Abstract:Do you frequently encounter unprofessional trading behavior from ScoreCM officials? Do you have to face repeated fund withdrawal denials or delays? It’s time to wake up to the growing investment scam within this forex broker. Investors frequently complain about the unethical trading practices while sharing ScoreCM reviews online. We have shared those reviews in this article. Take a look.

Do you frequently encounter unprofessional trading behavior from ScoreCM officials? Do you have to face repeated fund withdrawal denials or delays? Its time to wake up to the growing investment scam within this forex broker. Investors frequently complain about the unethical trading practices while sharing ScoreCM reviews online. We have shared those reviews in this article. Take a look.

Top Forex Trading Complaints Against ScoreCM

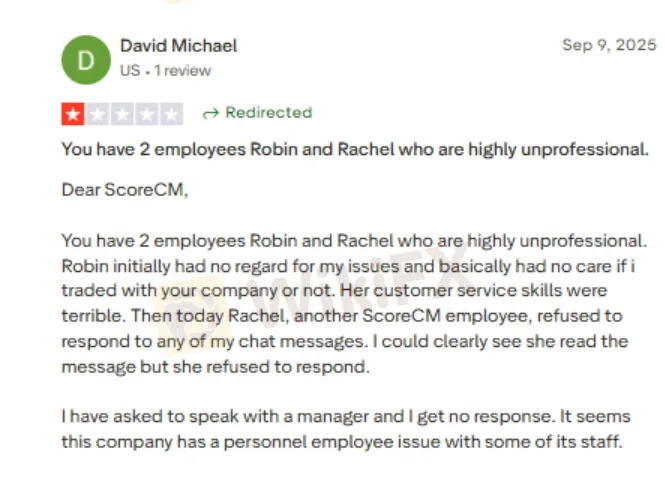

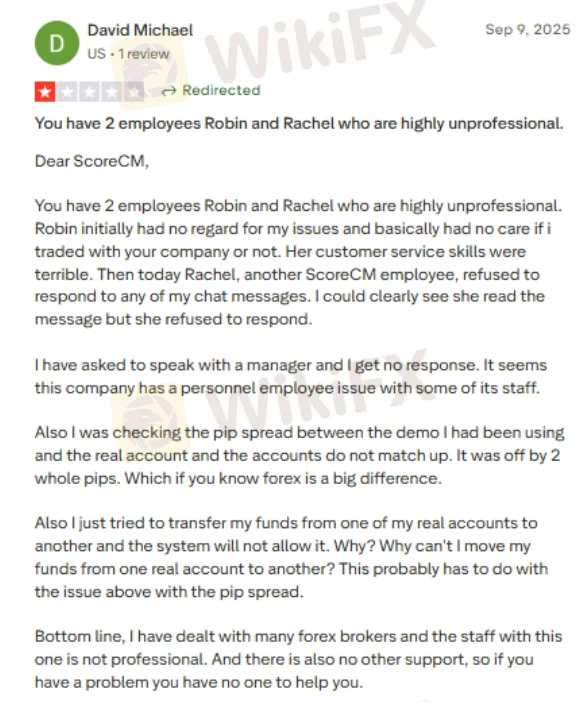

Unprofessional Behavior from ScoreCM Officials

Investor relationships thrive on transparency and trust — both of which seem absent from ScoreCM‘s operations. A trader reported misconduct by ScoreCM’s officials wherein the queries were intentionally left unanswered. The officials did not respond to any of the messages regarding the various queries the trader had. Here is the screenshot of the trader who reported misconduct by the broker officials.

