Abstract:RoboMarkets obtains Dubai SCA Category 1 licence, boosting its MENA brokerage expansion with full trading and securities dealer permissions.

RoboMarkets Expands to the Middle East with Top SCA Licence

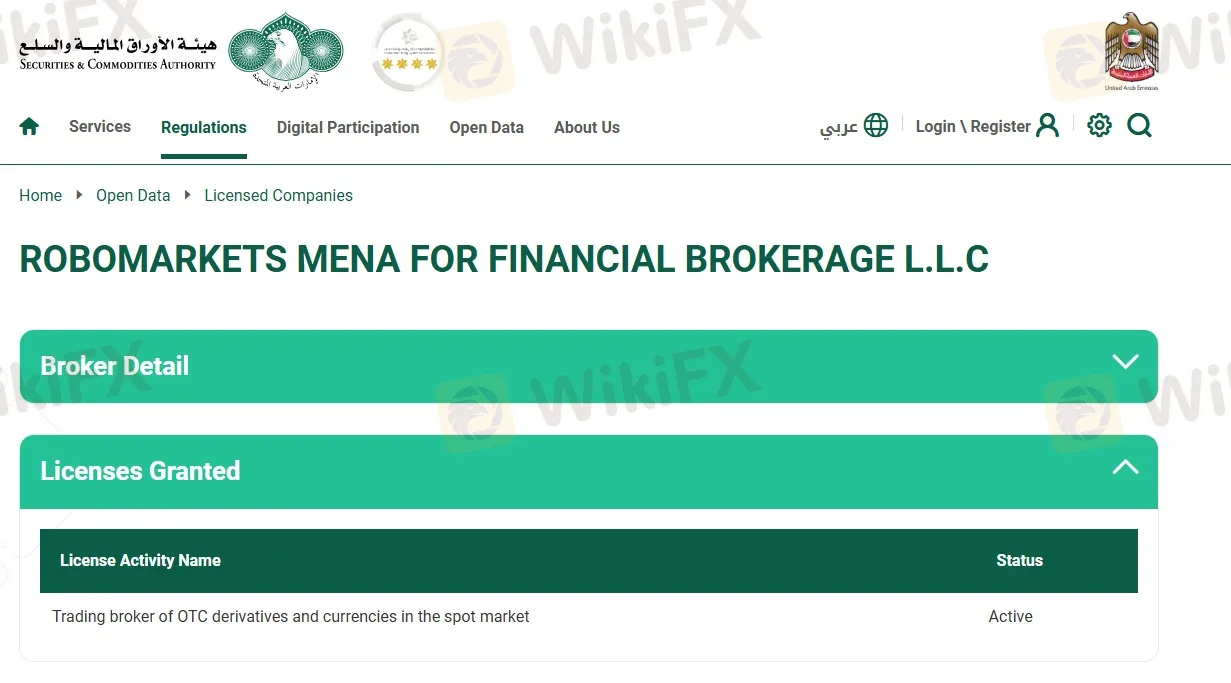

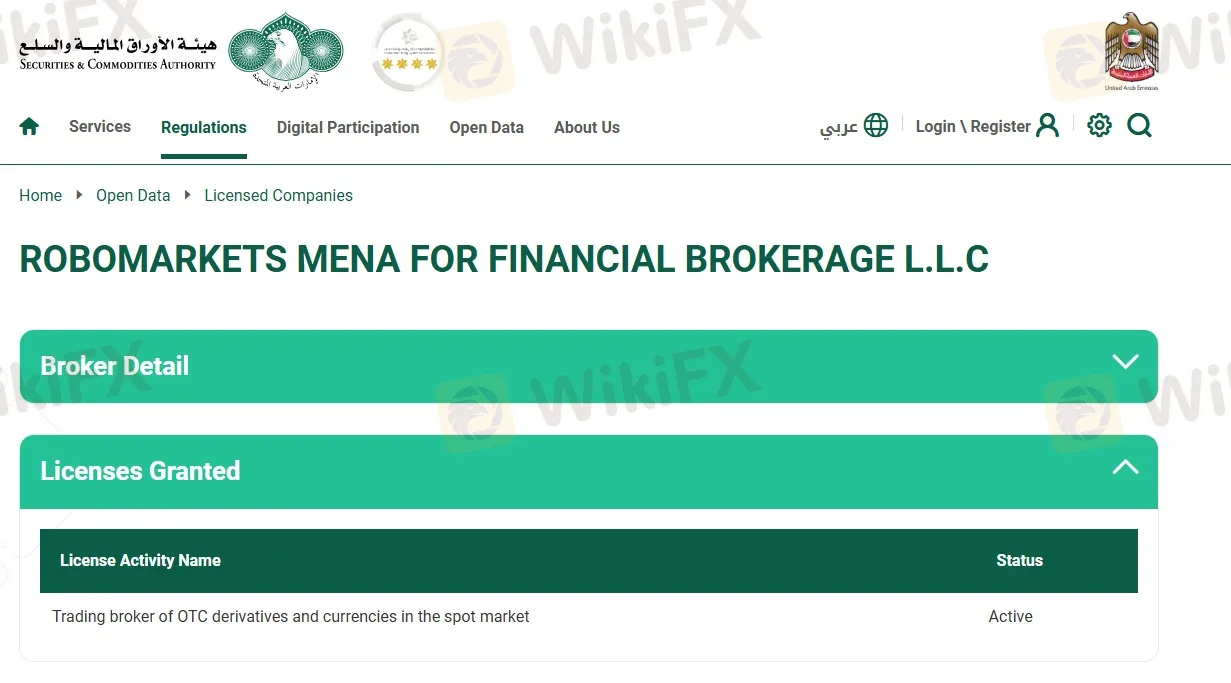

RoboMarkets has achieved a significant milestone in its Middle East expansion by securing a Category 1 licence from the Dubai Securities and Commodities Authority (SCA). The licence, awarded to its local entity RoboMarkets MENA for Financial Brokerage—established in July 2024—grants the broker wide-reaching permissions across trading and clearing functions.

Unlike many UAE forex and CFD brokers that operate under a limited Category 5 licence, RoboMarkets now holds one of the most comprehensive regulatory approvals available in Dubai. This Category 1 authorisation allows the company to act as a trading and clearing broker, securities dealer, trading broker in global markets, broker for non-exchange-traded derivatives, and spot FX trading in the UAE, as well as an on-market securities broker.

Competitive Market for CFD Brokers in Dubai

The move follows a steady influx of CFD brokers in Dubai seeking regulatory legitimacy through the SCA. Most competitors, including Exinity, VT Markets, Eightcap, EC Markets, and Taurex, have opted for Category 5 licences, which function similarly to introducing broker (IB) models. In contrast, only a handful of global leaders—such as Plus500 and XTB—have acquired the more advanced Category 1 SCA licence.

