简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

Abstract: Based on our research, NaFa Markets Review NaFa Markets shows all the typical signs of a fake trading company. We strongly recommend that all traders and investors completely avoid this platform. Our decision is not based on guessing but on careful analysis of real facts. The evidence shows a clever trick designed to attract unsuspecting investors and steal their money. This review will break down the methods used by NaFa Markets, giving you the information needed to protect yourself.

Based on our research, NaFa Markets Review NaFa Markets shows all the typical signs of a fake trading company. We strongly recommend that all traders and investors completely avoid this platform.

Our decision is not based on guessing but on careful analysis of real facts. The evidence shows a clever trick designed to attract unsuspecting investors and steal their money. This review will break down the methods used by NaFa Markets, giving you the information needed to protect yourself.

The main parts of our investigation, which we will explain in this report, are:

> 1. Fake Claims About Being Regulated

> 2. Unrealistic Promises of High Profits (Ponzi Scheme Signs)

> 3. Use of Misleading and Harmful Tactics

Scams like this show why checking a broker's credentials on a trusted third-party database like WikiFX is an essential first step before ever thinking about making a deposit. A real company will have a clear and checkable regulatory history. NaFa Markets does not.

Main Risk Analysis: The Evidence

This section of NaFa Markets Review goes beyond the initial warning to provide the concrete evidence supporting our assessment. Understanding *why* a broker is dangerous is key to developing the skills to identify other fake operations in the future. We will examine the primary warning signs one by one.

Warning Sign 1: Fake Regulation

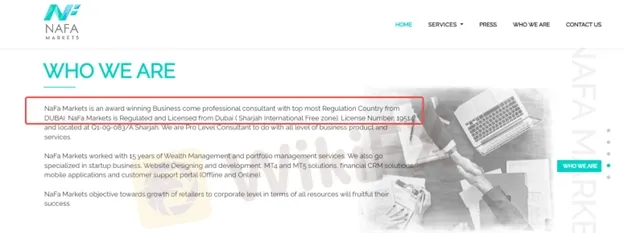

The most important factor in judging a broker's legitimacy is its regulatory status. This is where NaFa Markets' deception is most obvious. The company claims it is regulated by the “Sharjah International Free Zone (SAIF Zone)” and gives license number `19514`.

This claim is intentionally misleading. It is important to understand the difference between a business license and a financial license.

• A SAIF Zone License is a commercial or trade license. It gives a company the right to conduct general business activities within that specific free zone, such as import/export, consulting, or logistics. It has zero authority to regulate financial services, authorize forex brokerage activities, or permit a company to hold and manage client investment funds.

• Legitimate UAE Financial Regulation comes from one of two bodies: the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority (SCA). These are the only organizations in the UAE with the legal power to oversee and license forex and CFD brokers.

Our team conducted searches on the official public registers of both the DFSA and the SCA. The search for “NaFa Markets” found no results.

Using a non-financial business license to fake financial regulation is a deliberate and serious act of fraud. It is designed to create a false sense of security while operating completely outside the law, leaving investors with no help or protection.

Warning Sign 2: Ponzi Promises

In this NaFa Markets Review, one of the most alarming red flags is the companys promotion of a guaranteed “3% per month income.” Promising a fixed, high rate of return is one of the clearest indicators of a fraudulent scheme. Legitimate trading and investment are naturally tied to market risk. Returns are variable, unpredictable, and never guaranteed. Any company that promises a fixed monthly return from a volatile market is not generating profits from trading. Instead, they are almost certainly funding the “payouts” to early investors with the deposits of new investors. This is the textbook definition of a Ponzi scheme.

Think of it this way: A legitimate broker provides a bridge to the market; they don't guarantee what you'll find on the other side. Promising fixed returns is like a bridge toll operator promising you'll find a pot of gold at the destination. It is a logical and financial impossibility.

Lets break down the principle clearly, as highlighted again in this NaFa Markets Review.

· Fact: All trading involves risk, and profits are never certain.

· Fact: Global financial markets change daily; a fixed 3% monthly return (36% annually) is an extraordinary and unsustainable figure.

