Abstract:On its website, OmegaPro Forex makes no mention of the company's owners or executives.

OmegaPro Forex provides no information on its website about who owns or runs the company.

OmegaPro Forexs website domain (“omegaproforex.com”) was privately registered on February 8th, 2021.

In an attempt to appear legitimate, OmegaPro Forex represents it is incorporated in the UK as OmegaPro LTD.

An MLM company operating or claiming to operate out of the UK is a red flag.

UK incorporation is dirt cheap and effectively unregulated. On top of that the FCA, the UKs top financial regulator, do not actively regulate MLM related securities fraud.

As a result the UK is a favored jurisdiction for scammers looking to incorporate, operate and promote fraudulent companies.

For the purpose of MLM due-diligence, incorporation in the UK or registration with the FCA is meaningless.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

OmegaPro Forexs Products

OmegaPro Forex has no retailable products or services.

Affiliates are only able to market OmegaPro affiliate membership itself.

OmegaPro Forexs Compensation Plan

OmegaPro Forex affiliates invest $50 to $250,000 on the promise of advertised returns, either:

2% a day for 40 days (180%); or

145% after 20 days.

Referral Commissions

OmegaPro Forex pays referral commissions on invested funds via a unilevel compensation structure.

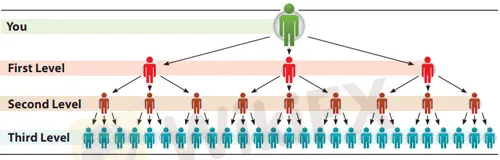

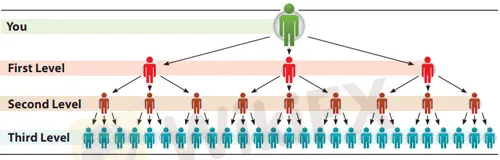

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliates unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

OmegaPro Forex caps standard referral commissions down three unilevel team levels.

Standard referral commissions are paid as a percentage of funds invested across these three levels as follows:

OmegaPro Forex affiliates who qualify as Representatives earn referral commissions across four unilevel team levels:

level 1 – 10%

level 2 – 4%

level 3 – 2%

level 4 – 1%

Note that OmegaPro Forex do not provide Representative qualification criteria.

Joining OmegaPro Forex

OmegaPro Forex affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $50 investment.

OmegaPro Forex solicits investment in dogecoin, bitcoin, litecoin and USD through Payeer and Perfect Money.

OmegaPro Forex Conclusion

Despite its name, OmegaPro Forex represents it generates external revenue via “crypto trading”.

Our Company managed to fully implement the tasks set before it and develop algorithms for successful actions in any situation.

With the help of unique methods of doing business and well-coordinated cooperation of all our employees, we have repeatedly increased our income in a short period of time, which is proved by a positive percentage of active transactions – more than 85%.

No evidence of OmegaPro Forex engaging in trading activity is provided. Nor is there any evidence of OmegaPro Forex using external revenue of any kind to pay affiliate withdrawals.

Not withstanding anyone able to legitimately generate 2% a day would keep it to themselves.

As it stands, the only verifiable source of revenue entering OmegaPro Forex is new investment.

Using new investment to pay returns makes OmegaPro Forex a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve OmegaPro Forex of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.