Abstract:NATURAL GAS, RHINE RIVER, INVENTORY, EIA, TECHNICAL OUTLOOK - TALKING POINTS

Natural gas prices accelerated higher overnight in the US and Europe

A near-critical drop in Europe‘s Rhine river threatens Europe’s energy

Prices may target the 9 psychological level after clearing 20-day SMA

Natural gas prices rose in the United States and Europe overnight. The US Henry Hub benchmark increased 4.71% to $8.202 per million British thermal units (mmBtu). European prices at the Title Transfer Facility (TTF) gained more than 6%, pushing prices above 200 euros per megawatt hour. The Japan-Korea Market (JKM) price for Asia was nearly unchanged.

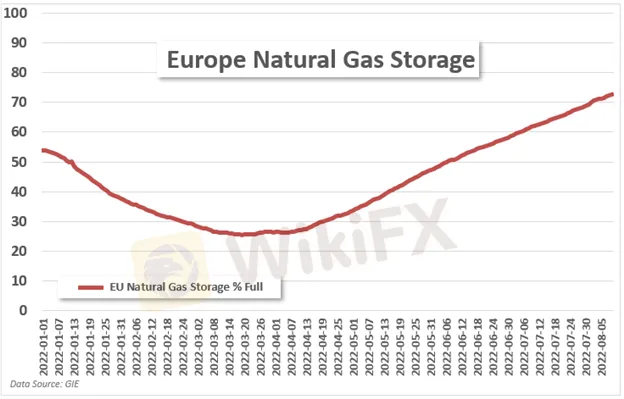

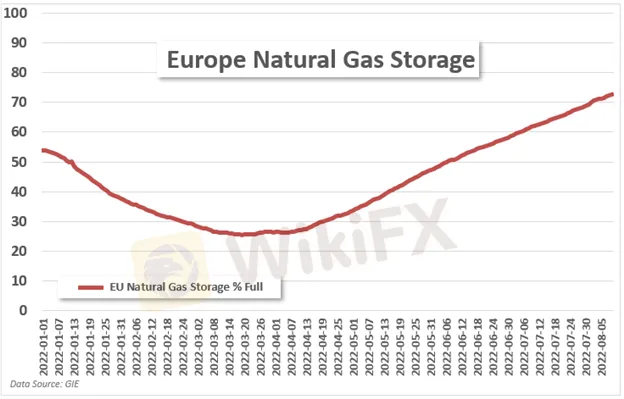

Europes gas storage is nearly 73% full as of August 10, according to Gas Infrastructure Europe (GIE) data. That is up 10% over the past 30 days despite heavily reduced flows from Russia via the Nord Stream 1 Pipeline. While the increased storage level is encouraging, Europe still faces a potential energy crisis, especially if the continent sees a colder-than-average winter.

A drop in the Rhine river‘s water level poses the latest threat to Europe’s energy supply. The Rhine is a key waterway for Germany, used to transport goods and commodities, including coal. A reduction in coal shipments may force Germany to burn more natural gas to meet its energy needs. That could slow progress in building winter stockpiles. German officials on Wednesday said water levels could drop to a critical point soon. Natural gas prices may rise over the next week if much-needed rain doesnt appear.

The Energy Information Administration‘s Weekly Natural Gas Storage Report is expected to show a 39 billion cubic feet (Bcf) injection for the week ending August 5, according to a Bloomberg survey. That would be down from the prior week’s 41 Bcf injection. Total US inventory is 336 Bcf below the 5-year average, per the EIA. Given the already tight market, a worse-than-expected reading could support further price gains.

US NATURAL GAS TECHNICAL OUTLOOK

Prices pierced above the 20-day Simple Moving Average (SMA) after bouncing higher from a trendline from May 2021 that has previously offered support and the 50-day SMA. Bulls may target the 9.00 psychological level. An attempt to clear that level failed in July. The RSI and MACD oscillators are moderating as prices moderate through APAC trading.

US NATURAL GAS DAILY CHART

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.