Abstract:Asian shares tracked solid Wall Street performance on Wednesday as strong overnight earnings for U.S. retail giants pointed to further scope for the Federal Reserve to tackle inflation with rate hikes.

Asian shares rallied on Wednesday as strong earnings for U.S. retail giants suggested further room for interest rate hikes from the Federal Reserve as it attempts to cool inflation.

European equities looked set for early gains as well on a data-heavy day, with British inflation and the final Euro zone Q2 GDP reading expected. FTSE 100 futures were up 0.25% and Euro Stoxx 50 futures were up 0.45%. S&P emini futures were up 0.1%.

Japans Nikkei rose 1.17% to 29,169.28 points, breaking through the 29,000 barrier for the first time since Jan. 6.

MSCIs broadest index of Asia-Pacific shares outside Japan rose 0.42%.

Stocks in New Zealand were flat and the kiwi dollar gained 0.28% after the countrys central bank announced a fourth consecutive 50 basis point (bps) rate hike to 3.00% without giving hints of slowing down.

Despite the hike being in line with forecasts, the announcement was described as “definitely more hawkish than expected” by Imre Speizer, head of NZ market strategy at Westpac, who pointed to the tone of the RBNZs statement and a 15 bps increase in its official cash rate (OCR) track to 4.10%.

“Clearly they‘re a bit more worried about wage inflation and a very tight labour market, that’s been a big recent development,” Speizer said.

Australias AXJO index gained 0.27% and the Aussie dollar mostly recovered early losses after wage data showed growth slightly below expectations and well behind inflation.

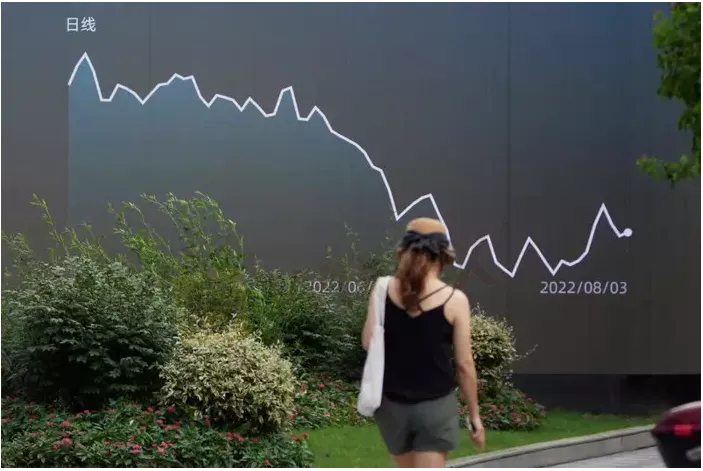

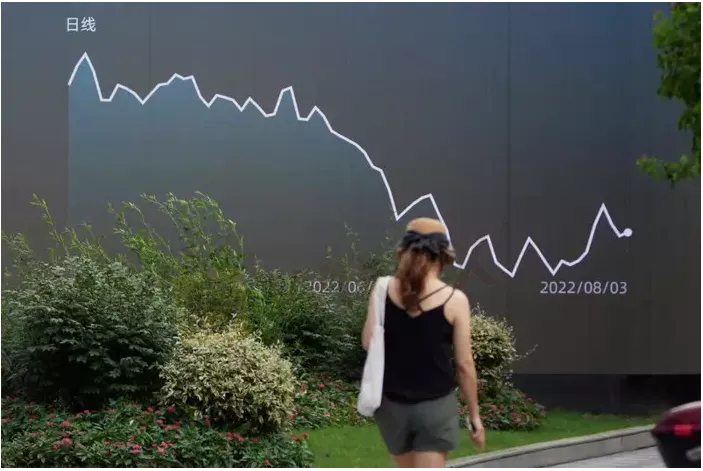

Hong Kongs Hang Seng index rose 0.78% and Chinese blue chips were up 0.6%.

The outlier in Asia was South Koreas KOSPI index, which lost 0.76% to snap a three-day rally as automakers Hyundai Motor and Kia Corp 000270.KS fell on new U.S. legislation that ends tax credits for electric vehicles built outside North America.

Overnight, the Dow Jones Industrial Average gained 0.71% and the S&P 500 gained 0.19% as Home Depot posted higher than expected sales and Walmart increased its profit forecast.[.N]

Investors now see a 42.5% chance of a third successive 75 bps rate hike at the Feds next meeting in September, up from 39% the previous day.

“There has been very little notice or commentary about the fact that expectations for 2023 Fed rate cuts have almost disappeared recently,” Nikko Asset Management chief global strategist John Vail noted in an email.

“Indeed, whereas Fed fund futures once predicted cuts in the first half, now a hike is partially priced in, while 2023 only predicts less than one 25 bps cut. This is likely due to hawkish Fed speeches rather than any change in the macro-economic fundamentals.”

Minutes from the previous Fed meeting will be released later in the day (1800 GMT), with investors hoping for more clues on its policy tightening outlook.

U.S. retail trade data for July will also come out later in the day, with investors watching for any signs of a recession.

“Retail sales should have been more resilient given that lower prices at the pump improved the spending power of the average American household, and Amazon Prime Day in the month possibly attracted bargain hunters as well,” wrote Saxo Bank analysts in a note, while pointing to “modest” consensus expectations of 0.1%.

Ten-year Treasury yields rose slightly and were trading at 2.8168%, having earlier wiped out an overnight rise to 2.8730%.

In commodities, Brent crude futures rose 1.2% to $93.43 a barrel while U.S. West Texas Intermediate (WTI) crude gained 1.3% to $87.65 per barrel.

Oil prices had fallen overnight to their lowest since before Russia‘s invasion of Ukraine in late February, with markets speculating on Iran’s response to a proposal to revive the 2015 nuclear deal, which could increase Iranian oil exports.

Spot gold rose 0.3% to $1,780.95 an ounce, while bitcoin rose 0.77% to $24,148.33. The leading cryptocurrency spiked to a two-month high of $25,201.93 over the weekend but is down 4.12% since then.