简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Core Durable Goods Orders Rise At Fastest Annual Rate in 3 Years

Abstract:Amid chaotic swings MoM driven by the variability of Boeing plane orders, analysts expected prelimin

Amid chaotic swings MoM driven by the variability of Boeing plane orders, analysts expected preliminary July data to show a 3.8% MoM decline (following June's big plunge, following May's big surge). The good news is that the actualk print was better than expected (-2.8% MoM) but still in the red for headline orders. This dragged down the YoY headline growth to 3.5% as the front-running of tariffs fades and earlier this month, Boeing Co. reported a fewer orders in July than in June.

Source: Bloomberg

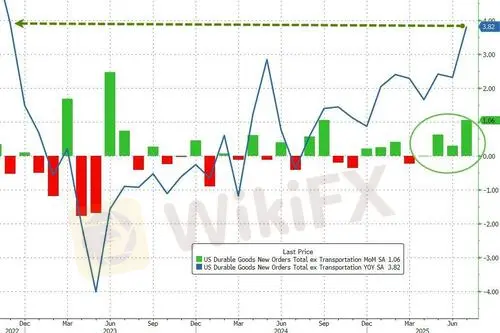

Under the hood, ex-Transports, durable goods orders rose over 1.0% MoM (the fourth straight month of gains), lifting core orders 3.8% YoY - its strrongest growth since Nov 2022...

Source: Bloomberg

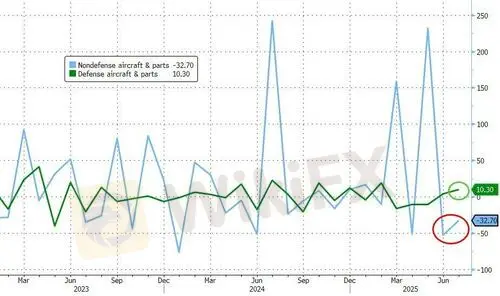

Once again, non-defense aircraft orders plunged (while defense aircraft orders rose)...

Source: Bloomberg

Capital Goods Orders, non-defense ex-aircraft rose 1.1% MoM (better than expected).

Non-defense capital goods shipments including aircraft, which feed directly into the equipment investment portion of the gross domestic product report, rose 0.7% after an upwardly revised gain a month earlier. Rather than orders, which can be canceled, the government uses data on shipments as an input to GDP.

The import/export tariffs - and the frontrunning of such - has clearly sparked chaos in the data.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Currency Calculator