简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

Abstract:You're wondering, 'Is RockwellHalal legit?' and this is the most important question you should ask before putting any of your money at risk. The promise of big profits can be very appealing, but it also requires careful investigation. In today's online world full of both opportunities and dangers, checking if a broker is trustworthy isn't just smart—it's necessary to protect yourself.

You're wondering, 'Is RockwellHalal legit?' and this is the most important question you should ask before putting any of your money at risk. The promise of big profits can be very appealing, but it also requires careful investigation. In today's online world full of both opportunities and dangers, checking if a broker is trustworthy isn't just smart—it's necessary to protect yourself.

In this detailed 2026 review, we will carefully look at the information RockwellHalal shares about itself. We will examine everything from their bold investment plans and company background to their contact information and security promises. Our goal is to help you answer one important question: Is this a reliable trading partner or a possible threat to your money?

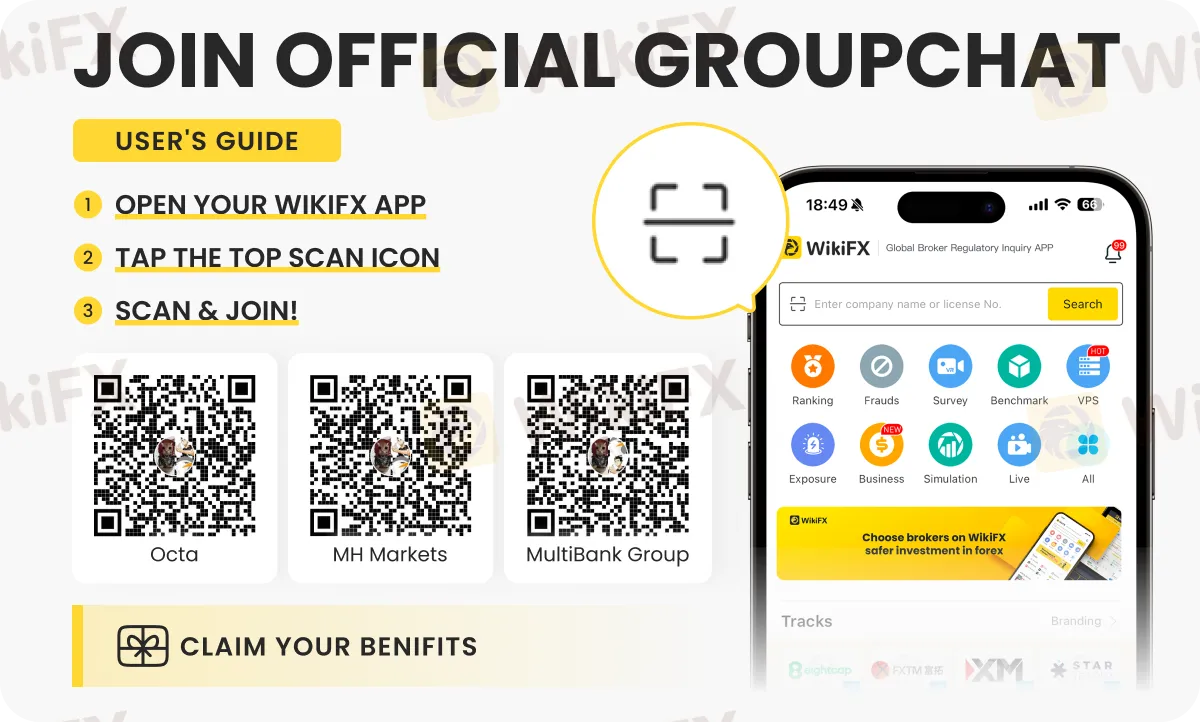

Before we start, an important first step when checking any broker is to verify their legal status on an independent website. We strongly suggest using a tool like WikiFX to get an unbiased, third-party opinion. This simple check can give you immediate answers and save you from serious problems.

What RockwellHalal Says About Itself

To judge if they're legitimate, we must first understand what the company officially claims. This section brings together the statements made on the RockwellHalal website, giving us a neutral starting point for the detailed analysis that comes next.

Company Mission

RockwellHalal describes itself as a “global team of legal, technology, and cryptocurrency experts” started in 2019. They claim experience in running digital asset exchanges in Switzerland and other international markets, with a goal to make cryptocurrency trading secure, ethical, and easy to access. The company says it has grown with offices across Switzerland and Europe.

Their stated mission is to be a top choice for private market investments for investors, partners, and professionals by:

• Creating excellent, long-term investment profits.

• Building long-term relationships based on trust and honesty.

