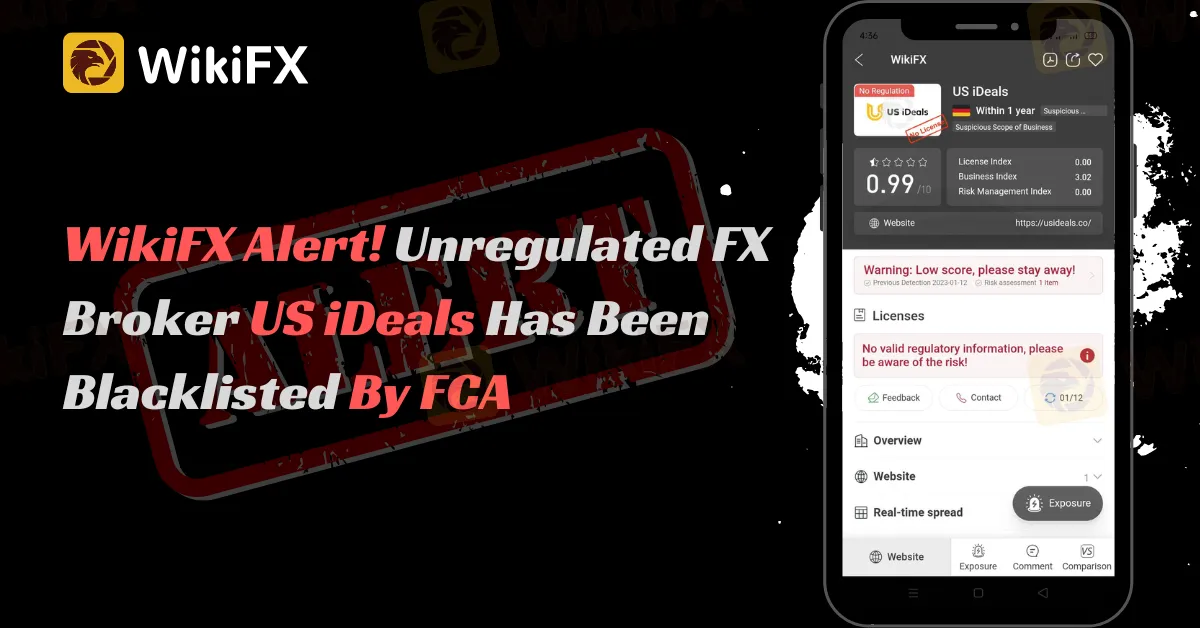

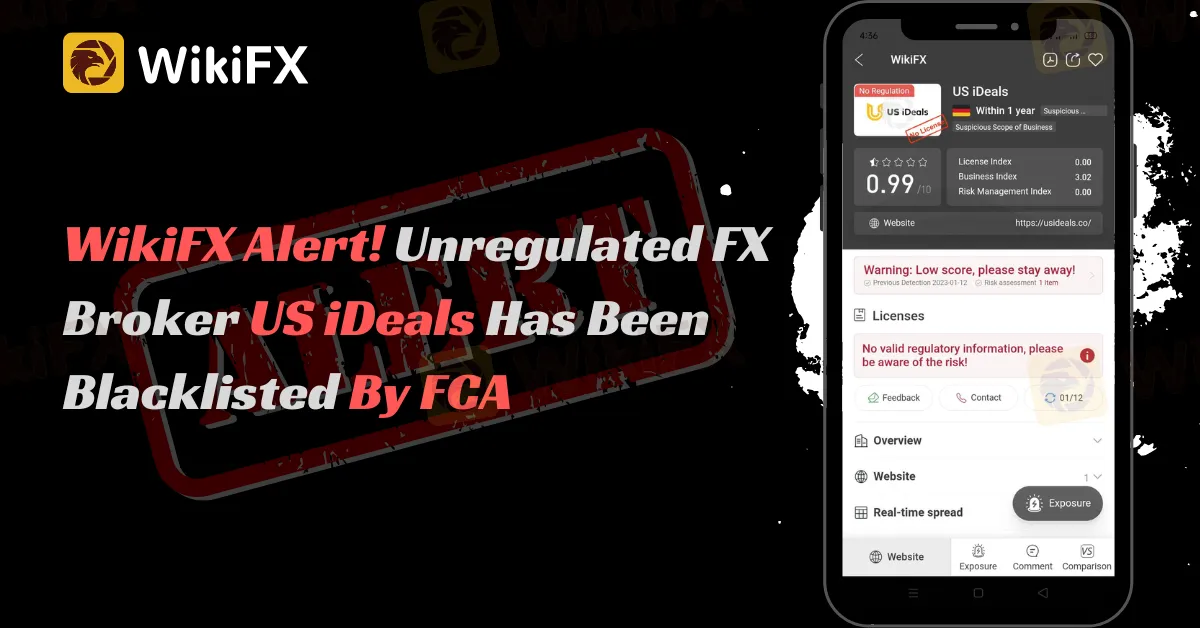

Abstract:FCA listed this broker US iDeals Trade as an undesirable firm that should be avoided by the public.

The FCA publishes a batch list of undesirable firms in order to protect the public from investing and to assist regulated firms in stopping the illicit activities of unregulated brokers, who are the cause of the increased risk of fraud and why people are afraid of trading investments, as well as others attempting to enter the world of online trading.

