Ringgit hits five-year high against US dollar in holiday trade

The Malaysian ringgit extended its rally, reaching a five-year high against the US dollar, trading in a narrow range of RM4.04-RM4.05.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

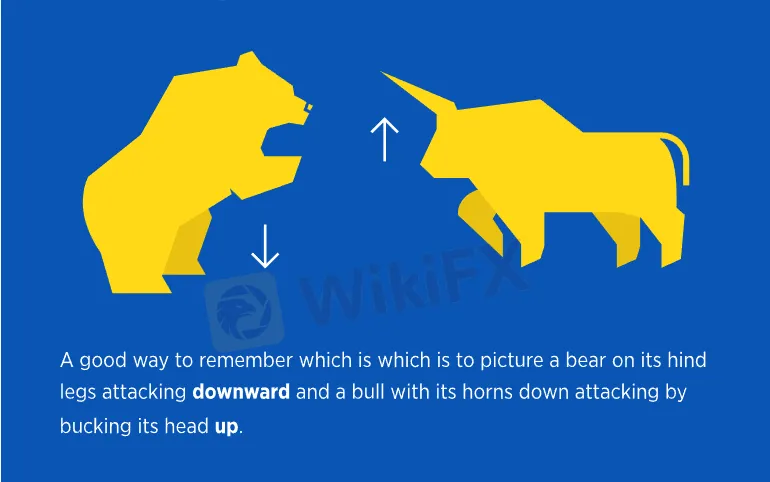

Abstract:Simply put, a bear market is one in which prices are heading down and a bull market is used to describe conditions in which prices are rising.

When the bulls reign in the market, people are looking to invest money; confidence is high and the acceptance of risk generally goes up.

This leads to rises in various markets – particularly in stock markets, but also in FX currencies such as the Australian dollar (AUD), Canadian dollar (CAD), New Zealand dollar (NZD), and emerging market currencies. Conversely, bull markets typically lead to a decline in safe-haven currencies such as the Japanese yen, the Swiss franc (CHF) and, in some cases, the U.S. dollar.

The U.S. dollar (USD) and Japanese yen (JPY) are safe-haven currencies and tend to strengthen in a bear market as riskier instruments are sold off and safe-haven currencies are in demand.

Why Does It Matter to You?

One of the key benefits of forex trading is the opportunity it offers traders in both bull and bear markets. This is because forex trading is always done in pairs, when one currency is weakening the other is strengthening thereby allowing you to take advantage of rising and falling markets.

Bull and bear markets are important to pay attention to as they can determine currency market trends. By being aware of market trends, can help you to make the best decisions of how to manage risk and gain a better understanding of when it is best to enter and exit your trades.

In a bull market, traders are looking to enter the market when prices are rising so that they can sell once they believe the market has reached its peak.What Happens in a Bear Market?

Bearish markets follow a downward trend as investors sell riskier assets such as stocks and less-liquid currencies such as those from emerging markets.

In a bear market, traders are looking to enter the market when prices are falling so that they can buy once they believe that market has reached its peak.

The U.S. dollar (USD) and Japanese yen (JPY) are safe-haven currencies and tend to strengthen in a bear market as riskier instruments are sold off and safe-haven currencies are in demand.

Why Does It Matter to You?

One of the key benefits of forex trading is the opportunity it offers traders in both bull and bear markets. This is because forex trading is always done in pairs, when one currency is weakening the other is strengthening thereby allowing you to take advantage of rising and falling markets.

Bull and bear markets are important to pay attention to as they can determine currency market trends. By being aware of market trends, can help you to make the best decisions of how to manage risk and gain a better understanding of when it is best to enter and exit your trades.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

The Malaysian ringgit extended its rally, reaching a five-year high against the US dollar, trading in a narrow range of RM4.04-RM4.05.

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

It starts with a phone call—often aggressive, always persistent. A "personal manager" promises to guide you through the complexities of the market, asking for a modest $200 deposit. But according to sixteen separate reports from victims across Latin America, Europe, and the Middle East, that initial deposit is just the entry fee to a financial hostage situation.

New fiscal proposals and hawkish central bank rhetoric are reshaping the outlook for the Japanese Yen, as the government unveils a record-breaking budget while the Bank of Japan (BoJ) hints at accelerated monetary tightening.