Conclusion: The promised returns are not generated from market activity. They are a lie used to entice deposits, which are then used to pay earlier investors or are simply stolen. The scheme is designed to collapse the moment new deposits slow down.

This analysis alone heavily tilts the balance in the NaFa Markets Pros and Cons with risk overwhelmingly outweighing any claimed benefit.

Warning Sign 3: Anonymous Operations

The official registered address for NaFa Markets is listed as `Q1-09-083/A, SAIF Zone, Sharjah`. Our NaFa Markets Review investigation confirms this address corresponds to a virtual office or a shared “flexi-desk” facility.

This is not a physical headquarters with a real management team, NaFa Markets Pros and Cons , compliance department, or support staff. It is a paper address, a common tactic used by shell corporations and online scams to create a appearance of legitimacy without any actual substance or accountability.

This anonymity serves a clear purpose: when the scheme inevitably collapses and withdrawals cease, there is no physical office to visit, no real management team to hold accountable, and no assets to recover. The operators can disappear without a trace, leaving victims with no one to pursue. A legitimate financial institution is proud of its physical presence; a scam hides behind a mail-drop address. This reality further reinforces the negative assessment found in the NaFa Markets Review.

NaFa Markets Pros & Cons: Revealed in NaFa Markets Review

Many potential investors search for a balanced view of a NaFa Markets Pros and Cons . In the case of NaFa Markets, this is a dangerous approach because every perceived “pro” is simply the bait in a carefully laid trap. The following table reframes their marketing points into the reality of the scam.

| The Perceived “Pro” (The Bait) | The “Con” (The Reality) |

| High, Guaranteed Monthly Income | This is not a pro; it is the primary indicator of a Ponzi scheme. Real trading has variable returns and inherent risk. |

| Simple, Easy-to-Use Platform | The platform is likely a fake or manipulated trading terminal (e.g., a pirated MT4/MT5) designed to show fake profits and encourage more deposits. |

| “Helpful” Advisors and Mentors | These are not advisors; they are high-pressure sales agents. Their sole job is to build a false rapport and pressure you into depositing more money. |

| Initial 'Successful' Withdrawals | This is a common tactic to build false trust. They may allow a small, early withdrawal to prove the system “works” before refusing larger withdrawals and demanding fees. |

As you can see, every supposed 'pro' is a carefully constructed element of the trap. This deceptive marketing is exactly why you must look past a broker's own claims and consult independent verification sources. A quick search for NaFa Markets Review on WikiFX would immediately reveal these discrepancies and the lack of a credible license, saving you from falling for the bait.

Deceptive Tactics: The Victim's Journey

To fully protect yourself, it's important to understand the psychological playbook these scams use. They rely on sophisticated methods of confusion and manipulation to guide victims from initial interest to devastating loss. A pattern clearly documented in the NaFa Markets Review.

The Copycat Strategy

The name “NaFa Markets” was not chosen by accident. It is deliberately similar to the names of legitimate, well-established financial firms to create confusion and piggyback on their reputations. Unsuspecting investors performing a quick search might see positive information related to the real companies and mistakenly associate it with the scam, a tactic frequently highlighted in NaFa Markets Review investigations.

It is vital to differentiate between these entities:

• ❌ Scam Platform: NaFa Markets (nafamarkets.com) - The unregulated entity this NaFa Markets Review is warning against.

• ✅ Legitimate Company: NAFA Capital Advisors (nafacapital.com) - An unrelated asset management firm based in India.

• ✅ Legitimate Company: NBP Funds (formerly NAFA Funds) - An unrelated, reputable fund manager in Pakistan.

Scammers thrive on this confusion. Always verify the exact URL and, most importantly, the specific regulatory license number and issuing authority. The name alone means nothing, as emphasized throughout this NaFa Markets Review.

A Typical Victim's Perspective

Based on our NaFa Markets Review of countless similar schemes, the victim's journey follows a predictable and tragic path. This narrative may feel familiar if you are already involved.

Step 1: The Honeymoon. You make an initial deposit. The platform is easy to use, and your account balance begins to grow steadily. You see consistent “profits” appearing, just as promised. You might even successfully process a small withdrawal of $100 or $200, which solidifies your trust. Everything feels perfect. As one user in a similar situation noted in May of 2025, “I appreciate the unlimited trading period, as it removes unnecessary pressure. I'm feeling positive.”

