Abstract:Markets.com is an online forex and CFD broker offering a series of trading instruments to its clients across the globe. Is Markets.com a trustworthy broker? In this article, we will reveal the pros and cons and you will have a clearer understanding of this broker. Now, find the answer by yourself.

Markets.com Review 2022 - Pros & Cons Revealed

Markets.com is an online forex and CFD broker offering a series of trading instruments to its clients across the globe. Is Markets.com a trustworthy broker? In this article, we will reveal the pros and cons and you will have a clearer understanding of this broker. Now, find the answer by yourself.

Overview

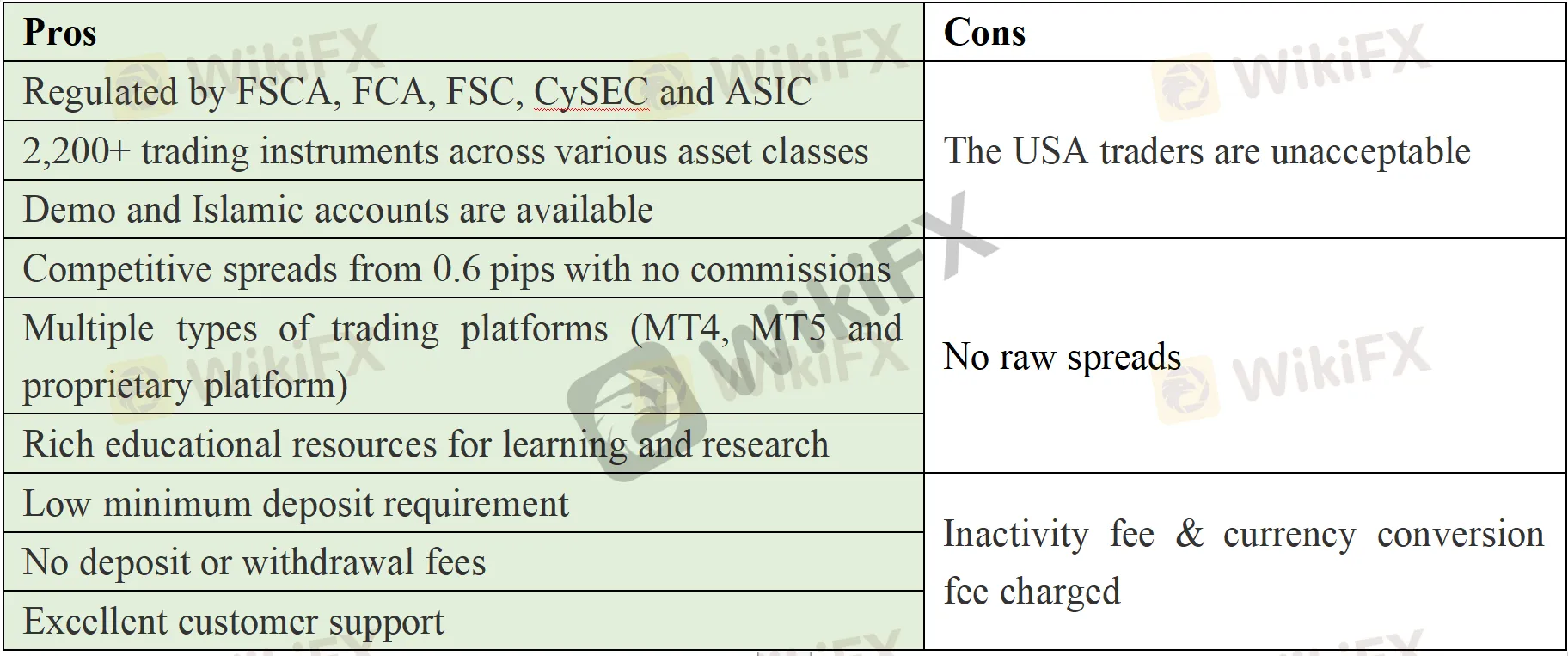

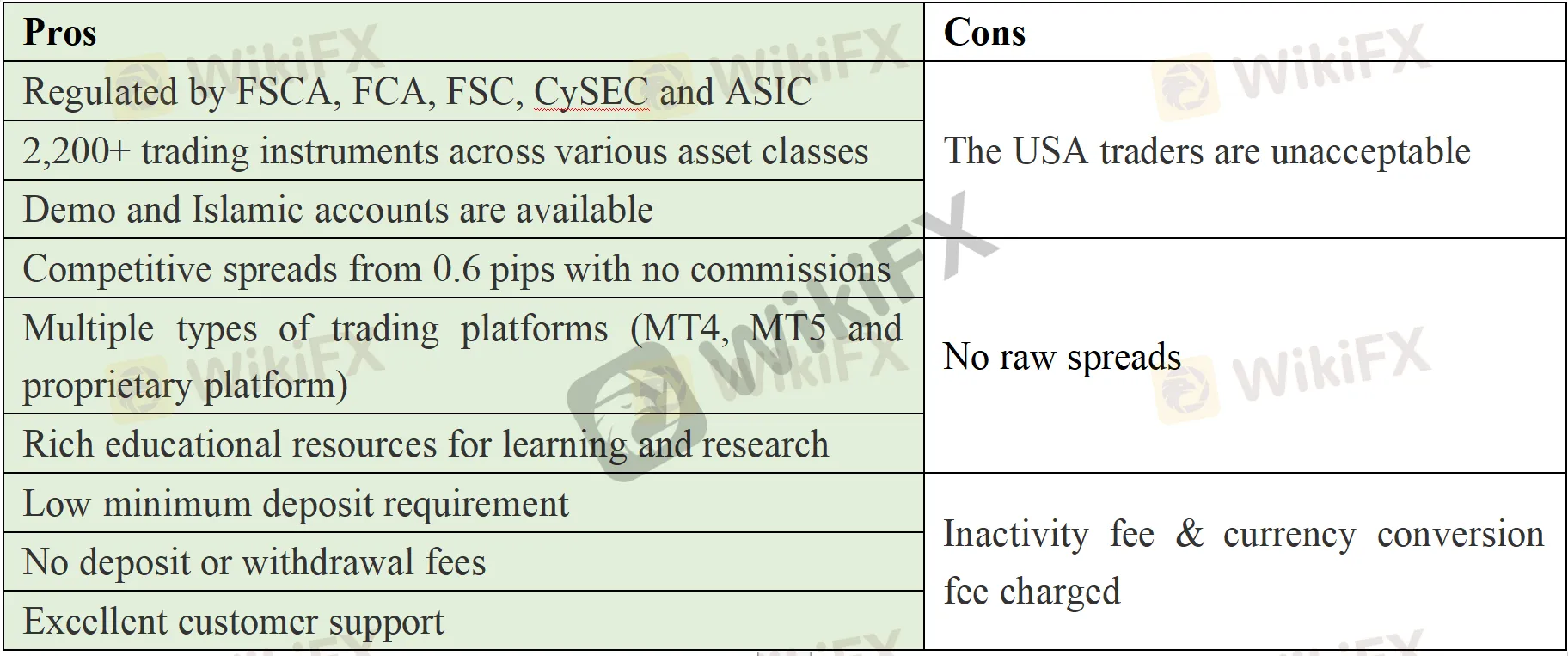

1. Pros and Cons

2. General Information & Regulation

3. Market Instruments

4. Account Types

5. Leverage

6. Spreads & Commissions

7. Trading Platform Available

8. Trading Hours

9. Education

10. Deposits & Withdrawals

11. Bonuses & Fees

12. Customer Support

13. Conclusion

1. Pros and Cons

2. General Information & Regulation

At WikiFX, we found that Markets.com is the trading name of Finalto (BVI) Ltd. It is a broker registered in the Virgin Islands and regulated in Cyprus. The broker is in MT4/5 full licence and has experience of 5-10 years. In addition, WikiFX has given this broker an objective score of 5.92/10, and the level of influence is A, which performs better than 74.7% of brokers.

3. Market Instruments

Markets.com advertises that traders can get access to more than 2,200 instruments across various asset classes in financial markets with its multi-asset platform, including CFDs, stocks, commodities, precious metals like gold, oil, forex currencies, indices, bonds, ETFs and cryptocurrencies.

4. Account Types

There are three different account types provided by Markets.com, namely demo accounts, Islamic accounts (swap-free) and real accounts. Opening an account requires the minimum initial deposit amount of $/€/£100.

Demo accounts: Suitable for forex trading beginners to practice how forex trading works before they start trading with real money. Traders can open a demo account with $10,000 virtual funds and unlimited time.

Islamic accounts: Also called swap-free accounts.

Real accounts: Holding this type of account, traders can get the chance to have an account manager to help them handle their accounts.

5. Leverage

The maximum leverage offered by Markets.com is up to 1:300 for global while 1:30 for Europe (all account types available). Note that inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

6. Spreads & Commissions

Markets.com claims to provide its clients with commission-free forex trading costs starting from 0.6 pips with no commissions.

7. Trading Platform Available

Platforms available for trading at Markets.com are the industry-standard MetaTrader4 and MetaTrader5, as well as its own web-based trading platform which is also available as a mobile app on iOS and Android devices.

