Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:With whom are you trading? Is the forex broker a reputable business? Can you put your faith in it?

With whom are you trading?

Is the forex broker a reputable business? Can you put your faith in it?

You will not know who you are negotiating with, unlike Batman in the last session scenario. Even if you did, that doesn't mean you should put your faith in them blindly.

Do not put your faith in Spider-Man. He made off with my money. If you don't want to see his future film, that's fine.

Even though it started out as a pleasant bet between Batman and Spider-Man to predict where the GBP/USD would go, it didn't end up that way. Batman was eventually fooled by a fellow superhero who pretended to be a “nice person.”

If you're unfamiliar with the narrative above, it's because you haven't read Batman and Spider-earlier Man's lecture on How Forex Brokers (Kinda) Work.

It is highly recommended that you study this lesson first.

Brokers of Foreign Exchange

You'll need a trading account with a supplier of online foreign exchange (FX) or CFD trading services, otherwise called a retail “forex brokers” or “CFD providers,” to trade forex.

You must deposit money into your trading account when you open one with this company in order to trade.

Are you certain that this broker is trustworthy?

Unfortunately, not all brokers are trustworthy and honest.

Lack of transparency and ambiguous regulatory structures with insufficient control are major issues in the retail FX trading business.

The forex market is less regulated than other financial markets because to its decentralized and global structure, which makes it more vulnerable to fraud.

Since the early 2000s, forex trading has grown even more accessible and popular among retail traders all over the world, thanks to the advent of internet-based trading platforms.

This influx of new traders (“fresh meat”) opens the door for dodgy brokers to engage in questionable practices some of which are tricky schemes, order manipulation, refusal to pay out for victories, and blocking account holders from withdrawing funds.

Many forex brokers were formerly unregulated, meaning they did not operate under the supervision of a governing body whose job it was to safeguard traders from being fleeced. So, if you've been duped, there's no way to get justice.

Your funds have been expended.

Fast forward to now, and while the retail forex industry is gradually becoming more regulated, dodgy brokers continue to operate.

As a result, the first most impotant step is to ensure that the forex broker you choose is legitimate.

When it comes to trading forex, it's critical to find reliable brokers and avoid those who aren't.

You don't want to join the group of unfavorable individual traders who have fallen victim to a forex scam.

Before depositing a large amount of money with a broker, do your study to distinguish trustworthy brokers from dishonest ones.

As a beginner trader, your first necessary decision will be which forex broker to use.

Why?

Because you're going to give this corporation money!

So the first thing you should check, especially before making your first trade, is if you'll be able to withdraw your funds once you've transferred them to the broker.

You may believe that once your funds are in your trading account, you would be able to trade with them and then withdraw them anytime you want to cash out your earnings.

But don't take my word for it! VERIFY!

Never take anything for granted, and always double-check.

It doesn't matter if you're the best trader in the world; if your broker disappears with your money, it doesn't matter.

You'd just end up becoming the world's most fantastic broke dealer.

If you want to stay awesome while staying out of debt, study the following questions before choosing a broker.

Is this an authentic business?

Is the forex broker an authentic business?

Don't let a well-designed website fool you.

Check to see if the website belongs to a legitimate, legally incorporated company.

Here are some things to look for to make sure they're a legitimate business:

· What is the company's official name?

· Where is it registered to do business and incorporated?

· What is the company's history?

· Is the company's information on Google?

· Has the company been the subject of any recent news releases or articles?

What is its location?

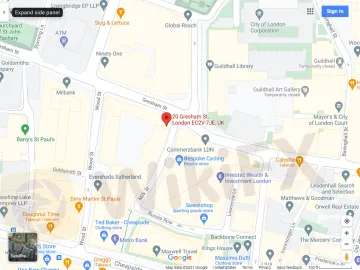

Is there a physical address for the company?

Don't be fooled by their website's given address.

Check to see if the address is for a real office.

Using Google Maps is a simple approach to see if the office is actually an office.

See what comes up when you type the address into Google Maps.

It is advisable to use Google Earth to get a better perspective of the office.

See what comes up when you type the address into Google Earth.

Zoom in close enough to see the structure they're in. Is this a real office structure? Or does it look suspicious?