Step 2: The Upsell. Your assigned “advisor” or “mentor” contacts you. They are friendly and encouraging. They congratulate you on your success and begin painting a picture of even greater wealth. They will urge you to deposit more funds—perhaps to reach a “VIP level,” join a “higher return bracket,” or participate in a “limited-time opportunity.” The pressure is subtle at first, then becomes more insistent, a behavior repeatedly seen in NaFa Markets Review cases.

Step 3: The Block. The moment you attempt to make your first significant withdrawal, everything changes. The request is delayed, then rejected. Your friendly advisor becomes evasive or disappears entirely. You are met with a wall of silence or a series of confusing excuses. A user caught in a parallel scheme reported in January 2026, “This is a fake firm, they rejected my payout of $3000 without any reason.”

Step 4: The Extortion. You are finally contacted, not with your money, but with a new demand. You are told that to release your funds, you must first pay an additional fee. The excuses are endless: a “tax payment,” a “risk margin fee,” an “account verification cost,” or a fee to “unfreeze the blockchain.” One victim of a nearly identical scam reported in September 2025, “a big red flag is they want your money before payout.”

Let us be completely clear at this NaFa Markets Review : Any request to pay more money in order to withdraw your own funds is 100% a scam. Legitimate brokers deduct any applicable fees or taxes directly from the withdrawal amount; they never, ever ask you to send them more money first. This is the final, desperate attempt to extract as much capital as possible before they disappear, a conclusion reinforced by every NaFa Markets Review.

Emergency Action Plan: What to Do

If NaFa Markets Review has raised alarms, it is important to act decisively. Your response should depend on your current level of involvement with NaFa Markets.

If You Have NOT Deposited

1. Stop all communication immediately. Do not respond to their calls, emails, or messages.

2. Block their phone numbers, email addresses, and any social media contacts.

3. Do not engage in arguments or try to reason with them. Their sole purpose is to wear you down and persuade you.

4. Report their social media profiles, advertisements, or groups if you can. This helps protect others from being targeted.

If You HAVE Already Deposited , Read this NaFa Markets Review for next steps

1. Stop everything. Do not deposit another cent, no matter what they promise or threaten. Do not believe that one final payment will unlock your funds. It will not.

2. Gather all evidence. Take screenshots of everything: your account dashboard showing your balance, all chat logs with your “advisor,” and every transaction record, deposit receipt, and email communication.

3. Contact your bank or payment provider now. If you paid by credit card or a service like PayPal, initiate a chargeback or dispute immediately. Explain that the merchant is fraudulent and the service was a scam. Time is absolutely critical, as chargeback windows are limited.

4. File an official report. Contact your local police and your country's national cybercrime reporting agency (e.g., the FBI's IC3 in the US, Action Fraud in the UK). Provide them with the complete file of evidence you have collected. While recovery is difficult, official reporting is the only way to create a legal record of the crime.

Final Verdict and The Ultimate Rule

Our NaFa Markets Review is completely negative. This is not a legitimate broker. It is a dangerous and predatory operation that shows every hallmark of being an outright scam, from its falsified regulatory claims to its Ponzi-like promises.

This situation serves as a harsh but valuable lesson for every investor. In the world of online finance, the ultimate rule must be: “Trust, but verify.” Never take a broker's claims about their regulation, location, or profitability at face value. Always assume they are being dishonest until proven otherwise through independent verification.

Before you even consider opening an account with any broker, make it a mandatory habit to perform your own independent check and read NaFa Markets Review. Use a comprehensive regulatory database and aggregator like WikiFX. A simple search can reveal fake licenses, user complaints, NaFa Markets Pros and Cons and official warnings in minutes, saving you from devastating financial loss. Your financial security is your own responsibility; empower yourself with the right tools.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Dollar Index Falters Near 97.00 as Washington Dysfunction Overshadows Economic Data

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Market Perception: 'SA Inc' Under Review

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Dollar Index Falters Near 97.00 as Washington Dysfunction Overshadows Economic Data

Energy Markets: Chevron and NNPCL Add 146,000 b/d to Global Supply

Currency Calculator