Abstract:Scam Alert: Money Plant FX is unregulated & not authorized in UAE. Don’t risk losing money—read this warning before investing!

Money Plant FX scam alert is sounding loud for traders in the UAE and beyond. This unregulated forex platform promises easy profits but delivers blocked withdrawals and ghosted support. As cases pile up, like one trader who grew $1,000 to $2,470 only to see a $900 payout stalled since December 23, 2025, the urgency is clear: dont risk your money here. Operating without authorization, Money Plant FX preys on hopeful investors with flashy claims of low spreads and high leverage. This exposure digs into the facts, from ignored support tickets to suspicious Comoros registration, urging caution before any deposit.

Money Plant FX Lacks UAE Regulation

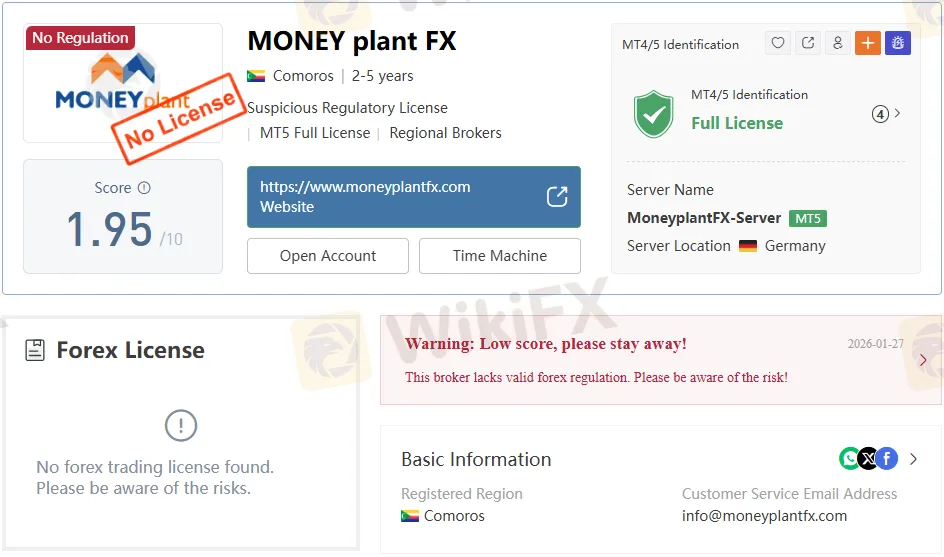

Money Plant FX operates without any authorization in the United Arab Emirates, a major red flag for local traders. UAE authorities require strict licensing for forex brokers, yet this platform shows no trace of compliance. Traders contacting regulators find zero records of oversight, leaving funds exposed to unchecked practices.

The broker‘s setup ignores regional rules designed to protect investors from fraud. While they promise quick withdrawals, the reality—repeated failed payout attempts—tells another story. As the next section details, without regulatory backing, there’s no recourse when things go wrong, a common thread in scam complaints.

Traders $900 Withdrawal Nightmare

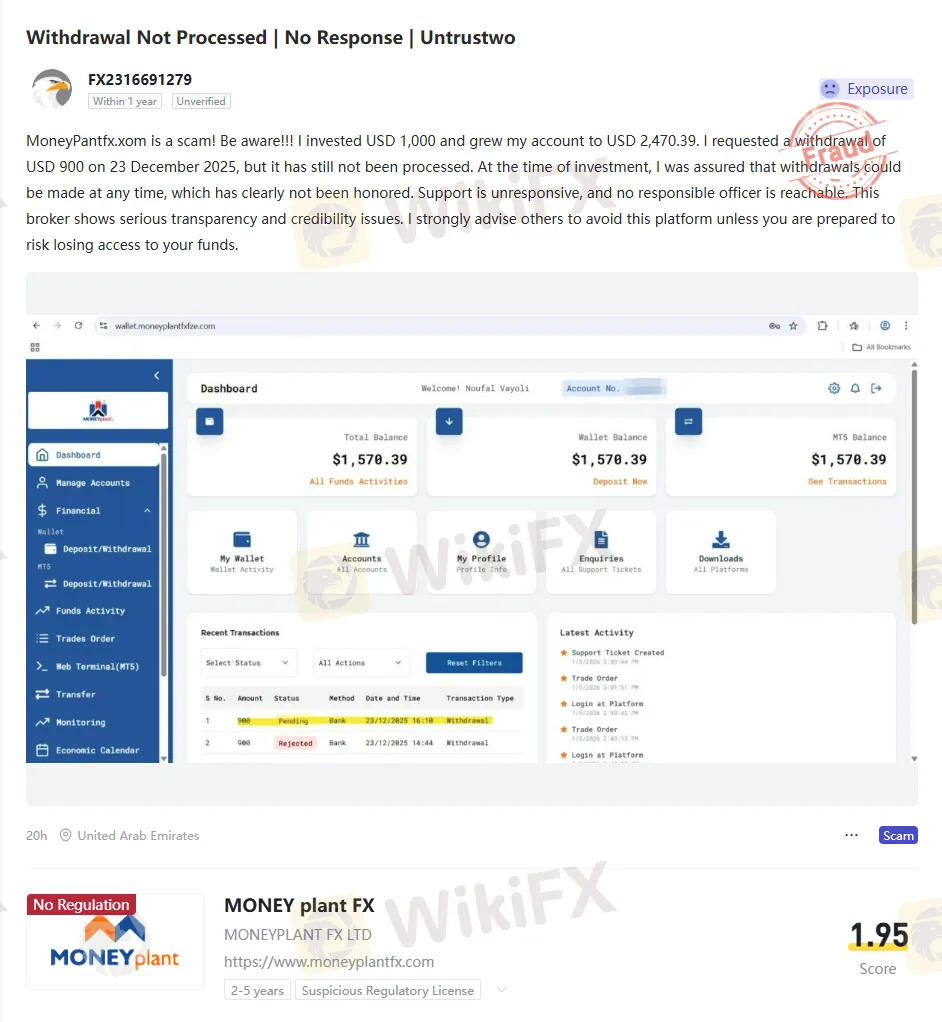

One investor deposited $1,000 and traded up to $2,470.39 in their account. On December 23, 2025, at 14:44, they requested a $900 bank withdrawal, followed by another attempt. By 16:18, the first was rejected, and the second was pending over a month later, into January 2026.

Dashboard screenshots reveal a balance frozen at $1,570.39, with no funds released despite assurances of anytime withdrawals. Support tickets, like one created at 15:28 on a recent day, go unanswered, and no officer steps in to resolve issues. This pattern screams deliberate stalling.

Such cases highlight broken promises. Initial reassurances lure deposits, but payouts vanish into silence, eroding trust fast. Investors report similar blocks that turn profits into losses overnight.

Unresponsive Support Raises Alarms

Money Plant FX boasts 24/7 support via email at info@moneyplantfx.com and a UAE phone line (971-43-489984). In practice, messages bounce into voids. Traders describe endless waits, with tickets piling up and going unanswered.

Recent activity logs show logins, trades, and ticket creations, yet no human intervention is evident. One log notes a support ticket at 38:34 PM, followed by ignored trade orders. This ghosting leaves users stranded, unable to reach anyone accountable.

Phone attempts yield dead lines or scripted dodges. The lack of live chat or callbacks fits a pattern of evasion, common in platforms dodging payouts. Real brokers prioritize contact; this one avoids it. Beyond support, the offshore location raises additional concerns.

Comoros Registration: Offshore Hideout

Money Plant FX ties to Comoros, an offshore spot known for lax oversight. Registered as MONEYPLANT FX LTD, it claims to have been operating since 2023 but holds no forex license there or anywhere credible. A low trust score of 1.95 out of 10 screams danger.

WHOIS data pegs the domain moneyplantfx.com to February 1, 2023, with an expiration in 2026, and it's hosted suspiciously across US and German servers. No solid company footprint beyond vague UK links to an old entity from 2017. This opacity fuels scam suspicions.

Comoros setups let operators vanish with funds. Without top-tier regulation like SCA in the UAE, protections evaporate. Traders chasing legitimacy find only smoke and mirrors.

