Abstract:A 56-year-old trader from Gombak, Malaysia, recently lost more than RM1.6 million in a sophisticated online investment scam orchestrated through the popular messaging application, WeChat.

A 56-year-old trader from Gombak, Malaysia, recently lost more than RM1.6 million in a sophisticated online investment scam orchestrated through the popular messaging application, WeChat. Selangor police chief Datuk Hussein Omar Khan confirmed the case, which involved a fraudulent investment app that exploited the victim's trust and led to substantial financial losses.

The investigation revealed that the trader was first approached by the suspect via WeChat, where they convinced him to download an investment app linked to a supposed online trading platform. The trader was then encouraged to deposit funds into this platform. Shortly after transferring the funds, the app showed that his investment was generating profits. This initial success appeared promising, strengthening the victim's trust in the platform and motivating further engagement.

However, complications began when the trader attempted to withdraw his alleged profits. The app cited various administrative fees and taxes as obstacles to the withdrawal. Among the reasons provided were so-called “cross-border transfer fees” and additional tax requirements, which the suspect claimed were necessary for the withdrawal process. According to the police report, these excuses compelled the victim to make further payments in an attempt to retrieve his funds.

Over time, the trader made a total of 44 transactions, transferring RM1,688,725 across four separate accounts associated with the fraudulent platform. Only after his continued efforts to withdraw funds remained unsuccessful did he realise that the promised profits were a sham. The trader then filed a report with the Selangor Police on November 9, prompting an official investigation into the case.

In response to the incident, Selangor's Commercial Crime Investigation Department opened an investigation under Section 420 of the Penal Code, which addresses cheating and dishonestly inducing the delivery of property. This case has sparked concerns among the authorities, leading them to urge the public to exercise caution when engaging in online investment schemes.

The police chief highlighted the importance of verifying the legitimacy of investment platforms before transferring funds, advising individuals to consult Malaysias central bank, Bank Negara Malaysia, and the Securities Commission Malaysia to authenticate the credentials of stock investments. He emphasised that scams exploiting digital platforms have become increasingly sophisticated, making it essential for investors to conduct thorough checks before committing to any investment apps.

