简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Poise at Peak Level

Abstract:The dovish tone of several Fed members weighs on the dollars strength and supports the U.S. equity market. Gold poised at all-time high levels on soften dollar and heighten geopolitical tension in Mid

The dovish tone of several Fed members weighs on the dollars strength and supports the U.S. equity market.

Gold poised at all-time high levels on soften dollar and heighten geopolitical tension in Middle East.

All eyes are on the RBA's interest rate decision, which is due today.

Market Summary

Ahead of the release of key U.S. economic data, including the GDP and PCE readings later this week, the market is anticipating clues on the Fed's monetary policy direction. Several Fed members expressed dovish sentiments last night, advocating for a larger rate cut, citing concerns that current interest rate levels are still weighing on economic growth. This has kept the U.S. dollar trading flat in the last session, as traders digest the dovish tone.

The sentiment also provided a boost to Wall Street, with major indexes hovering near all-time highs, buoyed by the expectation of further easing from the U.S. central bank. In the commodity market, safe-haven gold capitalized on the soft dollar, remaining above the $2,600 mark. The precious metal also received additional support from rising geopolitical tensions in the Middle East, following fresh airstrikes by Israel, which has worsened the regional conflict.

In the forex market, weaker-than-expected PMI readings from both the eurozone and UK weighed on the euro and Pound Sterling. However, the Pound Sterling quickly erased its losses and remained near its recent highs, signalling its status as one of the strongest performing currencies in the market. Meanwhile, attention is turning to the Reserve Bank of Australia (RBA), with expectations of a hawkish rate decision, further supporting the Aussie dollar.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32%) VS -25 bps (68%)

Market Movements

DOLLAR_INDX, H4

Expectations of a 50-basis point rate cut by the Federal Reserve in November have kept the US Dollar flat. Key upcoming data, including the Core PCE inflation report and employment components of the PMI, will shape future monetary decisions. Investors remain in a wait-and-see mode for additional trading trends.

The Dollar Index is trading flat while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the index might extend its losses after breakout since the RSI retreated from overbought territory.