• Using a professional, fact-based investment approach.

• Attracting, developing, and keeping outstanding professionals in a supportive workplace.

Investment Strategy Claims

The company describes its investment approach as focused on global private markets, including private equity, private credit, and infrastructure. They claim to take advantage of opportunities in mid-size companies and the “innovation economy.”

RockwellHalal highlights its use of “active secondary and co-investments” to support a primary fund program, which they say helps speed up investing and improve returns. A key part of their sales pitch involves using “innovative, cost-effective structures” designed to reduce the j-curve effect, a common problem in private equity where a fund's value drops in the early years. They also mention a commitment to including Environmental, Social, and Governance (ESG) factors in their investment process. The company vaguely mentions a “multiple trading focus” under a section called “Diversified Assets,” claiming this ensures steady payments.

Security and Support Promises

RockwellHalal makes several promises about the security of its platform and the quality of its customer services. These are key selling points designed to build trust with potential investors.

• Strong Security: The website claims to have an installed “Commodo License” to ensure encrypted communication from start to finish.

• Best Support: They promise 24/7 customer support services to ensure clients get help whenever they need it.

• Lower Fees: A central part of their value offer is providing lower fees than traditional fund models, which they argue improves net returns for investors.

Detailed Analysis: Warning Signs

While the company's official presentation sounds professional, a careful examination shows many inconsistencies, missing information, and warning signs. An experienced analyst knows that what a company doesn't say is often more important than what it does say.

Looking at Investment Packages

The biggest area of concern is in the investment packages and their promised returns. Legitimate investment firms are legally required to state that returns are not guaranteed and that money is at risk. RockwellHalal, however, presents specific return percentages tied to deposit levels, a classic sign of high-risk schemes.

Let's compare their promises to realistic market expectations.

| Package | Minimum Deposit | Maximum Return (Promised) | Typical Yearly Stock Market Return (for comparison) |

| Starter | $100 | 3.5% | 8-10% (S&P 500 average) |

| Pro | $1,500 | 20% | 8-10% (S&P 500 average) |

| Elite | $5,000 | 25% | 8-10% (S&P 500 average) |

The first problem is unclear information. The website does not specify the time period for these “Maximum return” figures. Are they daily, monthly, or yearly returns? If these were daily or even monthly returns, they would be extremely high and completely impossible in any real market. A 25% monthly return, for example, adds up to over 1,400% yearly, a figure never seen in legitimate investing.

Even if we assume these are yearly returns, a guaranteed 20% or 25% is highly suspicious. The average yearly return of the S&P 500, a benchmark for the US stock market, is around 8-10% over the long term, and this comes with significant ups and downs and no guarantees. Any company promising guaranteed returns of this size, especially in private markets which are naturally hard to sell and risky, should be viewed with extreme caution.

Contact and Location Investigation

A company's contact information and physical presence are basic indicators of its professionalism and legitimacy. In our experience analyzing financial firms, global institutions operate with specific corporate standards that RockwellHalal fails to meet.

• Email Address: The provided contact email is `rockwellhalal@gmail.com`. Legitimate financial corporations, particularly those claiming a global presence, operate with corporate email domains (e.g., contact@rockwellhalal.com), not free, generic email providers like Gmail. This is a significant sign of an unprofessional or potentially temporary operation.

• Phone Number: The listed phone number, +447309544162, is a UK mobile number. For a company that claims roots in Switzerland and provides a New York address, using a UK mobile number as its main contact is highly unusual. A credible firm would have dedicated business landlines for its registered offices.

• Physical Address: The address given is “13th Street. 47 W 13th St, New York, NY 10011, USA.” While this is a real address in New York, it is a large building that houses many apartments, retail stores, and other businesses. Without a specific suite number or a verifiable listing for “RockwellHalal” at this location, the address is effectively meaningless. It does not prove the existence of a corporate headquarters or even a small office. Legitimate brokers have clearly identifiable and verifiable office locations.

The Missing Regulation

This is the single most critical warning sign. Despite its claims of operating in “Switzerland and across international markets,” RockwellHalal's website makes no mention of being regulated by any government financial authority.

Financial regulation is absolutely necessary for investor protection. Respected regulatory bodies like FINMA (Switzerland), the FCA (UK), the SEC (USA), or ASIC (Australia) enforce strict rules. These rules include keeping client funds separate from company funds, ensuring fair trading practices, and providing a legal framework for help if a broker acts improperly or goes out of business.

