简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

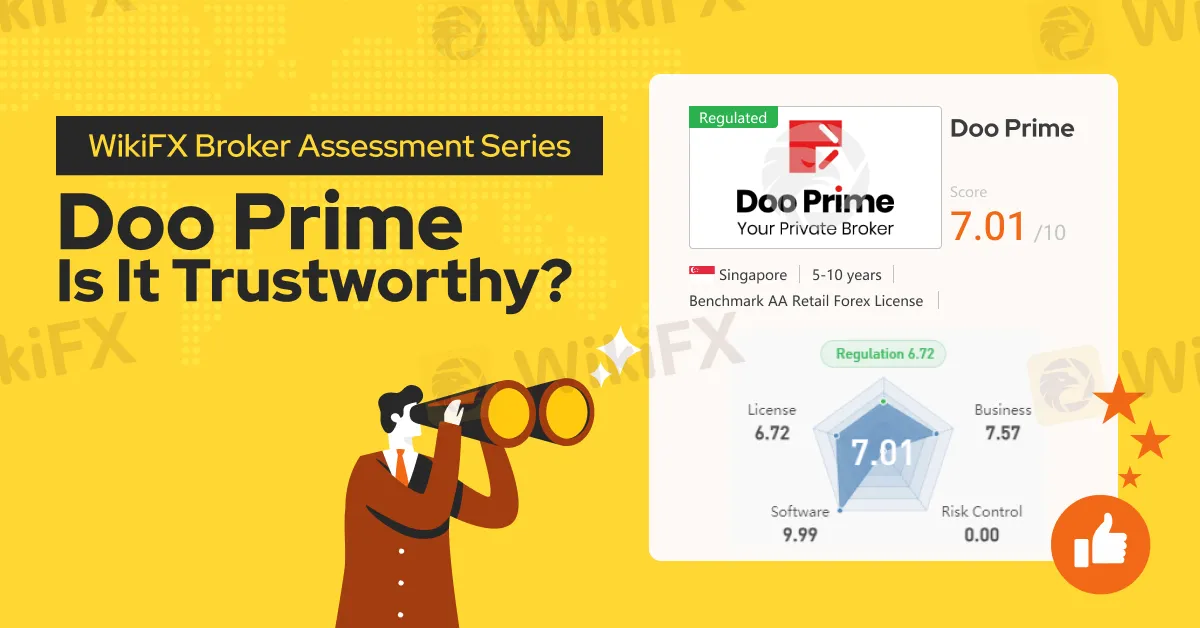

WikiFX Broker Assessment Series | Doo Prime: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Doo Prime, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Doo Prime operates as an online brokerage specializing in the trading of CFDs, distinguishing itself with competitive spreads as low as 0.0 pips.

Doo Prime provides a diverse range of over 10,000 tradable assets, covering currency pairs, securities, futures, commodities, metals, and global indices.

Doo Prime also provides a social trading platform called Doo Prime CopyTrading, a community-driven service that allows users to engage in copy trading with flexible profit-sharing options. Additionally, they offer a second copy-trading service called FOLLOWME, which enables traders to enhance their expertise through a social trading experience.

Meanwhile, Doo Prime features an introducing broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the company.

It is important to note that, at present, Doo Prime does not extend its services to Afghanistan, Canada, Congo (Kinshasa), Cuba, Cyprus, Hong Kong, Indonesia, Iran, Malaysia, North Korea, Singapore, Sudan, Syria, United Arab Emirates, United States and Yemen

Types of Accounts:

Doo Prime offers three account options: the Cent Account, the STP Account, and the ECN Account.

Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Doo Prime provides various payment options, including international wire transfer, local bank transfer (ePay, FasaPay, HWGC), electronic wallets, and credit cards (Visa, Mastercard, UnionPay, Amex, Google Pay, Apple Pay). The processing time for funds to be reflected in the account depends on the selected withdrawal method.

Trading Platforms:

Doo Prime provides three trading platforms:

- The MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 offers a pioneering trading system that seamlessly integrates and executes various market orders, including pending orders, stop orders, and trailing stops. It also provides powerful analysis tools, allowing traders to assess price volatility and strategize effectively with access to nearly 3,000 indicators, 24 analytical objects, and customizable dynamic charts. Additionally, the platform ensures a swift trading experience through automated trading and minimal execution delays, supported by Doo Prime MT4s dedicated VPS trading server.

- The MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, provides access to a depth of market and various advanced solutions. MetaTrader 5 is a cutting-edge trading platform that enables users to trade a wide range of products across multiple markets, offering powerful tools and efficient functionalities. Its comprehensive trading system allows for seamless execution of trades through a single account that supports all order types and execution modes. The platform also features specialized chart analysis, with the ability to create custom indicators or utilize up to 80 technical indicators and analysis tools across 21 timeframes, alongside access to over 100 charts to track trends across different markets. MT5 offers advanced technical analysis, incorporating 38 technical indicators, 44 graphical objects, and comprehensive market analysis to forecast price trends. With built-in fundamental analysis tools, traders can stay informed with real-time financial news, an economic calendar, and live quotes. Additionally, customizable trading alerts allow users to set specific conditions for notifications, ensuring they are always aware of critical trading events via email or mobile notifications.

