Abstract:An Electronic Communication Network (ECN) broker offers a specific account type that provides traders with low trading costs and direct access to the real market. This technology is particularly suitable for active traders and those seeking diversity, as it offers lower commission rates and tighter spreads. ECN brokers enable traders to compete with large financial institutions, and their advanced technology is attracting an increasing number of users. In this article, we will explore the top ECN brokers to consider in 2023.

What is an ECN Forex Broker?

ECN brokers act as intermediaries, providing traders with direct access to currency and equity markets by connecting them to other market participants. By consolidating price quotations from multiple sources, ECN brokers typically offer tighter spreads. Unlike conventional brokers, ECN brokers do not trade against their users; instead, they match trades among participants in the market. This results in narrower spreads compared to traditional brokers. However, it's important to note that ECN brokers charge a fixed commission fee for each transaction.

How do ECN Brokers work?

ECN employs an electronic communication system that facilitates trade execution for both buyers and sellers. It provides essential order information and manages order execution by matching buy and sell orders currently available in the market. Additionally, if specific order information is unavailable, the ECN system offers prices based on the lowest ask and highest bid in the open market.

Trading with ECN Forex brokers enables you to trade beyond the conventional trading hours of the market. This feature is particularly beneficial for individuals seeking flexibility in trading times or those who are unable to actively trade during regular market hours.

Top 5 ECN Brokers on Forex

Exness ECN Account

Established in 2008, Exness has built a strong reputation as a top broker catering to both active and passive investors. It stands out for its extensive range of trading instruments and commitment to reliability and innovation. Traders can choose from a variety of account types tailored to their specific needs, including cent and demo accounts for beginners and ECN accounts with ultra-low spreads starting from 0.1 pip for active traders.

Exness operates through registered offices located in the British Virgin Islands, Seychelles, Curaçao, South Africa, and Cyprus. Please note that retail customers are unable to access services from the Cyprus or United Kingdom offices.

With stringent oversight, Exness adheres to the highest regulatory standards. It is licensed and regulated by renowned authorities such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the United Kingdom, and the Financial Services Authority (FSA) and the Financial Sector Conduct Authority (FSCA) in South Africa. As evaluated by WikiFX, Exness holds an impressive score of 8.17 out of 10.

Trading Instruments

Currencies, assets of stock and commodity markets, cryptocurrencies

Commissions

Standard Account EURUSD Average Spread 1 pip, ECN/STP Account Fee $3.5 per lot

IC Markets ECN Account

IC Markets holds the distinction of being the largest Forex broker globally in terms of trading volume. Renowned for its exceptionally low spreads starting from 0.1 pips and competitive fees beginning at $3 per lot, the broker stands out in the market. This advantage is attributed to its advanced technology, direct access to liquidity, significant trade volume, and absence of a dealing desk, allowing for tight spreads.

With over a decade of experience in the forex industry, IC Markets Trading Company is dedicated to providing clients with optimal market conditions. Continuously enhancing their tools and technology, the broker strives to offer traders highly accurate analytical resources, up-to-date trading platforms, and seamless connectivity.

IC Markets Global operates under the oversight of respected regulatory bodies, including the Financial Services Authority of Seychelles, the Cyprus Securities and Exchange Commission, and the Australian Securities and Investments Commission. Evaluated by WikiFX, IC Markets earns an impressive score of 8.91 out of 10.

Trading Instruments

60 currency pairs, futures, CFDs on indices, commodities, metals, stocks and bonds

Commissions

IC Markets does not charge a commission on Standard Accounts. Everage standard account EURUSD spread is 0.8 pips, Raw account spread is near 0.1 pip. Raw account also has a fee - 3.5 per lot

