简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Upforex Regulation: A 2025 Deep Dive into Its Safety and Legitimacy

Abstract:When you're thinking about choosing a forex broker, the first and most important question you should ask is about regulation. Regulation is the foundation of financial safety. It creates rules, supervision, and protection for the money you invest. So, let's answer the main question directly: Is Upforex regulated?

When you're thinking about choosing a forex broker, the first and most important question you should ask is about regulation. Regulation is the foundation of financial safety. It creates rules, supervision, and protection for the money you invest. So, let's answer the main question directly: Is Upforex regulated?

After carefully reviewing public information and official records, the answer is clear: Upforex currently works without any valid supervision from a trusted financial authority. The company behind the brand is registered in Saint Lucia, which is an offshore location known for having very little to no regulation of forex and CFD trading. This article will give you a complete, fact-based analysis of what this lack of regulation means for traders. We will examine the company's background, look at the risks involved, and review its trading services to help you make a fully informed decision about the safety and legitimacy of Upforex.

Understanding Regulatory Status

Learning about a broker's company structure and regulatory claims is an important step in checking them out. When there's a difference between what a broker claims and what can be officially proven, that's often the first and most important warning sign. In the case of Upforex, a closer look shows a worrying picture that every potential investor needs to know about.

The Official Answer

As of our latest check on November 13, 2025, we confirmed that Upforex does not have a valid license from any recognized financial regulatory body. This isn't a matter of opinion; the broker simply doesn't appear on the official lists of top-level, mid-level, or even many lower-level regulators around the world. This lack of supervision is the most important factor when judging the broker's safety. It creates an immediate and serious warning: traders should be very aware of the major risks involved when dealing with an unregulated company. Without a regulator, there is no official third party to enforce rules of fair business, ensure client money is safe, or help solve disputes.

Offshore Registration Explained

UP Global Markets Ltd – Licensed by the Financial Services Commission (FSC) Mauritius as an Investment Dealer (Full Service Dealer, Excluding Underwriting) under License No. GB25204570. What does this mean for you as a trader?

• No Protected Funds: Regulated brokers must keep client money in separate bank accounts, away from the company's operating funds. This protects your money if the broker goes out of business. With an offshore, unregulated broker, there is no such guarantee; your funds could be mixed together and used for company expenses.

• No Investor Protection: Many top-level regulators require participation in an investor protection fund (like the FSCS in the UK or the ICF in Cyprus). These funds can pay back traders up to a certain amount if their broker fails. Offshore companies offer no such safety net.

• No Formal Problem Resolution: If you have a problem with a regulated broker over a trade, withdrawal, or any other issue, you can file a complaint with the regulator. With Upforex, your only option is the company itself, with no independent authority to appeal to.

For a complete understanding of a broker's background and to review user experiences, it's always smart to check their full profile on a comprehensive platform. You can do your own detailed review of Upforex to see all the data for yourself.

A Closer Look at Details

To give you a complete picture, here is the publicly listed information for Up Forex Ltd. This data helps ground the analysis in concrete, checkable details, though it doesn't change the basic issue of its unregulated status.

• Company Name: Up Forex Ltd

• Registered Region: Saint Lucia

• Operating Period: 5-10 years

• Contact Number: +971 526090312

• Customer Service Email: support@upforex.com

• Company Website: https://upforex.com/

• Physical Address: 4th Floor, Docks 4, The Docks, Caudan, Port Louis, Mauritius

*Disclaimer: Please note that while this contact information is publicly listed, we cannot guarantee it works or is real. This information is provided for reference only and does not mean we endorse or verify the broker's operations.*

Risk Assessment: Analyzing Warning Signs

Beyond the main issue of being unregulated, a deeper analysis of Upforex shows several specific warnings and operating characteristics that combine to create a high-risk profile. These are not minor concerns; they are major warning signs that point to a lack of transparency and potential danger for traders' money. Understanding these indicators is key to protecting yourself in the forex market.

Key Warnings to Pay Attention To

Several clear warnings have been connected with this broker's operations, each carrying serious implications for potential clients.

• High Potential Risk: This is the most direct warning possible. It suggests that the chance of financial loss when dealing with this broker is much higher than the standard market risks that come with trading. This assessment is typically based on factors like regulatory status, operating history, and user feedback.

• Suspicious Regulatory License: This is a critical warning sign. Investigations showed that Upforex has falsely claimed to be regulated by the Australian Securities and Investments Commission (ASIC), one of the world's top-level regulators. Making a false claim of regulation is a dishonest practice designed to trick unsuspecting traders by creating a false sense of security. This alone is a serious breach of trust.

