Abstract:Forex Signals: trading suggestions compiled by experienced analysts (e.g. what to buy or sell and how to do it). It is also possible for the provider to compile the forex signals via automated software based on artificial intelligence (AI).

Most forex signals are distributed via Telegram to members, but this channel can only be accessed by paying a monthly subscription fee. Also, forex signals are sent to traders via emails or other communication applications like WhatsApp. What’s more, some free forex signals can be found on social media sites such as Twitter and forums like Reddit.

Overview

1. What are Forex Signals?

2. What do Forex Signals Look Like?

3. What are the Common Forex Signals?

4. What are the Merits and Demerits of Forex Signals?

5. How do Forex Signals Work?

6. How to Choose the Free Forex Signal Providers?

7. Best Free Forex Signals Providers 2022 (TOP 10)

8. Conclusion

1. What are Forex Signals?

Forex Signals: trading suggestions compiled by experienced analysts (e.g. what to buy or sell and how to do it). It is also possible for the provider to compile the forex signals via automated software based on artificial intelligence (AI).

Most forex signals are distributed via Telegram to members, but this channel can only be accessed by paying a monthly subscription fee. Also, forex signals are sent to traders via emails or other communication applications like WhatsApp. Whats more, some free forex signals can be found on social media sites such as Twitter and forums like Reddit.

2. What do Forex Signals Look Like?

Forex signals usually include three or four parts: buy (long) or sell (short) position, forex currency pair, limit entry price, as well as order types. For example:

BUY EUR/USD @ 1.1220

TP @ 1.1070, SL @ 1.1214

As the above examples show, “BUY” is the position, “EUR/USD” is the forex currency pair, and “1.1220” is the limit entry price, which is usually shown in either five or four digits after the dot. Also, in the second example, “TP” and “SL” stands for “take profit” and “stop loss”, and they are both order types, “1.1070” and “1.1214” are the limit entry price.

Of course, order types do not only include take profit (TP) and stop loss (SL), but also market order (MO), pending order (PO), and limit order (LO). etc.

In addition, a TS (trailing stop) is usually found at the end of the forex signal. However, not every broker and platform supports this order type.

3. What are the Common Forex Signals?

There are three common forex signals, just as the following lists:

1) Forex Price Action Signal

Forex price action signal is an indicator that traders can use to develop an understanding and make decisions regarding trends, key price levels and risk management.

2) Forex Swing Signals

A forex swing signal involves profiting from price swings in a particular market. Many of these trades remain open for several days or weeks. There is no perfect time frame for every trader. Swing traders, however, prefer the daily timeframe because it sometimes offers large price fluctuations and deeper swings.

3) Forex News Signals

Trading opportunities based on the news are automatically notified to traders through forex news signals. Using a modern news trading system, traders can identify trading opportunities by aggregating several high-performance news sources. The analysts analyze news events daily and make predictions regarding unexpected economic events. Their subscribers are then informed of their predictions every day. Moreover, some news trading signal providers also provide reasons why the consensus might be incorrect.

The above three common forex signals are all can be available for free. However, we cannot be sure if these signals are reliable at the beginning. Therefore, to test their reliability, you can use a demo account with virtual currency in real market conditions.

4. What are the Merits and Demerits of Forex Signals?

Forex signals have both pros and cons:

Merits

1) A way to learn about analysis.

The trades and their outcomes will be shown along with the analysis that influenced them.

2) Make money while you learn.

In addition to learning how to analyze and trade, you can also earn money.

3) Trade only when necessary.

Market watchers who don't or can't always monitor the market will benefit from this.

4) Develop a sense of confidence.

Based on solid information, you make good trades.

5) Your trading should be free of emotion.

You won't be influenced by your emotions when you trade. Only mathematical formulas will guide your trades.

Demerits

1) You may rely on signals.

Market analysis and trading are done for traders, so traders may stop looking for opportunities themselves and stop analysing the markets. As a result, they may stop learning how to trade.

2) The reliability of signals isn't always guaranteed.

Technical and fundamental signals may be wrong at times.

3) The signals may not be appropriate for your strategy.

