Abstract:Explore the significance of the lowest inflation rate in over two years, its impact on the Consumer Price Index (CPI), and the opportunities it presents for traders. Delve into how this eases Federal Reserve's tackling of inflation and how Wall Street reacted, as well as how the dip in CPI benefits workers' wages.

The month of June was a historic one for inflation, marking the lowest annual rate in over two years. This momentous occasion was a result of a decline in costs as well as comparisons to an era when price surges were hitting their highest in over four decades.

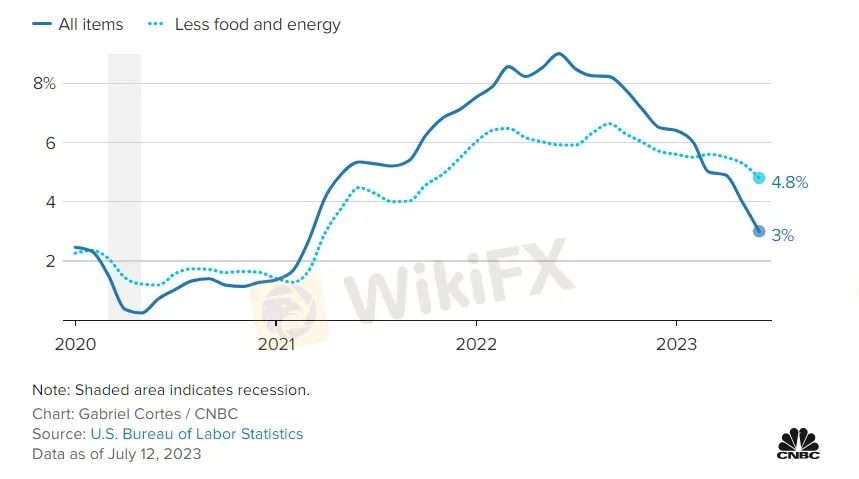

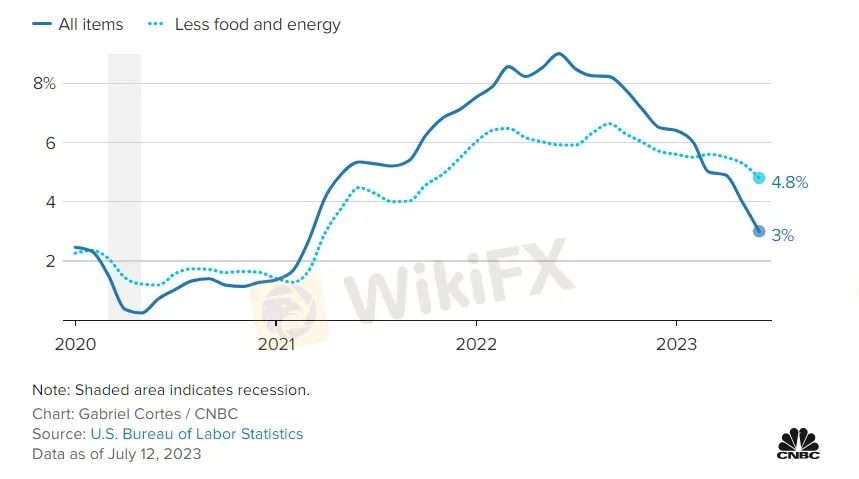

The Consumer Price Index (CPI), a renowned gauge of inflation, saw a year-on-year increase of 3%, the most modest growth since March 2021. Meanwhile, prices for an array of goods and services, as measured on a monthly basis, saw a rise of 0.2%.

Interestingly, this shift undercuts the Dow Jones' projections, which had anticipated rises of 3.1% and 0.3% respectively.

(Striking infographic illustrating year-over-year CPI changes up to June 2023)

When we remove the inherently unpredictable food and energy prices from the equation, the core CPI experienced a 4.8% annual and 0.2% monthly increase. While the annual rate represents the lowest since October 2021, it still falls shy of the consensus estimates, which had forecast respective increases of 5% and 0.3%.

These surprising figures present the Federal Reserve with some much-needed wiggle room as they tackle inflation, which hit a staggering 9% annual rate just a year prior — the highest since November 1981.

As George Mateyo, Chief Investment Officer at Key Private Bank, puts it, “Today's report confirms that even though the country is dealing with blistering temperatures outside, inflation is finally chilling out.” This marks a major victory for the Federal Reserve, as their policies seem to be taming inflation while not hampering growth.

However, the Federal Reserve's battle isn't over yet. Core inflation is still well over the 2% annual target, which means another rate hike is still on the table later this month, according to Mateyo.

The Federal Reserve anticipates a continued decline in the inflation rate, especially as costs of shelter ease, a factor that accounts for roughly a third of the CPI. Despite this, the shelter index saw a 0.4% uptick last month, contributing about 70% to the headline CPI increase.

Wall Street greeted this report with enthusiasm, resulting in Dow Jones Industrial Average futures climbing nearly 200 points. Meanwhile, Treasury yields saw a universal drop.

Despite these positive reactions, traders are still banking on a quarter percentage point rate hike when the Fed convenes on July 25-26.

However, the market suggests this could be the last hike before officials pause to let the previous series of increases percolate through the economy.

Back when inflation began its ascent in 2021, Federal Reserve officials and economists believed it would be “transitory,” fading as Covid-specific factors eased. However, when inflation displayed surprising tenacity, the Fed responded with a series of hikes, culminating in a 5 percentage point increase since March 2022.

On the other hand, crypto traders may expect good opportunities in trading Crypto.

Despite the overall easing in CPI, some sectors bucked the trend. For instance, energy prices went up 0.6% for the month. Yet, in a twist of fate, the energy index actually fell 16.7% from a year ago. Other sectors saw more relief, with food prices rising just 0.1%, used vehicle prices decreasing 0.5%, and airline fares plummeting 3%.

The dip in CPI also brought good news for employees, as real average hourly earnings, adjusted for inflation, increased 0.2% from May to June, and rose 1.2% on an annual basis.

Stay ahead of the curve and keep tabs on all market updates with the WikiFX App. Download it here: https://www.wikifx.com/en/download.html for all the latest news at your fingertips.