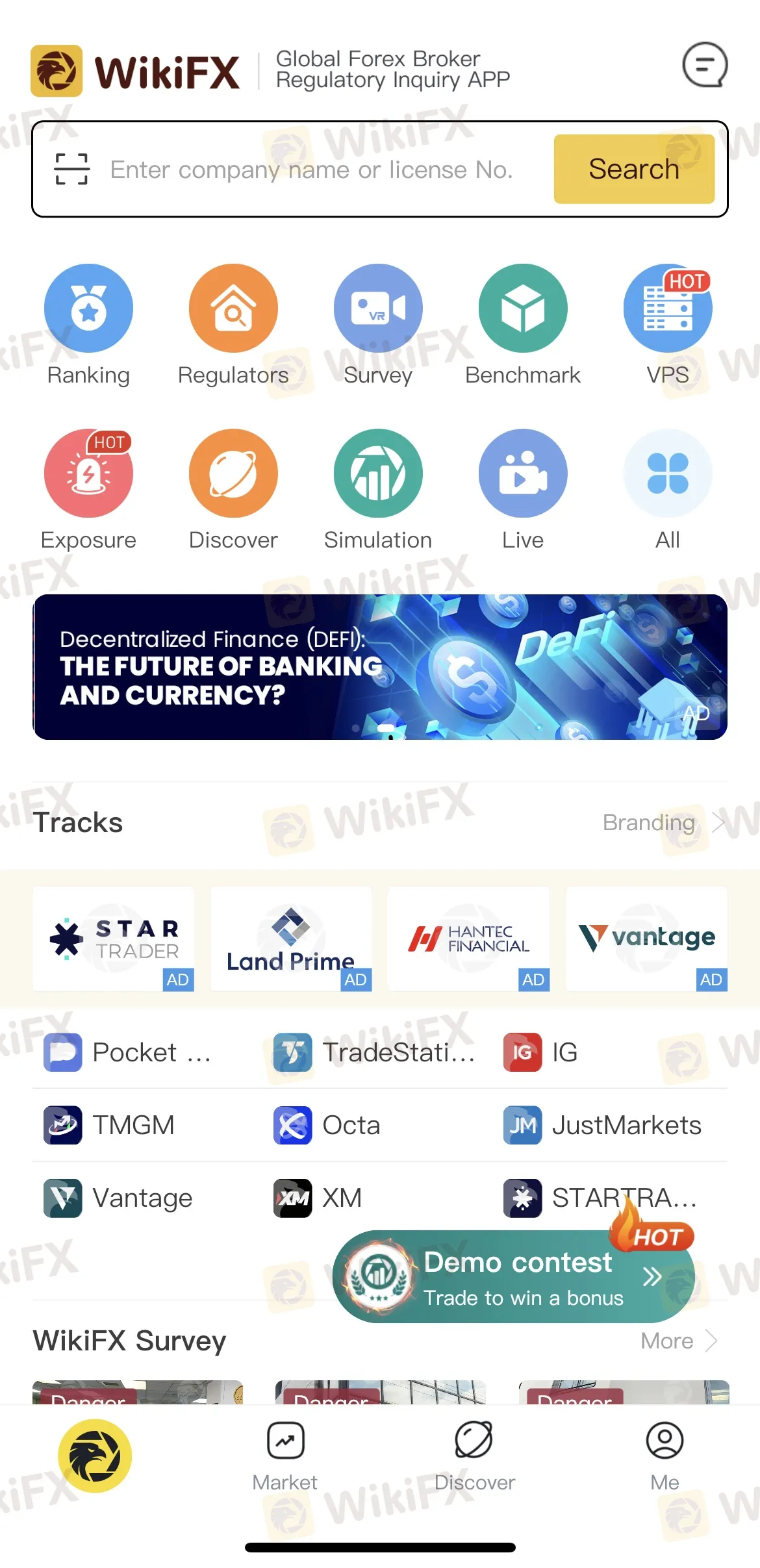

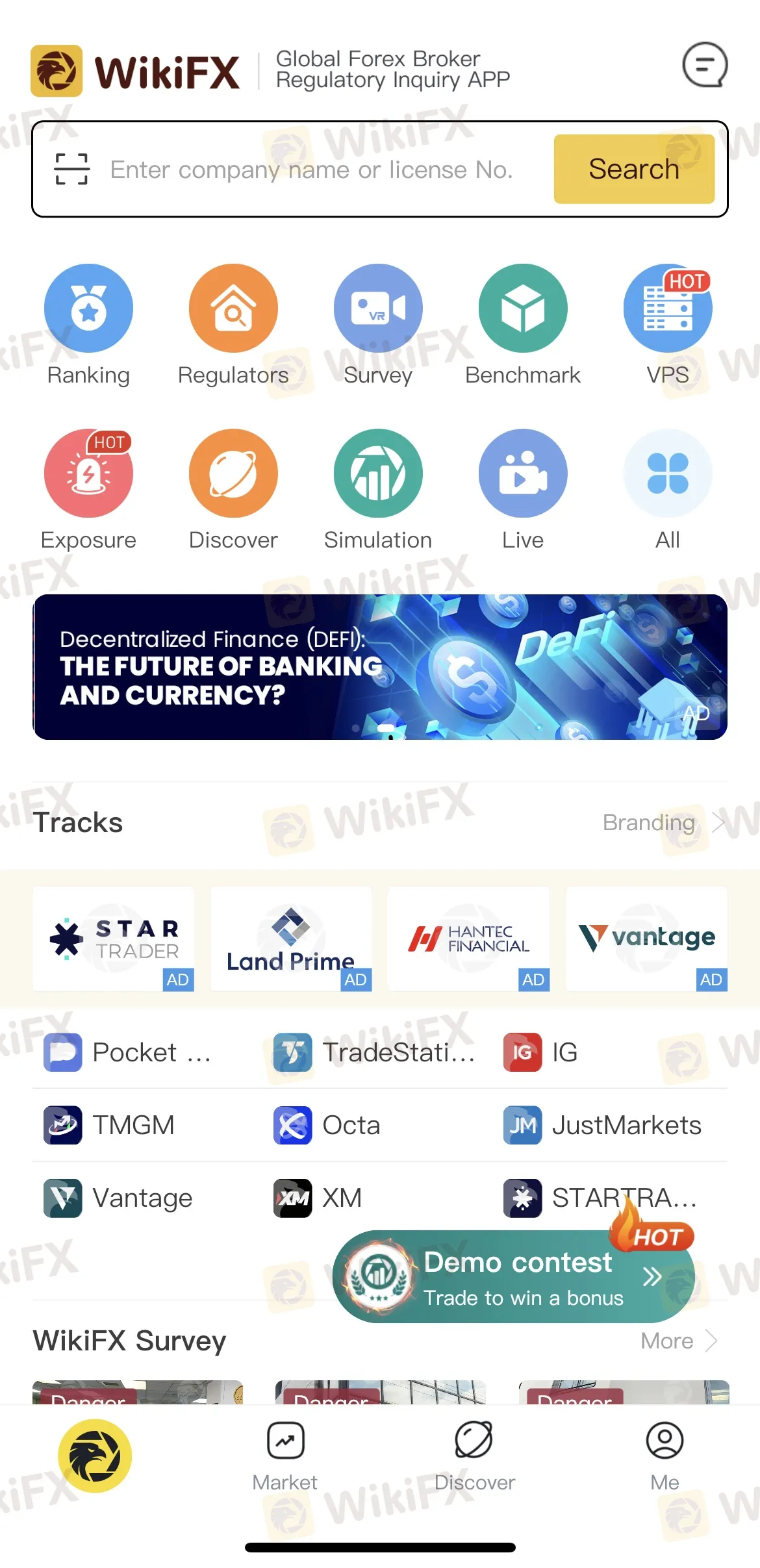

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment syndicates.