banking, pamumuhunan, pautang, credit cards, pangangasiwa ng kayamanan, at seguro |

| Platform ng Paggagalaw | HSBC HK App, HSBC Reward+, HSBC HK Easy Invest, PayMe by HSBC, HSBC HK App - Lite Mode |

| Suporta sa Customer | 24/7 suporta, live chat |

| Tel: +85222333322 | |

| Address: Antas 11(B1), Pangunahing Tower ng Opisina, Financial Park Complex, Jalan Merdeka, 87000 Labuan F.T. | |

Impormasyon ng HSBC

Ang HSBC (HSBC) ay isang kilalang institusyong pinansyal na rehistrado sa Hong Kong, na nireregula ng Securities and Futures Commission (SFC) ng Hong Kong at ng Labuan Financial Services Authority (LFSA) ng Malaysia, kasama ang iba pa. Nag-aalok ito ng malawak na hanay ng mga serbisyong pinansyal, kabilang ang banking, pamumuhunan, pautang, credit cards, pangangasiwa ng kayamanan, at seguro. Bukod dito, nakatuon ang HSBC sa pagsuporta sa environmental, social at governance (ESG) at pananatiling pamumuhunan, nagbibigay sa mga customer ng maraming pagpipilian sa pamumuhunan at mga kagamitang pang-mobility.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mahabang kasaysayan | Hindi Napatunayang lisensya ng ASIC |

| Nireregula ng SFC at LFSA | Komplikadong istraktura ng bayad |

| Iba't ibang mga produkto at serbisyo | |

| Suporta sa live chat |

Tunay ba ang HSBC?

Ang HSBC ay nireregula sa ilang mga bansa at rehiyon, kabilang ang Hong Kong, ang rehiyon ng Labuan sa Malaysia, at Australia.

Sa Hong Kong, ang HSBC ay may AAA523 lisensya para sa pagtetrading ng mga kontrata sa hinaharap, na nireregula ng Hong Kong Securities and Futures Commission (SFC).

Sa Labuan, nireregula ng Labuan Financial Services Authority (LFSA) ang HSBC bilang isang Market Maker (MM), ngunit hindi ibinunyag ang numero ng lisensya.

Gayunpaman, ang lisensiyang regulado ng Australian Securities and Investments Commission (ASIC) ay hindi napatunayan.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Hongkong and Shanghai Banking Corporation Limited | Dealing in futures contracts | AAA523 |

| Labuan Financial Services Authority (LFSA) | Regulated | Hongkong and Shanghai Banking Corporation Limited | Market Maker (MM) | Hindi Nailabas |

| Australia Securities & Investment Commission (ASIC) | Hindi Napatunayan | HSBC BANK AUSTRALIA LIMITED | Market Maker (MM) | 232595 |

Ano ang Maaari Kong I-trade sa HSBC?

Nag-aalok ang HSBC ng kumpletong hanay ng mga produkto sa kalakalan, kabilang ang mga shares, trusts, bonds/certificates of deposit (CDs), structured products, warrants & CBBCs, IPOs, gold, ESG at sustainable investing, at iba pa.

| Mga Produkto sa Kalakalan | Supported |

| Shares | ✔ |

| Trusts | ✔ |

| Bonds/CDs | ✔ |

| Structured products | ✔ |

| Warrants & CBBCs | ✔ |

| IPOs | ✔ |

| Gold | ✔ |

| ESG | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Uri ng Account

Nag-aalok ang HSBC ng all-in-one account. All-in-one integrated bank account para sa deposits, credit cards, investments, insurance, at iba pa.

Mga Bayad ng HSBC

Komisyon: Libre sa Komisyon, hindi magpapataw ng komisyon ang HSBC sa kliyente.

Nag-aalok ang HSBC ng malawak na hanay ng mga serbisyong pinansiyal sa iba't ibang sektor, kabilang ang credit cards, loans, excessive overdrafts, investments, at life insurance.

Para sa karagdagang impormasyon, mag-click dito: https://www.hsbc.com.hk/fees/

| Serbisyo | Mga Bayarin at Singil | ||

| Mga Credit Card | Octopus Automatic Add Value Service (AAVS) | Ang unang pag-apply mo sa serbisyong ito ay libre. May bayad na HKD20 para sa paglipat o pag-aktiba ng serbisyong AAVS mula sa ibang bangko. | |

| Mga Pautang | Late Charge | Personal Instalment Loans | 2.25% kada buwan na kinokompyut ng araw-araw para sa mga halagang nakabuhol, plus HKD400 sa bawat installment na dahil sa kakulangan sa pondo |

| Personal Tax Loan | |||

| Revolving Credit Facility | 8% flat sa bayad na nakabuhol (minimum HKD100, maximum HKD200) plus ang Prevailing Rate | ||

| Overdrafts | Service Fee | Personal Overdraft | Taunang Bayad: 1% ng limitasyon ng overdraft kada taon (Minimum: HKD200, Maximum: HKD700) |

| HSBC One at Personal Integrated Account - Malinis na Credit | Buwanang Bayad: Pro-rated sa HKD50 batay sa porsyento ng paggamit ng limitasyon ng credit sa nakaraang buwan, maximum na HKD50 | ||

| HSBC Premier - Malinis na Credit | |||

| Seguro | Kung isusuko ng customer ang patakaran bago matapos ang termino ng patakaran, maaaring mas mababa sa halagang binayad ang makukuha ng customer. | ||

