Abstract:Has your forex trading experience with FXONET been marred by investment scams, capital losses, and withdrawal issues? You’re not alone! Many traders have reported these experiences online, with some of them taking legal recourse to recover their stuck funds. While reading FXONET reviews online, we found a lot of negative comments for the broker. And a large chunk of them resorted to legal means for fund recoveries. In this article, we have shared some negative reviews of FXONET. Read on!

Has your forex trading experience with FXONET been marred by investment scams, capital losses, and withdrawal issues? Youre not alone! Many traders have reported these experiences online, with some of them taking legal recourse to recover their stuck funds. While reading FXONET reviews online, we found a lot of negative comments for the broker. And a large chunk of them resorted to legal means for fund recoveries. In this article, we have shared some negative reviews of FXONET. Read on!

Sharing Top Trading Complaints Against FXONET

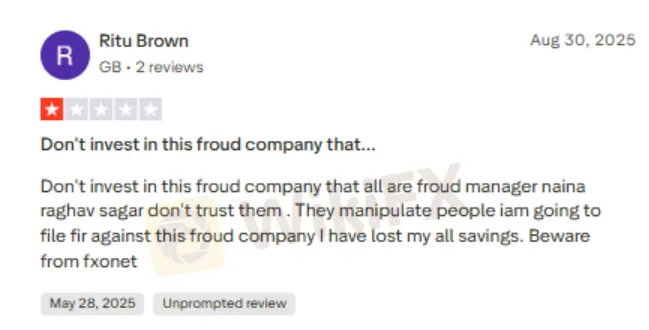

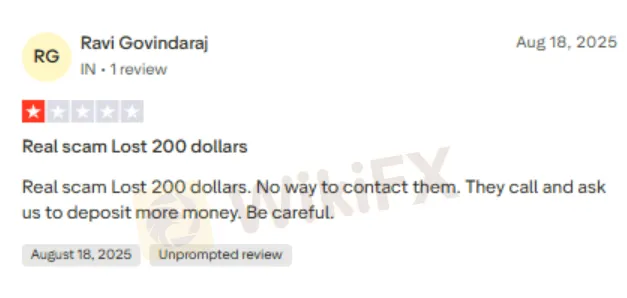

Fund Loss Complaints Flare Up Against FXONET

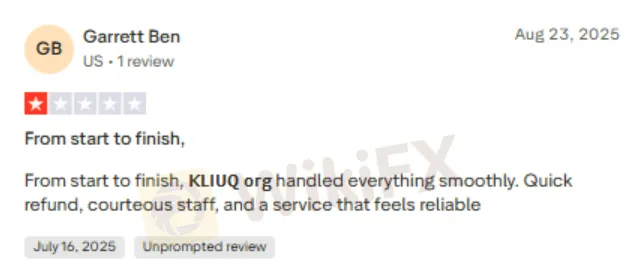

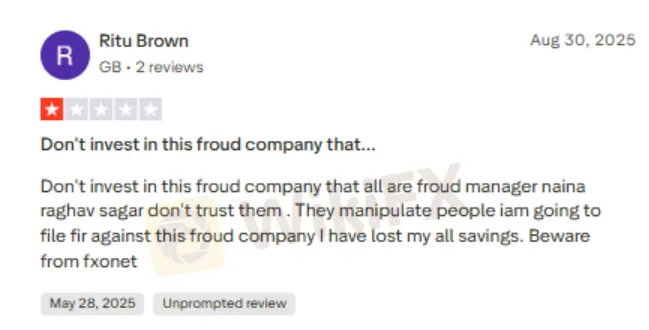

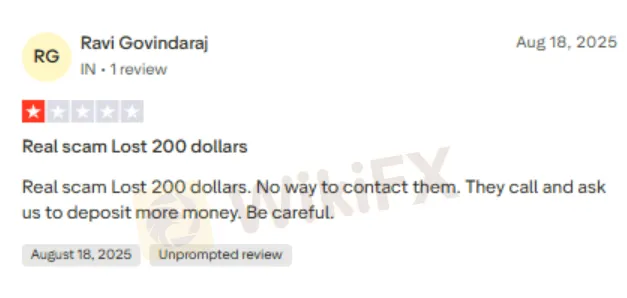

While checking FXONET reviews online, we found a lot of them complaining about the capital they lost when trading with this forex broker. While some lost all their life savings, others bore significant losses. This made us share multiple screenshots regarding capital losses. Take a look at these below.

