Abstract: In Pakistan, several brokers faced complaints in February 2024, raising concerns about their practices and reliability. This article focuses on the most complained brokers during that month, as reported by WikiFX.

In Pakistan, several brokers faced complaints in February 2024, raising concerns about their practices and reliability. This article focuses on the most complained brokers during that month, as reported by WikiFX.

Oqtima

WikiFX Rating: 6.66/10

Number of Complaints in March: 5

Oqtima, a trading platform based in the United Kingdom, is a regulated broker under the oversight of two reputable regulatory bodies. The Cyprus Securities and Exchange Commission (CySEC) in the European Union and the Seychelles Financial Services Authority (FSA). Oqtima caters to various investment goals and risk profiles through its diverse range of market instruments, including metals, and crypto.

We have received five exposures against this broker recently.

FX Corp

WikiFX Rating: 6.90/10

Number of Complaints in March: 2

FX Corp is a regulated financial services provider offering a range of foreign exchange solutions to individuals and businesses. With its headquarters in Sydney, Australia, the company operates under the regulatory oversight of the Australia Securities & Investment Commission (ASIC).

Trader500.com

WikiFX Rating: 1.32/10

Number of Complaints in March: 1

Registered in the United Kingdom, Trader500.com is a forex broker providing access to a vast range of investment portfolios. With the Trader500.com platform, three trading accounts are available, Bronze, Silver, and Platinum. Besides, the MT4 trading platform is also available.

Thunder Markets

WikiFX Rating: 4.81/10

Number of Complaints in March: 1

Thunder Markets is a Seychelles-based forex and CFD broker that was founded in 2022. The company is regulated by the Seychelles Financial Services Authority (FSA). Thunder Markets offers a variety of trading accounts, including a Classic Account, a Thunder Account, and a Demo Account. The minimum deposit for the Classic Account is $500, and the minimum deposit for the Thunder Account is $1,000. The Demo Account is a risk-free way to practice trading with virtual funds.

HERO MARKETS LTD

WikiFX Rating: 1.11/10

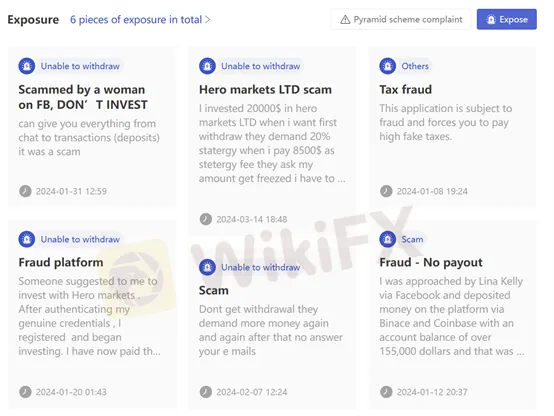

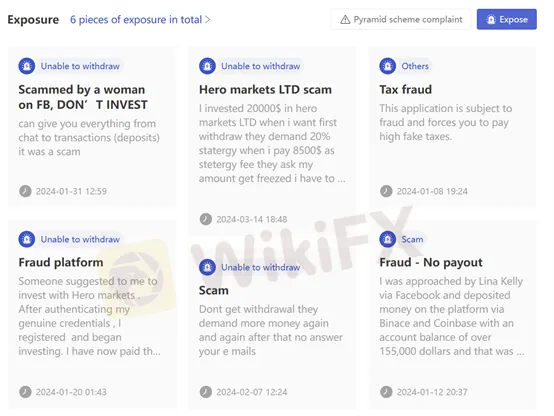

Number of Complaints in February: 6

HERO MARKETS LTD, a brokerage firm founded in 2023, operates out of China. While it offers a diverse range of tradable assets, including Forex, Stock Market Indices, Shares, and Noble Metals, it's essential to note that the company is not regulated as a broker. The maximum leverage offered is up to 1:400, allowing traders to amplify their positions. However, specific information regarding spreads and payment methods is not provided. The trading platform offered is ST5, and there is only one account type, the Real Account, mentioned. Unfortunately, there is no availability of a Demo Account, Islamic Account, or educational resources, and customer support is limited to email communication through support@heromarketsltd.com. Further details about the company's founding year and regulatory status are also unavailable.

VITTAVERSE

WikiFX Rating: 1.25/10

Number of Complaints in March: 2

VITTAVERSE is a trading platform registered in Saint Vincent and the Grenadines, offering a diverse range of market instruments including currencies, commodities, ETFs, cryptocurrencies, stocks, and indices. Established within the last one to two years, the company operates without regulatory oversight.

Conclusion

Selecting a reputable broker is a critical decision for investors. The brokers mentioned here have garnered varying levels of trust and scrutiny. Individuals need to conduct thorough due diligence and research before choosing a broker to ensure their investments and interests are protected. Regulatory compliance, reputation, and user feedback should all be considered when making this crucial decision. Although some brokers here have relatively high scores, it doesn't mean you can trust them without care.

WikiFX Rating System is updated in real-time, ensuring investors have access to the latest, most accurate, and comprehensive broker information.

The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction. If you want to know more information about the reliability of certain brokers, you can open our website or you can download the WikiFX APP to find the most trusted broker for yourself.