简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

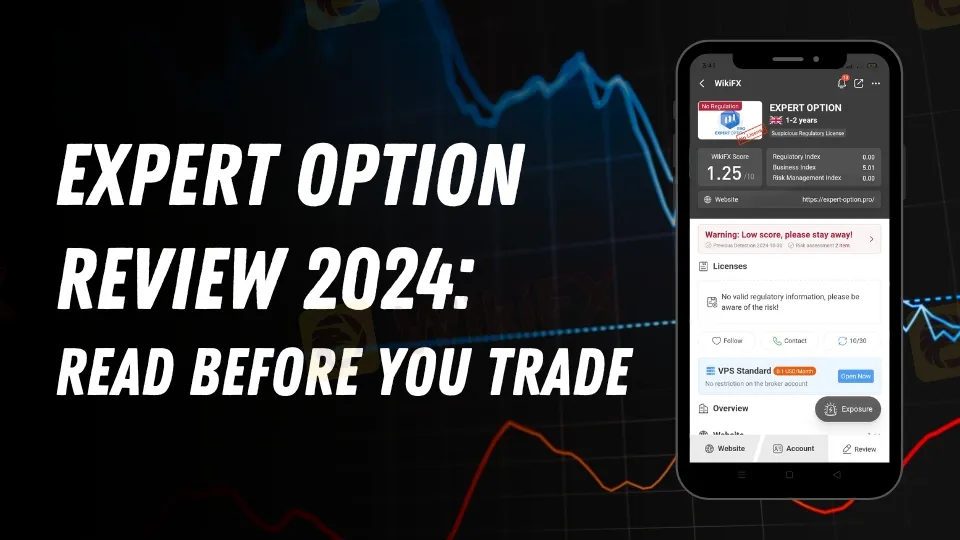

EXPERT OPTION Review 2024: Read Before You Trade

Abstract:EXPERT OPTION is unregulated with an inaccessible website and a 1.25/10 WikiFX rating. Verify brokers using WikiFX to avoid trading risks and unlicensed platforms.

Overview

EXPERT OPTION, a broker previously operating out of the United Kingdom, is currently identified as unregulated and unlicensed. According to the available information, the company lacks any official authorization from recognized financial regulatory bodies. The absence of proper regulation should be a significant concern for traders, as it indicates a lack of oversight and accountability in the brokers operations. This raises critical questions about the safety and security of funds invested through this platform.

Website Status

The official website of EXPERT OPTION, https://expert-option.pro/, is now listed as inaccessible or expired, which further complicates attempts to gather up-to-date information about their services or to communicate with the company. A non-functional website typically signals major issues within the company, including potential closure, operational halts, or severe mismanagement. For traders, this status suggests that any attempt to access the platform or retrieve funds could be impossible.

Regulation and Security Concerns

Operating without regulatory approval, EXPERT OPTION holds no licenses from major regulatory authorities such as the UKs Financial Conduct Authority (FCA) or other globally recognized financial watchdogs. This lack of oversight places traders at high risk, as the broker is not held to any legal standards or obligations to safeguard clients' funds. In the world of online trading, dealing with an unregulated broker means clients have minimal to no recourse in case of disputes, fraud, or mismanagement.

WikiFX Rating

WikiFX, a platform designed to evaluate and verify brokers‘ regulatory status and credibility, has given EXPERT OPTION a score of 1.25/10. This rating is one of the lowest possible, reflecting the platform’s serious shortcomings. WikiFX uses a combination of regulatory information, user feedback, and operational data to calculate its ratings, and the score given to EXPERT OPTION suggests significant concerns in areas such as transparency, trustworthiness, and financial stability.

Importance of Verification Through WikiFX

Before engaging with any broker, traders are encouraged to utilize WikiFX or similar tools to verify the legitimacy and regulatory status of the platform. WikiFX serves as a valuable resource for identifying unlicensed brokers and evaluating the credibility of trading platforms based on real-time data. By checking with WikiFX, potential traders can avoid unregulated brokers like EXPERT OPTION, whose operations lack the necessary oversight to ensure the protection of client funds and adherence to industry standards.

Conclusion

With an inaccessible website, a lack of regulation, and a low WikiFX rating of 1.25/10, EXPERT OPTION poses significant risks for potential traders. The combination of these factors suggests that the broker may no longer be operational or trustworthy. As always, verifying a brokers credentials and regulatory status through tools like WikiFX is an essential step before committing any funds to online trading platforms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator