简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Are the Functions of Forex Brokers?

Abstract:What is the order execution quality of your FX broker?

Let's look at how forex brokers work via the lens of a story....

Once upon a time, Batman and Spider-Man, two archrivals, were hanging out.

They were lazing on the couch watching Justice League (Snyder's Cut), but their attention span began to wane after a few hours.

Even Batman became irritated as he watched his character onscreen snarl in a low, deep voice owing to his resentment at not having innate superpowers like the others.

Spider-Man suddenly sprung to his feet and exclaimed, “Yo Bruce!”

I'm known as Batman!

What the hell, Bruce. Anyway, I've got a great idea!

Oooh! I enjoy having a good time! What exactly is it?

Let's play a game of guessing whether something's price will rise or fall.

Is this a guessing game? You spiders are quite astute.

I'm not a spider, dude. After being bitten by a radioactive spider, I've recently developed spider-like skills. There's a distinction to be made. I'm not a spider just because I'm dressed in a spandex costume with a spider insignia on it.

Sure, whatever you want. Still, my Batsuit is superior. It draws attention to my nipples and my perfectly chiseled abs. In any case, I'm intrigued. I'm not only affluent, but also clever.

This is how the game works: Try to predict whether the GBP/USD exchange rate will rise or fall. Let's pretend the exchange rate is currently 1.4000. Do you believe it will rise or fall?

My predictions are always correct. Please elaborate on the game's specifics.

Batman isn't fond of spiders. He unlocks his Batphone and uses Google to check the current GBP/USD conversion rate, which is 1.4000. He wants to be sure Spider-Man isn't simply pulling figures from his spider butt.

I believe it will rise.

Is that true? So, let's place a wager.

What kind of wager are you making? How is it going to work?

If the price of GBP/USD rises, I'll pay YOU the difference between where it is now and where it is when you decide to settle the bet. However, if the GBP/USD exchange rate falls, you will be responsible for the difference. The payments will be made in cash. Additionally, you have the option to close the bet at any time. So, what are your thoughts?

Let's get started! That's a wager I'll take.

At 1.4000, Batman is long 1 unit of GBP/USD. This translates to $0.0001 for a 1 pip move.

One hour later, Spider-Man informs Batman that the GBP/USD exchange rate has climbed to 1.4100. It has increased by 100 pips.

The exchange rate has increased by 0.01 or 100 pips, Dark Knight.

When Batman checks his Batphone, he notices that the GBP/USD exchange rate has climbed to 1.4100.

I'm not sure how much longer this price will last. I'm leaving. Let's call it a day.

GBP/USD was at $1.4000 when the bet began. GBP/USD was at $1.41000 at the end of the bet. The difference is therefore $0.01 or one cent.

Oh, for God's sake. On the currency market, my “spidey sense” doesn't appear to operate. It appears that I was defeated. Your winnings are $0.01. Don't blow it all in one go.

Spider-Man tosses a coin to Batman.

After some hungry thoughts, Batman gratefully receives the money and remarks,

“All I made was $0.01 profit.” A spider might be satisfied with such a small profit, but a bat is not. I could have gained a lot more money and grown even wealthier if I had just placed a greater bet.

Let's make the same wager, Mr. Spoiled Bratman. But this time, instead of investing 1 GBP/USD unit, let's gamble 10,000 GBP/USD units!

But I'm not lugging around £10,000 in cash! My Batsuit is too small for me. It's like putting on a pair of black thin jeans that completely covers my lovely figure.

Oh. And here I was thinking you were well-off. How much cash do you have on hand?

Batman takes a look through his Batwallet.

I have $20 in my pocket. With the exception of the penny I just earned from you.

Batsy, no problem. Let's imagine I've given you the entire amount as a loan. You'll earn $1 for every 1-pip move this way. This means that if GBP/USD rises 100 pips again, you'll make $100 instead of $0.01!

