Beware Multibank Group Scams: Real Trader Complaints

Multibank Group scams warning: denied withdrawals & fake trading profits. Don’t fall victim—read the latest scam cases today!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

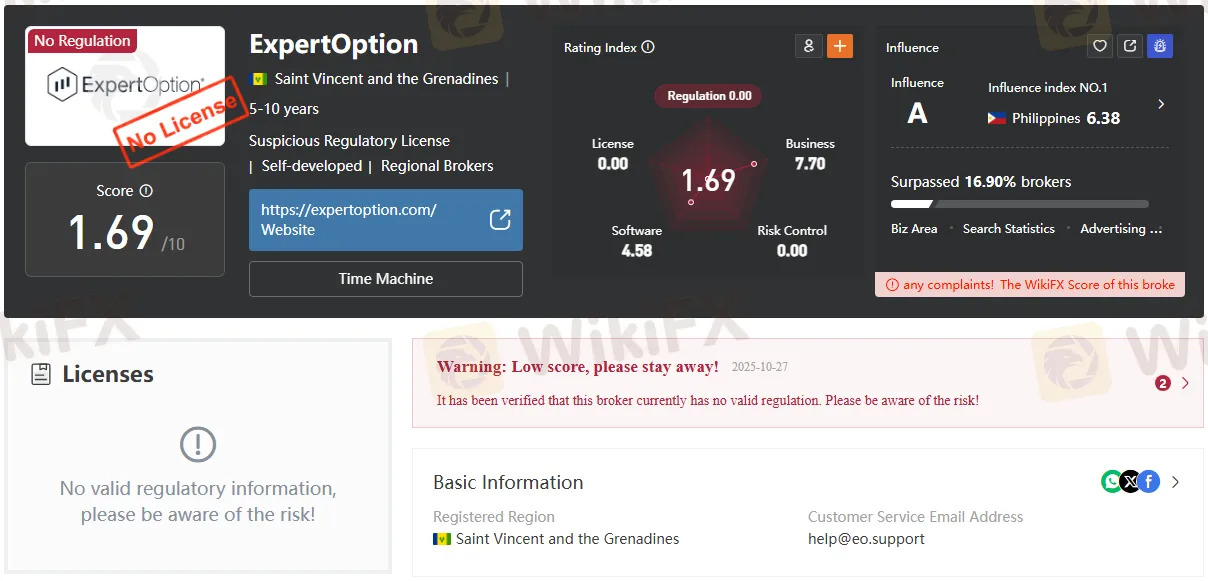

Abstract:Expert Option is not regulated by any major authority. It operates offshore with only Financial Commission membership, not full broker regulation.

Expert Option has positioned itself as a global trading platform offering access to more than 100 assets, including stocks, commodities, indices, and cryptocurrencies. The broker claims to serve millions of clients worldwide, with a minimum deposit of just $10 and trade sizes starting at $1. While the platform highlights accessibility, fast execution, and social trading features, its regulatory status raises important questions for traders seeking security and transparency.

This review examines Expert Option in detail, focusing on its regulatory framework, account types, trading conditions, and overall credibility. The goal is to provide a clear picture of what traders can expect before committing funds.

One of the most critical aspects of any broker is its regulatory oversight. According to the companys own disclosures, Expert Option is operated by EOLabs LLC, registered in St. Vincent and the Grenadines. This jurisdiction is known for its light-touch financial supervision, and the broker is not licensed or regulated by any recognized financial authority such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia).

Instead, Expert Option highlights its membership with The Financial Commission, an independent dispute resolution body. Membership provides access to a compensation fund of up to €20,000 per client in case of disputes. While this offers some reassurance, it is not equivalent to full regulatory oversight. Traders should understand that the Financial Commission is not a government regulator but a private organization.

Expert Option was established in 2014 and claims more than 70 million clients globally. However, the broker explicitly restricts services in numerous countries, including the United States, Canada, the European Union, the United Kingdom, and others. This exclusion list covers most major regulated markets, leaving the platform primarily available in regions with less stringent financial oversight.

The companys registered address is in Kingstown, St. Vincent and the Grenadines, a common base for offshore brokers. While this does not automatically imply malpractice, it does mean that clients have limited legal recourse in case of disputes.

Expert Option provides a proprietary trading platform available on desktop, mobile (iOS and Android), and web browsers. The platform emphasizes simplicity and accessibility, with features such as:

The platform is designed for beginner-friendly use, but advanced traders may find the tools limited compared to MetaTrader 4 or 5.

Expert Option offers a tiered account structure, starting with a Micro account requiring just $10. Higher-tier accounts unlock additional benefits:

Benefits vary by account type, with higher tiers offering features such as daily market reviews, financial research, and priority withdrawals. However, the maximum trade size and number of open deals are capped at lower levels for smaller accounts.

The broker supports more than 20 payment systems, including Visa, Mastercard, Maestro, UnionPay, Neteller, Skrill, and Binance Pay. Deposits are instant, and withdrawals are processed with no stated commission. However, priority withdrawals are reserved for Gold, Platinum, and Exclusive accounts.

While the payment options are diverse, the absence of regulation means that clients rely solely on the brokers internal policies for fund security. This is a significant risk factor compared to regulated brokers that must adhere to strict client fund segregation rules.

Expert Option promotes itself as a leader in social trading. The platform allows users to view trades made by others in real time, follow top investors, and even compete in country-based rankings. This gamified approach appeals to beginners but also carries risks, as following other traders does not guarantee profitability.

The broker also maintains active social media channels on Facebook, Twitter, Instagram, and YouTube, where it shares updates and promotional content.

Expert Option highlights its award as “Best Trading Platform” at the China Trading Expo in Shenzhen (2017). While this recognition adds some credibility, traders should note that industry awards are not a substitute for regulatory licensing.

The broker includes standard risk warnings, emphasizing that trading involves a significant risk of loss and may not be suitable for all investors. It advises clients not to invest funds they cannot afford to lose and to seek independent financial advice if uncertain.

Importantly, the company acknowledges that it is not supervised by the Japanese Financial Services Agency (JFSA) and does not target residents of Japan. Similar disclaimers apply to other restricted jurisdictions.

The safety of Expert Option depends largely on a trader‘s risk tolerance. While the platform offers user-friendly features, multiple account types, and a wide asset selection, the lack of recognized regulation is a major drawback. Traders have limited protection in case of disputes, aside from the Financial Commission’s compensation fund.

For beginners seeking a low-cost entry into trading, Expert Option may appear attractive. However, experienced traders and those prioritizing fund security may prefer brokers regulated by authorities such as the FCA, ASIC, or CySEC.

Expert Option markets itself as a global trading platform with millions of users, low entry requirements, and innovative social trading features. Yet, its offshore registration and lack of recognized regulation remain significant concerns. While the brokers membership with The Financial Commission provides some dispute resolution mechanisms, it does not replace the protections offered by licensed regulators.

Traders considering Expert Option should weigh the convenience of its platform against the risks of trading with an unregulated broker. As always, due diligence and risk management are essential before committing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Multibank Group scams warning: denied withdrawals & fake trading profits. Don’t fall victim—read the latest scam cases today!

Cyprus regulator CySEC confirms HTFX’s decision to abandon its investment firm license, joining other brokers reshaping the island’s financial sector.

If you are researching Sucden review or looking into Sucden Forex trading, this in-depth article will help you understand the strengths and weaknesses of Sucden Financial, its regulatory standing, trading services, and whether it’s the right choice for you.

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.