Abstract:FXPRIMUS's withdrawal issue has left investors in a state of distress, highlighting the urgent need for transparency and accountability in the financial industry, with platforms like WikiFX playing a crucial role in safeguarding traders' interests.

In the world of online trading, a stark reminder of the dangers lurking in the shadows of the financial markets comes to light through the ordeal faced by Muhammed, who has fallen victim to a broker's deceitful practices. Muhammed's experience with FXPRIMUS, a company that has raised concerns among investors, underscores the crucial role that platforms like WikiFX play in safeguarding traders' interests when withdrawal issues arise.

Muhammed's unfortunate tale begins with a simple desire – to withdraw his hard-earned money from his trading account with FXPRIMUS. However, what should have been a straightforward transaction turned into a nightmare. After requesting a withdrawal, he waited in earnest for six long days, only to be met with a disheartening silence from the broker. Despite his persistent efforts to reach out to FXPRIMUS for answers, there was no response in sight.

Furthermore, Muhammed noticed a disconcerting development that added another layer of complexity to his situation. His withdrawal, initially deducted from his Metatrader application, never found its way to his bank account. Instead, FXPRIMUS inexplicably restored the funds back to the trading application, leaving Muhammed in a state of confusion and distress.

As if that weren't enough, FXPRIMUS went a step further by revoking Muhammed's transaction authorization, effectively trapping his funds within the trading platform. The broker's actions, or rather lack thereof, left Muhammed feeling helpless and vulnerable, with his emails to the company falling on deaf ears.

Muhammed's experience with FXPRIMUS is not an isolated incident. Many investors have reported similar withdrawal-related issues with this broker, shedding light on the broader problem of unscrupulous practices within the financial industry. These practices not only erode trust in the market but also leave traders like Muhammed in dire straits.

In such trying times, investors like Muhammed can find solace in platforms like WikiFX. This comprehensive resource empowers traders with the tools and knowledge needed to navigate the complex landscape of online trading.

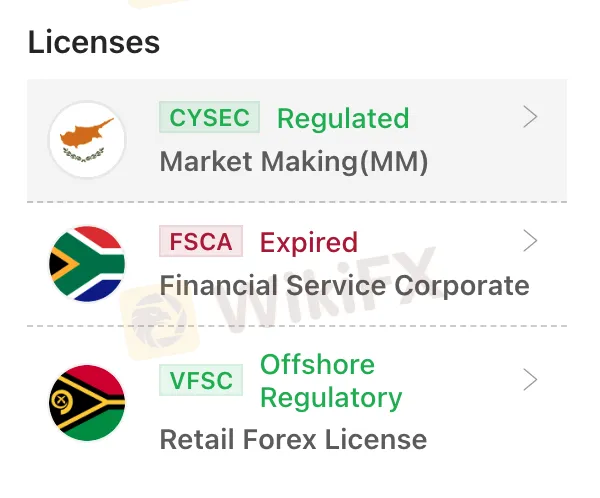

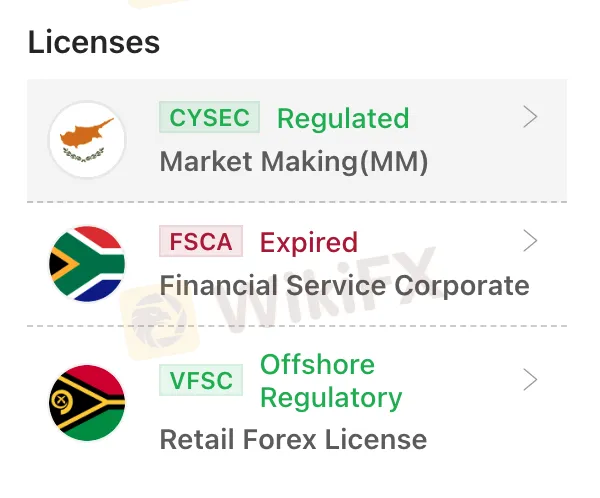

One significant aspect is Broker Research. Before investing with any broker, WikiFX provides a wealth of information about them. Users can access crucial details about a broker's regulatory status, history, and reputation, helping them make informed decisions.

Another crucial function of WikiFX is promoting Transparency and Accountability in the financial industry. By exposing unscrupulous brokers and raising awareness about potential pitfalls, it aims to create a safer and more trustworthy trading environment.

In Muhammed's case, a simple check on WikiFX before engaging with FXPRIMUS could have saved him from the distress he now endures. Armed with information on the broker's dubious practices and negative user reviews, Muhammed could have made an informed choice.

By leveraging WikiFX's resources, investors can equip themselves with the knowledge and support needed to protect their interests and navigate the intricate maze of financial markets. As the financial world evolves, platforms like WikiFX will continue to serve as invaluable guardians of transparency and accountability, providing a lifeline to traders when they need it most.