Abstract:Although WTI recently suffered a sharp loss to $39.57 amid the increase of oil production in Libya and the outbreaks in Europe and America, it may gain strength later from the deeper oil output cuts of OPEC+ and the U.S. presidential election.

WikiFX News (26 Oct.) -Although WTI recently suffered a sharp loss to $39.57 amid the increase of oil production in Libya and the outbreaks in Europe and America, it may gain strength later from the deeper oil output cuts of OPEC+ and the U.S. presidential election.

It is reported that Libya's oil production will rise above 1 million barrels a day in the next four weeks, and its crude exports will increase in the future. Besides, the second wave of the pandemic across Europe and America is worse than expected, which has further hindered the recovery in global oil demand. According to a report from the International Energy Agency (IEA), a full rebound in world energy demand will be delayed to 2025.

With that said, however, oil prices can hardly fall over the long run. OPEC+ sources show that OPEC+ compliance with agreed oil cuts in September was seen at 102%, indicating members' resolve to stabilize oil prices remains firm.

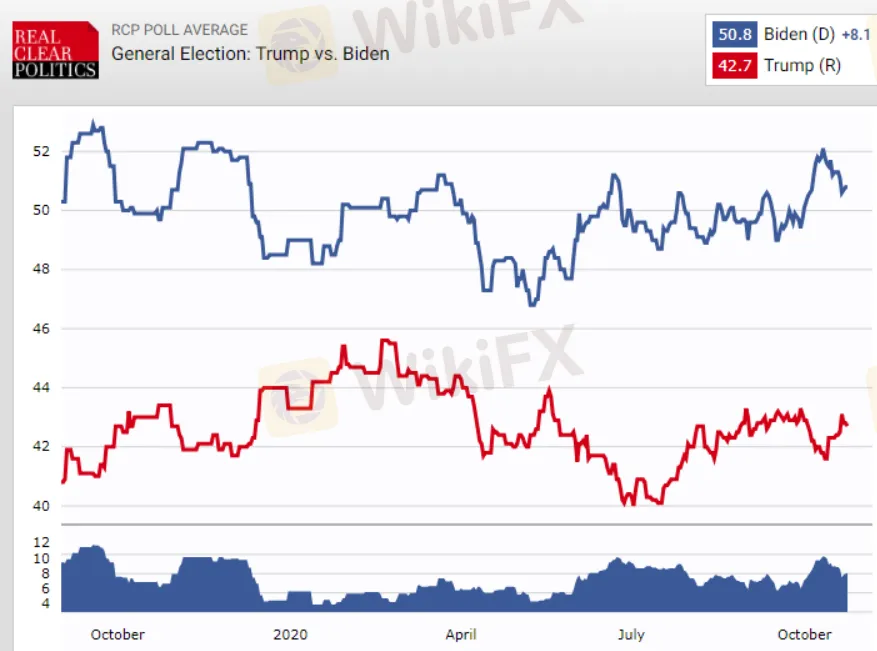

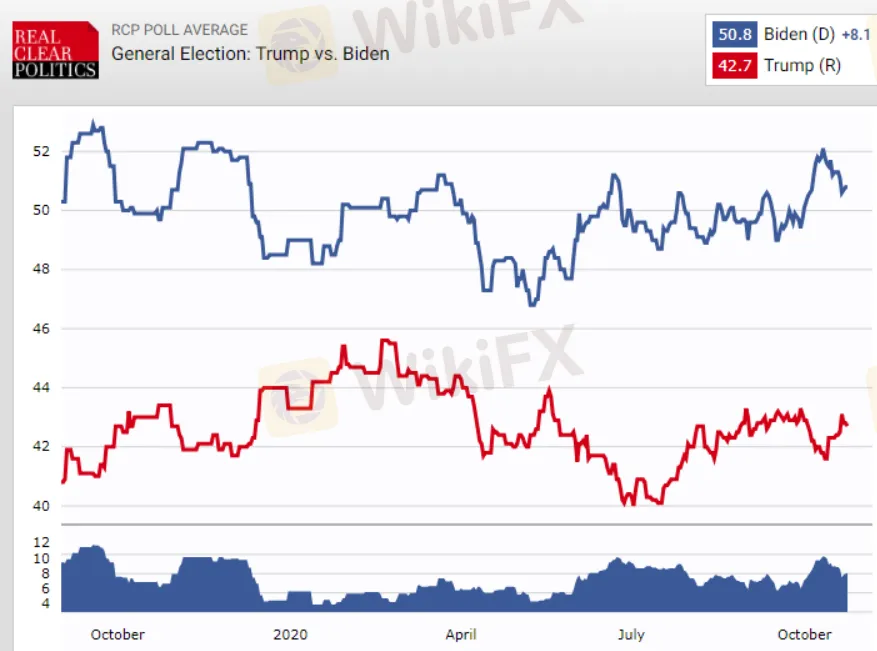

In addition, Biden said in the third debate that he would eliminate federal subsidies for the oil industry. With Election Day approaching, more U.S. oil producers will exit the market if that happened, which will boost oil prices.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Approval rating of Biden vs. Trump