CySEC Warns Five Unlicensed Trading Sites

CySEC flags five unlicensed trading websites targeting European investors and urges investors to exercise due diligence via its official register before depositing funds.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Despite claiming legitimate regulation, Zenstox has become the subject of an alarming surge in complaints regarding blocked withdrawals and aggressive account mismanagement. WikiFX investigates the pattern where "personal account managers" allegedly guide traders into debt, only to lock the doors when it’s time to cash out.

Abstract:

Despite claiming legitimate regulation, Zenstox has become the subject of an alarming surge in complaints regarding blocked withdrawals and aggressive account mismanagement. WikiFX investigates the pattern where “personal account managers” allegedly guide traders into debt, only to lock the doors when its time to cash out.

By WikiFX

All cases detailed in this report are based on authentic user complaints filed with the WikiFX Exposure Center. To protect the privacy and safety of the victims, their real identities have been anonymized.

For many traders entering the Forex market, the promise of a professional “Account Manager” implies safety and expert guidance. However, recent data from the WikiFX Exposure Center suggests that for clients of Zenstox, these managers may be the primary architects of their financial distress.

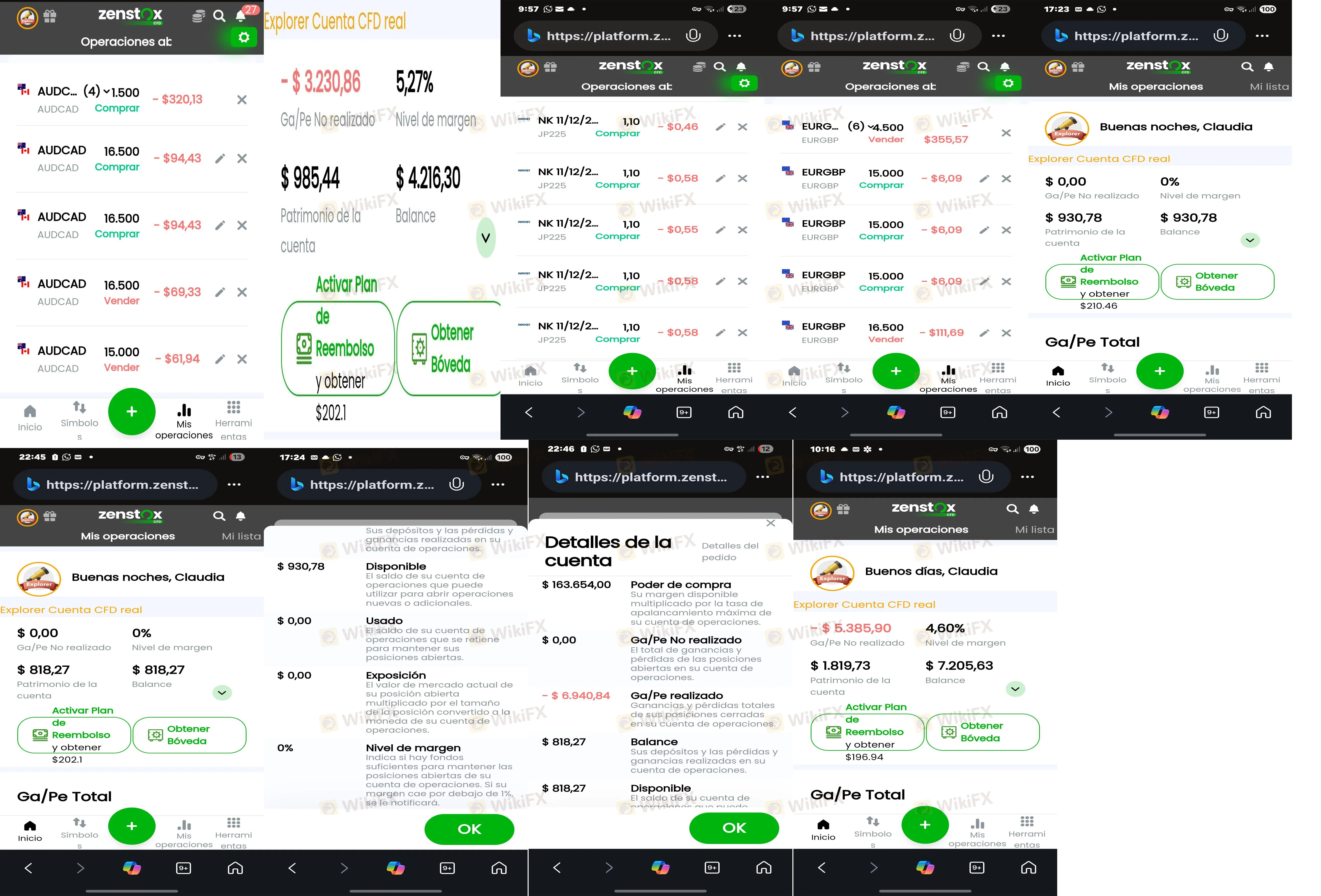

Our investigation reveals a distinct operational pattern targeting traders across the Middle East and Latin America. It begins with a modest deposit—often around $200. According to a victim from Mexico, once this initial amount is deposited, the broker simulates rapid success, “doubling” the amount on the screen to build false confidence.

However, the tone quickly shifts. Traders report being inundated with calls from “senior executives” urging them to upgrade to VIP status or leverage their accounts for higher returns. One trader reported being pressured to secure personal loans to meet a $1,000 deposit threshold, lured by promises of a “300% return.”

The critical issue arises when clients attempt to retrieve their funds. While deposits are processed instantly, withdrawals appear to be systematically obstructed.