- Doo Prime In Trade Mobile is a comprehensive mobile trading application designed to offer users real-time access to their account information, track market trends, and seize investment opportunities on the go. With a single click, users can manage all their accounts through this full-featured, cloud-based trading platform. The app provides a global market view by integrating authoritative news from various sectors, including securities, currencies, and futures, offering users a quick snapshot of market dynamics. It also features real-time price updates, allowing seamless monitoring of preferred currency pairs. The user-friendly interface ensures easy navigation for viewing account details or executing trades, making it accessible to both novice and experienced traders.

Research and Education:

Despite the absence of free educational and research resources, Doo Prime offers access to Trading Central, a renowned financial technical analysis provider. This service integrates a specialized TC technical indicator plug-in, giving traders access to a powerful toolset. Among its key features is Analyst Views, which delivers the latest professional market analysis, helping traders validate their decisions by providing various benchmarks and strategies through real-time charts. While some might see the lack of complimentary resources as a drawback, the inclusion of such advanced analytical tools ensures traders have access to high-quality insights for informed decision-making.

Customer Service:

Doo Prime offers 24/7 customer service support in multiple languages, including English, Chinese, Korean, Spanish, and more. Clients can contact Doo Prime via email at en.support@dooprime.com or by submitting an inquiry through the broker's online question form. Additionally, trading clients have the option to reach Doo Prime by phone using the numbers provided in the image below.

Conclusion:

To summarize, here's WikiFX's final verdict:

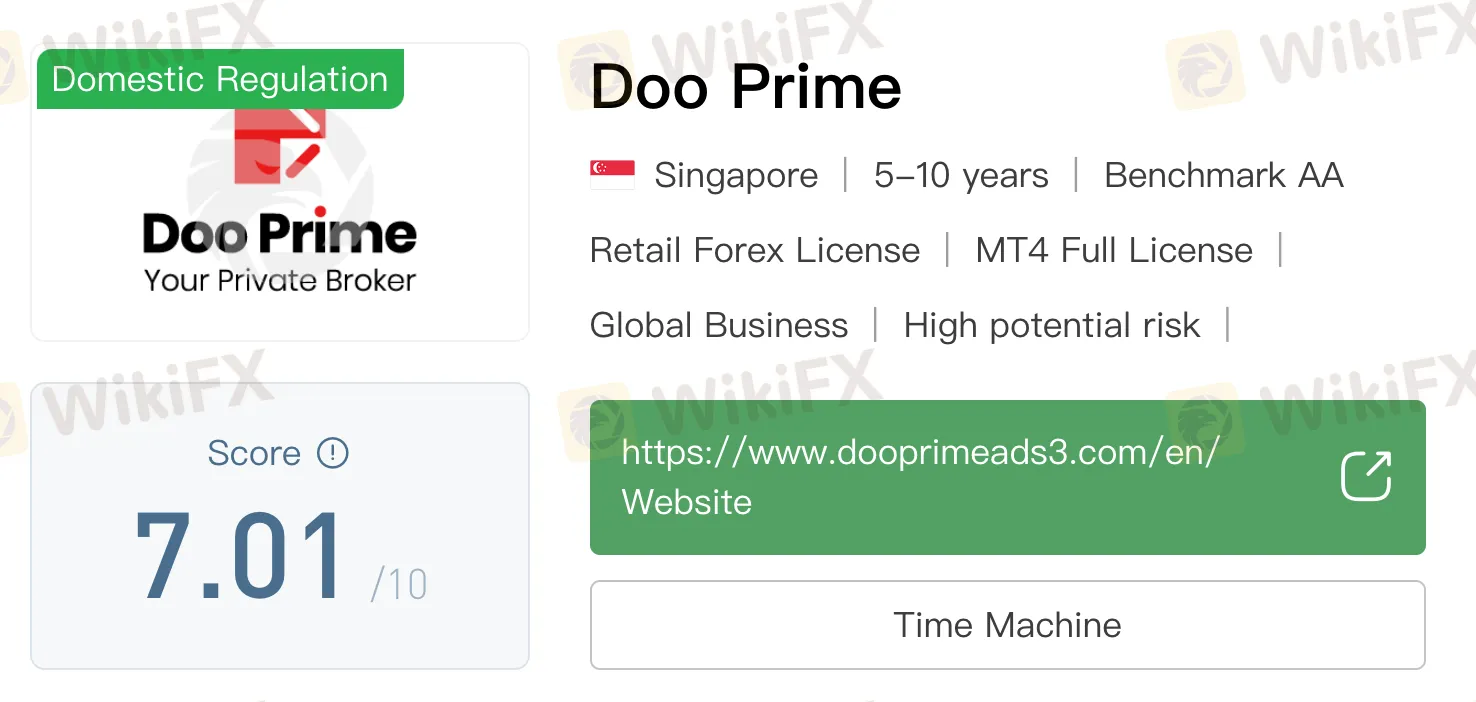

WikiFX, a global forex broker regulatory platform, has assigned Doo Prime a WikiScore of 7.01 out of 10.

Doo Prime is regulated by multiple reputable financial authorities, as confirmed by WikiFX. These include the Seychelles Financial Services Authority, Malaysia's Labuan Financial Services Authority, the United States' Financial Industry Regulatory Authority (FINRA), the Vanuatu Financial Services Commission, and the Australian Securities and Investments Commission (ASIC). WikiFX has further validated the legitimacy of these licenses, ensuring that Doo Prime operates within the regulatory frameworks of these jurisdictions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator