Abstract:FP Markets, a trading name of FIRST PRUDENTIAL MARKETS PTY LTD, is a forex and CFD broker headquartered in Australia, regulated by the Australian Securities and Investment Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the European Securities and Markets Authority (ESMA) since 2005. FP Markets is on the list of 2022 10 Best Forex Brokers in the world, providing its clients with a wide selection of trading financial instruments with leverage up to 500:1, variable raw spreads from 0.0 pips and low commissions on the industry-standard MetaTarder4 and MetaTrader5 trading platforms, a choice of forex, Iress and Islamic account types, as well as copy trading service and 24/7 multilingual customer support service.

Overview

1. General Information & Regulation

2. Market Instruments

3. Account Types

4. Leverage

5. Spreads & Commissions

6. Trading Platform Available

7. Trading Tools

8. Trading Hours

9. Deposit & Withdrawal

10. Fees

11. Customer Support

12. Conclusion

1. General Information & Regulation

FP Markets, a trading name of FIRST PRUDENTIAL MARKETS PTY LTD, is a forex and CFD broker headquartered in Australia, regulated by the Australian Securities and Investment Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the European Securities and Markets Authority (ESMA) since 2005.

FP Markets is on the list of 2022 10 Best Forex Brokers in the world, providing its clients with a wide selection of trading financial instruments with leverage up to 500:1, variable raw spreads from 0.0 pips and low commissions on the industry-standard MetaTarder4 and MetaTrader5 trading platforms, a choice of forex, Iress and Islamic account types, as well as copy trading service and 24/7 multilingual customer support service.

View more details in the below video:

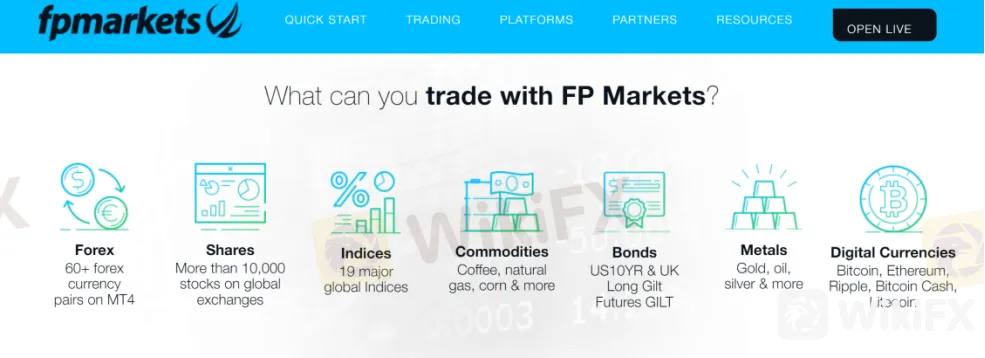

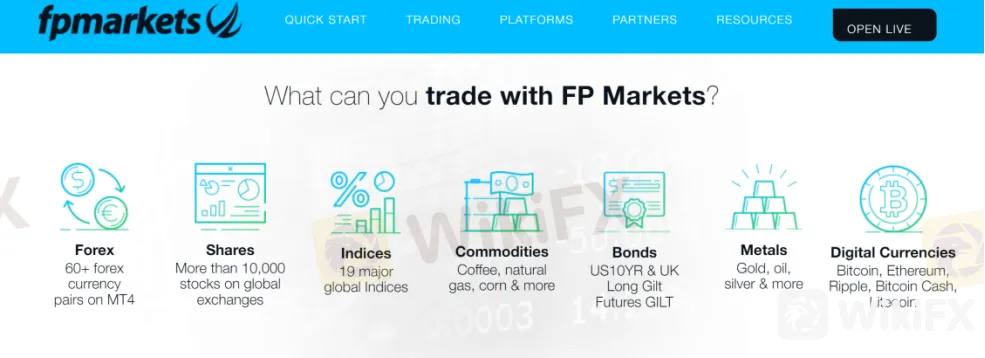

2. Market Instruments

FP Markets advertises that it offers access to more than 1,000 instruments, including forex (60+ forex currency pairs) and CFD trading in shares, indices, commodities, bonds, metals (gold, oil, silver, etc.) and digital currencies of Bitcoin, Ethereum, Ripple, Bitcoin Cash and Litecoin.

