Abstract:In this article, we will conduct a comprehensive examination of KVB, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

KVB Prime Limited (referred to as “KVB”) is an online brokerage based at Hamchako, Mutsamudu, The Autonomous Island of Anjouan, Union of Comoros.

KVB provides a diverse range of tradable assets, including currency pairs, shares, cryptocurrencies, commodities, and global indices.

Additionally, KVB offers a social trading service that facilitates money managers and traders in enhancing efficiency, increasing profitability, and generating passive income through copy-trading and signal providing.

Meanwhile, KVB features an introducing broker (IB) program, allowing individuals and businesses to earn commissions by referring new clients to the company. Commissions or rebates are determined by the referees trading volume transactions.

Types of Accounts:

KVB offers two account options: the Classic Account and the Plus Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

KVB offers deposits and withdrawals via local bank deposits and cryptocurrencies in the form of USDT-ERC20 and USDT-TRC20. While KVB asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client.

Additionally, KVB will not facilitate fund transfers to or from third-party accounts.

Trading Platforms:

KVB provides three distinct trading platforms to cater to the diverse needs of its clients.

The MetaTrader 4 (MT4) platform is available on PC, mobile, and web, recognized for its advanced features and comprehensive tools supporting precise trading analysis. It offers a customizable interface with various order types, email and push notification alerts, and supports automated trading through Expert Advisors. MT4 also includes robust charting capabilities, back testing functionalities, and strategic trading methods, making it a preferred choice for many traders.

The KVB mobile application, developed in-house, offers comprehensive trading functionalities accessible globally with a single click. It features analysis charting, order execution, and account management tools, alongside economic events tracking. Users can manage trades efficiently, set deviations, take profits, and apply stop losses from a unified screen. The app includes an in-app calculator for margin, spread, and swap calculations, and provides access to global market news, economic calendars, and live market analysis. Clients receive daily market analysis through the app, enhancing their trading experience with timely insights.

For desktop users, KVB offers the ActsTrade platform, compatible with Windows and MacOS. ActsTrade features a user-friendly interface with advanced order management tools designed for efficient position control. It caters to both novice and experienced traders with intuitive design and functionality aimed at ensuring a seamless trading experience. ActsTrade supports traders in making informed decisions and optimizing trading efficiency, making it a versatile option for desktop-based trading.

Research and Education:

Unlike its industry peers, KVB does not provide extensive educational resources for traders. However, the broker does offer regularly updated market analysis, an economic calendar that helps traders keep track of important events that could potentially cause major volatility in the financial markets, as well as a news flash section with brief news snapshots.

Customer Service:

KVB offers customer service support in multiple languages, including English, Chinese, Vietnamese, Thai, Korean, and Bahasa Indonesia. Their representatives are available Monday through Friday from 7:30 am to 11:00 pm.

Clients can contact KVB via email at support@kvbplus.com. Unfortunately, no phone number is listed on KVB's official website.

Conclusion:

To summarize, here's WikiFX's final verdict:

