Abstract:despite fastest rise in output charges since the survey began in July 1996

Key findings

Embargoed until 0930 BST (0830 UTC) 5 April 2022

News Release

S&P Global / CIPS UK Services PMI®

Source: S&P Global, CIPS.

UK service providers signalled an exceptionally strong

increase in business activity during March and the rate of

expansion accelerated to its fastest for 10 months. Survey

respondents widely noted that the removal of pandemic

restrictions and return to offices had led to a sharp rebound

in customer demand.

However, business expectations for the year ahead dropped

for the second month running and were the lowest since

October 2020. Weaker optimism was mainly linked to the war

in Ukraine and subsequent economic uncertainty. Severe

cost pressures also weighed on confidence and led to a rapid

rise in output charges. The rate of prices charged inflation

was the steepest since the index began in July 1996.

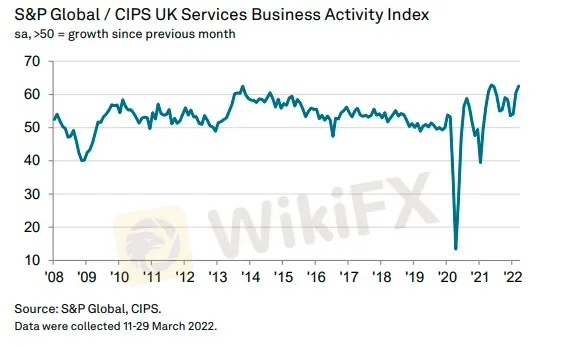

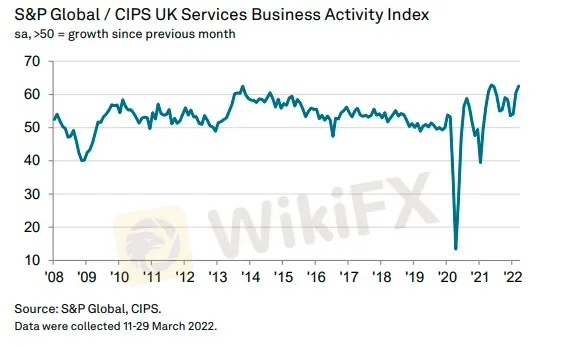

The headline seasonally adjusted S&P Global / CIPS UK

Services PMI® Business Activity Index rose for the third

month running to reach 62.6 in March, up from 60.5 in

February. This highlighted a continued rebound in output

growth from the Omicron-related slowdown seen at the

end of last year. Moreover, the rate of expansion was the

second-strongest since May 1997 (exceeded only by the

post-lockdown recovery in May 2021).

Higher levels of business activity were supported by a strong

rise in new work during March. More than twice as many

survey respondents (31%) reported an increase in new orders

as those that signalled a fall (15%). Businesses operating in

the travel, leisure and entertainment sectors commented on

especially strong demand during the latest survey period.

Greater business requirements and robust long-term

expansion plans fuelled another month of strong job

creation in March. The latest rise in staffing numbers was the

fastest since October 2021. Survey respondents suggested

that tight labour market conditions had made it difficult to

fill vacancies and pushed up starting salaries.

Recruitment difficulties, capacity constraints and worsening

supplier performance all contributed to an increase in

backlogs of work across the service economy in March.

Higher levels of unfinished business have been recorded in

each of the past 13 months, although the latest rise was the

slowest so far in 2022.

An unprecedented 40% of the survey panel reported an

increase in their average prices charged in March, while only

3% signalled a decline. The resulting seasonally adjusted

Prices Charged Index pointed to the strongest rate of

inflation since the survey began in July 1996.

Another rapid rise in output charges was overwhelmingly

linked to higher salary payments and increased prices paid

for energy, fuel and raw materials. Around 65% of the survey

panel reported a rise in their operating expenses in March,

while less than 1% noted a decline. The latest index reading

signalled the second-fastest rate of input cost inflation since

the survey began (exceeded only by the record high seen last

November).

Concerns about the impact of escalating inflationary

pressures on household budgets acted as a brake on growth

expectations across the service sector in March. Survey

respondents also cited uncertainty related to the war in

Ukraine and greater hesitancy among clients. The overall

degree of positive sentiment regarding the business outlook

dropped to its lowest for 17 months.