By joining this top tier of brokers, RoboMarkets positions itself as a stronger contender in the evolving financial brokerage sector in the Middle East, especially as investor appetite in Dubais retail and institutional trading markets continues to rise.

New Leadership and Strategic Focus

RoboMarkets‘ Dubai register also reflects new executive leadership, with Karine Ugarte taking charge as CEO of RoboMarkets MENA in May 2025. The appointment signals the company’s strategic push to deepen its footprint across the Gulf region.

This expansion comes after RoboMarkets reshaped its European operations in early 2025. The Cyprus-regulated unit, formerly active in retail CFDs, shifted exclusively to institutional clients, while its Germany-based entity pivoted to stock, bond, and ETF brokerage. Meanwhile, its Belize-regulated brand RoboForex continues to serve retail CFD traders offshore.

Industry experts note that holding an SCA Category 1 licence not only differentiates RoboMarkets from other trusted CFD brokers in the Middle East but also enhances investor confidence through stricter compliance and oversight structures applied under Dubais financial framework.\

About RoboMarkets

Founded in 2012, RoboMarkets is a European brokerage group offering access to multi-asset trading services, including stocks, ETFs, bonds, forex, and CFDs. The company operates under several regulatory frameworks worldwide, serving both retail and institutional clients, with a growing focus on innovation and global market expansion.