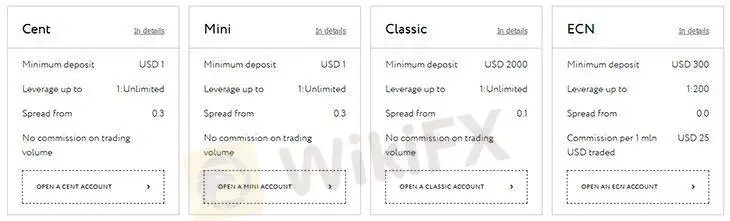

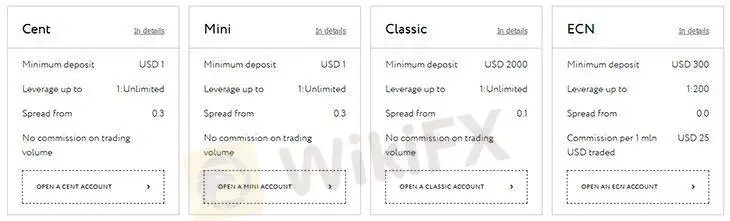

FXOpen ECN Account

Established in Cairo in 2003, FXOpen Broker Company swiftly rose to prominence in the Forex industry after commencing its dealing services in 2005. The company's commitment to excellence shines through its provision of optimal trading conditions, cutting-edge technologies, and a comprehensive range of financial services. Notably, FXOpen made history as the first broker to offer customers exclusive trading through the MetaTrader 4 terminal-based electronic communication network (ECN).

FXOpen is a reputable online trading platform that enables users to trade various assets, including forex, shares, commodities, indices, and cryptocurrencies. Regulated by the esteemed Financial Conduct Authority (FCA), it stands as a symbol of trust and integrity. With FCA licenses being highly regarded worldwide, traders can have full confidence in the safety and security of their funds at FXOpen.

Tailored to cater to traders of all skill levels, FXOpen's Forex trading accounts provide a range of options to suit individual trading styles, capital, and risk tolerance. Whether you're a novice or a seasoned professional, you can select from four account types that align with your specific needs. FXOpen's WikiFX score stands at an impressive 7.12 out of 10, further validating its position in the industry.

Trading Instruments

50 currency pairs, CFD, indices, gold and silver, 43 pairs with BTC, LTC, EOS, PTC, ETH, DASH, EMC