• Suspicious Scope of Business: This flag indicates that the broker may be offering services or financial products that don't match its size, company structure, or claimed expertise. For an unregulated offshore company, offering a wide range of complex instruments without proper oversight can be a method to attract clients into potentially risky or unclear products.

• Low Score: On a scale of 1 to 10, the broker receives a very low score of 0.96. This number combines data across multiple categories, including licensing, business practices, risk management, software, and regulatory oversight. A score this low is a clear, data-driven indicator of poor overall standing and high risk.

The Offshore Problem

Upforex offers leverage of up to 1:300 on its Pro-ECN account. For many traders, especially those with smaller amounts of money, high leverage can seem very attractive. It offers the potential to control a large market position with a relatively small deposit, increasing potential profits.

However, from an expert point of view, high leverage from an unregulated broker is a dangerous combination. It is a double-edged sword that increases losses just as easily as it increases gains. Top-level regulators in places like the EU, UK, and Australia have put strict leverage limits for retail clients (often around 1:30) precisely to protect them from the catastrophic losses that high leverage can cause. An unregulated broker offering high leverage operates without these safety measures. A single volatile market movement can lead to a margin call and the total loss of your investment in seconds, and without regulatory protection, you have no recourse.

User Influence and Presence

The broker's influence within the global financial industry is rated as 'D', which means a very low level of market presence and brand recognition. This suggests it is a minor player without significant reputation or established trust within the trading community.

Analysis of its online business activity shows its main traffic comes from India and Malaysia. While this gives us a snapshot of its geographic focus, it doesn't change the underlying risk factors. The concentration of business in regions with varying levels of local regulatory enforcement can sometimes be a strategic choice for offshore brokers. To see updated information on Upforex's business influence and compare it with other brokers, you can explore its detailed profile page for a more thorough look.

A Look Inside Trading Conditions

While the regulatory status and associated risks are the main concern, a full evaluation requires an objective look at the trading conditions Upforex offers. This includes its account structure, product range, trading platform, and payment systems. Analyzing these elements provides a complete picture of the user experience, often revealing further operational weaknesses.

Accounts and Minimum Deposit

Upforex lists three account types: Pro-ECN, Elite-ECN, and Standard. However, detailed information is only provided for the Pro-ECN account. The features of this account are outlined below.

| Account Feature | Pro-ECN | Elite-ECN | Standard |

| Minimum Deposit | $1000 | -- | -- |

| Spreads | From 0 pips | -- | -- |

| Commission | $7/Round lot | -- | -- |

| Maximum Leverage | 1:300 | -- | -- |

The most striking detail here is the $1000 minimum deposit. This is much higher than the industry standard. Many well-regulated, reputable brokers allow traders to open accounts with $250 or less. Requiring such a high initial investment for an unregulated company is a major point of concern. It places a large amount of trader money at risk from the very beginning, with no regulatory protection.

Instruments and Platform

Upforex claims to offer a range of trading instruments, providing access to several major markets:

• Forex: Over 30 currency pairs, including majors, minors, and some exotics.

• Metals: CFDs on precious metals.

• Futures: CFD contracts on various futures.

• Shares: CFDs on global stocks.

• Cash CFDs: CFDs on indices.

For its trading interface, Upforex provides a web-based platform. Based on our practical testing of the platform through a demo account, we observed it to be quite basic. It lacks many of the advanced charting tools, analytical features, and customization options that are standard on industry-leading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The absence of these well-regarded, third-party platforms is another indicator that the broker may not be investing in a strong and transparent trading infrastructure.

During the demo test, the spread for the benchmark EUR/USD pair was observed to move around 1.0 pips. While this spread is competitive on the surface, it is important to add a warning: demo account conditions do not always reflect live trading conditions. With an unregulated broker, there is a risk of experiencing significant slippage, wider spreads, and poor execution on a live account.

Deposits, Withdrawals, and Fees

A broker's payment system is an important part of its operation. Limited options and high fees can be significant friction points and potential warning signs. Upforex's payment system is notably restrictive and costly.

• Available Methods: The only listed methods for deposits and withdrawals are VISA, MasterCard, Bank/Wire Transfer, and Bitcoin.

• Missing Methods: The absence of popular and trusted e-wallets like Skrill, Neteller, or PayPal is highly unusual for a modern broker. These payment processors have their own compliance standards, and their absence can sometimes indicate that a broker is unable or unwilling to meet them.

• Transaction Fees: Upforex charges fees on both deposits and withdrawals, which is a significant disadvantage for traders. The fee structure is as follows:

• Credit Cards (VISA, MasterCard): 1.5% fee

• Bitcoin: 2.5% fee

• Bank/Wire Transfer: 1.0% fee

These fees eat directly into a trader's money and profits and are not standard practice among most competitive brokers, who often offer fee-free deposits.