Plataforma ng Pagtetrade

| Plataforma ng Pagtetrade | Supported | Available Devices |

| HSBC HK App | ✔ | Mobile |

| HSBC Reward+ | ✔ | Mobile |

| HSBC HK Easy Invest | ✔ | Mobile |

| PayMe by HSBC | ✔ | Mobile |

| HSBC HK App - Lite Mode | ✔ | Mobile |

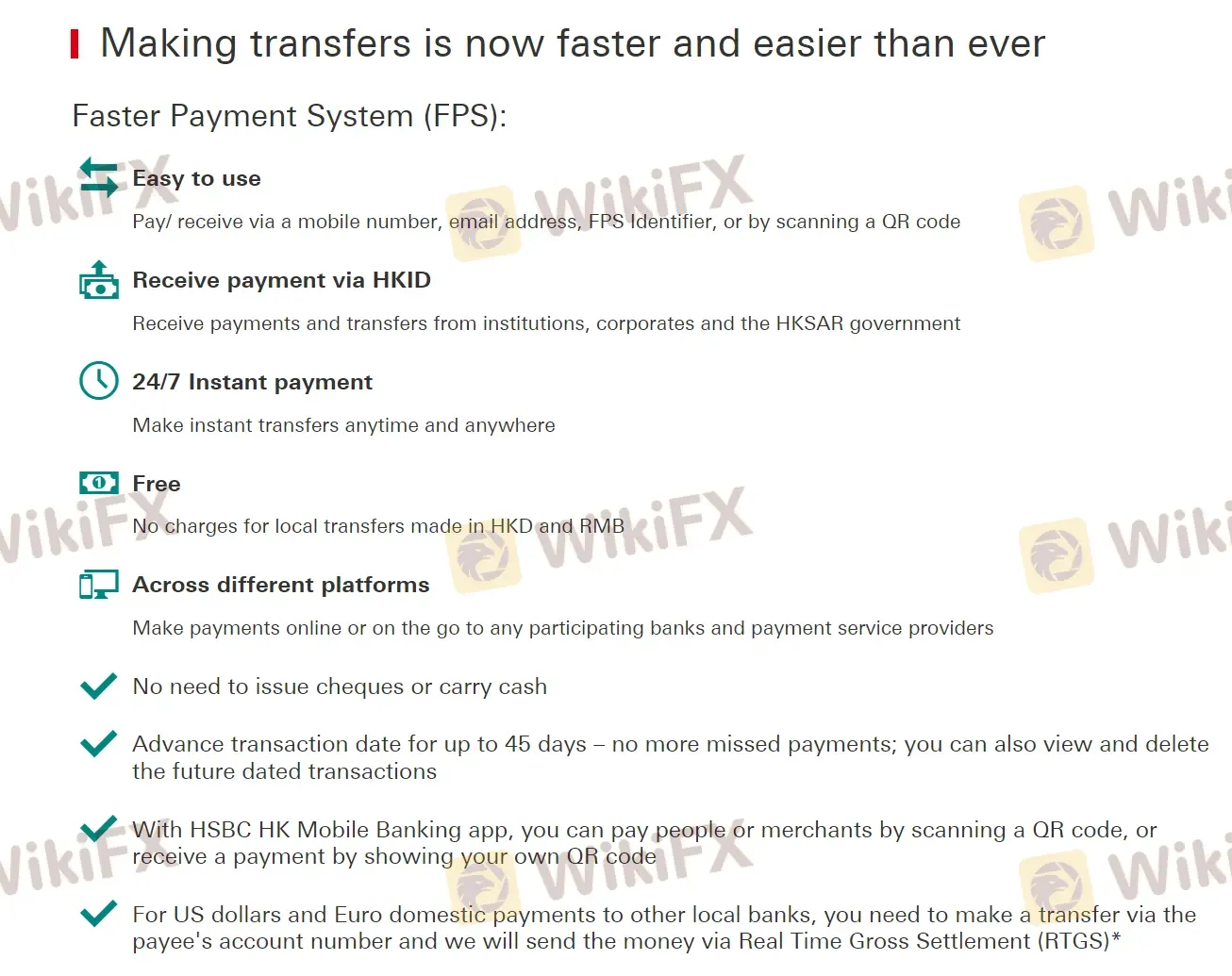

Deposito at Pagwiwithdraw

Nag-aalok ang HSBC ng mabilis na paglilipat sa pamamagitan ng Faster Payment System (FPS). Bukod dito, maaaring mag-scan ng QR code ang mga gumagamit para magpadala o tumanggap ng pera sa pamamagitan ng HSBC HK Mobile Banking app, o para sa lokal na paglilipat sa USD at EUR, real-time full settlement (RTGS) sa pamamagitan ng numero ng account.