Abstract:Forex trading, boasting over 6 trillion USD in daily trades in 2023, is the largest market in the world. It is renowned for its liquidity, enabling seamless transactions 24 hours a day, 5 days a week.

Forex trading, boasting over 6 trillion USD in daily trades in 2023, is the largest market in the world. It is renowned for its liquidity, enabling seamless transactions 24 hours a day, 5 days a week.

What is liquidity in the forex?

Beginning with the basics, forex liquidity refers to how easily a currency pair can be bought or sold. In a liquid market, traders dont need to worry about the absence of a counterparty to trade with, as it always has sufficient buyers and sellers.

How do you identify liquidity in forex pairs?

Liquidity measurement in the forex market for traders often involves the examination of the bid-ask spread.

This is the discrepancy between the maximum price a buyer proposes to pay (bid) and the minimum price a vendor agrees to receive (ask) for a specific forex pair. A slim spread usually points out that adequate buyers and sellers are ready to transact at these quotes. It's critical to understand that spreads tend to differ across brokers due to variations in their pricing strategies and markups.

For instance, in a Broker's MT5 platform as shown below, it is clear that major currency pairs such as EUR/USD exhibit tight spreads (0.00005), which is a sign of their substantial liquidity. Meanwhile, minor currency pairs like CAD/JPY show slightly expanded spreads (0.019), indicating their comparatively lower liquidity. Please remember that forex spreads are generally tighter and more consistent than other asset classes'.

Another way to identify liquidity in the forex is to look at trading volumes. When they are high, it generally indicates a greater availability of buyers and sellers in the market, which leads to increased liquidity. Over a 24-hour period, volumes tend to start to increase in the Tokyo session, continuing to trend up in the London session before peaking in the New York session.

Volumes can be shown on Deriv MT5 charts under Insert > Indicators > Volumes > Volumes, as seen below.

Analysing the forex market

Traders interested in forex should keep an eye on both economic data and geopolitical events.

Notably, the release of a countrys inflation data is eagerly awaited. Higher-than-expected inflation figures may lead to raised interest rates from Central Banks, attracting traders seeking greater interest income and therefore increasing the demand and value for the currency.

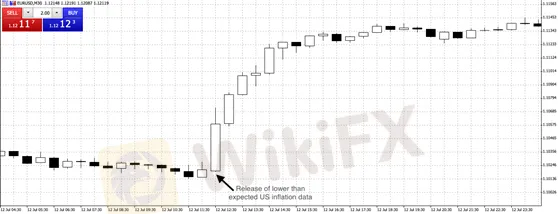

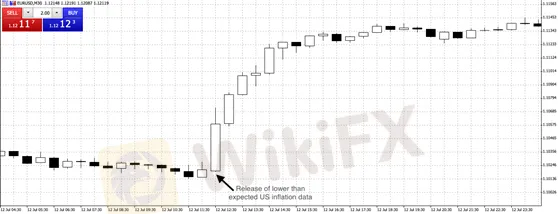

Alternatively, in the MT5 platform for some brokers example below, we can see that lower-than-expected US inflation data implied lower interest rates to the market, making the USD less appealing to investors.

Geopolitical events can also impact price movements in the forex market. Political conflicts and trade disputes between countries may prompt risk aversion in the forex market, causing investors to move their funds to safer assets. Elections can also lead to market volatility, impacting the value of currencies.

Forex trading for you

As the world economy embraces globalisation, events become more interconnected. By closely monitoring these factors and combining them with other trading techniques, traders may increase their chances for more successful trades.