Conclusion: The Final Verdict

After a detailed and objective examination of Upforex regulation, corporate background, and operating practices, the verdict is clear. Upforex is an unregulated broker registered in an offshore location that provides no meaningful protection for traders. This single fact underlies the entire risk assessment.

The broker's profile is marked by a collection of serious warning signs. These include a verified false claim of being regulated by ASIC, multiple high-risk warnings, a non-standard web platform that lacks the features of industry-leading software, and a restrictive and costly payment system. The high minimum deposit of $1000 is particularly alarming, as it requires traders to place a significant amount of money at risk with a company that has no oversight. While the offer of high leverage may seem tempting, it is a misleading lure that, in an unregulated environment, drastically increases the risk of total and rapid financial loss.

Given these findings, traders must exercise extreme caution. The risks associated with depositing funds with an unregulated offshore entity like Upforex are substantial and varied, ranging from the security of funds to fair trade execution.

Choosing a broker is one of the most important decisions you will make in your trading journey. The most important step in that decision is verifying regulation. For thorough research on any broker, using a comprehensive resource like WikiFX to check licenses, investigate warnings, and read user reviews is a highly recommended practice. Before making any commitment, we strongly encourage you to view the full, complete profile and any recent updates on Upforex to ensure you have the most current information available.

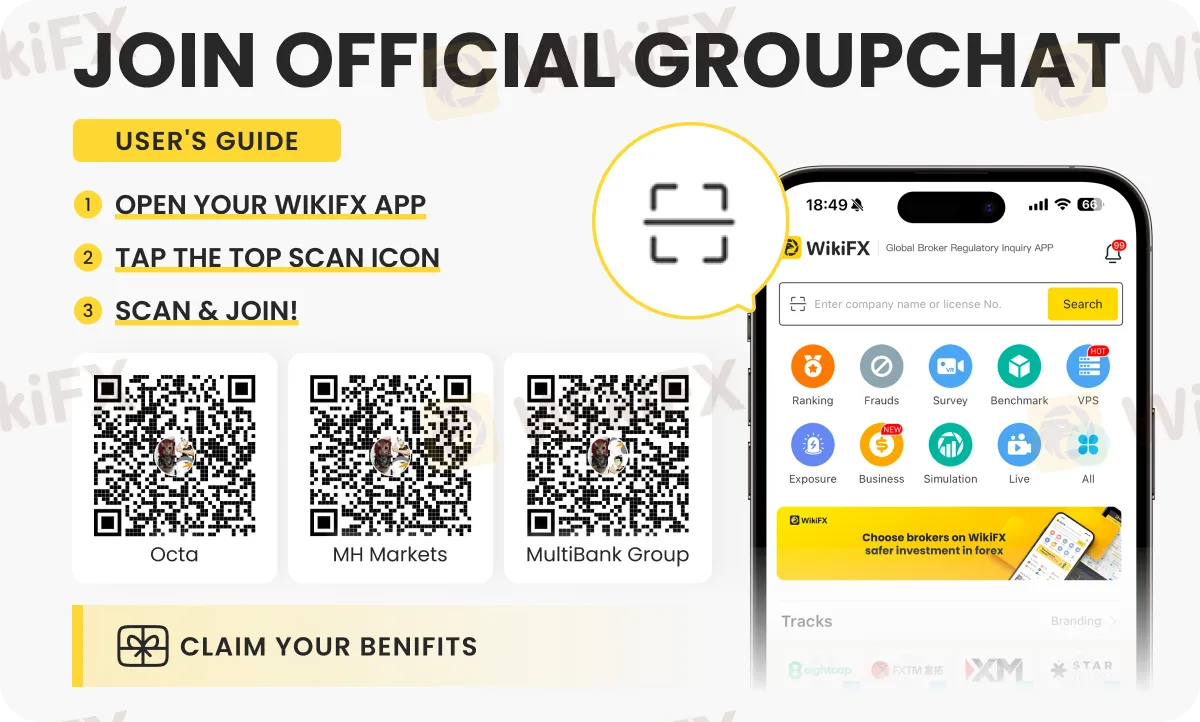

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

8xTrade Review 2025: Safety, Features, and Reliability

AfterPrime Regulation: Is It Legit or Suspicious?

Seacrest Markets Under Fire Over Withholding Salaries and IB Payments

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

ehamarkets Review 2026: Regulation, Score and Reliability

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Big Boss Review 2025: Safety Warning and Regulatory Analysis

Currency Calculator