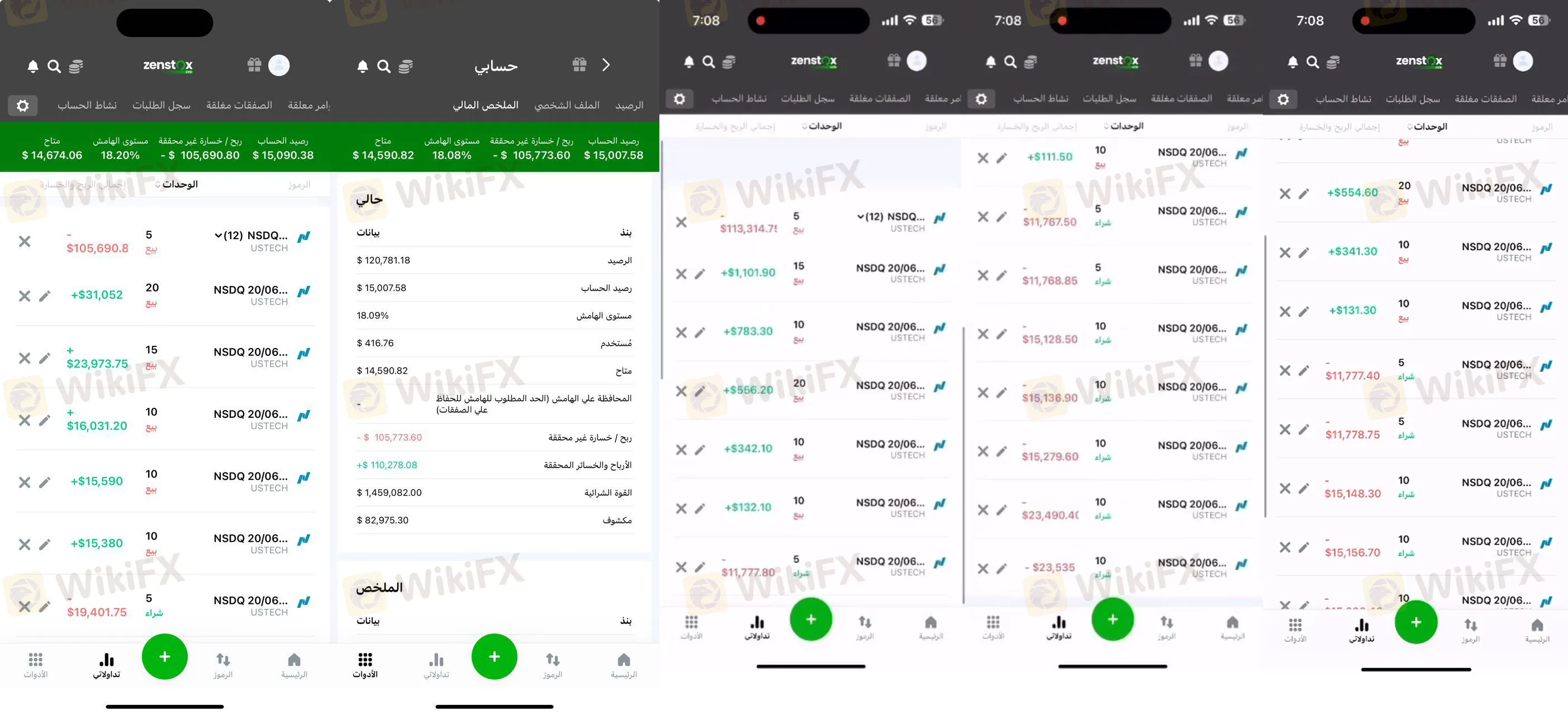

A trader from the UAE described a harrowing experience where, despite transferring over $23,000 in less than 20 days, not a single dollar could be withdrawn. The reason given is almost always identical: the account volume is insufficient. When traders comply and open new positions to meet these arbitrary requirements, the goalposts move again.

In a particularly severe case involving a $73,000 balance, a user from Qatar reported that after a year of trading, their request to withdraw $57,000 was approved and then retroactively rejected three days later without valid justification.

