简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WIKIFX REPORT: Sunton Capital Suspected of Fraud, Profit Can be 50% per Month?

Abstract:Last week, the public was horrified by the Sunton Capital case, which resulted in losses for many traders, particularly in the forex (foreign exchange, foreign currency) market, as a result of alleged fraudulent forex broker investments made using this trading robot platform.

Last week, the public was shocked by the Sunton Capital case which caused many traders, especially forex (foreign exchange, foreign exchange) to suffer losses due to the alleged fraudulent investment of forex brokers carried out through this trading robot platform.

Through various channel communication, such as Telegram accounts, Instagram, and the official website, where the last two channels are currently inactive, Sunton Capital attracts public interest by offering lucrative returns.

The benefits offered to prospective customers vary, ranging from 40%, 50%, to 60% of the invested capital.

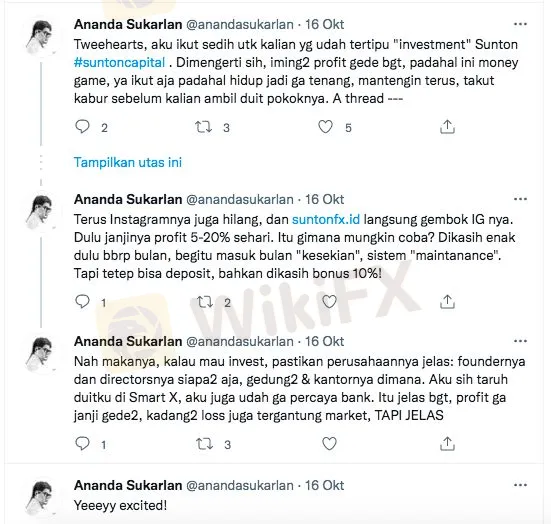

This was revealed starting from the upload of a Twitter user and musician Ananda Sukarlan (@anandasukarlan) who exposed this alleged fraud.

In this post, he expresses his concern for the victims of Sunton Capital. He said the mechanism carried out at Sunton Capital was money games and ponzi.

“So sorry for the victims… Next time we have to know the difference between money games, fake investments and real software or robots. If it‘s real, the profit can’t be that big and its not always profitable,” Ananda tweeted last week.

“Oh, that‘s why, don’t invest in money games or Ponzi. In the end, all the money is 0. Looking for money, you cry,” he added.

He said that initially Sunton Capital offered a fairly large profit, in the range of 5% to 20%.

Then on October 14, 2021, at 21:27 when the trade took place, SuntonFX made a margin call in which the chart was totally manipulated. A margin call is a warning system indicating that the trading account funds are insufficient to open a trading position.

After the margin call occurs, all Sunton Capital services can no longer be accessed. Besides that, his Instagram account is gone, and his website https://suntonfx.id inaccessible.

“So, if you want to invest, make sure the company is clear: who the founders and directors are, where are the buildings & offices,” he explained.

Not long ago, SuntonFXs Instagram account also disappeared. In its announcement on the Facebook page, Sunton Capital Indonesia even stated that from June 1, 2021 to October 14, Sunton Capital Ltd was a scam and was over.

Based on the information circulating, Sunton Capital is a foreign forex broker originating from the UK.

The way SuntonFX works is similar to a broker in general. Before trading, customers are required to make a minimum deposit of US$ 50.

Furthermore, the investment manager will direct the customer to make a sale or purchase transaction based on a predetermined time.

But now, the broker is in trouble and many customers in Indonesia are harmed.

Official site https://suntonfx.id can no longer be accessed, it just says ‘This page is the default page. Please upload your website content.’

Meanwhile, CNBC Indonesia sent a direct message to Instagram suntonfx.id not even replied.

Meanwhile, the Telegram account currently has up to 11,215 members. In this account, apart from being given the lure of high profits, examples of the forms of ‘profits’ offered are also explained.

For example, if you join the basic plan of 2 million. Mopit disbursement every day for up to 1 week:

Day 1 = 800,000

Day 2 = 800,000

Day 3 = 800,000

Day 4 = 800,000

Day 5 = 800,000

Day 6 = 800,000

Day 7 = 800,000 + capital kk 2,000,000.

“So the total in 1 week along with your capital.. 7,600,000 kk 1 week Disbursement: 40% per day from day 1-7 get 800k profit results every day @Sunton_Capital_ID,” wrote the Telegram account.

In response to this, the Investment Alert Task Force (SWI) revealed that Sunton Capitals operations in Indonesia were not licensed.

“Sunton Capitals activities do not have a permit in Indonesia, so they are illegal,” said Tongam L. Tobing, Chairman of SWI to CNBC Indonesia, Monday (18/10/2021).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

My Forex Funds Charts Path for 2025-2026 Revival After Legal Wins

My Forex Funds unveils 2025-2026 roadmap post-CFTC win: asset recovery, data analysis, and team rebuild.

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Amillex Global Secures ASIC Licence for Expansion

Amillex Global gains ASIC AFSL licence, boosting FX and CFDs credibility. Expansion targets Asia, Australia, and institutional trading growth.

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Currency Calculator