Because I don't trust men in tight black suits with capes, I'll use your $20 as collateral to cover the initial risk if the price drops and moves against you.

Consider it a security deposit. You'll get your money back if you win the wager.

Instead of paying up, you can opt to get in your Batmobile and leave if the GBP/USD starts to decline.

Also, if the price falls more than 20 pips, you won't have enough money to pay any additional losses, therefore I'll close the bet and keep your $20.

The bet remains active until you tell me to close it, as long as the price does not fall below 20 pips, which is the value of your collateral ($20).

Okay. That sounds promising. What about you, though? Are you certain you'll be able to pay this time if I win?I don't want to be caught off guard, so holding your $20 as collateral will keep me safe. Your $20 will be forfeited to me if you try to leave without paying.

Spider-Man gives a menacing grin.

Yes, of course. I'm a member of the Avenger team. You can rely on me.

Fine.

Fantastic. Let's get started!

The current GBP/USD exchange rate is 1.41000, according to Batman's Batphone.

I believe it will rise from its present price of 1.4100. To start the bet, I'll put down $20.

Spider-Man senses that the GBP/USD exchange rate will continue to rise, so he stalls by pretending not to hear Batman.

Hello? Did you hear what I said? Spiders, unlike snakes, are not deaf. To start the bet, I'll put down $20.

What was it again? So you want to place a wager? My GBP/USD exchange rate has changed. It's now at 1.4150. Do you still want to place a wager?

What the hell, dude. I thought you said the GBP/USD exchange rate was at 1.4100. Now you're going to raise the price?

That's the new price I've set for myself. So, do you want to join us? You'd better hurry before I raise my fee once more.

Fine. I'm all for it. I'm sure it will go up from 1.4150

At 1.4150, Batman is now long 10,000 units of GBP/USD. A one-pip move is worth $1.

After a few hours, Spider-Man reports that the GBP/USD exchange rate is currently at 1.4350.

The GBP/USD exchange rate has risen by 200 pips.

I'd want to call it a day at this point.

GBP/USD was at $1.4150 when the bet began. GBP/USD was at $1.4350 at the completion of the bet. The difference is therefore $0.02 or 200 pips.

However, because the bet amount is 10,000 units, Spider-Man will pay Batman $200 ($0.02 x 10,000).

Fothermucker! You appear to have won the bet once more! It has increased by 200 pips, implying that you have won $200.

Batman has made $200 with the fictitious “10,000 units” that Spider-Man dreamt up.

Spider-Man compensates him with $200 from his own pocket, as well as the original $20. (that was used as collateral).

Batman won $200 with just $20. A tenfold return!

Let's try it again. GBP/USD, I believe, will continue to....

Damnit. The Bat-Signal is activated! BRB!

After twenty minutes...

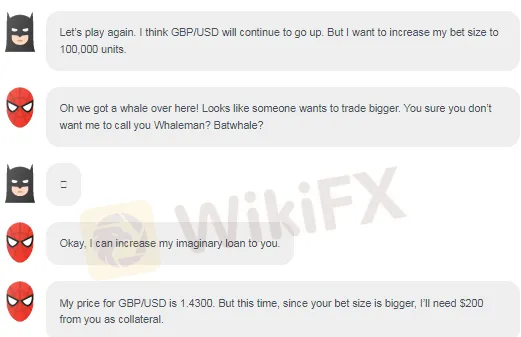

Let's try it again. I believe the GBP/USD exchange rate will continue to rise. But I'd like to boost my stake to 100,000 units.

Over here, we've got a whale! Someone appears to be looking to make a larger trade. Are you sure you don't want to be known as Whaleman? Batwhale?

Okay, I'll raise my fictitious loan to you.

My GBP/USD pricing is 1.4300. However, because your bet is larger this time, I'll need $200 from you as collateral.

Spider-Man receives the $200 he just won from Batman.

At 1.43000, Batman is now long 100,000 GBP/USD units. As a result, a one-pip move now equals $10.

GBP/USD has tumbled to 1.4295, a 5 pip decrease, in just a few minutes.

GBP/USD is now 5 pips lower. This translates to a $50 unrealized loss (5 pips x $10).

I can settle the bet right now and take $50 from your collateral as payment, then return the remaining $150 to you if you like.

No way! Don't be a bother! GBP/USD is still expected to rise, in my opinion. The wager is still open!

Okaaay.

GBP/USD plummets five minutes later.

The GBP/USD exchange rate has decreased to 1.4275. You've lost 25 pips now. This implies that you have a $250 unrealized loss. I've closed the bet and your collateral is now mine because your collateral ($200) isn't enough to cover this loss. Thank you so much for the $200!

There's a lot to unpack in this little story.

Consider the following:

· Spider-Man constructs a “guessing game” in his thoughts where you may wager on the direction of the price of anything and profit if your prediction is correct?

· Isn't it true that Spider-Man can make up any price he wants?

· Even when Batman is going to open his bet, Spider-Man can change his pricing at any time?

· Regardless of whether Batman has enough money, Spider-Man can make up any bet size he wants?

· Isn't it true that Spider-Man is always on the losing end of a wager? Is there anyone else?

This account has a wealth of information about how to trade with a retail FX broker.

Batman is you, the trader, in case it wasn't clear. Spider-Man, on the other hand, is a forex broker.

Notice how neither Spider-Man nor Batman owned any British pounds. There were no actual quids exchanged. They were just placing dollar-denominated bets on the GBP/USD exchange rate.

You don't own the currencies when you trade FX in the retail market.

You're essentially betting with your forex broker on whether a currency pair's price will climb or fall.

The payment is the difference in price between when the bet was placed and when it was settled.

Depending on who is at fault, you or the broker will be responsible for the difference.

For you, the danger is that your forex broker defaults or runs out of money before paying you any winnings you've achieved.

Let's go back to the beginning of the story to understand how this could happen.

The next morning, Batman and Spider-Man have breakfast together.

After they've finished their avocado toasts with chopped nuts and smoked olive oil, Batman looks Spider-Man in the eyes and says,

“Let's play that guessing game again.” Today, I believe GBP/USD will rise. The size of my wager will be 100,000 units.

Okay. The price of my GBP/USD is 1.4300. I'll need $200 from you as collateral once more.

Spider-Man is given $200 by Batman.

If you didn't notice, Spider-Man generated a 100,000-unit position size using only $200 in “margin.” Leveraged trading is exemplified by this example.

After an hour, Batman inquires about the current GBP/USD exchange rate.

The GBP/USD exchange rate is now at 1.4600.

Booyah! The GBP/USD exchange rate has increased by 300 pips! I've got $3,000 profit at $10 per pip! I'm going to get myself a new Batboat.

Congratulations, but there's an issue.

What?

I'm unable to pay. I am unable to do so due to a lack of funds.

What do you mean you're short on cash?! You, on the other hand, accepted the wager!

That's exactly what I did. But I didn't expect to lose. The $200 you provided me as collateral is the only money I have. That's something I can return to you.

WTF?! What happened to my $3,000?

Spider-Man raises his head and points to the sky....

Take a look! The Bat-Signal has arrived!

When Batman raises his eyes, he sees nothing. When he returns his gaze to the ground, he notices that Spider-Man has vanished!

The “home went bust” in this scenario.

Spider-Man gambled on the opposite side of Batman's wager, but he lacked the funds to meet his duty to Batman.

This is referred to as “counterparty credit risk” (Can the transaction's other party pay?).

When you open a trade with a forex broker, you and the broker become the trade's counterparties.

The broker, like Spider-Man, takes the opposing side of your wager.

Are you certain it will be able to meet its obligations to you?