A regulated broker is proud of its license and displays its regulatory body and license number prominently on its website. The complete absence of this information from RockwellHalal is a massive warning sign. It suggests that they are operating outside the legal framework designed to protect investors, meaning that if you deposit funds, you may have no legal protection or way to get your money back if something goes wrong.

The absence of a verifiable license number is the single biggest indicator of a high-risk operation. You can and should independently verify any broker's regulatory claims on a platform like WikiFX before creating an account or sending funds.

Breaking Down Vague Language

Experienced investors learn to see through vague marketing language. RockwellHalal's website is filled with terms that sound impressive but lack real meaning.

For instance, the claim of having an “installed strong Commodo License” is misleading. This is likely a misspelling of a “Comodo SSL Certificate” (now Sectigo). An SSL certificate is a standard security feature that encrypts data sent between your browser and the website. It protects your login details from being stolen, but it says absolutely nothing about the security of your invested funds, the legitimacy of the company, or how they handle your money. It is a basic website feature, not a measure of financial security.

Similarly, phrases like “multiple trading focus” or “differentiated global platform” are meaningless without specific, verifiable details. What assets do they trade? What makes their platform different? Legitimate firms provide detailed documentation on their strategies, assets, and technology. Vague jargon is often used to create a appearance of expertise without providing any real information.

Signs of a Legitimate Broker

To provide a clear contrast, it's important to understand what to look for in a truly legitimate and trustworthy broker. This knowledge helps you properly check any future investment opportunity. Use this checklist as a guide to protect your money.

A Broker Legitimacy Checklist

• ✅ Verifiable Regulation: The broker clearly displays its regulating authority (e.g., FCA, CySEC, ASIC, FINMA) and provides a license number. Most importantly, you can take this number and independently verify it on the regulator's official public website.

• ✅ Professional Corporate Identity: The company uses a professional email domain that matches its website name. It lists verifiable physical office addresses with suite numbers and provides dedicated business landlines, not mobile numbers.

• ✅ Realistic Risk Warnings: Instead of promising high returns, a legitimate broker provides extensive and easily accessible legal disclaimers. These documents clearly state that trading involves significant risk, that past performance does not guarantee future results, and that you could lose your entire investment.

• ✅ Clear Fee Structure: All costs associated with trading and account management are clearly detailed. This includes spreads, commissions, overnight swap fees, inactivity fees, and withdrawal fees. There are no hidden charges.

• ✅ Separated Client Funds: The broker explicitly states that client funds are held in separated accounts at reputable, top-tier banks. This means your money is kept separate from the company's operational capital, protecting it in the event the brokerage firm faces financial difficulty.

• ✅ Strong Industry Reputation: The firm has a long, verifiable operating history, often spanning many years or even decades. It has a substantial number of independent reviews on trusted financial forums and third-party review sites, showing a track record of reliable service and withdrawals.

Conclusion: Your Final Decision

We began by asking a simple question: Is RockwellHalal legit? After a thorough analysis of the company's own claims against established industry standards for safety and transparency, we can now form a clear answer.

A Summary of Evidence

While we cannot make a definitive legal judgment of “RockwellHalal Scam,” the evidence presented by RockwellHalal itself points overwhelmingly toward a high-risk operation. The combination of unrealistic and unclear return promises, unprofessional contact details (a Gmail address and a UK mobile number), a non-verifiable physical address, and, most critically, a complete lack of any verifiable financial regulation, paints a concerning picture. These characteristics are not found in legitimate, established global investment firms. They are, however, commonly associated with unregulated entities that pose a significant danger to investor money.

Our Final Recommendation

Our recommendation is clear: prioritize the safety of your funds above all else. The appeal of high returns should never overshadow the basic need for security and regulatory oversight. Given the serious concerns and the number of warning signs identified in our analysis, particularly the absence of regulation, we would strongly advise against sending any funds to RockwellHalal or any entity that shows a similar profile. The risk of potential financial loss is far too high.

Your Safest Next Step

The world of online trading and investing contains many reputable, well-regulated brokers who operate with transparency and honesty. It also contains many traps designed to take advantage of hopeful investors. Protect your money with careful research. Before you proceed with any broker, take two minutes to perform your own investigation. Use a trusted, independent verification tool like WikiFX to check their license, operating history, and real user reviews. This is the single most important step you can take to ensure you are partnering with a legitimate and safe financial company.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Big Boss Review 2025: Safety Warning and Regulatory Analysis

EURUSD Fails to Make New Highs

Situation In Venezuela Adds To Dollar Uncertainty

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

Dollar on Edge: Supreme Court Tariff Ruling and Deficit Warnings Collide

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Currency Calculator