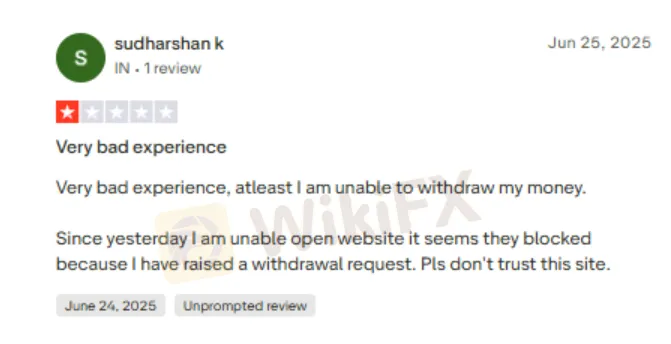

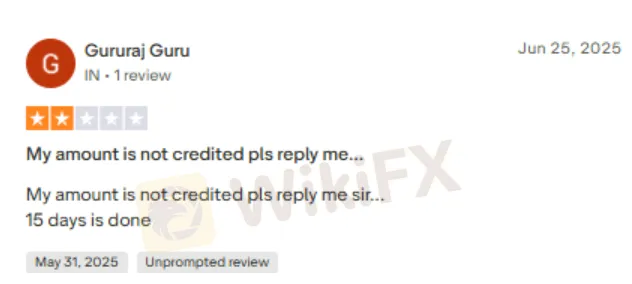

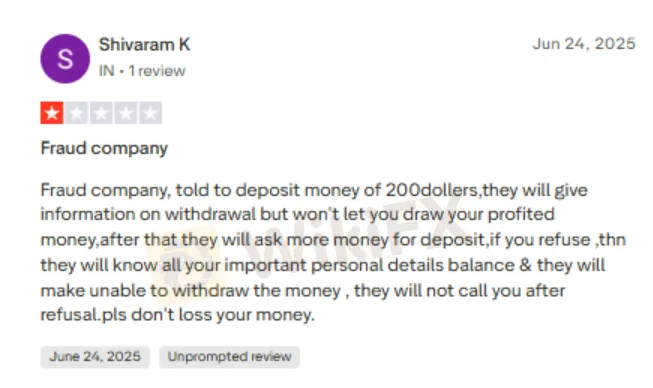

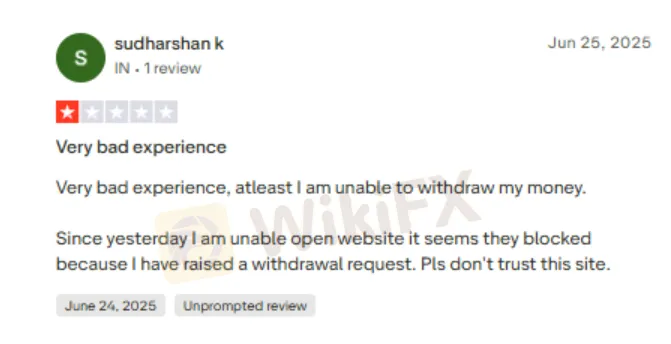

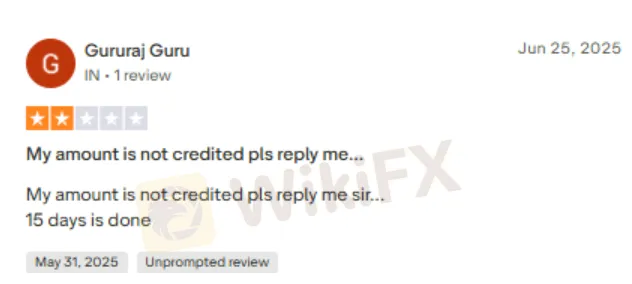

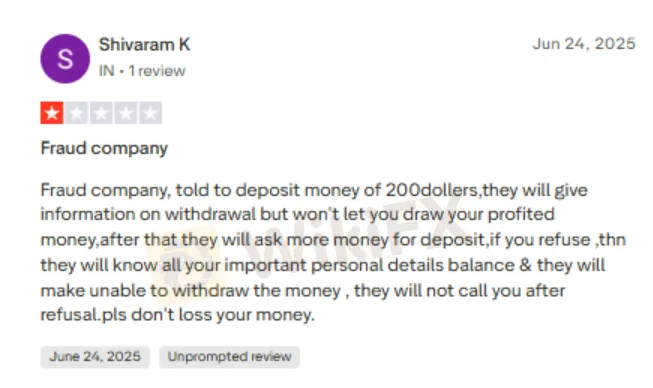

Withdrawal Access Blocked for Most Traders

Traders constantly face withdrawal denials, as FXONET does not grant them access to their funds. Many traders have reported that the broker has blocked their withdrawals, making investment scam complaints even more credible. Here are some withdrawal-related trading complaint screenshots.

