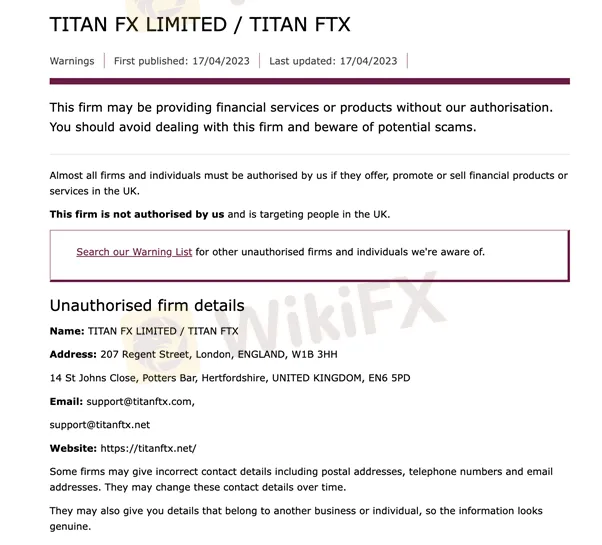

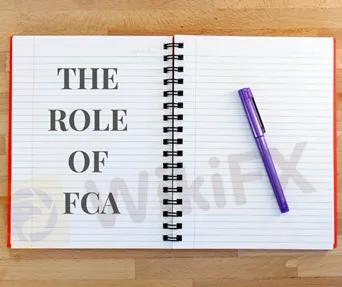

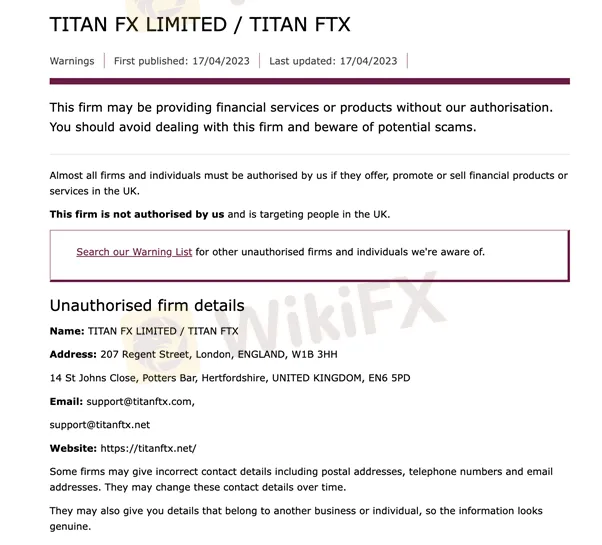

Abstract:Recently, the United Kingdom’s Financial Conduct Authority (FCA) issued a circular report on alerting potential investors about Titan Limited.

According to the FCA, Titan Ltd company was providing financial services and goods to customers in the UK without having proper consent from the regulator.

Additionally, the business keeps a presence in other countries, and it advertises to potential customers on its website, titanftx.net. Despite prior warnings from the FCA criticising this broker, the website still appears to be accessible to potential customers based in the UK.

WikiFX cross-chceked our database and found that Titan is indeed an unreliable broker with a fairly low WikiScore, indicating a potential high level of risk.

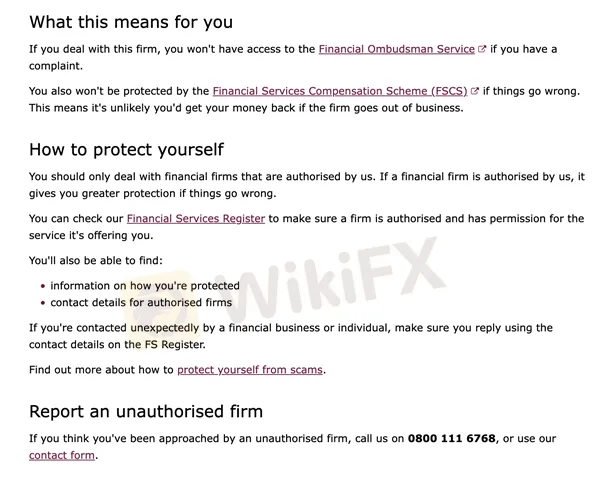

The UKs financial watchdog cautioned investors against doing business with financial firms it has not authorised, reiterating earlier warnings.

This is not the first time Titan Ltd has raised concerns of the regulatory bodies. Previously, Ontario Securities Commission (OSC) warned its residents that the broker in question was never authorised to conduct business within the region. Not only that, but France's financial watchdog also highlighted that Titan was never an approved investment service provider.

The Financial Conduct Authority (FCA) is a regulatory body in the UK that keeps an eye on financial markets and financial services companies to make sure they operate honestly, fairly, and in a transparent manner. Since its establishment in April 2013 and the subsequent replacement of the Financial Services Authority (FSA), the FCA has been in charge of overseeing close to 60,000 financial firms and markets in the UK.

The FCA seeks to preserve the market's integrity, foster healthy competition within the industry peers, and safeguard consumers from financial risk. The FCA establishes and enforces guidelines and standards for financial institutions, monitors their compliance with laws, and takes enforcement action against institutions that flout the law. The FCA also works to educate the public about financial services and products and offers consumers advice and direction.

The FCA urged customers to steer clear of engaging with any company or unregulated business. Simultaneously, they were encouraged to report companies they believed were operating illegally in Britain. The regulator also reminded investors to check both the Interim Permission Register, which lists businesses that have yet to receive approval, and its Financial Services Register, which displays a complete list of authorised businesses.

The FCA has warned the public to be on guard against the growing danger of unregulated businesses preying on UK citizens. This appeal is made in light of recent reports that investors have lost millions to dishonest brokers and an increase of more than 50% in complaints to the FCA consumer helpline.