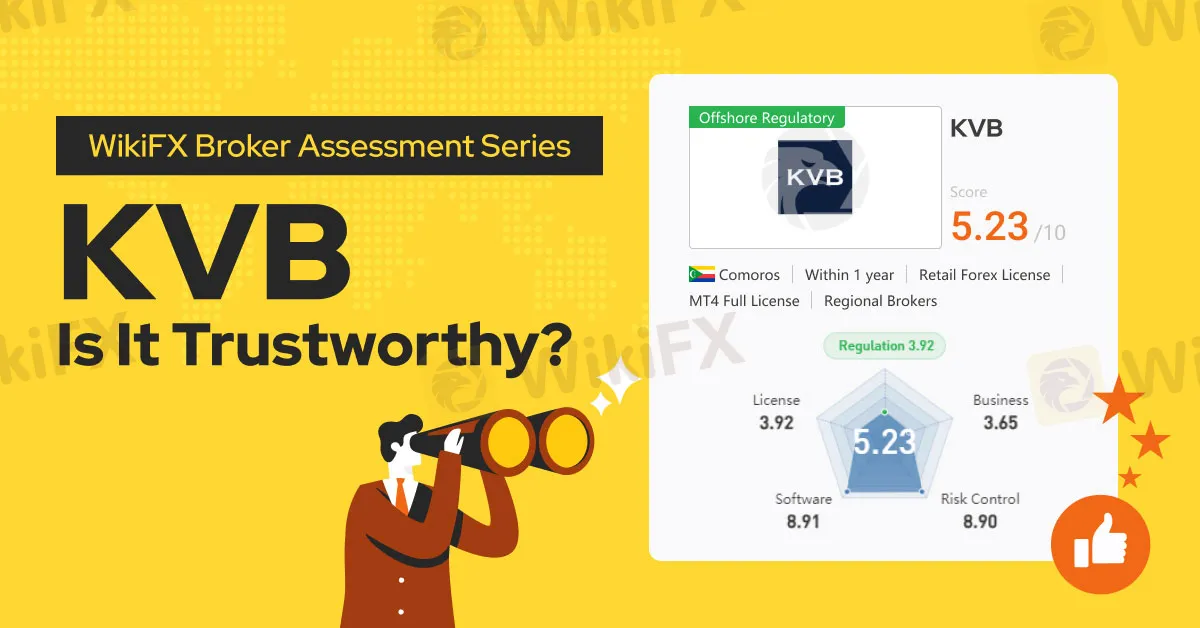

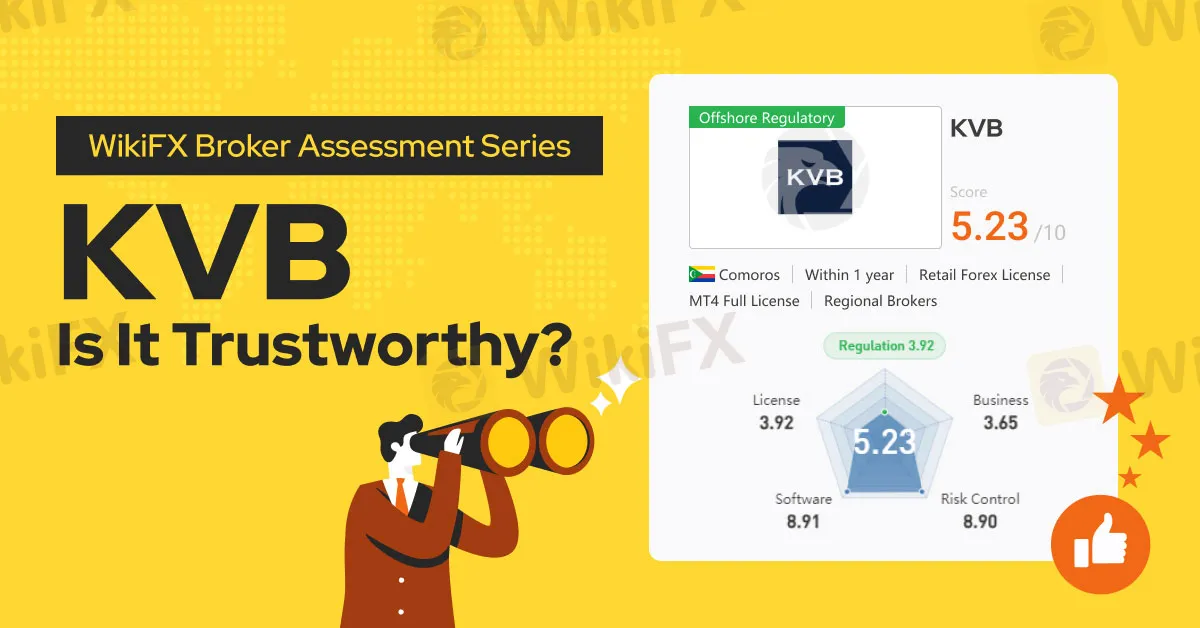

WikiFX, a global forex broker regulatory platform, has assigned KVB a WikiScore of 5.23 out of 10.

Upon examining KVBs license, WikiFX found that the broker is regulated by the Anjouan Offshore Finance Authority (AOFA) of Comoros under license number LI5626/KVB.

WikiFX has also validated the legitimacy of the license.

It is important to note that KVB only provides its services to certain countries in the world. Therefore, prospective clients who are interested in trading with the broker should check if its services are available in their respective countries.