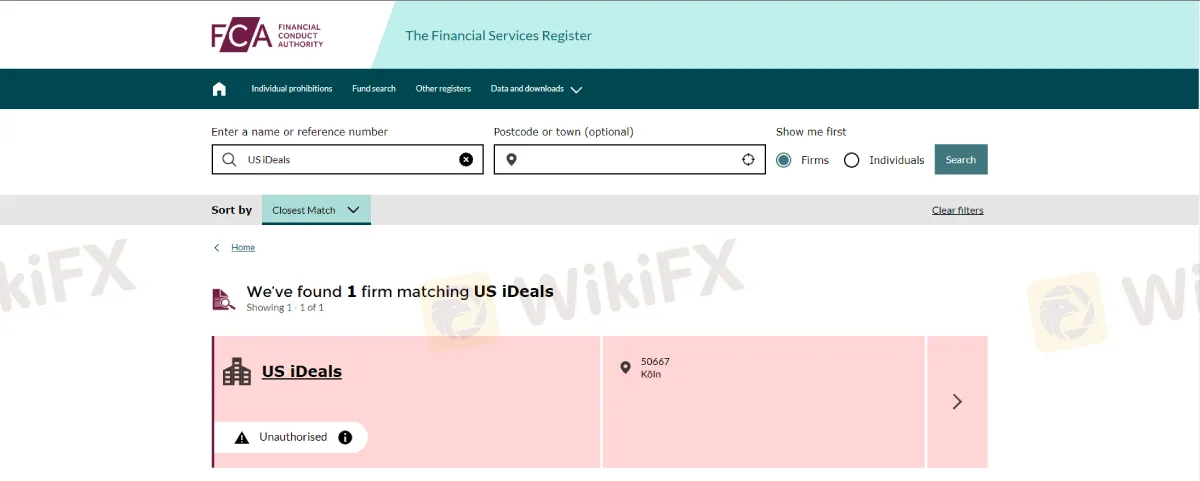

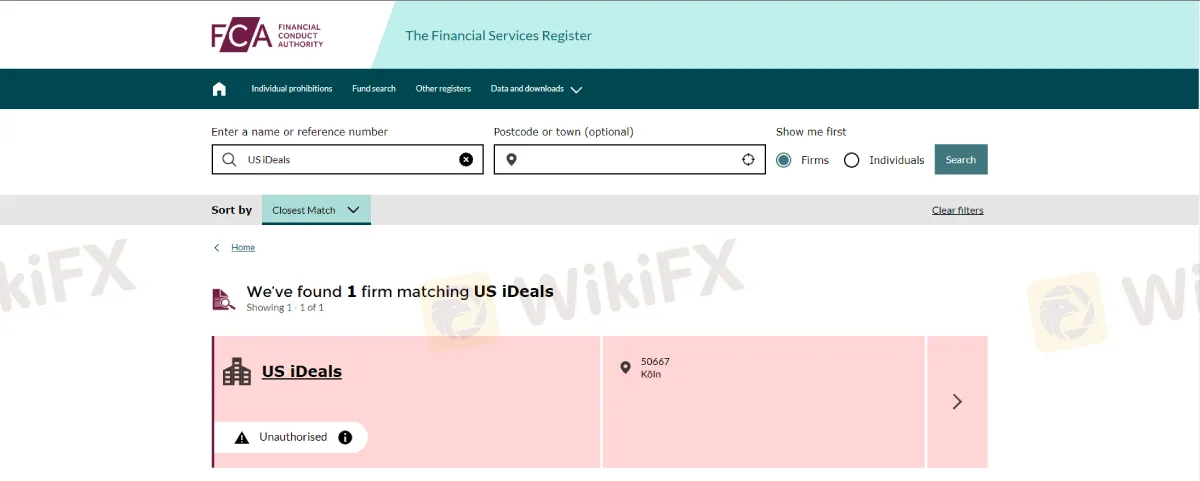

One of the online trading firms listed by the FCA due to a lack of authorization to provide, promote, or sell financial services or products in the UK is US IDEALS.

Let's check the regulatory status of US IDEALS

According to its official website, US iDeals offers a variety of trading instruments to trade from and has different accounts to choose from.

Furthermore, the said firm stated that the company has been regulated among major financial regulators namely ASIC, DFSA, FCA, and CySEC.

They also have affiliations with the world's leading providers of investment such as Blackrock, Ameriprise Financial, UBS Group, and Fidelity.

The statement above means a lot to investors if someone doesn't know how to investigate to make sure the claim is true and correct.

The truth!

Upon checking the name of the broker on the said financial regulators, they claimed. No name of US iDeals registered either of the regulators. In fact, FCA released a warning statement to the public to be avoided by the people in the UK as well as the other countries.

ASIC

DFSA

FCA

CySEC

We also try to find some feedback from their investors but no single feedback was found.

WikiFX, serve as a medium platform for financial regulators especially FCA, to encourage their victims to send a report about the said broker to conduct an investigation.

This kind of broker needs strict monitoring as they may change their name and will back to their operation to fraud the public.

Final word,

It's important to report any suspicious or fraudulent activity to the appropriate regulatory authorities as soon as possible and to seek legal or financial advice if you have been a victim of a scam. Many regulatory authorities have processes in place for dealing with complaints about regulated brokers and may take action against them if they have violated any rules or laws.

It may also be helpful to talk to other people who have gone through similar experiences or to reach out to organizations that provide support for victims of investment fraud. It's also important to understand that being scammed doesn't reflect on your intelligence or character and you should not be ashamed of falling victim to a scam.

Download the install the WikiFX App from the download link below to stay updated on the latest news, even on the go. You can also download the app from the App Store or Google Play Store.

Download link

https://www.wikifx.com/en/download.html