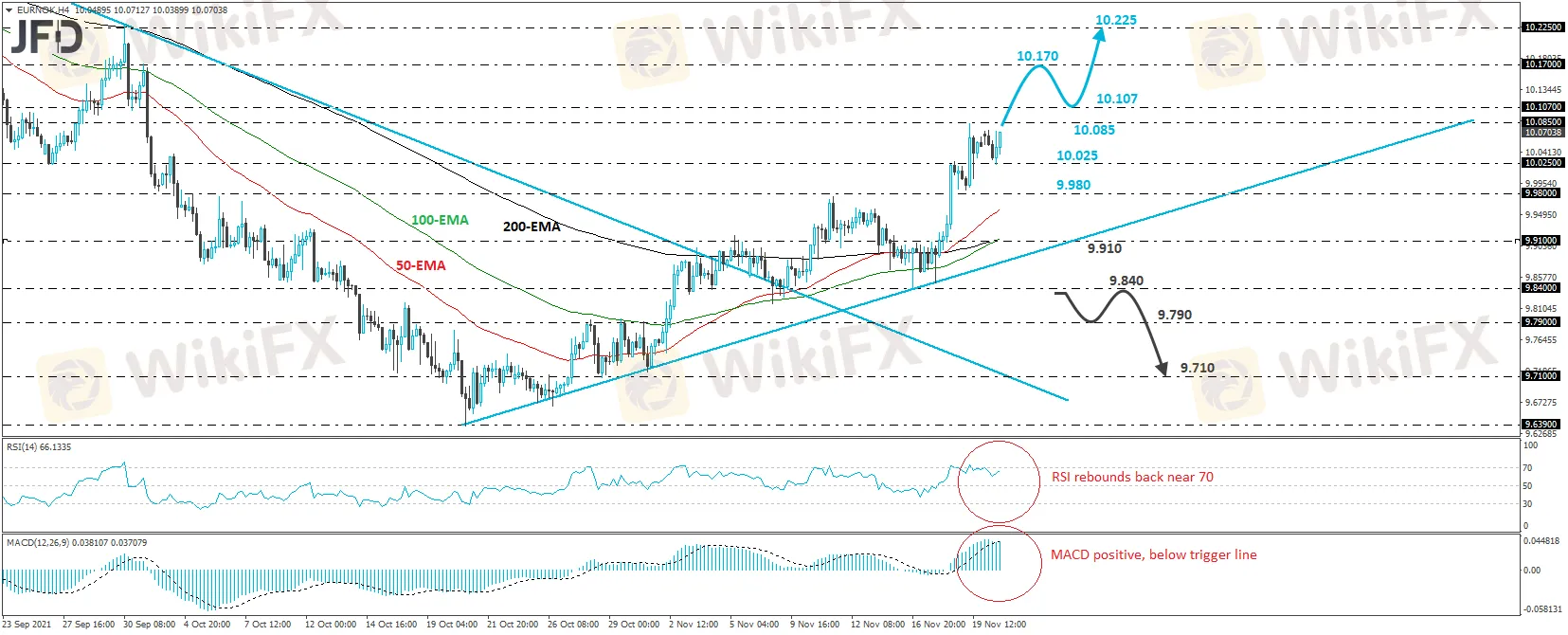

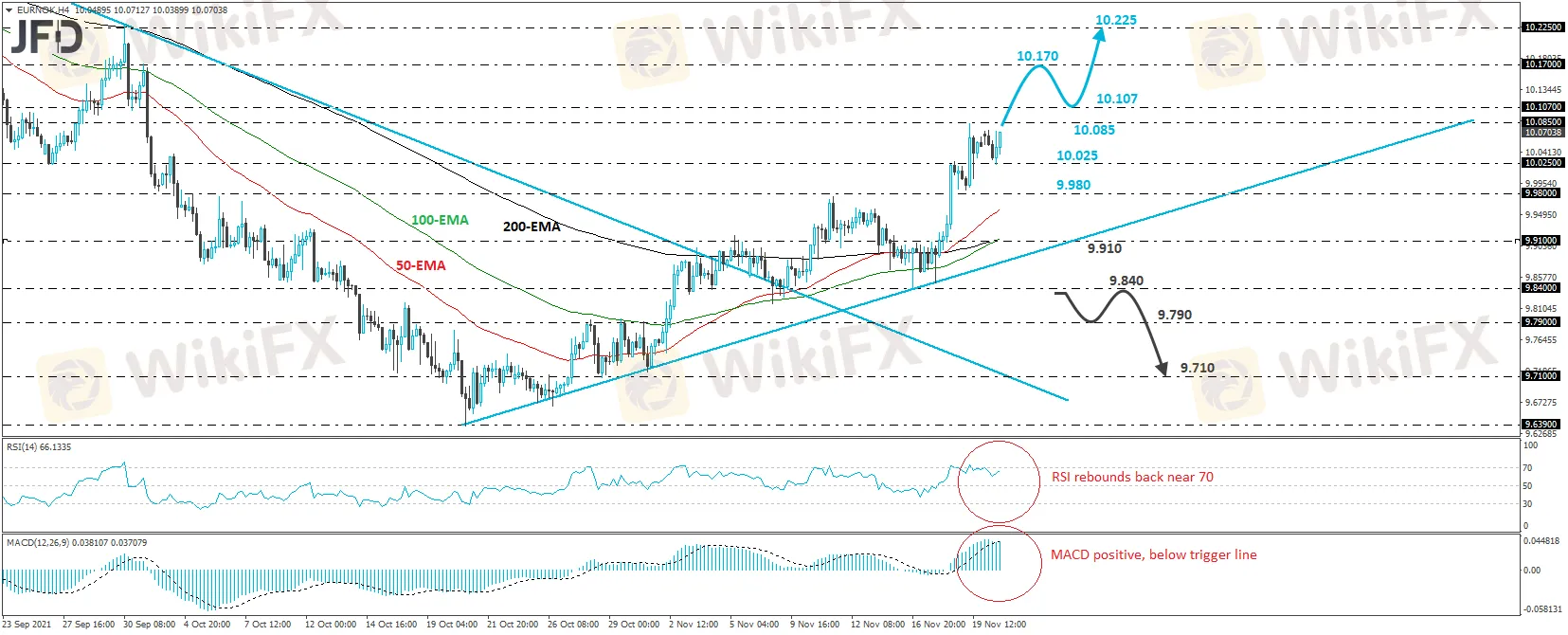

Abstract:As it was observed from the markets analysis that EUR/NOK traded higher on Friday, breaking above the 10.00 zone, and specifically above the resistance (later turned into support) of 10.025, marked by the high of November 18th. Then, the rate hit resistance at 10.085, and pulled back to test the 10.025 zone as a support this time, But before rebounding back again. Above all, the rate remains above the upside support line drawn from the low of October 20th, which combined with the latest rally paint a positive near-term picture.

As it was observed from the markets analysis that EUR/NOK traded higher on Friday, breaking above the 10.00 zone, and specifically above the resistance (later turned into support) of 10.025, marked by the high of November 18th. Then, the rate hit resistance at 10.085, and pulled back to test the 10.025 zone as a support this time, But before rebounding back again. Above all, the rate remains above the upside support line drawn from the low of October 20th, which combined with the latest rally paint a positive near-term picture.

It can be examined further that, advances upon a break above the 10.107 territory, which is defined as a support by the inside swing low of September 30th. This would confirm another higher high and may initially pave the way toward the peak of October 1st, at 10.170. If the bulls are not willing to stop there and eventually break higher, then we could see the trend extending towards the peak of September 30th, at 10.225.

When we Look at the short-term oscillators, we can observe that the RSI, already slightly below 70, has turned up again. It can possibly emerge above 70 again soon. The MACD, on the other side, lies slightly above both its zero and trigger lines, but has turned somewhat down. This is likely to makes us fell somehow serious about the observation to become aware that another setback may likely happen before the next leg north.

For us to start examining as whether the bears have gained the upper hand, or not we would first expect to see a dip below 9.840. This will also confirm the break below the upside support line taken from the low of October 20th, and may initially target the 9.790 zone, which provided resistance between October 28th and November 1st. But If that barrier fails to hold each, then a declines towards the 9.710 territory may likely to occur, the position is marked as a support by the low of October 28th. The structure or the pattern of the Paira can be observed below to compare the analysis.