Commissions

Spread is from 0.1 pip, fee - $1.5-3.5 per lot

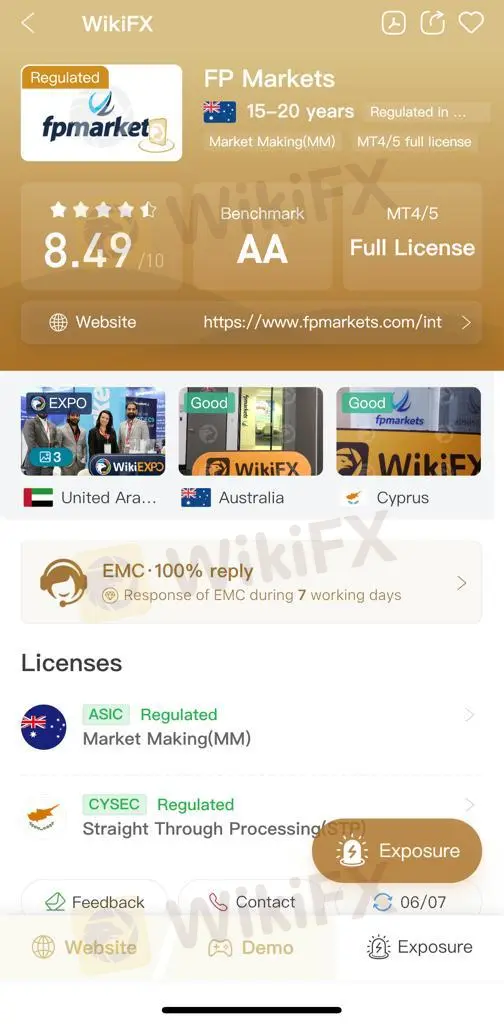

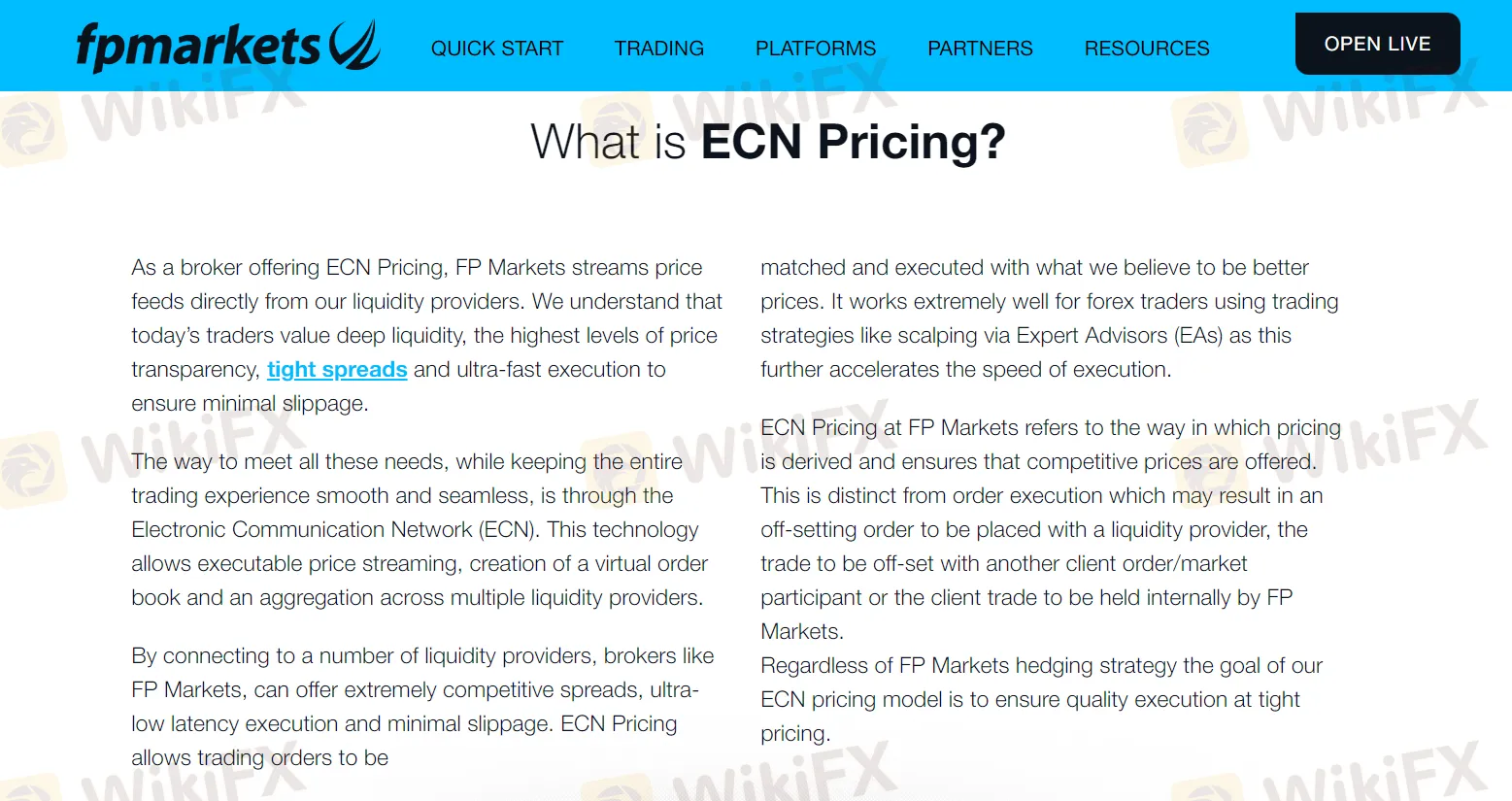

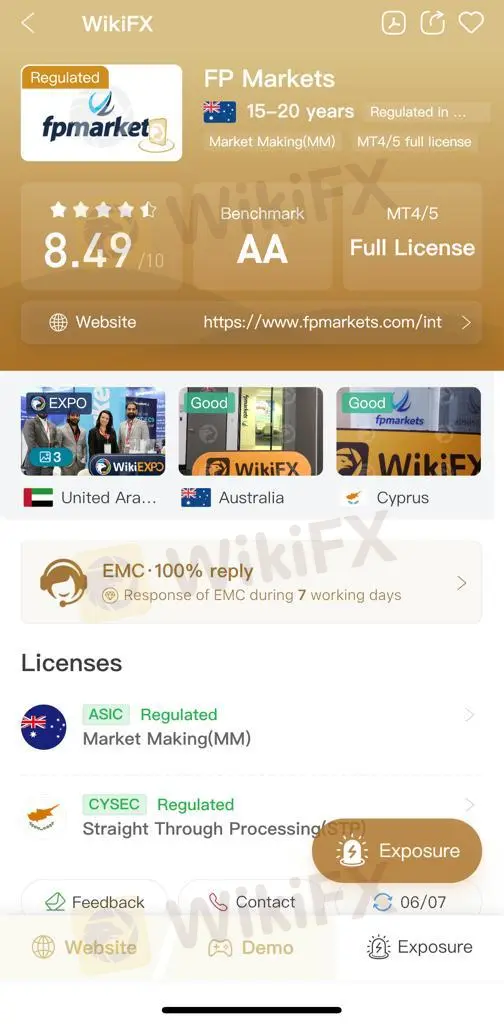

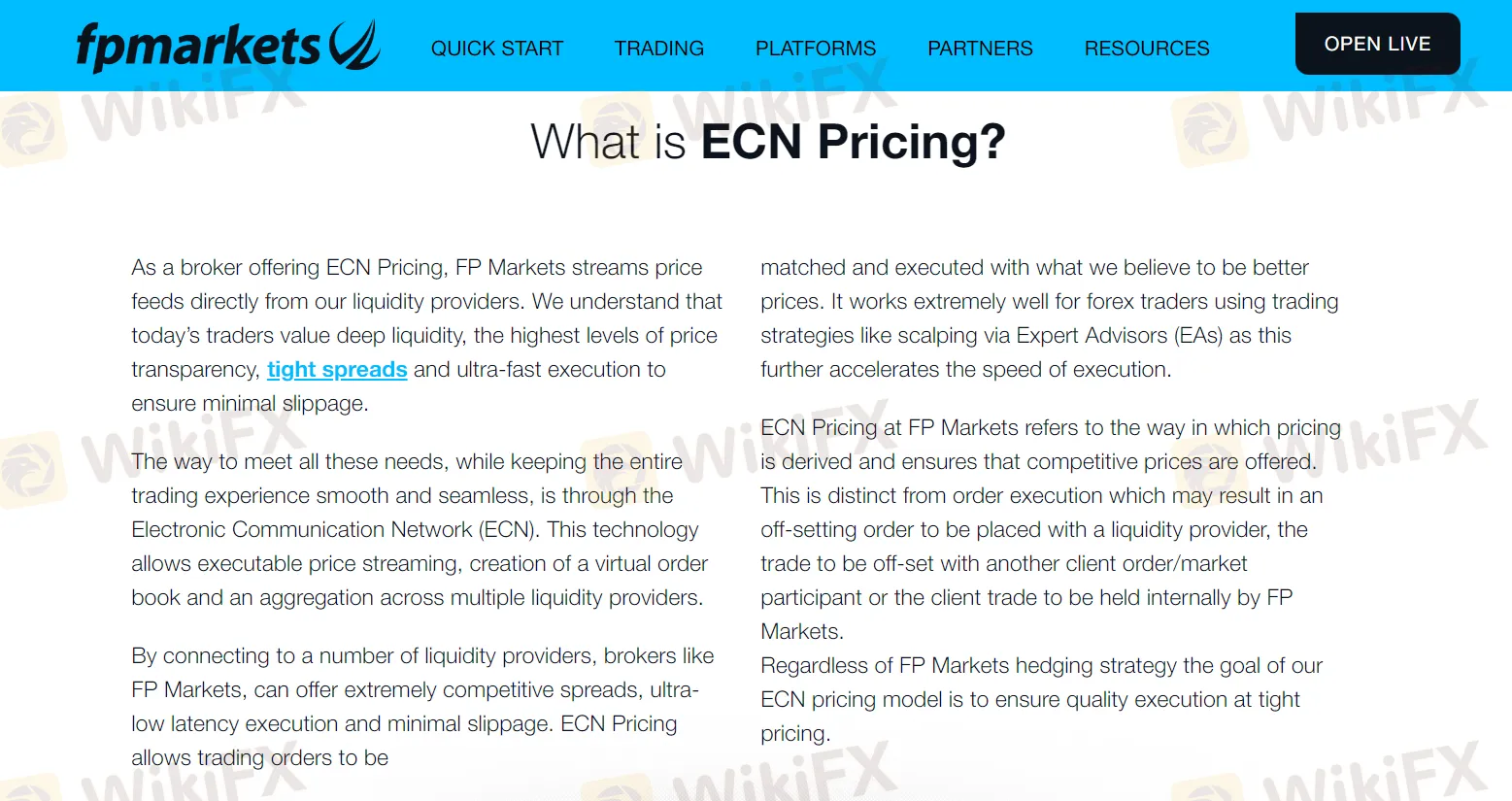

FP Markets ECN Account

Since 2005, FP Markets has been enabling clients to access the Forex market, offering a remarkable selection of over 10,000 trading instruments. The broker's appeal lies in its favorable trading conditions, lightning-fast order execution, and popular trading terminals, making it an attractive choice for traders.

FP Markets stands out with its industry-leading spreads, reaching as low as 0.0 pips during peak market liquidity. With a focus on competitive pricing, the trading platform delivers compelling spreads for forex pairs and CFD indices.

Regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySec), FP Markets demonstrates its adherence to both its internal policies and regulatory obligations. This regulatory oversight instills confidence and trust among traders. FP Markets garners an impressive WikiFX score of 8.49 out of 10, further affirming its position in the market.

Trading Instruments

With HYCM you can trade Forex, indices, metals, oil, gas, raw materials, securities, cryptocurrency

