Abstract:The US dollar is on the backfoot after last night‘s dovish FOMC pulled the rug from under the greenback. Coming up, the Bank of England’s latest policy decision will be confined by ongoing Brexit chaos.

Market Themes and Movers – FOMC, BoE Decision, Euro, JPY and NOK in Favour

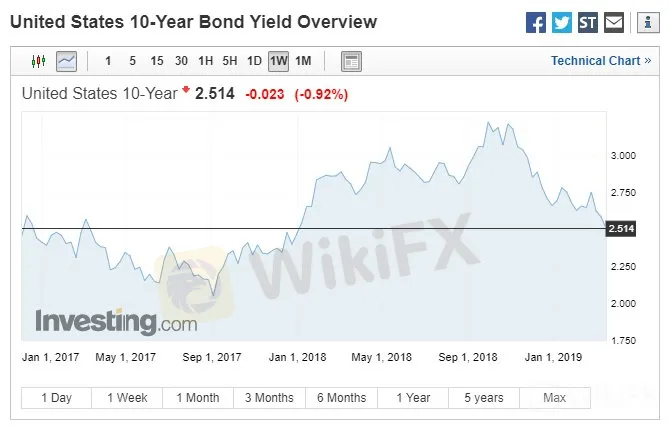

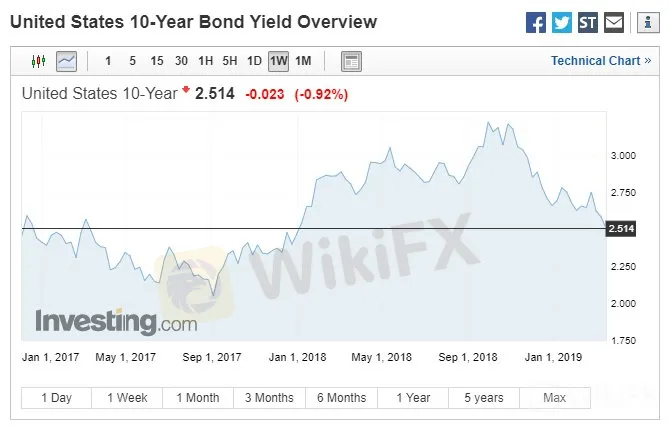

USD: Wednesdays FOMC meeting revealed a dovish US central bank with further interest rate hikes in 2019 now looking very unlikely. The Fed hinted at a 0.25% hike in 2020 but markets are now pricing-in a cut in rates in 2020 as growth concerns continue. The central bank also reigned in its bond normalization program with sales expected to stop by the end of September, three months earlier than had been expected by some market commentators. US Treasury yields fell to multi-month lows, dragging the US dollar down.

GBP: The Bank of England is fully expected to leave all monetary policy settings unchangedat today‘s MPC meeting as Brexit continues to cloud the UK’s economic outlook. Recent jobs, wages and retail sales data has beaten market expectations and highlights a growing divergence between robust employment and weak economic growth. The Bank of England will need to tread carefully once/if Brexit is resolved.

EUR/JPY/NOK: Both the Euro and the Japanese Yen reacted positively to the outcome of the FOMC meeting and pushed ahead against the US dollar. While gains may be limited in the short-term, both may continue to find favour going forward and press through recent resistance levels. The Norges Bank raised interest rates by 0.25% to 1.0% today, as expected, and signalled another hike in H2 this year, boosting the value of the Norwegian Krone further.

Chart of the Day – Multi-Month Low 10-Yr US Treasury Yield

DailyFX Economic Calendar: For updated and timely economic releases.

{6}

How to use IG Client Sentiment to Improve Your Trading

{6}

Retail sentiment is an important tool for any trader to help gauge market sentiment and positioning. We provide updated daily and weekly positional changes on a wide range of currencies and asset classes to help decision making.

Market Movers with Updated News and Analysis:

S&P Backing into Support, Dow Jones and Nasdaq 100 Chart Outlook.

EURUSD Price Hitting Resistance But Sentiment Remains Bullish.

Yen May Rise as Dovish SNB, BoE Add to Global Slowdown Fears.

{12}

US Dollar Dives After March FOMC Meeting Reveals Dovish Fed.

{12}

Gold Price Forecast Brightens Amid Drop in US Treasury Yields.

--- Written by Nick Cawley, Market Analyst

To contact Nick, email him at Nicholas.Cawley@ig.com

Follow Nick on Twitter @nickcawley1