Are you sure you want to send over your money to this broker if it looks like the skyscraper above?

If you don't see a building and instead see a warehouse on a tiny tropical island or, even worse, an empty plot of land, you should probably avoid this company.

Who is in charge of the business?

Do you know who is in charge of the company? Is it a “ghost corporation” with no active employees, or is it something else entirely?

Who are the company's founders and owners?

A principal is someone who owns a major portion of a firm or has a formal title and authority over the company's operations.

Principals could include the firm's founder (or co-founders), President, CEO, COO, CFO, other C-level executives, or anyone who owns 10% or more of the company.

Distance yourself from companies that are “ownership-opaque,” meaning their real owners and/or company officers aren't revealed.

This lack of transparency could be attributed to the fact that it's a criminal organization whose members want anonymity.

If you're entrusting your money to a company, you should get to know the people who run it.

You'll know who to hold accountable if something goes wrong.

Is it possible for you to get in touch with the company?

Is there a variety of ways to contact the company?

You want to know that your broker will be there for you if you have a question or an issue.

· Is there a phone number on it?

· Is there an email address for it?

· Is there a live online chat option?

· What are the hours of operation for customer service?

It's not enough for them to list all three on their website. Just because it appears that you can contact the broker in a variety of methods doesn't mean it is accurate. Check to make sure they all work and aren't simply for show.

Is there someone who answers the phone quickly?

How long does it take for a response? (Automatic responses are not counted.)

Is it effective? Or are you simply required to fill out a form to send a message?

⌚What are the hours of operation for their customer service? Is their customer service team available around the clock, five days a week?

You can also open a demo account to see how wonderful their customer service is. Send them a query using their support tool once you've logged in to their demo trading platform.

They should be responsive because you're a possible new customer who might open a live account. If not, you should be concerned about their customer service once you've become a customer.

A good broker should have a dedicated customer service team that can respond to your inquiries. Because an email response can take days in a live trading situation, phone access or live web chat is required.

At the end of the day, you want to know that the broker will be available to you when you require assistance.

Is your cash secure?

Do not open a live or “real money” account without first understanding how your cash will be handled.

You should ask yourself the following questions:

· What bank do you use to keep track of your customers' money?

· Is there a separate bank account for consumer funds from the company's bank account?

A credible bank should be used by the forex broker. Inquire about the companies they work with. Would you put your money in the hands of an unknown bank?

Make sure a forex broker employs separate accounts before you put any money.

A segregated account is a bank account that keeps all of its clients' money separate from the company's funds.

This means that your funds are kept distinct from those of the broker.

The fundamental purpose of segregated accounts is to prevent the broker from utilizing YOUR cash for anything other than trading.

Customers' funds will be accessible to be used for operational expenditures if a forex broker does not segregate accounts. Perhaps a (or two) exotic sports car for the CEO?

Alternatively, it might simply spend all submitted monies to purchase a large amount of bitcoin and then vanish.

Shady brokers have in the past misused their customers' funds for their personal gain, placing this money at undue risk.

You don't want your broker to spend your funds in the wrong way. A separate account safeguards your funds against dishonest and unscrupulous broker behavior.

It also ensures that customer monies are quickly recognized if a broker goes bankrupt. In the event that the forex broker goes bankrupt, your money is not at risk.

Regulations vary by region, but generally speaking, segregated accounts cannot be used to pay creditors, and customer cash must be returned to them.

Consider how a broker's money and its customers' money are intertwined. Companies that your broker owes money to potentially come after your money if this is the case!

Customers' funds will be easily identified and repaid in the event of bankruptcy if they are held in segregated accounts.

Customers' money is kept separate from a broker's money in segregated accounts. Do not deposit money with a broker who does not employ segregated funds.

Summary

You must engage the services of a retail forex broker in order to trade forex. And, because you'll be depositing your hard-earned cash, you should do your due diligence and ensure that the company is legitimate.

Let's go over the questions you should think about:

· Is this business real?

· What is its location?

· Who is in charge of the business?

· Is it possible for you to get in touch with the company?

Is your money in safe hands?

There is one final question that you should think about.

Is the forex broker regulated and licensed?

This is such an essential subject that it warrants its own lesson.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.