TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Vault Markets, a Southern African brokerage, faces scrutiny for its regulatory status and website accessibility. Learn more about its compliance in this detailed report.

Vault Markets, a brokerage that purports to service Southern African customers, has been criticized for its regulatory framework and online accessibility. This study educates investors and traders about Vault Markets and FX brokerage regulatory compliance.

Vault Markets trades currencies and commodities in South Africa, Dar es Salaam, Tanzania, and Windhoek, Namibia. These offices are located in famous neighborhoods such as Nelson Mandela Square in Sandton and SKYCITY MALL in Dar es Salaam, indicating an aim to build a reputable and accessible presence in significant financial centers in the region.

Vault Markets' main website (vault-markets.com) is down, reports say. It immediately doubts the broker's openness and operating reliability. A functioning and easily accessible website is essential for every forex broker since it serves as the major platform for customer engagement, account administration, and the distribution of trading materials. The broker's operational integrity is called into question by the absence of website accessibility, which not only makes it difficult for prospective customers to collect information and create accounts,

When choosing a forex broker, regulatory status is crucial. Brokers must protect customer funds, trade ethically, and be transparent. Unfortunately, Vault Markets does not yet have any regulations. This absence of governmental control considerably raises the risk for traders and investors, who have no redress in the case of a broker's disagreements, fraudulent tactics, or financial collapse.

Regulatory authorities like the FCA in the UK, CySEC in Cyprus, and ASIC in Australia place strict standards on forex brokers to protect customer money, trading operations, and the trading environment. Brokers without regulation expose customers to many risks.

Regulation is more than a bureaucratic hurdle; it underpins confidence and security in the turbulent and competitive foreign exchange market. Regulated brokers must keep segregated client accounts, conduct regular audits, follow rigorous capital adequacy rules, and engage in compensation programs that safeguard customers' cash in the case of broker failure.

Furthermore, regulatory organizations offer a framework for dispute resolution and guarantee that brokers adhere to fair trade principles, such as transparent pricing, order execution without undue delays, and the absence of manipulative activities. For traders, selecting a registered broker means selecting a partner that appreciates transparency, ethical procedures, and customer protection.

Vault Markets tries to be a respected Southern African broker, but its unregulated position and website accessibility issues deter customers.

Due diligence and regulatory compliance will give traders and investors a piece of mind and assure a fair, transparent, and safe trading environment when picking a forex broker.

Visit WikiFX to access a detailed report on Vault Markets. Gain insights into the regulatory standing, user reviews, and potential risks associated with trading through this broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

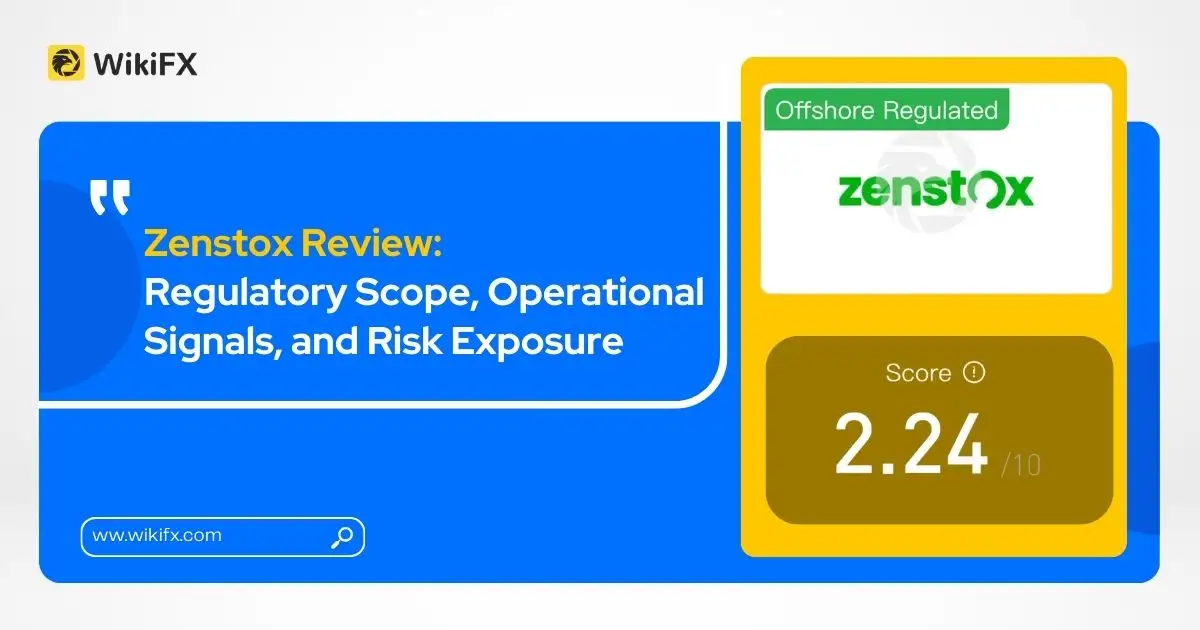

New findings raise concerns over Zenstox’s offshore licensing, internal trading structure, and reported fund access issues.

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Yiannos Ashiotis, the Group Managing Partner of Pnyx Hill and the Board Chairman of Revolut Digital Assets Europe.

TopFX is a regulated broker under CySEC, holding Market Maker license No.138/11 since 2011.