3. Account Types

FP Markets provides its clients with a free 30-day demo account, which allows traders to gain experience and familiarity with online trading as well as to learn about forex fundamentals such as base currencies, forex currency pairs, charting tools and volatility. With no initial deposit required or trading risks involved, you can develop your trading strategies. Traders can then upgrade to live accounts with just a 100 deposit if they wish.

In particular, this broker also offers two forex account types: Raw and Standard, and three Iress account types: Standard, Platinum and Premier, as well as two Islamic account types: Islamic Standard and Islamic Raw. The forex Standard and Raw, Islamic Standard and Islamic Raw require the minimum deposit amount of A$100 or equivalent. While the Iress Standard, Platinum and Premier accounts require the minimum initial capital of A$1,000, A$25,000 and A$50,000 respectively.

4. Leverage

A leverage ratio of up to 500:1 is offered by FP Markets, which is much higher than that provided by most brokers. Inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

5. Spreads & Commissions

FP Markets claims that different account types can experience quite different spreads and commissions.

For example, the spread on the forex Standard and Islamic Standard starts from 1.0 pip, while the clients on the forex Raw and Islamic Raw account can enjoy raw spreads from 0.0 pips.

As for commissions, this broker charges the forex Standard and Islamic Standard accounts zero commission, while the forex Raw and Islamic Raw account will be charged a $3 commission per lot per side. For Iress account types, the minimum commission is A$10 and then 0.1% for the Iress Standard account; A$9 minimum and then 0.09% for the Iress Platinum account, and no minimum, then 0.08% for the Iress Premier account.

6. Trading Platform Available

Platforms available for trading at FP Markets are MetaTarder4, MetaTrader5, IRESS, WebTrader and mobile apps for iPhone and Android devices.

MetaTrader4 and MetaTrader5 are the worlds most trusted and popular trading platforms. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance.

This broker also states that these trading platforms offer an advanced client portal to track your trading in real-time, as well as superior VPS solutions for EAs, scalpers and auto-trading.

With mobile apps, trading can be done at any time and anywhere through the right terminals including iPhone and Android terminals.

7. Trading Tools

There are five different trading tools provided by FP Markets, namely MAM/PAMM, VPS, Traders Toolbox, Forex Calculator and Autochartist.

MAM/PAMM: This broker offers managed accounts, which gives clients the chance to have MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module Manager) trade all of their accounts.

VPS: With Forex VPS or Virtual Private Server, traders can run automated trading strategies 24 hours a day, 7 days a week, with the quickest possible connectivity.

Traders Toolbox: A suite of 12 online trading tools is included in the FP Markets MT4 Traders Toolbox.

Forex Calculator: There are numerous forex calculators available, including Pip Calculator, Currency Converter, Margin Calculator, Swaps Calculator and Swaps Calculator.

Autochartist: In Autochartist, technical indicators are used to uncover chart patterns in real-time to help traders understand trading opportunities. Trading opportunities are alerted in real-time based on continuous market analysis.

8. Trading Hours

At FP Markets, Forex Market Hours vary depending on countries. In particular, for Sydney Session, the trading time is between 3 pm and 12 am (EST); TOKYO Session is 7 pm–4 am (EST); LONDON Session is 3 am–11 am (EST) and 8 am–5 pm (EST) in NEW YORK Session.

While for MT4/MT5 users, the trading time is 24 hours a day with a two-minute break from 23:59 to 00:01. The trading week starts at 00:02 Monday and closes at 23:57 Friday.