While your broker ensures that you will be able to pay if it wins (and you lose), you must equally ensure that your broker will be able to pay if you win (and it loses)!

Spider-Man likewise left without returning the $200 used as collateral, resulting in Batman losing all of the money he handed to Ant-Man.

Spider-Man took Batman's money and ran (jumped?) away, never to be seen again until his next film.

Legitimate forex brokers would rather continue in business than go out of business and take your money. They, unlike the unscrupulous Spider-Man, have strategies for dealing with this danger.

In a subsequent course, we'll take a closer peek under the hood and explain what happens when a forex broker executes your trades. You'll discover how forex brokers manage their risk in order to avoid going bankrupt.

However, this is only one (of several) factors to consider when selecting a forex broker.

It's crucial to understand how a typical retail forex broker operates in order to correctly evaluate retail forex brokers, so here's what we'll go over:

With whom are you trading?

You won't know who you're trading with, unlike Batman in the story above. Even if you did, that doesn't imply you should put your faith in them blindly. Even Batman was misled by an allegedly “nice guy” fellow superhero.

Your forex broker is a faceless corporation that requires you to send it money in order to conduct business with it.

Are you certain they are who they claim to be? Is it a reputable firm that offers genuine forex trading services? Is it a fore broker that isn't real? How do you know the corporation won't just disappear with your money?

Who exactly are you trading with? Is this a trustworthy broker?

What exactly are you trading?

Notice how neither Spider-Man nor Batman owned any British pounds. There were no actual pounds exchanged. They were just placing dollar-denominated bets on the GBP/USD exchange rate.

So, what exactly are you trading if you're not truly buying or selling?

What are your genuine trading locations?

Notice how Spider-Man used his imagination to establish a “market” for Batman (to wager on the direction of the GBP/USD price)?

Also, did you note that there were just two people involved?

When Batman placed a wager, Spider-Man did not go out into the “market” to find someone to take the other side of the wager.

Spider-Man just backed the underdog in all of Batman's wagers.

Real bets were made and expected to be honored as long as both parties agreed on the terms. There were no other people involved.

So where are you trading if you're not in the “market”?

How do FX traders deal with risk?

Notice how the price of GBP/USD shifted negatively against Spider-Man during the last bet between Spider-Man and Batman, and he ended up not having the money to pay?

Because Spider-Man is the only person betting against Batman, Batman should have double-checked that Spider-Man would be a solid bet.

Retail forex brokers should be treated with the same caution, as they operate in a similar manner.

So, how can your forex broker avoid going bankrupt if it continually takes the other side of your trades? And you're bringing your money down with you?

Are the rates your forex broker quotes you reasonable?

Take note of Spider-ability Man's to quote any price he wants.

Fortunately, Batman was astute enough to use his Batphone and consult a third-party data source (Google) to confirm that Spider-price Man's was correct.

But what happens if he doesn't? Spider-Man might continue to make up prices in his favor after the bet was placed. For example, he could claim that the GBP/USD has dropped 500 pips (when it hasn't), forcing Batman to wager at a loss.

So how do you know the rates you see on the trading platform are fair if your forex broker can quote you whatever price it wants? What is the source of the prices?

What is the order execution quality of your FX broker?

Notice how Batman tried to place a wager when the GBP/USD exchange rate was at 1.4100, but Spider-Man declined and adjusted it to 1.4150 instead?

Slippage is the term for this.

The discrepancy between a trade's estimated price and the price at which it is actually performed is known as slippage.

Slippage can happen for a variety of reasons, and it can both help and hurt a trader.

Negative slippage occurred in Batman's case, meaning Spider-Man gave him a lower price than expected. As a result, the profit or loss is reduced.

Even if a pricing is precise and reasonable, it matters nothing if your order cannot be fulfilled at that price.

How can you tell if its order execution is up to par? Where will orders be fulfilled at the pricing you specify?

In the following classes, we'll go over these concepts in depth (and more).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Currency Calculator