Perfil de la compañía

| Turing Resumen de la reseña | |

| Fundado | 1996 |

| País/Región Registrado | Reino Unido |

| Regulación | No regulado |

| Instrumentos de mercado | Forex, Metales y Criptomonedas |

| Cuenta demo | Sí |

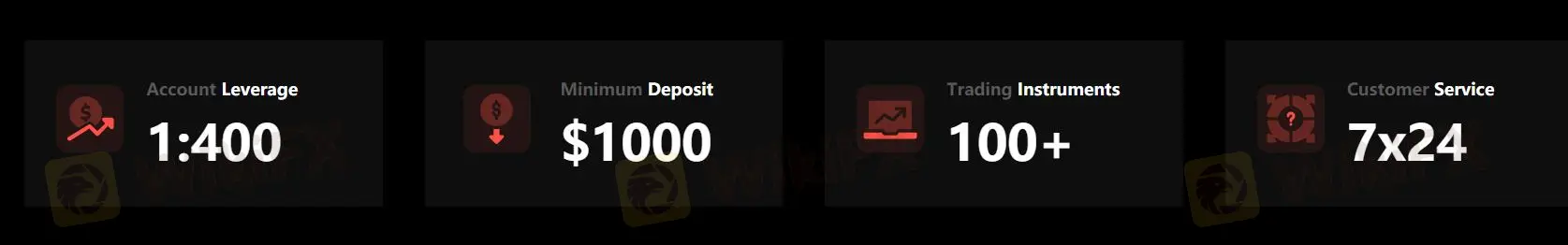

| Apalancamiento | Hasta 1:400 |

| Spread | A partir de 0.0 pips |

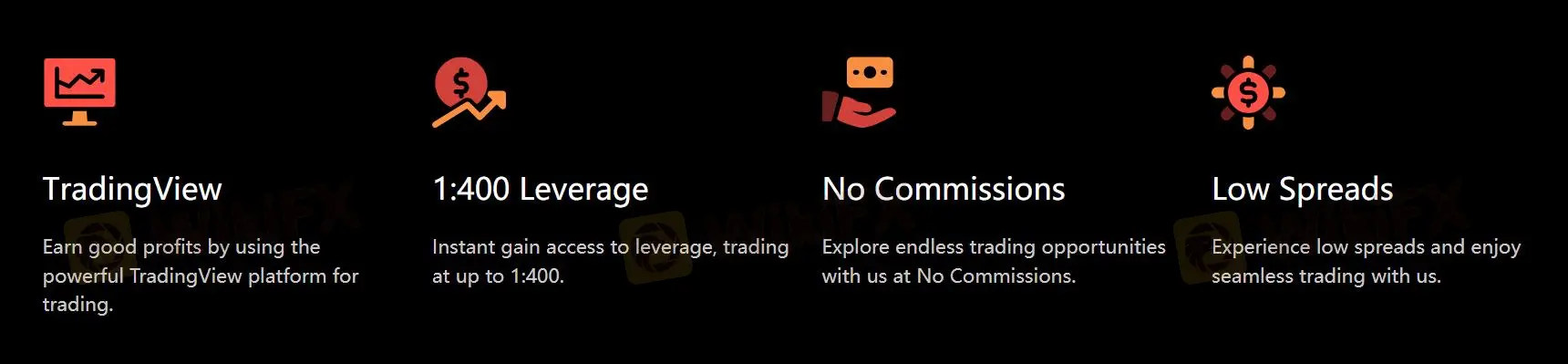

| Plataforma de trading | TradingView |

| Depósito mínimo | $1000 |

| Soporte al cliente | support@turingfx.pro |

| Soporte de chat en vivo 24/7 | |

Información de Turing

Turing es una plataforma de trading en línea que ofrece más de 100 instrumentos de trading, incluyendo Forex, Metales y Criptomonedas. Turing ofrece spreads bajos y alto apalancamiento de hasta 1:400 sin comisiones a través de la plataforma TradingView. Sin embargo, requiere un depósito mínimo alto de $1000.

Ventajas y desventajas

| Pros | Cons |

|

|

|

|

|

|

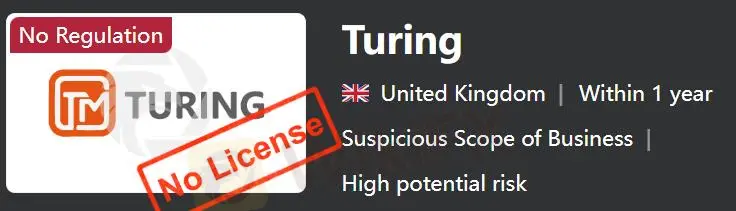

¿Es Turing legítimo?

Turing no está regulado.

¿Qué puedo operar en Turing?

Turing ofrece más de 100 instrumentos de trading, principalmente Forex, Metales y Criptomonedas.

| Instrumentos negociables | Soportados |

| Forex | ✔ |

| Criptomonedas | ✔ |

| Metales | ✔ |

| Índices | ❌ |

| Materias primas | ❌ |

| Acciones | ❌ |

Tarifas de Turing

Turing ofrece spreads bajos y alto apalancamiento de hasta 1:400 sin comisiones.

Plataforma de Trading

| Plataforma de Trading | Soportada | Dispositivos Disponibles | Adecuada para |

| TradingView | ✔ | PC y Móvil | Inversores de todos los niveles de experiencia |

Depósito y Retiro

Turing requiere un depósito mínimo alto de $1000.