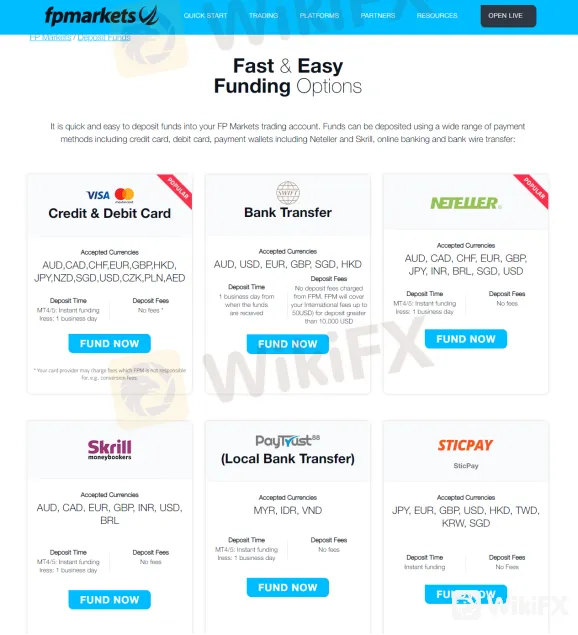

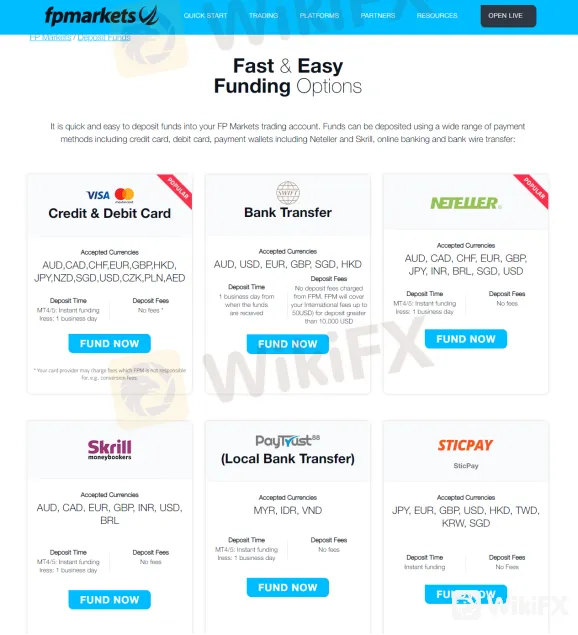

9. Deposit & Withdrawal

FP Markets works with 22 means of deposit and withdrawal choices, consisting of credit/debit cards (Visa and MasterCard), Bank Transfer, Neteller, Skrill, PayTrust, Sticpay, Fasapay, Virtual Pay, Rupee Payments, dragon pay, Perfect Money, Asian, African and Latam Payments, Paylivre, Cryptocurrencies of Bitcoin, Ethereum and others, Rapid, Rapid transfer, MPSA, South East Asia online Banking, Luqapay, Pagsmile and broker to broker.

The minimum initial deposit requirement is 100.

This broker does charges some deposit and withdrawal fees. For most deposit payment options, there are no fees charged, while withdrawal fees vary depending on withdrawal payment methods. More specific information can be found in the below screenshots.

As for the processing time deposit and withdrawal requests, part of deposits can be processed instantly, while others will be required within 1 business day. Most withdrawals usually can be processed within 1 business day, while other withdrawals require more time to process but no more than 5 days.

10. Fees

On top of deposit and withdrawal fees, FP Markets reveals that it doesnt charge an inactivity fee.

However, traders should attention that traders who offer access to state-of-the-art online trading platforms, mobile trading apps, educational resources, and financial research tools may charge clients various trading fees to maintain these services and earn revenue as a company.

11. Customer Support

FP Markets customer support can be reached by telephone: +44 28 2544 7780, email: supportteam@fpmarkets.com or live chat. Besides, you can also follow this broker on some social media platforms such as QQ: 1076175717, Facebook, Twitter, Instagram, LinkedIn and YouTube. Office: First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

12. Conclusion

To conclude, is FP Markets a reliable forex broker? Given that the eleven parts we have discussed before (regulation, market instruments, account types, leverage, spreads & commissions, trading platform available, trading tools, trading hours, deposit & withdrawal, bonus & fees and customer support), FP Markets aren't perfect, but we found many useful aspects with their overall offering.