简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Amillex Regulated? A Complete Guide to Its Licenses and Safety

Abstract:When checking out a forex broker, one of the first questions traders ask is, "Is this broker regulated?" For Amillex, the answer isn't simply yes or no. The broker works under a two-license system, with credentials in both Saint Vincent and the Grenadines and Mauritius. This complex regulatory setup can confuse traders who are trying to figure out if their money is safe and if the trading environment is reliable. This article will give you a clear, detailed explanation of what these regulations mean for you as a trader. We will look at the broker's business details, break down its account options, and examine real user experiences to help you make a well-informed decision about whether Amillex fits your trading needs and comfort level with risk.

When checking out a forex broker, one of the first questions traders ask is, “Is this broker regulated?” For Amillex, the answer isn't simply yes or no. The broker works under a two-license system, with credentials in both Saint Vincent and the Grenadines and Mauritius. This complex regulatory setup can confuse traders who are trying to figure out if their money is safe and if the trading environment is reliable. This article will give you a clear, detailed explanation of what these regulations mean for you as a trader. We will look at the broker's business details, break down its account options, and examine real user experiences to help you make a well-informed decision about whether Amillex fits your trading needs and comfort level with risk.

Understanding The Regulatory System

A broker's regulatory status is the foundation of how trustworthy it is. For Amillex, this foundation is built across two very different countries, each with different effects for everyday traders. Understanding this difference is important for evaluating how much protection you can expect.

A Two-License System

Amillex Global Ltd has licenses from two separate regulatory agencies: the Saint Vincent and the Grenadines(SVG) and the Financial Services Commission (FSC) of Mauritius. This is fairly common, but traders need to understand that not all licenses offer the same level of oversight or protection. The services you get and which company your account is registered with will determine which regulatory protection, if any, applies directly to you.

Saint Vincent and the Grenadines (SVG) License

Amillex LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 3928 LLC. The Registered Office: Suite 305, Griffith Corporate Centre, Kingstown, St. Vincent and the Grenadines.

The Mauritian (FSC) License

The main license covering Amillex's everyday trading operations is a Retail Forex License from the FSC of Mauritius, with the license number GB24203163. This is classified as an offshore regulation. Offshore regulators often have different, and sometimes less strict, requirements compared to their top-level counterparts in areas like client fund separation, negative balance protection, and access to investor compensation programs.

Publicly available information includes a specific warning associated with this license: “The Mauritius FSC regulation...is an offshore regulation. Please be aware of the risk!” Furthermore, the broker is categorized as having a “Medium potential risk.” This doesn't automatically label the broker as unsafe, but it serves as a clear signal that traders must do their own thorough research and proceed with more caution than they might with a broker regulated in a top-level country.

Company Identity and Verification

To provide a complete picture, here are the official company details for the entity holding these licenses. Transparency in this area is a positive sign for any brokerage.

• Company Name: Amillex Global Ltd

• Registered Region: Mauritius

• Company Address: The Cyberciti Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius

• Operating Period: 1-2 years

This information confirms the broker is a relatively new company, having been in operation for one to two years as of 2025.

A Look at Trading Conditions

Beyond regulation, the practical aspects of trading—platforms, account types, and costs—are what shape a trader's daily experience. Here, we examine what Amillex offers to its clients.

Trading Platforms: MetaTrader 5

Amillex has standardized its platform offering on MetaTrader 5 (MT5). This powerful and modern platform is available across Desktop, Mobile, and a WebTrader version for browser-based access. MT5 is well-regarded for its advanced charting capabilities, extensive library of technical indicators, support for automated trading via MQL5, and its ability to trade across multiple asset classes from a single interface.

An important point for many experienced traders is the availability of MetaTrader 4. Based on the broker's listed offerings, MT4 is not available. While some data may indicate the existence of MT4 licenses or servers, the client-facing product is centered exclusively on the MT5 ecosystem. Traders who rely on MT4-specific expert advisors (EAs) or indicators should take this into careful consideration.

Comparing Account Types

Amillex provides three different account types, catering to different trading styles and cost preferences. All accounts share a low minimum deposit of $50 and offer maximum leverage up to 1:500, making them accessible to a wide range of traders. The main differences lie in the spread and commission structure.

| Account Type | Minimum Deposit | Spreads (from) | Commissions | Maximum Leverage |

| RAW | $50 | 0.0 pips | $ 0.01 | 1:500 |

| CENT | $50 | 1.2 pips | $ 0.01 | 1:500 |

| STANDARD | $50 | 0.8 pips | $ 0.01 | 1:500 |

The RAW account is designed for scalpers and high-frequency traders who want the tightest possible spreads and are willing to pay a fixed commission. The CENT account offers a competitive balance with zero commissions and moderately low spreads starting from 0.8 pips. The STANDARD account, with slightly wider spreads and no commission, is suitable for beginners or discretionary traders who prefer all costs to be built into the spread.

Deposits, Withdrawals, and Assets

Flexibility in funding and a diverse product range are important factors. Amillex performs well in this regard, offering a very low minimum deposit of just $50. The broker supports an extensive array of deposit and withdrawal methods, catering to a global client base. These include:

• Cryptocurrency (USDT ERC-20, USDT TRC-20)

• E-wallets and Payment Systems (Help2Pay, ChipPay, FPX, DragonPay, FasaPay, and others)

• Bank Transfer

Processing times are a key strength, with most digital and e-wallet transactions being instant. Bank transfers, as is standard, can take up to five working days.

The range of tradable instruments is also comprehensive, allowing traders to build diverse portfolios.

• Forex

• Precious Metals

• Energies & Commodities

• Shares & Indices

• Bonds

• Cryptocurrencies

User Experiences and Disputes

Regulatory analysis and product specifications provide one side of the story. The other, equally important side comes from the real-world experiences of traders who have used the platform. Amillex regulation has a mixed reputation, with both strong praise and serious complaints.

Positive User Feedback

A number of users have reported positive experiences with Amillex. Common themes in this feedback, which we must note is often unverified, include:

• A stable trading environment with no reports of order freezing or excessive slippage.

• Fast and convenient deposit and withdrawal processes, a point of significant importance for traders.

• Responsive and effective customer service when issues or questions arise.

• Appreciation for the lack of holding time restrictions on trades, which is beneficial for traders using certain strategies like rebate collection.

“Exposure” Incidents

Conversely, there are serious complaints, primarily centered on withdrawal difficulties. These “exposure” reports, though also unverified, highlight a significant point of friction.

• Case 1: A user reported depositing funds via a Chinese bank card (CNY) and later being unable to withdraw profits in USDT. The user claimed their bank card was subsequently frozen and that customer service became unresponsive before their trading account was blocked.

• Case 2: A similar incident was reported by another user who, after depositing in CNY, had their withdrawal request in USDT denied and their account frozen.

These cases represent a trader's worst-case scenario and warrant close examination.

The Broker's Official Response

To provide a balanced perspective, it is essential to consider Amillex's official replies to these complaints. The broker has publicly responded, framing the issues as a matter of regulatory compliance. Their key arguments are:

• Anti-Money Laundering (AML/KYC) Compliance: Amillex stated that withdrawal requests in a different currency from the deposit (e.g., depositing CNY and attempting to withdraw USDT) automatically trigger strict AML protocols. This cross-currency movement is a major red flag for financial institutions globally.

• Requirement for Enhanced Verification: The broker claimed they required additional identity verification documents from the users to proceed with the compliance review, which the users allegedly failed to provide.

• Same Channel Policy: Amillex reiterated a standard industry policy: withdrawals must, whenever possible, be processed through the same channel and in the same currency as the initial deposit to prevent money laundering.

• Fund Security: In their responses, the broker asserted that the clients' funds remained secure in their trading accounts. They stated the funds would be available for withdrawal back to the original CNY bank account once the required verification was successfully completed.

Interpreting the Disputes

These disputes highlight a critical and often contentious area in the broker-client relationship: AML and KYC compliance. While these procedures can be intensely frustrating for traders and lead to significant delays, they are a mandatory legal requirement for legitimate financial institutions. The broker's response suggests their actions were driven by these obligations.

This situation underscores the absolute importance for traders to thoroughly read and understand a broker's terms and conditions—especially regarding deposit and withdrawal policies—before funding an account. To get a comprehensive view of all user reviews, broker responses, and the full profile, traders often consult independent inquiry platforms to gather more information and see if patterns emerge over time.

Conclusion: Your Verdict on Amillex

So, is Amillex regulated and is it a safe broker? The evidence presents a complex picture that requires careful consideration.