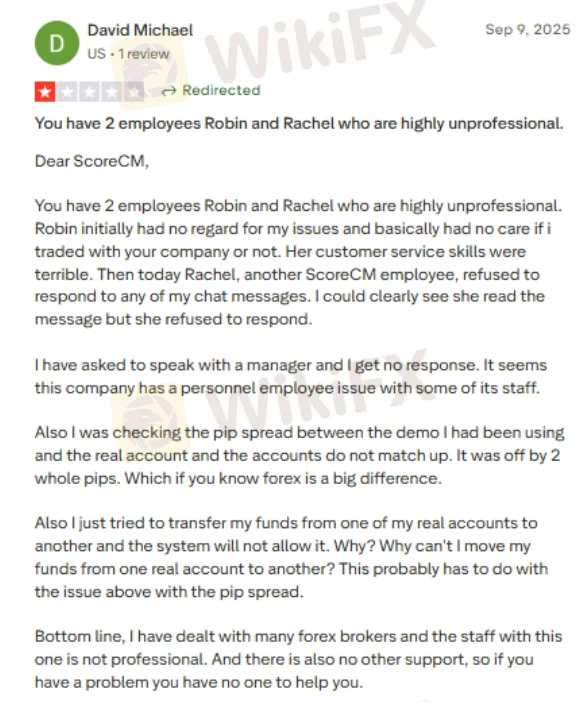

Massive Pip Spread Difference & Fund Transfer Hassle

The same trader also pointed out the flaws regarding the massive differences in pip spreads that the trader witnessed between the demo and real accounts. As per the trader, the difference was a whole 2 pips, which is arguably a massive deviation. The trader also raised the issue of not being able to transfer funds from one of the real accounts to another. This points to the growing scam within ScoreCM.

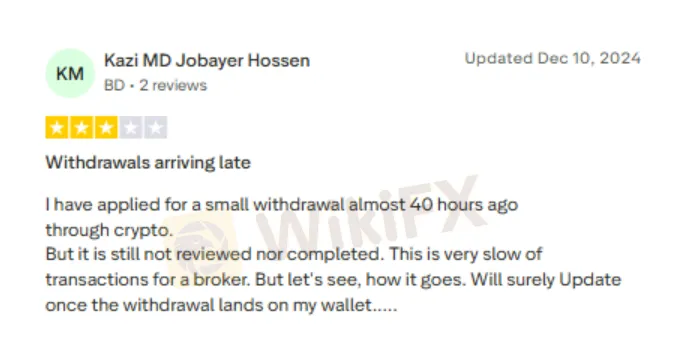

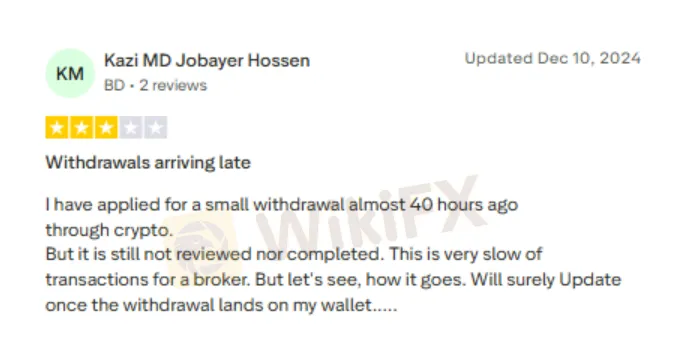

Slow Withdrawal Process Concerns Traders

ScoreCM is also found guilty of delaying the withdrawal process and worsening the traders experience. The withdrawal glitch prompted one trader to share this complaint online.

The Review of ScoreCM by WikiFX - Score, Regulation Status & Other Details

Before sharing ScoreCM reviews, the WikiFX team investigated the broker on many aspects and found it not worthy for traders. The investigation saw the broker running forex business for more than a year without a valid license from a competent financial authority. This is the biggest red flag that traders should take note of. Considering every trading aspect, the WikiFX team handed ScoreCM a poor score of 1.27 out of 10.

To your best interest, avoid such a forex broker. Instead, partner with a regulated broker with sound investor reviews and business fundamentals for a rewarding experience.

For more such scam alerts & forex investment updates, join the ‘WikiFX Masterminds’ club.

You can join it through these steps -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.