High Leverage Hides Massive Risks

Up to 1:1500 leverage delivers big wins on the Standard account, with a $100 minimum deposit. Spreads start at 1.2 pips, zero commission claimed on majors like EURUSD. But swap fees are hidden, and no Islamic accounts for UAE traders.

Margin call at 50%, stop-out 20%—aggressive settings amplify losses. EA allowed, MT5 platform with copy trading sounds pro, but without regulation, execution risks skyrocket. High leverage often masks manipulation in unregulated shops.

Profits evaporate on withdrawal tries, as one trader learned after growing funds. Leverage tempts, but the real game is keeping your money. The following section turns to another red flag: issues with wallet transactions.

Wallet and Transaction Red Flags

The wallet at wallet.moneyplantfxfze.com shows recent transactions: 2 withdrawals, 1 rejected, 1 pending. Balance sits at $1,570.39 post-deposit, with MT5 linked. Activity includes trades and logins, but no outflows.

Fund activity lists all as “Deposit Now” prompts, pushing more in while blocking outs. The platforms section offers the MT5 web terminal, but access feels locked after the request. This setup funnels money one way.

The monitoring table logs the failed $900 and $908 attempts precisely, with timestamps that match the complaint. No reversals or explanations follow, pointing to systemic payout blocks.

Trading Instruments Lack Substance

Over 30 forex pairs, commodities, metals, indices, stocks—no crypto or ETFs. Claims deep liquidity, 24/5 trading, variable spreads. Yet, execution on MoneyplantFX-Server (Germany ping 157ms) feels off without oversight.

Standard account suits regulars: market execution, USD/EUR base. Demo available, but live traps await. Diverse portfolio touted, but high fees on holds undermine it.

No proof of interbank ties; segregation promised but unverified. In scams, instruments dazzle to hook deposits. Moving forward, its important to consider whether hidden fees are impacting actual profits.

Hidden Fees Eat Profits

Deposits free via Visa, Skrill, Neteller, bank wire—$100 min, 24 hours to 4 days. Withdrawals sting: up to $40 bank wire, 2.5% cards, 0.5% ewallets. Processing time claimed at 24 hours, but delays prove otherwise.

No inactivity fee listed, but swap opacity hurts overnight trades. Zero-commission bait hides these bites, a standard in bait-and-switch ops.

One traders $900 hit fees and stalls, shrinking real take-home. Always calculate net after these gotchas. Next, platform quality is another critical factor to scrutinize in these situations.

MT5 Platform: Looks Good, Feels Off

MetaTrader 5 powers everything: desktop, mobile, web. Copy trading, advanced charts pitched as elite. Server MoneyplantFX-Server claims mature tech and a full license facade.

But a low score warns of risks; no MT4, cTrader limits choices. Mobile apps for iOS/Android push convenience, yet login issues post-withdrawal hint at locks.

Full license claims ring hollow without regulation. Tech impresses until funds stick. Weighing the platform‘s features against its pitfalls, let’s assess the pros and cons.

Pros Don't Outweigh Scam Signs

Low $100 entry, MT5 support, zero commission lures beginners. Mobile/copy trading adds appeal for passive plays. UAE phone numbers are local.

But cons dominate: no regulation, payout fails, fee hides, no swaps/Islamic details. High leverage risks wipeouts.

Surface shine fades against hard evidence of blocked cash. Recognizing these warning signs can help traders spot the traps described in the next section.

Spotting Money Plant FX Traps

Flashy site hypes “Easy Trade Easy Money,” 24/7 updates. Quick 5-min signup, multilingual support sold hard. But domain youth, offshore base screams caution.

Check WHOIS and regulator sites first. UAE focus without SCA nod? Run. Test small withdrawals early.

Victim stories match: growth then freeze. Patterns don't lie. Bringing all these points together, the bottom line becomes clear.

Bottom Line

Money Plant FX is an unregulated scam platform that refuses payouts, ignores UAE rules, and hides behind a Comoros registration with a 1.95 trust score. Traders like Noufal Vayoli lose access to funds they've earned amid unresponsive support and stalled withdrawals. Steer clear—verify any broker on official UAE SCA lists, start with demos elsewhere, and report suspicions to regulators. Protect your capital; regulated alternatives like Exness offer real safety without the fraud risk.