TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract: FXTRADING.com is an online brokerage firm that offers trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. WikiFX has comprehensively reviewed this broker by analyzing its regulations, specific information, etc. so that you have a deep understanding of this broker.

FXTRADING.com is an online brokerage firm that offers trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. WikiFX has comprehensively reviewed this broker by analyzing its regulations, specific information, etc. so that you have a deep understanding of this broker.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform that provides basic information and regulatory license inquiries. |

| WikiFX can evaluate the safety and reliability of more than 59,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To understand FXTRADING.com better, we explore it by analyzing two main perspectives:

A. General Info of FXTRADING.com

B. Regulatory Status

FXTRADING.com is an online broker offering trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. The company was established in 2014 and is headquartered in Sydney, Australia.

Besides Demo account, this broker offers Standard account and Pro account. The minimum deposit of a Standard account is only $50.

This broker offers maximum leverage of up to 1:2000. Traders should understand that high leverage can magnify your profits, but it can also result in a significant loss of capital.

The spreads and commissions depend on accounts and instruments. Clients on the Standard account can have variable spreads from 1 pip and there is no commission, while clients on the Pro account, can enjoy raw spreads from 0 pips but have to pay a commission of $2.0 per lot.

FXTRADING.com offers a variety of trading platforms to meet the diverse needs of its clients.

One of the most popular platforms is MetaTrader 4 (MT4), available for PC, Mac, iOS, Android, and as a web-based version. MT4 is a user-friendly platform equipped with advanced charting tools, technical indicators, and automated trading options.

In addition to MT4, FXTRADING.com also provides MT5 and WebTrader, allowing you to start trading directly after opening an account without the need for any additional downloads.

In terms of deposit and withdrawal, like many good brokers, FXTRADING.com provides a detailed form with important information about currency, payment method, minimum amount, arrival date, fees, etc. Deposits include PayPal, VISA, MasterCard, Neteller, UnionPay, Local Internet Banking, POLi, International Bank Wire Transfer and Local Bank Transfer.

FXTRADING.com offers customer support 24/7 AI support, and 24/5 via email, phone, and live chat.

What is a Legitimate License?

The legitimate license of FXTRADING.com

FXTRADING.com maintains a strong regulatory work-frame. adhering to the respective financial regulatory standards in these jurisdictions. Regulatory oversight by ASIC and VFSC contributes to a safer trading environment for clients.

This broker has official accounts on X, Facebook, and Instagram. And for different countries or languages, the broker also has a corresponding account to operate and promote.

Overall, FXTRADING.com is a regulated broker with a decent WikiFX score. The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction. Before deciding to invest with FXTRADING.com or any other broker, it's crucial to stay updated with the latest information on WikiFX and conduct your due diligence. Market conditions and broker reputations can change, so make sure to make informed decisions to avoid potential regrets in your trading journey.

If you want more information about brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

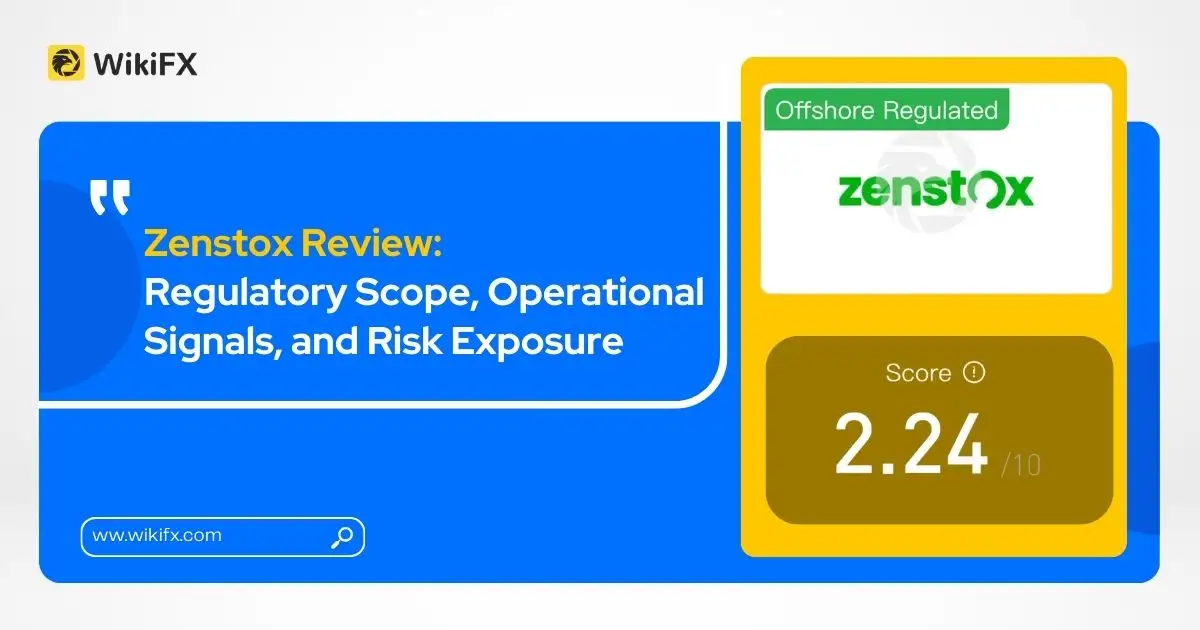

New findings raise concerns over Zenstox’s offshore licensing, internal trading structure, and reported fund access issues.

TopFX is a regulated broker under CySEC, holding Market Maker license No.138/11 since 2011.

The Danish Financial Supervisory Authority (Finanstilsynet) has confirmed that the Copenhagen Interbank Offered Rate (CIBOR) qualifies as a significant benchmark under the revised EU Benchmarks Regulation (BMR), following a notification that its use exceeds EUR 50 billion across the European Union.