To summarize our findings:

• Two Different Types of Regulation: Amillex is regulated, but its setup is complex. The main license for everyday clients is from the FSC in Mauritius, an offshore location that carries different risk implications than top-level regulators. Its Australian ASIC license is for institutional services and likely does not apply to the average everyday trader's account.

• Mixed User Reputation: The broker earns praise for its trading conditions, platform stability, and service speed. However, this is contrasted by serious withdrawal disputes. The broker's defense points to strict, if poorly communicated, AML/KYC enforcement.

• Solid Operational Base: Operationally, Amillex appears solid. It offers the modern MT5 platform, accessible account tiers with competitive conditions, and a wide array of tradable assets and payment methods.

Our final takeaway is that Amillex is a formally regulated broker and not an outright scam. However, its primary offshore regulatory status, combined with the “Medium potential risk” classification and contentious user disputes, means traders must exercise a heightened level of caution. The decision to trade with Amillex ultimately hinges on your personal risk tolerance and your diligence in adhering to their compliance procedures, particularly regarding fund transfers.

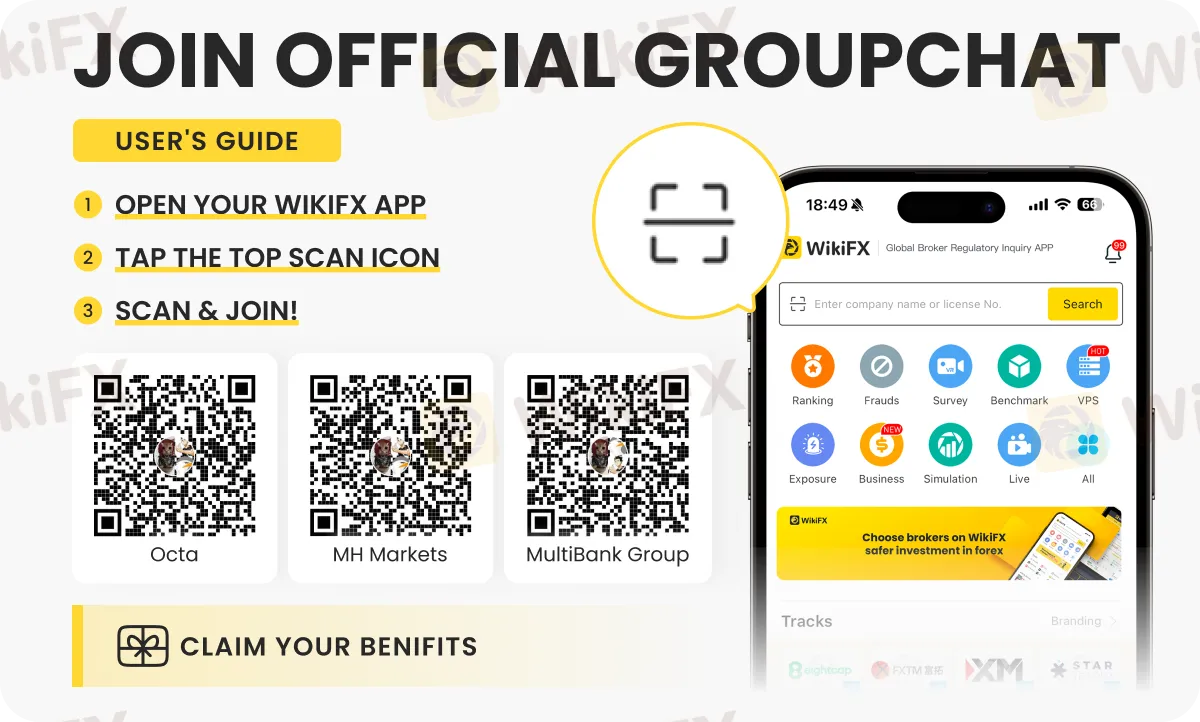

We always advise traders to remain vigilant and continuously monitor their broker's status. You can do this by keeping an eye on the broker's profile and any new alerts on an independent inquiry app like WikiFX.

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fed

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

War Risk Premium Explosions: Gold Hits

FCA Warns on Complex ETP Sales Practices

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

A major development in Trump's Fed feud is set to happen next week in the Supreme Court

Forex 101: Welcome to the $7.5 Trillion Beast

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Currency Calculator