Abstract:Traders choose short selling because it is interesting to speculate and hedge. To speculate means creating a pure price bet for it would decline in the future. If the speculation is wrong, they should buy shares at a loss or higher.

Due to the use of margin in the short selling, the conduct is over a short time period, thus it is near to act of speculation. In addition, there are also people who do short selling to hedge a long position.

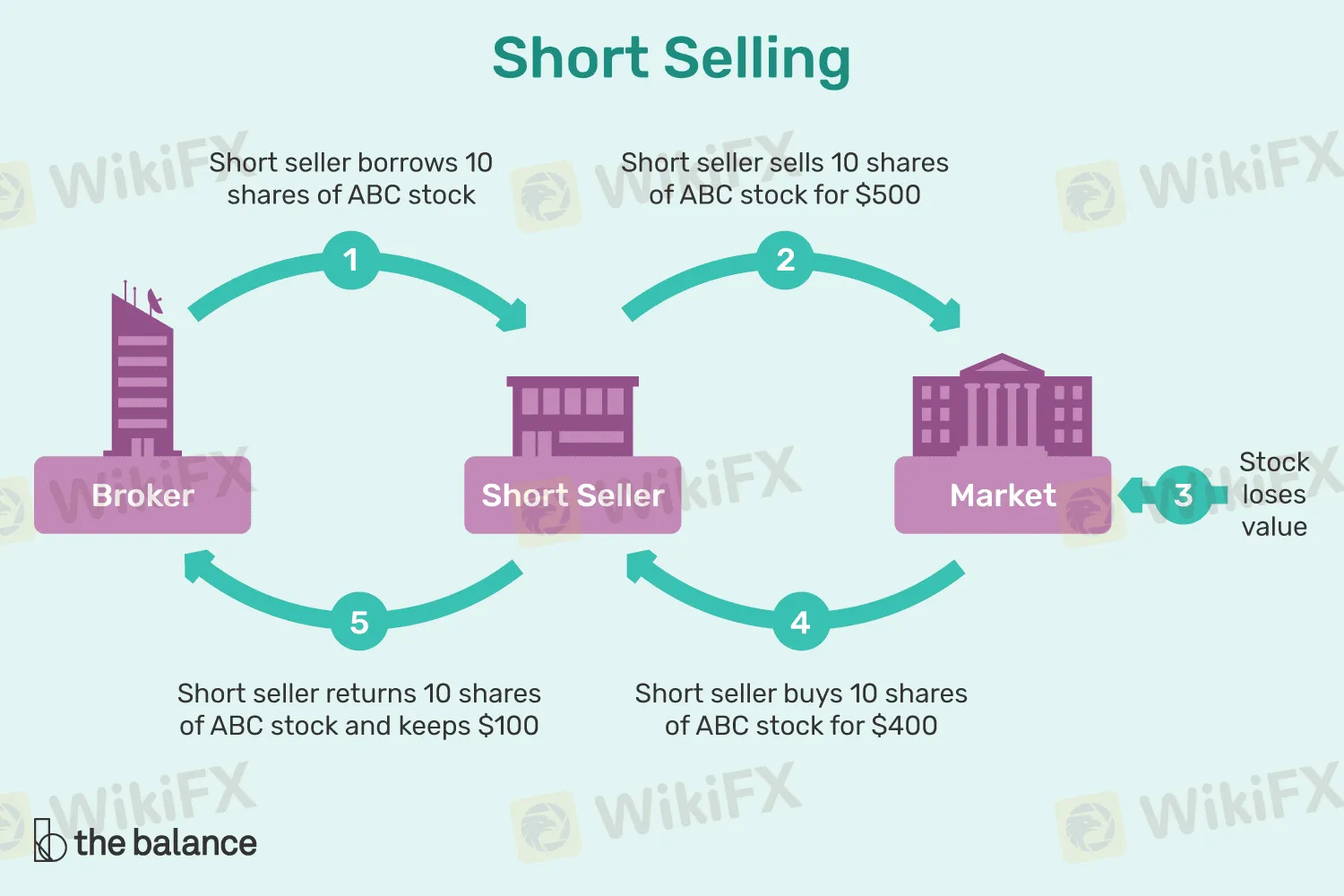

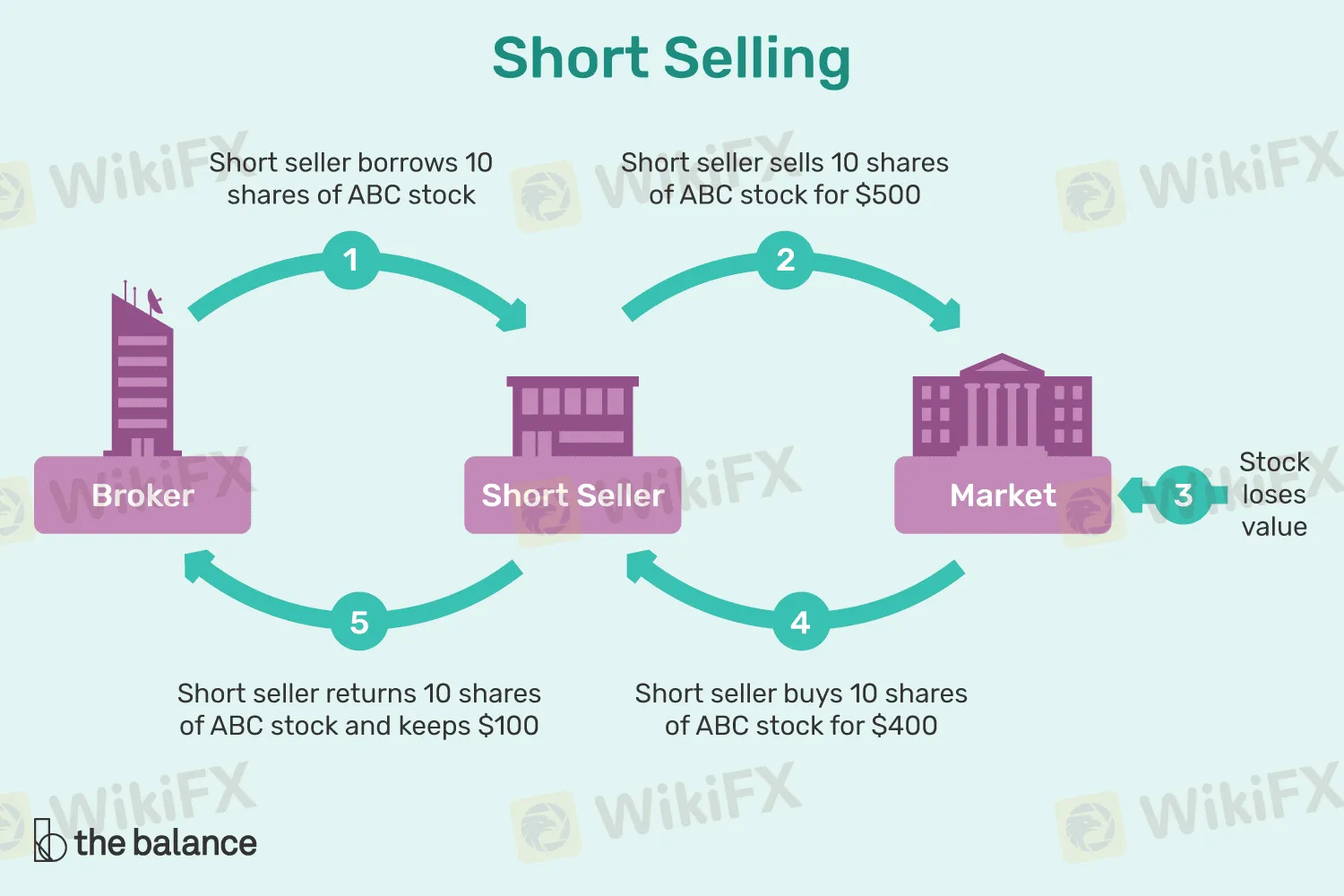

The example would be, if you are in the long positions you might aim to sell short against the long position to lock your profit in case you face loss. This is similar to a situation where you limit downside losses in the long position. If you want to create a profit in short selling position, you should consider this scenario. You trade at $50 for instance that would decline in price for the next few months. They would borrow 100 shares then sell them to other investors. So, the trader now short 100 shares to sell something they borrow or not they have. Short selling is possible only when you borrow the shares. So, it is not available sometimes, especially during the situation where traders flock for it.

Less than a month later, the company whose shares are borrowed announced the dismal financial condition, thus the stock fell to around $40. On this occasion, the trader would decide to close this short position and buy the 100 shares at $40 to replace borrowed shares. This is to note that this replacement of the borrowed shares do not include the commissions and margin account charge. The calculation is $1,000: ($50 – $40 = $10 x 100 shares = $1000, said Investopedia.

But it does not mean that it is not prone to failing. Imagine a trader did not close out the short position of the $40, but leave it open for further decline. Then, a competitor enters acquiring the company for $65 takeover per shares. Then, the trader encounters loss. Thus, trader might need to buy back the shares at the higher price.