Commissions

The fees are charged as the spread

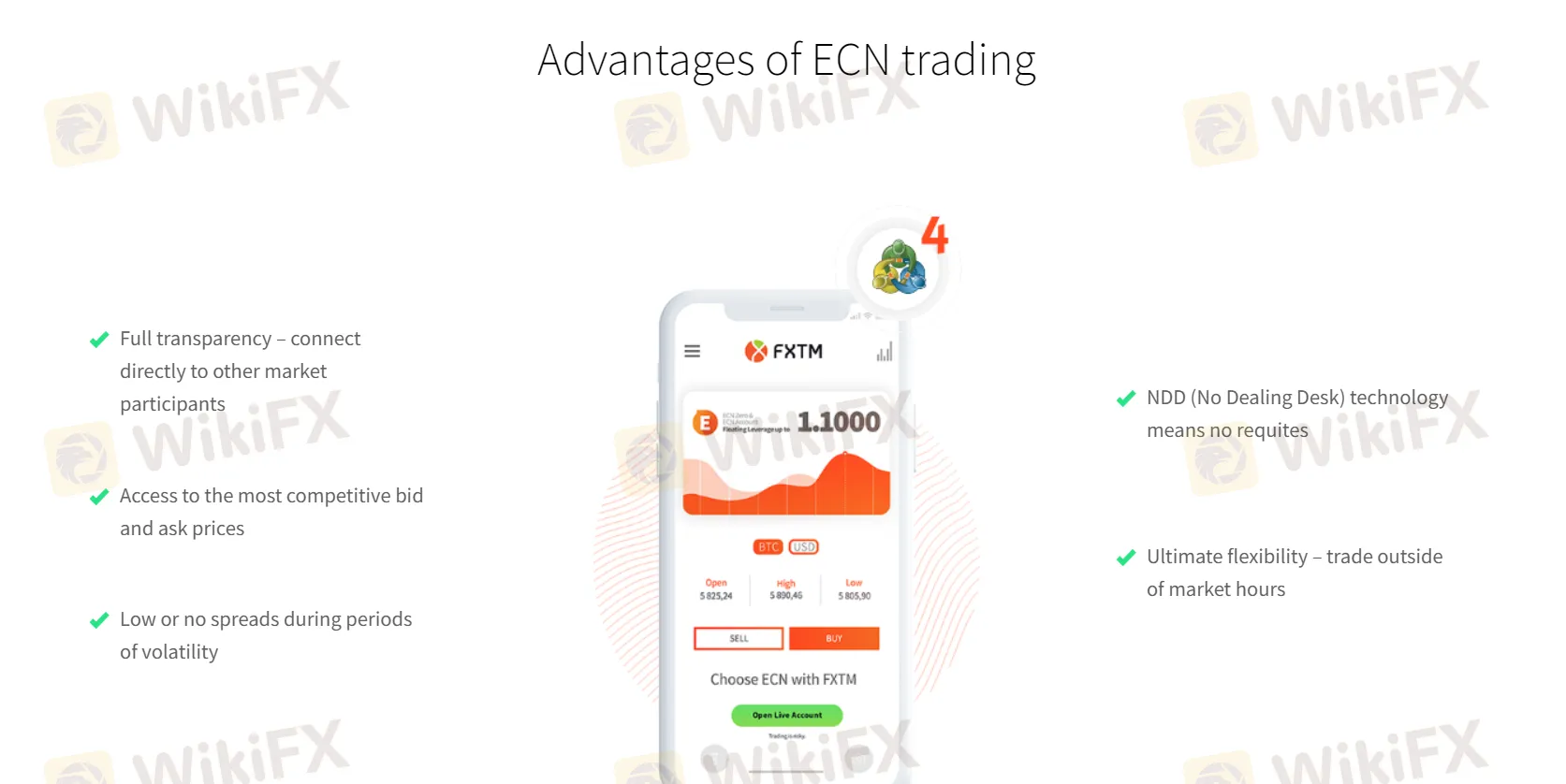

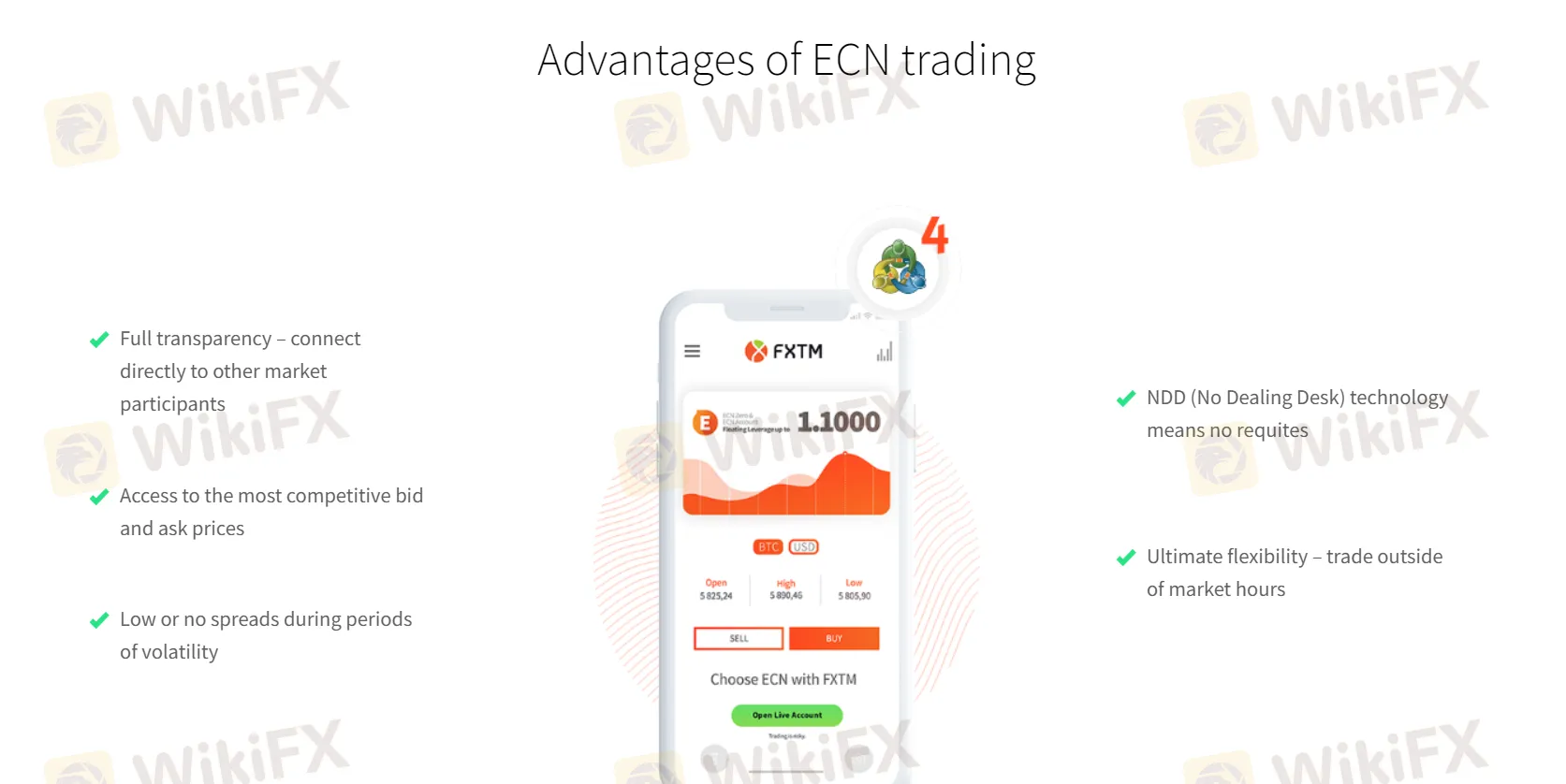

FXTM ECN Account

Established in 2011, FXTM (ForexTime) is a reputable broker offering profitable opportunities through active trading and investment programs. With a range of trading accounts tailored for both novice and professional traders, FXTM operates in 150 countries, ensuring the complete safety of client funds through segregated accounts.

Beyond providing access to over 250 financial instruments, including spot indices, FX currency pairs, and CFDs in commodities, indices, metals, and stocks, FXTM places a strong emphasis on educating beginners. They offer a wealth of educational resources such as videos, e-books, forex trading seminars, investment programs, and webinars.

Committed to regulatory compliance, FXTM is regulated by esteemed authorities including the Cyprus Securities and Exchange Commission, the South African Financial Sector Supervision Authority, the UK Financial Conduct Authority, and the Mauritius Financial Supervisory Commission. FXTM holds a WikiFX score of 7.66 out of 10, indicating its credibility.

Trading Instruments

Currency pairs, precious metals, CFD contracts on stocks, commodities, and indices

Commissions

Standard account EURUSD typical spread is 1.6 pips

How to Choose an ECN Broker?

When selecting an ECN broker, it is important to consider their spreads and fees. Opt for brokers with tight spreads below 0.3 pips and fees ranging from $1 to $2 per lot. Avoid those with wider spreads and higher fees as they may erode your trading profits.

Regulation and trustworthiness are crucial factors. Trade only with ECN brokers regulated by reputable regional or international regulatory bodies. Verify the broker's official name on the regulatory authority's database to ensure their compliance and legitimacy.

Trading speed is vital for seamless execution. Assess the broker's trading speeds through user reviews, real-time data updates on their platform, and personal experiences with a demo account.

Extra features like VPN (Virtual Private Network) may be desired for private trading. However, be aware that some ECN brokers prohibit VPN usage due to privacy and security concerns. Check local laws to ensure safe and compliant VPN usage.

*The provided information is for reference purposes only and should not be considered as financial advice or investment recommendation. You should DYOR before start your trading journey!