简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WAYONE CAPITAL Review 2025: Institutional Audit & Risk Assessment

Abstract:WAYONE CAPITAL currently holds a critical WikiFX Score of 1.86 and operates as an Unregulated entity registered in Saint Lucia. Based on the absence of authorized financial oversight and verified reports of withdrawal failures, this broker is classified as a high-risk platform. The operational model suggests an offshore entity targeting specific demographics (primarily India and the UAE) without the requisite liquidity safeguards or legal compliance frameworks expected of a Tier-1 brokerage. Traders are advised to exercise extreme caution, as the platform demonstrates significant indicators of potential insolvency or fraudulent activity.

Executive Summary

WAYONE CAPITAL currently holds a critical WikiFX Score of 1.86 and operates as an Unregulated entity registered in Saint Lucia. Based on the absence of authorized financial oversight and verified reports of withdrawal failures, this broker is classified as a high-risk platform. The operational model suggests an offshore entity targeting specific demographics (primarily India and the UAE) without the requisite liquidity safeguards or legal compliance frameworks expected of a Tier-1 brokerage. Traders are advised to exercise extreme caution, as the platform demonstrates significant indicators of potential insolvency or fraudulent activity.

Quick Take: Pros and Cons

Operational Highlights

- ✅ Platform Standard: Supports the industry-standard MetaTrader 5 (MT5) for advanced charting.

- ✅ Account Accessibility: The “Classic” account allows entry with a minimal deposit of $100.

- ✅ Leverage Flexibility: Offers high leverage up to 1:500 for aggressive trading strategies.

Critical Risk Factors

- ❌ Critical WikiFX Score: A score of 1.86/10 indicates a near-total lack of reliability.

- ❌ Regulatory Void: No valid license from any financial authority (Unregulated).

- ❌ Withdrawal Failures: Multiple confirmed cases of capital retention and refusal to pay.

- ❌ High Cost Structure: “Classic” spreads start at 1.8 pips, which is uncompetitive.

- ❌ Security Gaps: Trading software lacks two-factor authentication (2FA) or biometric security.

Regulatory Compliance & Safety Profile

License Verification

Upon auditing the corporate structure of WAYONE CAPITAL, the data reveals a severe compliance void. The entity is registered in Saint Lucia, a jurisdiction often utilized by International Business Companies (IBCs) for tax optimization rather than rigorous financial supervision. Currently, WAYONE CAPITAL holds no valid regulatory license from reputable bodies such as the FCA (UK), ASIC (Australia), or DFSA (Dubai), despite its operations in the UAE.

Risk Warning: Unregulated Status

Operating without regulatory oversight presents immediate and catastrophic risks to retail capital:

- Lack of Segregated Funds: Unlike regulated brokers, there is no legal mandate for WAYONE CAPITAL to keep client funds in segregated Tier-1 bank accounts. This creates a risk of commingling, where client deposits could be used for corporate operational expenses.

- Absence of Compensation Schemes: Clients are not protected by safety nets like the FSCS (UK) or ICF (Cyprus). In the event of broker insolvency or “exit scams,” user capital is likely non-recoverable.

- Jurisdictional Arbitrage: By operating from Saint Lucia while targeting clients in India and the UAE, the broker creates a legal disconnect that makes cross-border litigation nearly impossible for defrauded traders.

Trading Infrastructure & Costs

Leverage Policy

WAYONE CAPITAL offers dynamic leverage ranging from 1:200 to 1:500 depending on the account tier.

- Classic Account ($100 Deposit): Offers 1:500 leverage. While this allows traders to control large positions with small capital, in an unregulated environment, this is often a mechanism to accelerate client losses (churn). High leverage without negative balance protection—which is not confirmed here—exposes traders to debt beyond their initial deposit.

Cost Structure

The cost analysis reveals a pricing structure that is unfavorable for retail traders:

- Classic Account: The base spread starts from 1.8 pips. In the current competitive landscape where standard spreads average 1.0–1.2 pips, this represents a significantly higher cost of trading, severely impacting profitability for day traders and scalpers.

- VIP & ECN Accounts: While the VIP account offers spreads from 0.8 pips, it requires a deposit of $2,500. Investing this volume of capital into a platform with a 1.86 safety score is financially imprudent.

- ECN Account: Requires $5,000 entry. Details on commissions are opaque, but the risk-to-reward ratio regarding the safety of principal is disproportionately high.

Software Architecture

The broker utilizes the MetaTrader 5 (MT5) platform. While the software itself is rated highly for its technical capabilities (customizability, search functions), the specific implementation by WAYONE CAPITAL has security flaws. The audit notes a lack of two-step login and biometric authentication. In an era of increasing cyber threats, the absence of these basic security protocols exposes client accounts to unauthorized access.

Market Sentiment: User Complaints

Risk Factors: Confirmed Withdrawal Denials

Analysis of user feedback indicates a pattern of behavior consistent with liquidity crises or fraudulent intent.

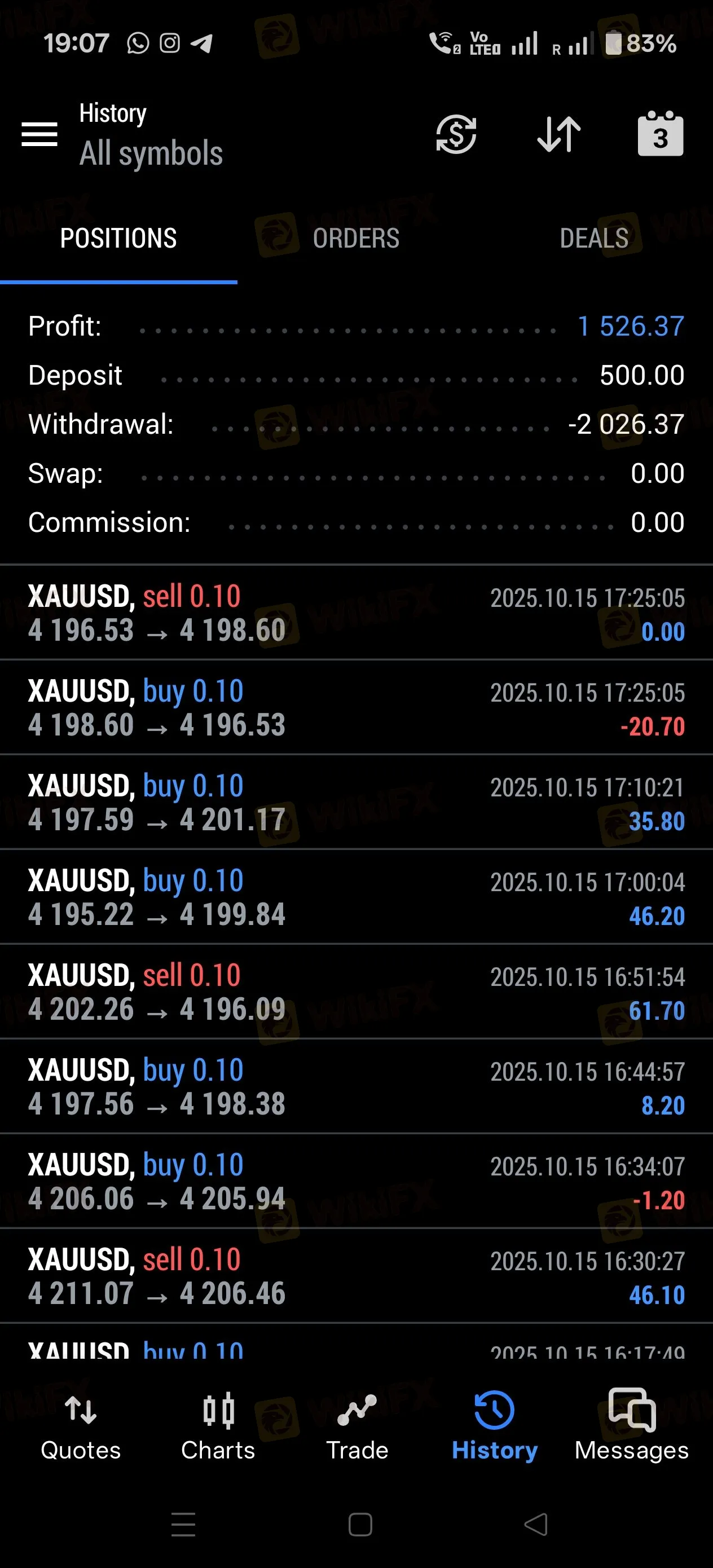

- Case 1 (India - Nov 2025): A user reported a withdrawal failure of $2,026. The broker's support cited personal excuses (e.g., the owner, “Vikas sir,” is unwell) to delay payments. This lack of automated payment processing and reliance on a single individual's health suggests a manual, unmanaged handling of client funds, which is a hallmark of non-professional operations.

Case 2 (India - May 2025): Another user alleged the entity is a “Full Scam Company,” stating that withdrawal requests were completely ignored. The user described the financial devastation caused to multiple victims, highlighting that the customer service channels became unresponsive once withdrawal demands were made.

Analyst Note: The specific mention of excuses such as an owner's illness is highly irregular for a financial institution. Legitimate brokers utilize automated payment gateways and finance departments; they do not rely on the personal availability of a single director. This is a severe red flag indicating that the “brokerage” may be a one-man operation or a Ponzi scheme.

Final Verdict

WAYONE CAPITAL fails to meet the minimum requirements for a secure trading environment. With a WikiFX Score of 1.86, a total lack of regulatory licensing, and documented evidence of withdrawal refusals, the platform poses an imminent threat to client capital. The combination of high spreads, unsafe leverage limits (1:500), and amateurish excuses for non-payment suggests the entity operates without liquidity providers or ethical standards.

Recommendation: Investors are strongly advised to avoid depositing funds with this entity. Existing clients should attempt to withdraw capital immediately, though success is unlikely given the current complaint history.

For the most current regulatory certificates and real-time blocklisting status, verify WAYONE CAPITAL on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Precious Metals Surge: Central Banks and Fed Outlook Fuel 'Bare-Knuckle' Bull Market

RIFAN FINANCINDO BERJANGKA Review (2025): Is it Safe or a Scam?

Fed’s Paulson Douses Rate Cut Hopes, Strengthening 'Higher for Longer' Case

WAYONE CAPITAL Review 2025: Institutional Audit & Risk Assessment

Is BotBro Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

The 'Wolf' Strategy: Phantom Tariffs and the Dollar's Resilience

US Forces Capture Maduro in Dawn Raid; Trump Pledges Oil Sector Takeover

Goldman Sachs Strategy: Markets to Turn "Wilder" in 2026

Geopolitical Risk: Tensions Spike as Iran Draws 'Red Line' Against US Intervention Threats

Currency Calculator