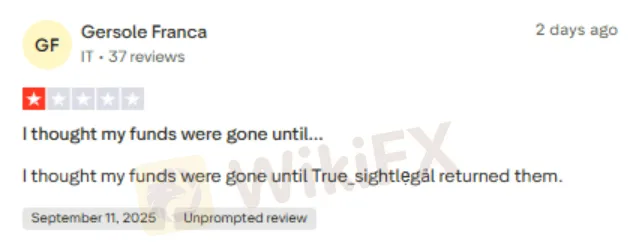

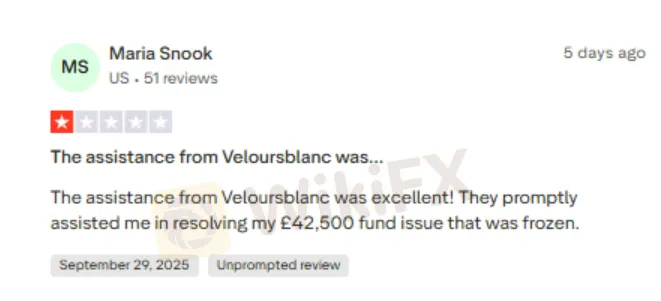

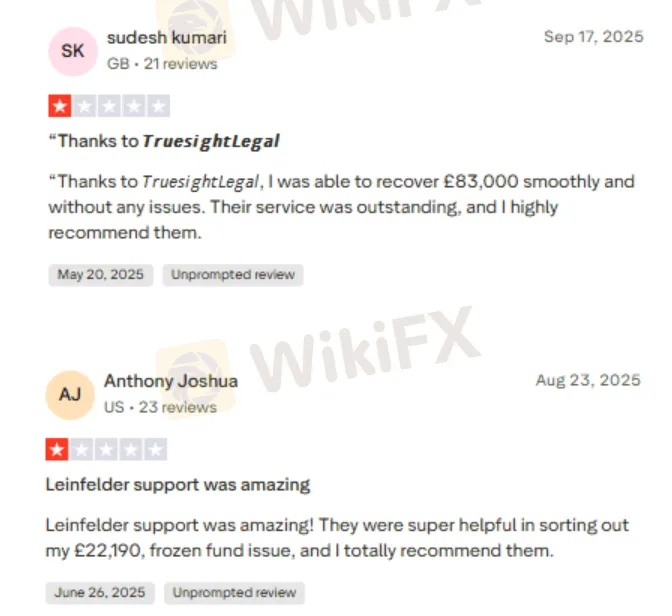

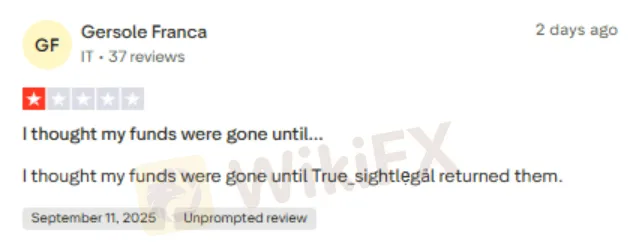

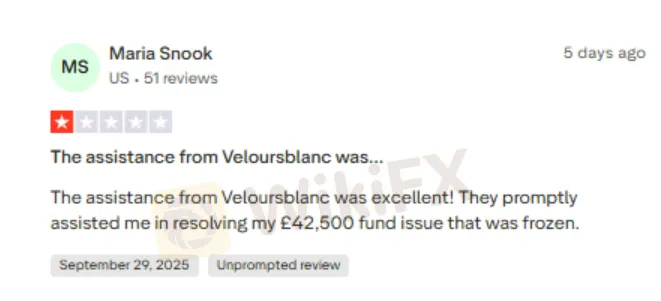

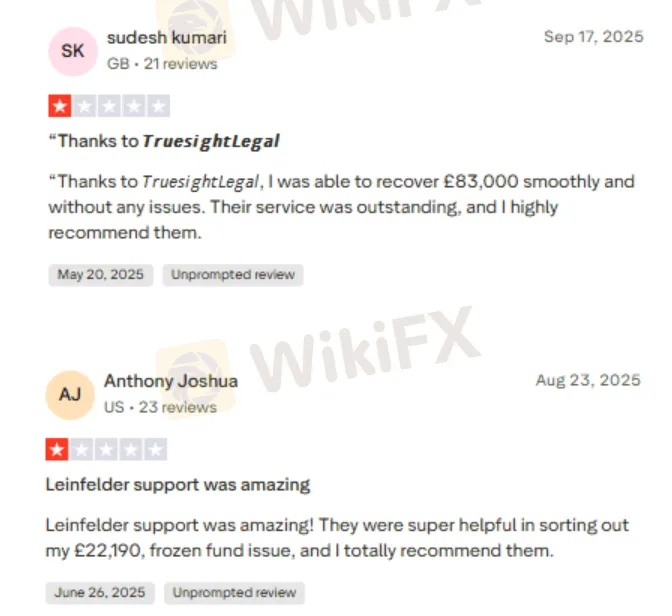

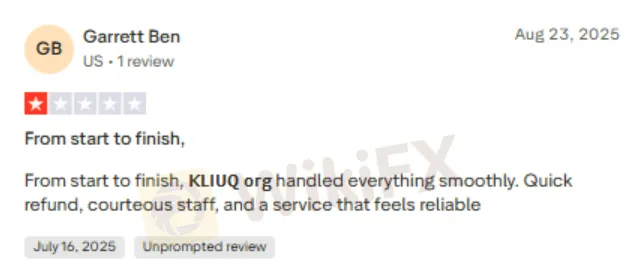

Many Traders Had to Take Legal Recourse to Recover Their Funds

The fund recovery issue with FXONET has been so immense that many traders had no option but to choose legal firms specialized in helping investors recover their capital. Courtesy of the help, many traders recovered their funds. Here are some screenshots.

WikiFX Shares FXONET Reviews - Score, Regulatory Status & More Details

NO REGULATORY LICENSE is what the WikiFX team found when investigating FXONET. Therefore, the large number of trading complaints against the broker is not a surprise. Traders will invariably face capital losses, withdrawal issues, and poor customer support service with these brokers. The Comoros-based forex broker has been scamming traders for more than a year of its operation. The lack of a regulatory license and massive trading complaints made us give the broker a poor score of 1.27 out of 10.

Catch forex scam news and other financial updates on WikiFX Masterminds. Join now using these steps -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.