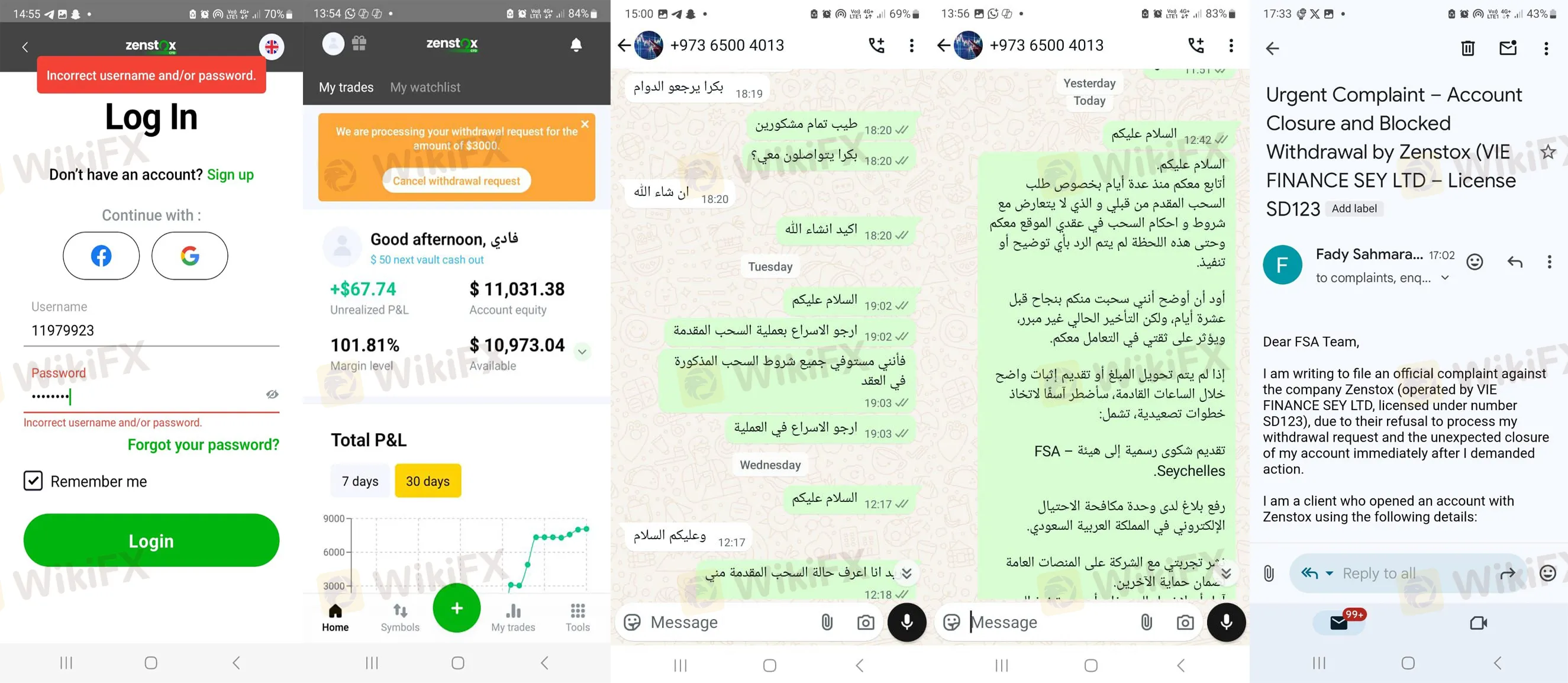

When bureaucratic delays fail to deter the client, the tactics allegedly turn aggressive. WikiFX has received reports of account managers shouting at clients, using insults, and issuing ultimatums.

A disturbing trend identified in the complaints is “forced trading.” When a client insists on withdrawing, managers allegedly coerce them into opening high-risk positions—often on volatile assets like Zinc or Gold—under the guise of “meeting turnover requirements.”

One victim reported that after requesting a withdrawal, their manager, identified as “Yousef,” forced them into six quick trades on Zinc that wiped out the entire balance. Another trader from Egypt claimed to have audio and video evidence of managers blackmailing them to sign documents before any withdrawal would be considered—a request that remained unfulfilled even after signing.

Eventually, for many, the platform simply goes dark. A user from Saudi Arabia reported that after successfully withdrawing once in early June 2025 to build trust, subsequent larger requests were ignored. By mid-June, their login credentials were blocked entirely with no explanation.

While Zenstox holds a license, it is crucial for traders to understand the limitations of “Offshore Regulation.” The broker is registered in Seychelles. Unlike top-tier licenses (like the FCA in the UK or ASIC in Australia), offshore regulators often have looser requirements regarding capital segregation and client compensation schemes.

WikiFX Regulatory Data for Zenstox:

| Regulator Name | License Type | Current Status |

|---|---|---|

| Seychelles Financial Services Authority (FSA) | Retail Forex License | Offshore Regulation |

The existence of this license does not automatically guarantee the safety of funds, especially when the broker operates from a jurisdiction where legal recourse for international clients is difficult and costly.

The volume of complaints against Zenstox has reached a critical level (16 complaints in just 3 months). The recurring consistency in user stories—aggressive account managers, refusal of withdrawals, and forced trading losses—presents a high-risk profile for potential investors.

We strongly advise traders to exercise extreme caution. If you are currently trading with Zenstox, avoid further deposits and document all communications with their support team.

Risk Warning: The information provided in this article reflects the current regulatory status and user feedback available to WikiFX. Trading forex and CFDs involves a high level of risk and may not be suitable for all investors. Ensure you fully understand the risks involved before trading. The regulatory status of brokers can change; please verify the latest information on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

CySEC flags five unlicensed trading websites targeting European investors and urges investors to exercise due diligence via its official register before depositing funds.

The rise of deepfake scams impersonating national leaders and public figures has caused significant financial losses in Malaysia, prompting the government to propose an AI Governance Bill aimed at strengthening safeguards, restoring public trust and providing regulatory clarity to support responsible AI use and investment.

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.