Euro updated technical trade levels – Daily & Intraday Charts

EUR/USD recovery off downtrend support approaching downtrend resistance- risk for inflection

Support 1.0226, 1.0096, 1.0000– Resistance 1.0352/85, 1.0464/68 (critical), 1.0637

Euro surged more than 1.2% against the US Dollar today on the heels of a better than expected US July inflation report with CPI suggesting the price increases may be leveling off. The move saw Fed interest rate expectations abate with EUR/USD rallying to fresh monthly highs. The advance takes price towards a key resistance pivot and were looking for possible price inflection just higher for guidance. These are the updated targets and invalidation levels that matter on the EUR/USD technical price charts. Review my latest Strategy Webinar for an in-depth breakdown of this Euro technical setup and more.

EURO PRICE CHART – EUR/USD DAILY

Technical Outlook: In last month‘s Euro Short-term Price Outlook we noted that the, “threat remains for a larger rebound within the broader downtrend towards slope resistance while above parity. Be on the lookout for topside exhaustion ahead of 1.0385 IF the larger downtrend is to remain viable.” EUR/USD has rallied more than 1.1% since the start of August with the rally now approaching confluent downtrend resistance at 1.0352/85- a region defined by the 2016 low & the 2016 low-day close. We’re looking for possible price inflection here with a topside breach / close above needed to keep the immediate advance viable in the days ahead.

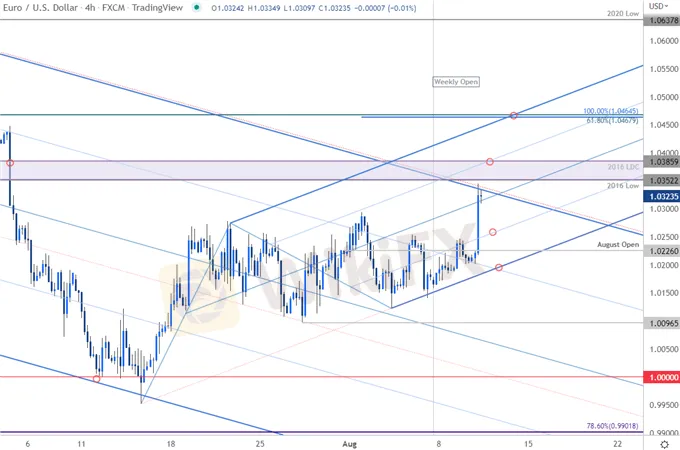

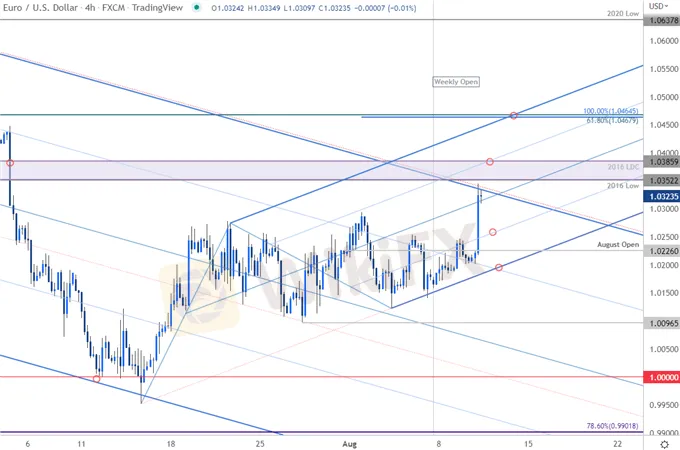

EURO PRICE CHART – EUR/USD 240MIN

Notes: A closer look at Euro price action shows EUR/USD continuing to trade within the confines of an embedded ascending pitchfork formation extending off the July / August lows. Note that the 75% parallel now converges on the 1.0352/85 resistance zone and further highlights the technical significance of this level near-term. A breach higher from here keeps the focus on confluent Fibonacci resistance at the 61.8% retracement of the late-May decline / 100% extension of the July advance at 1.0464/68- look for a larger reaction there IF reached.