In most cases, you'll have to adapt your strategy according to the provider.

4) The cost of signals can be high.

Find out how much your provider will charge you before you sign up. You may be charged monthly, by signal, by trade, or a combination of the three. Don't forget to consider these fees when calculating your earnings.

5) It can cost you money to deal with viruses and malfunctions.

Losses and bad trades can be caused by errors in the analysis and the system.

All in all, traders who are new to the forex market need to learn some basic knowledge of the forex market such as the merits and demerits of forex signals and how it works. Only in this way can they start by trading with a forex signal.

5. How do Forex Signals Work?

Generally, forex signals services work as follows:

Step 1: You subscribe to a forex signal service.

Step 2: Telegram sends you a signal indicating what entry, exit, and stop-loss orders to place.

Step 3: You place the respective orders at your preferred forex broker.

Step 4: The trade will be closed when the stop-loss or take-profit order price is reached.

The above process can be repeated between 1 and 5 times per day depending on the provider. Therefore, the signals must generate more winning trades than losing ones over the month.

6. How to Choose the Free Forex Signal Providers?

When choosing the best free forex signal providers, you need to consider six key factors:

1) Positions Available

For a good understanding of the signal service over a wide range of market conditions, at least 100 positions are recommended.

2) Risk-Reward Ratio

A positive risk-to-profit ratio should be maintained by the provider. It is generally preferred to have a risk-to-reward ratio greater than 1:1.

3) Success Rate

Signal services are evaluated by how often they win (more than 70% of trades) or how often they lose (50%). The reason behind this is to make sure the signal provider hasn't just had one very successful trade.

4) The Number of Consecutive Losing Trades

Following a forex signal can result in a drawdown or potential loss.

5) Choose More Experienced

It is very important to consider the age and experience of the provider of the best Forex signals if you want to choose the best ones. The truth is that forex signals are not trading bots, and you need to have experience when it comes to trading.

6) Quality over Quantity

Bear in mind that making more trades doesn't always mean making more profit. It is more important to focus on the quality of the signals provided to you than the number of them. No matter how many signals a provider offers, choose one that gives the best signals.

In a word, choosing the best forex signals provider is not an easy task. Various factors should be examined before choosing a provider, which includes not only the above six elements but also the provider's reputation, monthly fee, supported pairs, number of daily signals, etc.

7. Best Free Forex Signals Providers 2022 (TOP 10)

1) Learn2Trade

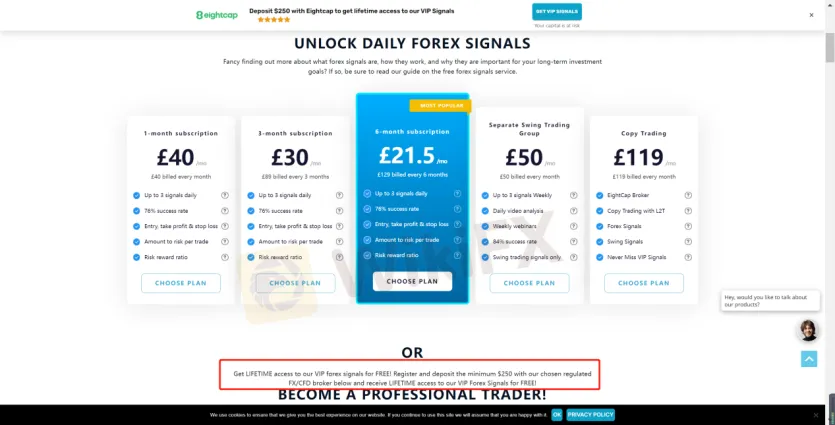

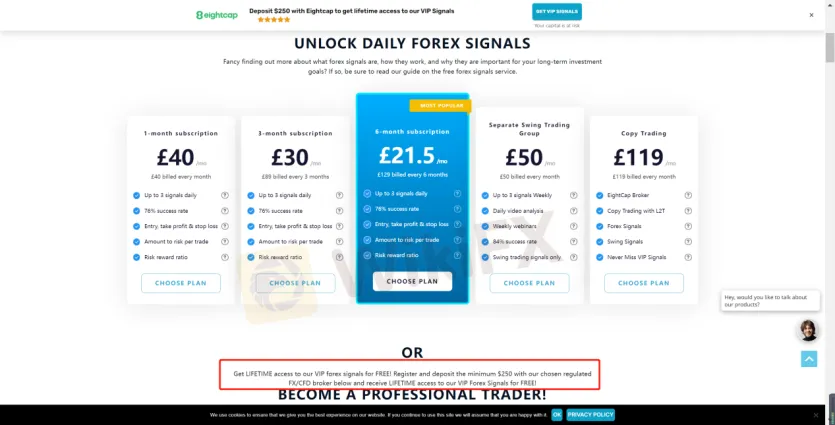

Learn2Trade is the best forex signals provider in 2022 and has 41,400 subscribers on Telegram, offering pro trading news, trade alerts, technical analysis and more. It gives its traders five different premium plans to choose from, but they are all not free and traders have to pay some fees to start a plan. However, it advertises that the VIP forex signals are free for life, and the traders need to do is just sign up and deposit a minimum of $250 with its chosen regulated forex and CFD broker. As displayed on the site, we can find the free forex signals telegram group includes 3 free forex signals a week. Besides, it also provides free cryptocurrency signals. In contrast to other providers, Learn2Trade does not omit key information, such as the limit entry price, in its free signals.

2) PriceAction Ltd.

PriceAction Ltd. has one of the largest trading communities on their Telegram platform, which they use to send forex signals. Traders can join their free Telegram channel (1-3 free signals) to see the performance and test the accuracy of their signals. Besides Forex signals, it also provides scalping signals for other instruments, such as indices, commodities and others.

3) FX Premiere

There are three paid signal plans provided by FX Premiere, namely basic, standard and premium fx signals, with fees of $37/monthly, $97/4 months and $199/12 months respectively. It also offers 1 free signal per day.

4) Forex GDP

Forex GDP offers 2-4 free forex signals per month. However, certain metrics are blacked out when receiving free signals, so users will need to pay for the full suggestion.

5) Daily Forex

Daily Forex offers traders a 30-day free trial and it posts several free forex signals with no fixed amountevery day with a clear overview of all required information, such as a suggested limit order price, as well as stop-loss and take-profit levels.

6) Wolfx Signals

Wolfx Signals is a provider specializing in both cryptocurrency and forex trade signals. It offers monthly plans, 3 months plans and lifetime plans to suit different traders needs. Also, from the information on the Internet, we found it seems to provide free forex signals but the number is not stated.

7) Direct Forex Signals

From the information on the site, we found that apart from three paid signal packages (£30 for 1 month, £55 for 3 months and £85 for 6 months), Direct Forex Signals also offers free signals (more specific information needs to subscribe to get) but for a limited time only.

8) Algo Signals

Algo Signals provides free forex signals using an automated robot. It is different from most robot providers in that you will not be able to access the software file. Instead, the robot will trade for you behind the scenes. You do not have to pay anything to join Algo Signals, but you will have to register with one of its partnered brokers. A minimum deposit of $250 is required to activate the robot. $1500 Demo Account can be opened once your brokerage account has been funded. As well as forex, Algo Signals also trades cryptocurrencies, including Bitcoin and Ethereum.

9) ForexSignals.com

You will have to pay $58 per month to gain access to the forex signal room, which offers the choice to follow individual traders. However, ForexSignals.com offers a 7-day free trial.

10) FXLeaders

Despite offering a premium service, FXLeaders also provides free forex signals throughout the trading week. In addition, there is no need to download a forex signals app since all suggestions are available online. The service provides 90-100 forex signals per month for free. However, the major disadvantage for FXLeaders is that it doesn't offer the suggested entry price. Therefore, you'll need to subscribe to the premium service.

8. Conclusion

In conclusion, providers who offer free forex signals are all for the purpose of earning money. They wouldn't spend countless hours researching currency markets for their clients if there was not any financial reward. Therefore, the best forex signal providers usually offer a free service along with their premium packages. As traders, all that we can do is just learn and learn, and always be cautious.