MetaTrader4: Available for mobile, desktop and web, MT4 remains one of the most popular and easy-to-use trading platforms specially designed for forex trading, providing Expert Advisors, micro-lots, hedging, one-click trading, etc.

MetaTrader5: MT5 is a multi-asset derivatives platform crafted for trading on a wide range of forex, futures, stocks and CFDs. Its a tuned-up, faster version of MT4 which enables hedging and netting, and delivers an increase in technical indicators as well as more insight into the market depth and a wider number of timeframes.

Mobile App: Compatible with iOS and Android terminals, Markets.com mobile app is designed for traders who are always on the move, enabling you to execute trades instantly with a single tap, place orders and manage alerts and positions on the go. This mobile app can be downloaded from Apple Store or Google Play Store.

8. Trading Hours

Different asset classes at Markets.com can be traded at different trading hours, more specific information can be found in the below screenshot.

9. Education

As for education, Markets.com gives its clients a diverse range of education resources, such as XRay, Ebook, Webinars, News, Analysis and FAQs.

XRay: XRay is traders own tailored, personalized financial live-stream service. Traders can get vital decision-making news, expert views and commentary, all live and interactive directly in-platform.

Ebook: New traders can learn by themselves through the ebook “The A-Z of Trading: A Beginners Guide to Trading Financial Markets”.

Webinars: It allows traders to upgrade their market knowledge with free training from some of the top minds in the world of financial markets. Markets.com advertises that its expert presenters are on hand to answer your questions and guide you through a range of topics, from using our state-of-the-art platforms to understanding the ins and outs of the markets.

News: The broker says that its expert team reports on the daily changes and developments in the market that could impact your trades and investments. From earnings season to policy announcements and elections, anything that impacts the markets can be found in Trading News, alongside our insights into what impact traders could see.

Daily Market Analysis: Sometimes issues are too complicated for a news article to provide enough of the background and information that you need. And when it comes to trading and investing, a clear understanding of the issues is vital. Traders can find longer, more in-depth insight into the biggest issues in the market from financial experts.

FAQs: Almost every regulated broker offers this kind of service. FAQs can help traders to find the answers to questions quickly and easily.

10. Deposits & Withdrawals

Markets.com works with multiple payments and withdrawals of funds, including credit/debit cards like MasterCard and Visa, Wire Transfer and e-wallets such as Neteller and Skrill.

Minimum DepositAmount

The minimum initial deposit requirement is €/£/ $100.

Minimum Withdrawal Amount

The minimum withdrawal amount varies on withdrawal options.

Credit/Debit cards: minimum €/£/ $10

Wire Transfer: minimum €/£/ $100 and €20 within the EU

E-wallets: minimum €/£/ $5

Deposit & Withdrawal Fees

There are no deposit or withdrawal fees at Markets.com. Payment providers or banks may, however, charge transaction fees according to their fee schedule. Markets.com does not cover any fees associated with the payment methods, such as exchange fees (due to currency conversions).

Withdrawal Processing Time

Markets.com says it will make every effort to ensure that traders' funds are transferred as promptly as possible.

Credit/Debit cards: 2-7 business days

Wire Transfer: 2-5 business days

E-wallets: up to 24 hours

11. Bonuses & Fees

Markets.com offers some bonuses to clients residing in certain jurisdictions, yet no more information is specified directly.

This broker does charge some fees. For example, for accounts that have been inactive for more than 3 months, an inactivity fee of $10 per month will be charged. There is also a currency conversion fee of 0.60%.

12. Customer Support

Markets.coms customer support can be reached from Mon 00:00 to Friday 23:55 PM (GMT +2) which is Sun 22:00 PM – Friday 21:55 UK time by telephone: +442031500380, email: support@markets.com, 24/5 live chat or fill in Online Query Form to get in touch. Besides, you can also follow this broker on some social media platforms such as Facebook, Twitter, Instagram, LinkedIn and YouTube. Company address: Ritter House, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands.

Online Query Form

Information on Twitter

This broker does have an official account on Twitter. It was created in October 2014. And it currently has 7,500+ followers.

Information on Facebook

This broker also has an official account on Facebook. There are almost 100,000 users have followed it.

Information on LinkedIn

On LinkedIn, Markets.com has more than 4,500 followers.

Information on YouTube

The broker has 6,100 subscribers on YouTube and it has created a huge number of videos for its subscribers to get more knowledge about Markets.com.

13. Conclusion

Overall, Markets.com can be summarized as a trustworthy broker that is regulated well and offers relatively great trading conditions, as well as rich educational resources and excellent customer support service.

Anyway, WikiFX advises you to think carefully and do more research before investing in any broker. WikiFX contains details of more than 37,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link below (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers you are curious about.