Monthly open support at 1.0226 backed closely by the lower parallel (currently ~1.02). Near-term bullish invalidation now raised to the weekly opening-range lows- weakness beyond would threaten resumption of the broader downtrend towards 1.0096 and another test of parity.

Bottom line: Euro has rebounded off downtrend support with the recovery now eyeing a test of downtrend resistance- risk for price inflection / breakout. From at trading standpoint, look to reduce portions of long-exposure / raise protective stops on a stretch towards 1.0355/85 – losses should be limited to the 1.0226 IF price is heading higher on this stretch with a breach / close above this pivot keeping the focus on 1.0465. Review my latest Euro Weekly Price Outlook for a closer look at the longer-term EUR/USD technical trade levels.

EURO TRADER SENTIMENT – EUR/USD PRICE CHART

A summary of IG Client Sentiment shows traders are net-long EUR/USD - the ratio stands at +1.26 (55.69% of traders are long) – typically weak bearish reading

Long positions are7.17% higher than yesterday and 9.71% lower from last week

Short positions are 4.49% lower than yesterday and 15.01% higher from last wee

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are more net-long than yesterday but less net-long from last week. The combination of current positioning and recent changes gives us a further mixed EUR/USD trading bias from a sentiment standpoint.

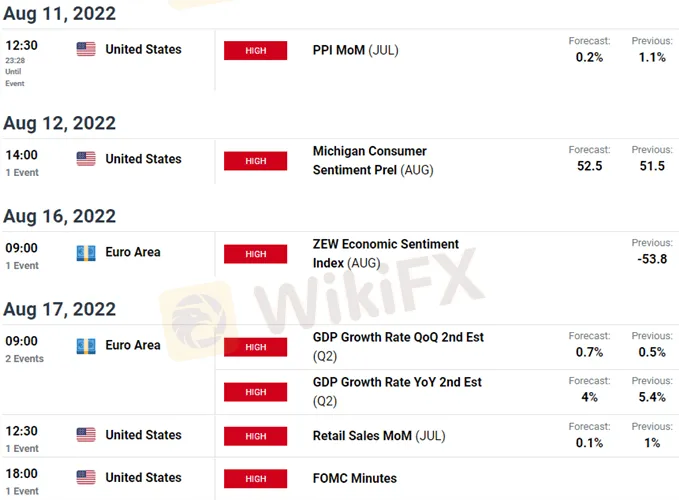

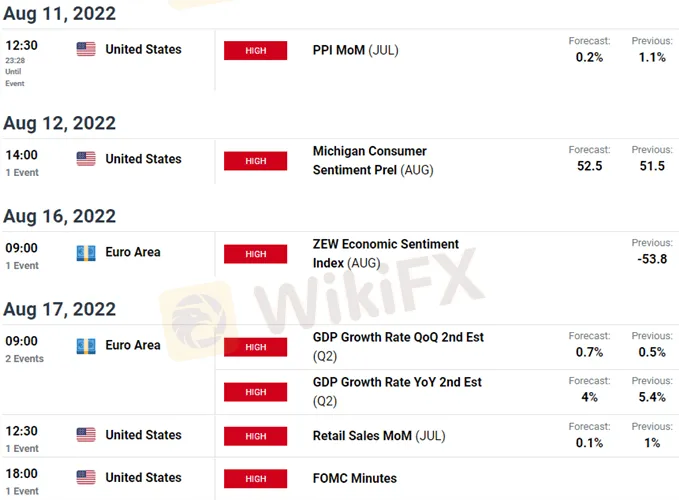

EURO / US ECONOMIC CALENDAR

ACTIVE TECHNICAL SETUPS

S&P 500 Short-term Technical Outlook: SPX500 Coils into August

Gold Price Short-term Technical Outlook: Gold Rally at Trend Resistance

Canadian Dollar Short-term Price Outlook: USD/CAD Rebound Faces NFP

Crude Oil Short-term Outlook: WTI Spills Lower- Support in View

Nasdaq Technical Outlook: NDX Fed Rally Faces Downtrend Resistance

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.