Abstract:ACY Securities expands into Colombia, boosting its LatAm presence with instant crypto withdrawals and FSCA-backed growth in South Africa.

ACY Securities Expands Footprint in Latin America

Australia-based broker ACY Securities has officially opened a new office in Bogotá, Colombia, marking its first on-the-ground expansion into the Colombian trading market and the wider Latin American region. Colombia has emerged as a fast-growing hub for online trading, drawing attention from leading CFD brokers in Latin America, with ACY joining competitors already establishing regional operations.

The firms latest move is part of a broader push toward the LaTAM forex brokers landscape, following its rapid African expansion earlier this year. According to ACY, the Colombian office will strengthen regional coverage under the leadership of Alla Darwish, Managing Director for the MENA division, while aligning with a global strategy that emphasizes localized support for retail forex clients.South Africa Hub Strengthens Global Operations

Prior to its Colombian debut, ACY solidified its African operations with the launch of a Johannesburg office in 2024, after acquiring Ingot Brokers South Africa. The firm secured an FSCA regulated broker license (No. 51008), allowing it to formally roll out its multi-asset trading solutions—including MetaTrader 4, MetaTrader 5, Copy Trading services, and the in-house developed LogixTrader platform.

The South Africa trading hub is positioned as a key pillar of ACY‘s growth, leveraging the country’s established capital markets and regulatory sophistication. Local traders benefit from a broader cryptocurrency CFD selection, bilingual support teams, and tailored education programs.

Innovation with Instant Crypto Withdrawals

Parallel to its geographic expansion, ACY has rolled out instant crypto withdrawals for eligible clients. The feature enables seamless transfers of USDT and USDC, raising the fee-free allowance from three to five withdrawals per month. Integrated across ACYs proprietary trading platform (LogixTrader), MT4, MT5, and copy trading, this upgrade enhances liquidity and cash-flow management for traders and affiliates.

“Clients asked for speed and simplicity in accessing funds,” said Ashley Jessen, COO of ACY Securities. “By enabling direct wallet payouts and expanding fee-free limits, were empowering traders to manage profits and scale efficiently.”

This enhancement also benefits affiliates, particularly those using copy trading services, who can now receive commissions and performance payouts more swiftly.

Conclusion

By entering Colombia and consolidating its South African operations, ACY Securities is positioning itself as one of the best forex brokers in Colombia 2025 while strengthening its global brand through bold, technology-driven services. With LogixTrader platform reviews highlighting its innovative tools and risk controls, ACY demonstrates that its dual focus—market expansion and tech upgrades—remains central to its strategy.

Important reminder:

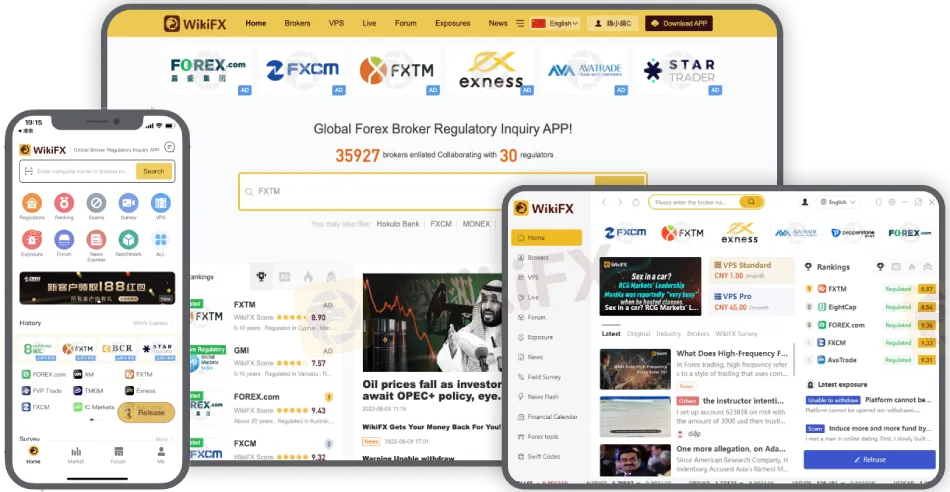

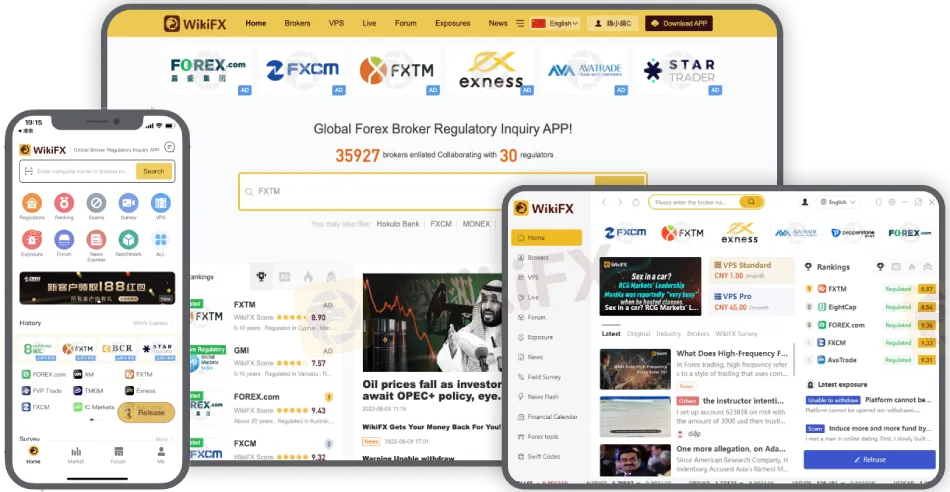

Always check a brokers negative cases on the WikiFX app before trading to reduce counterparty risk and avoid platforms with unresolved disputes. Scan the QR code below to download and install the app on a smartphone for quick verification and ongoing monitoring.

Why checking cases matters:

Negative case histories can signal issues such as withdrawal delays, account restrictions, and fee disputes that materially affect trading outcomes. Using a verification step with WikiFX helps surface regulatory status, risk exposure records, and user complaints to make safer, evidence-based decisions.