Resistance level: 101.80, 102.35

Support level: 100.55, 99.70

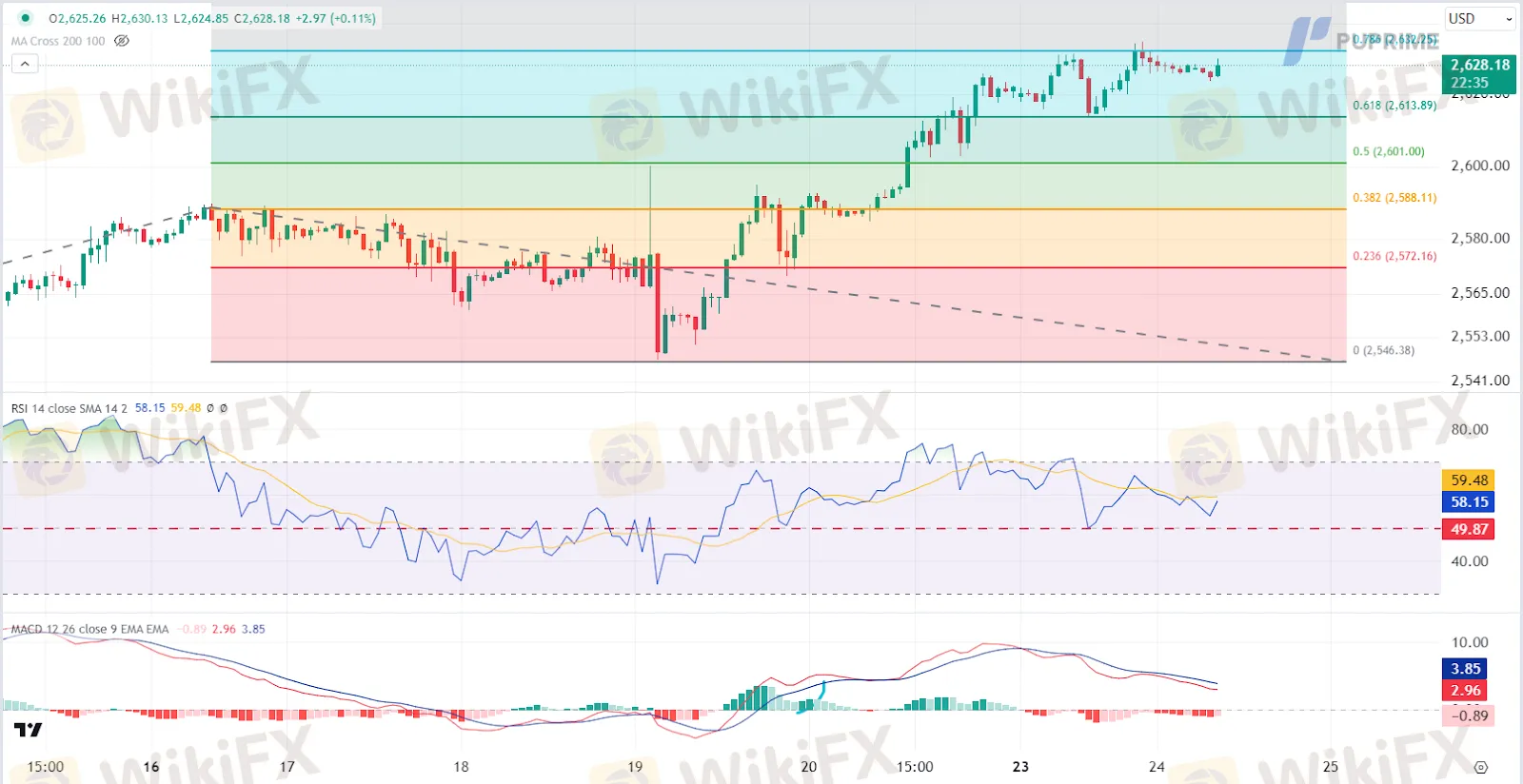

XAU/USD, H4

The escalation of Israeli airstrikes in Lebanon, resulting in over 492 deaths, triggered risk-off sentiment, prompting a sharp rebound in gold prices. The military conflict between Israel and Hezbollah continues, with thousands of families displaced and Hezbollah launching over 200 rockets into northern Israel.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2635.00, 2660.00

Support level: 2615.00, 2600.00

GBP/USD,H4

The Pound Sterling continues to show resilience as one of the strongest currencies in the market, despite weaker-than-expected UK PMI readings. The disappointing data suggested a potential slowdown in the U.K.'s economic growth, which initially caused a slight dip in the GBP/USD pair. However, this decline was short-lived, as the U.S. dollar eased in strength later in the session. This recovery in the Pound's strength allowed the pair to spike back to recent high levels, reinforcing the bullish sentiment around the currency.

The GBP/USD pair remains trading with extremely strong bullish momentum and is awaiting a further catalyst to break above its next resistance level at 1.3360. The RSI is hovering close to the overbought zone, while the MACD continues to edge higher, suggesting the pair remains trading with strong bullish momentum.

Resistance level: 1.3360, 1.3440

Support level:1.3280, 1.3140

EUR/USD,H4

The EUR/USD pair has eased from its recent bullish run and is now forming a head-and-shoulders price pattern, indicating a potential trend reversal. The euro has been weighed down by poor PMI readings, which came in below the 50 mark, suggesting that the eurozone economy is in contraction. This weakening economic outlook is negatively impacting the euro's strength. Additionally, the continuous release of weak economic indicators from the eurozone, coupled with the dovish stance from the ECB, is likely to further pressure the pair, potentially driving it lower in the near term.

EUR/USD is forming a head-and-shoulders price pattern, and a lower-high price pattern suggests a trend reversal signal for the pair. The RSI is declining toward the oversold zone, while the MACD is edging lower, suggesting the bullish momentum is vanishing.

Resistance level: 1.1130, 1.1223

Support level: 1.1020, 1.0920

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

ED uncovered 106 Crore "Nagaland Crypto Scam"

Smart Prop Trader to Close Doors in December 2024

Meme Coins: Fleeting Fortune or Financial Folly?

Philippine Scam Ring Targets Aussie Men with Fake Crypto Offers

Philippines Cracks Down on POGOs and Rising Crypto Scams

Italian Regulator Warns Against Go Markets Clone

Trump Administration Pushes for CFTC to Lead Crypto Regulation

Oil Prices Mixed Amid Accusations of Ceasefire Violations Between Israel and Hezbollah

India's Rs 6,000 Crore Ponzi scam

Currency Calculator