简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

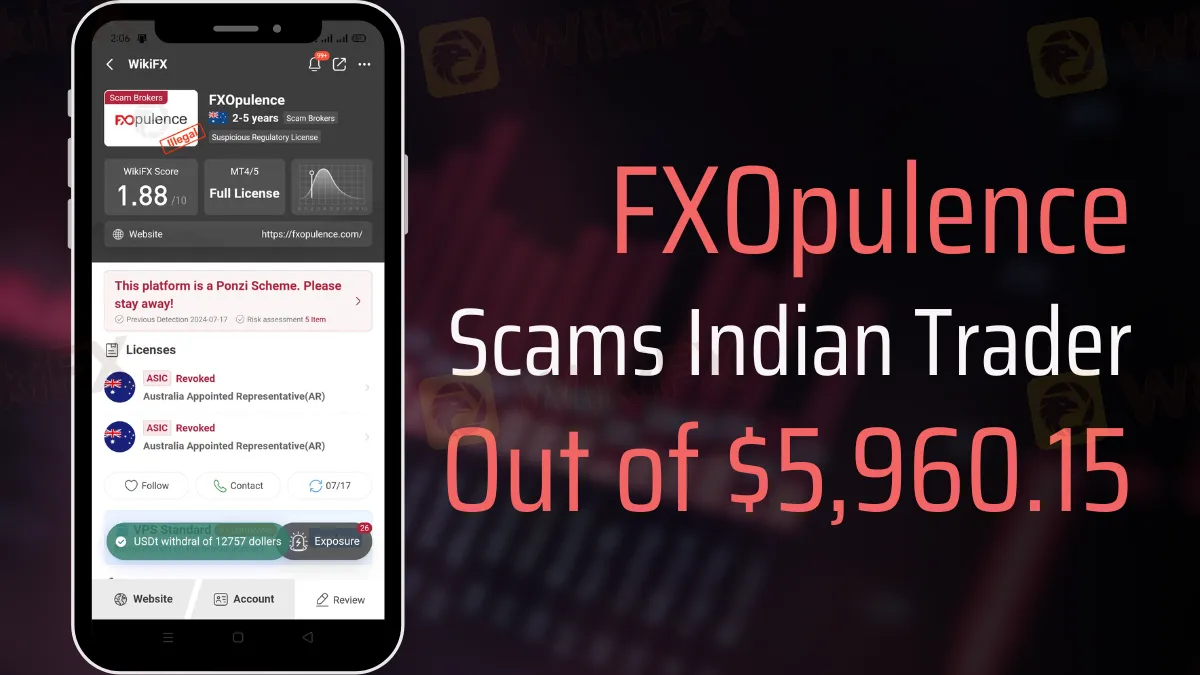

FXOpulence Scams Indian Trader Out of $5,960.15

Abstract:Indian trader lose $5,960.15 to FXOpulence after being unable to withdraw funds. Learn how to avoid such scams and protect your investments.

In a distressing turn of events, Indian traders have become victims of an unscrupulous broker, FXOpulence. Despite their best efforts, these traders faced significant financial losses when attempting to withdraw funds from their FXOpulence accounts. This article delves into the details of the scam, providing insights into the shared experiences of the victims and offering guidance on avoiding similar pitfalls.

Case Study: A Trader's Nightmare

One Indian trader, who prefers to remain anonymous, reported losing 5,960.15 USD after FXOpulence denied his withdrawal request. The trader expressed his frustration, stating, “I cannot withdraw my money from FXOpulence. Please do what is needed.” Despite repeated attempts, the trader could not retrieve his funds, highlighting the deceitful practices of FXOpulence.

Unfortunately, this trader is not alone. Another Indian national fell victim to the same scam, losing 5,834.75 USD. These cases underscore the significant risk posed by unregulated brokers like FXOpulence.

Read the article case below:

Avoiding Scammers Like FXOpulence

Protecting oneself from such fraudulent brokers requires constant vigilance and the right tools. Here are some essential tips and features from WikiFX to help traders safeguard their investments:

- Verify Regulatory Status: Always check a broker's regulatory status before investing. WikiFX provides detailed information on brokers' regulatory compliance.

- Read User Reviews: Look for user feedback and reviews on platforms like WikiFX to gauge a broker's credibility and reliability.

- Check Broker Ratings: Use WikiFX's rating system to assess a broker's overall trustworthiness based on various criteria.

- Stay Informed: Keep up-to-date with the latest news and alerts about broker scams and fraudulent activities through WikiFX's news section.

- Use Trusted Platforms: Only trade with well-regulated brokers with a proven track record of ethical practices.

Conclusion

The cases of the Indian traders scammed by FXOpulence are a stark reminder of the dangers posed by unregulated brokers. By leveraging the tools and resources provided by WikiFX, traders can make informed decisions and protect their investments from similar fraudulent activities. Always prioritize safety and due diligence to ensure a secure trading experience.

Avoid falling victim to brokers like FXOpulence. Check reviews and regulatory status now. Visit FXOpulence's page on WikiFX for details.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Rupee gains against Euro

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator