Abstract:Collectively, the firms incurred a total fine of $289 million. Additionally, the CFTC has filed similar allegations.

The United States securities regulator has imposed fines totaling $289 million on 11 broker-dealers for purportedly violating regulations related to recordkeeping procedures. The Securities and Exchange Commission (SEC) has issued cease and desist orders against the companies that have acknowledged these violations.

The companies mentioned are affiliates of Wells Fargo, which has consented to pay a penalty of $125 million. BNP Paribas Securities Corp and SG Americas Securities have individually agreed to fines of $35 million each, as stated by the SEC.

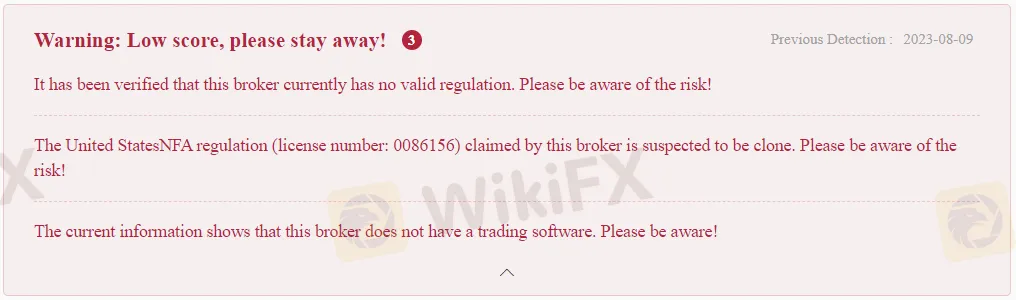

BNP Paribas Securities Corp: https://www.wikifx.com/en/dealer/2361641814.html

Among the remaining firms are BMO Capital Markets, Mizuho Securities USA, Houlihan Lokey Capital, Moelis & Company, Wedbush Securities, and SMBC Nikko Securities America. Wedbush, functioning as both a broker-dealer and investment adviser, faces additional accusations for purportedly breaching the Investment Advisers Act of 1940 and failing to prevent or detect such violations.

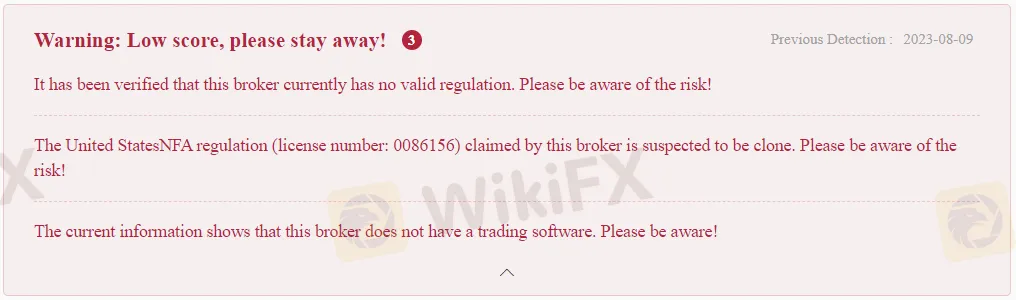

BMO Capital Markets: https://www.wikifx.com/en/dealer/8411502255.html

Mizuho Securities USA: https://www.wikifx.com/en/dealer/4621673807.html

Wedbush Securities: https://www.wikifx.com/en/dealer/1051991346.html

Investor Protection

Gurbir Grewal, the Director of the Division of Enforcement at the SEC, emphasized the significance of adhering to the federal securities laws' books and records requirements, highlighting their role in safeguarding investors and promoting efficient markets.

While some broker-dealers and investment advisers have taken heed by self-reporting violations or enhancing their internal policies and procedures, today's actions serve as a reminder that many others have yet to do so, Grewal added.

Specifically, the regulatory body identified instances of off-channel communication in the 11 firms, where employees utilized messaging platforms like WhatsApp, iMessage, and Signal. Consequently, these companies allegedly failed to maintain proper records of these communications.

Monitoring and Enforcement of Compliance

The SEC asserts that this omission deprives the regulator of its ability to effectively fulfill oversight responsibilities, including the monitoring and enforcement of compliance with federal securities laws. Furthermore, the regulator noted that these violations occurred across different levels of authority within the employees.

Simultaneously, the Commodity Futures Trading Commission (CFTC) imposed penalties exceeding USD $1 billion on swap dealers and their affiliated futures commission merchants for allegedly disregarding bookkeeping procedures.

Kristin Johnson, a commissioner at the CFTC, commented: “The increasingly prevalent use of personal electronic communication methods, such as email, text, social media, and chart-based apps for conducting regulated business, might facilitate quicker and more convenient communication. However, the use of unauthorized channels contravenes crucial regulatory obligations for recordkeeping.”