Company Summary

| Aspect | Information |

| Company Name | TradeATF |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years |

| Regulation | Unregulated |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:500 |

| Spreads | starting from 0.0 pips |

| Trading Platforms | MT4, MetaTrader WebTrader, Mobile Trading App |

| Tradable Assets | Forex, CFDs on stocks, indices, commodities, and cryptocurrencies |

| Account Types | Silver, Gold, and Platinum |

| Demo Account | Yes |

| Customer Support | 24/5 live chat, email (Support@global.tradeatf.com), phone, Twitter https://twitter.com/TradeATF, Facebook (https://www.facebook.com/TradeATF/) |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Card, e-Wallets, and Cryptocurrency |

| Educational Resources | webinars, trading tutorials, and eBooks. |

Overview of TradeATF

TradeATF is a UK-based trading platform established within the last 2-5 years. Notably, it operates without specific regulations. With a low minimum deposit of $50 and a high maximum leverage of 1:500, it caters to traders of various risk levels.

The platform offers trading in Forex, CFDs on stocks, indices, commodities, and cryptocurrencies. Utilizing user-friendly platforms like MT4, MetaTrader WebTrader, and a mobile app, TradeATF provides competitive spreads starting from 0.0 pips.

Traders can choose from different account types - Silver, Gold, and Platinum - with a demo account available for practice. Customer support is accessible 24/5 through live chat, email, phone, Twitter, and Facebook.

Deposits and withdrawals are facilitated through Bank Wire Transfer, Credit/Debit Card, e-Wallets, and Cryptocurrency. TradeATF also emphasizes trader education, providing webinars, trading tutorials, and eBooks to enhance users' market knowledge and skills.

Regulatory Status

TradeATF operates as an unregulated trading platform, meaning it does not fall under the oversight of any financial regulatory authority. Traders and investors should be aware that the absence of regulatory supervision may entail additional risk.

In unregulated environments, clients may have limited recourse and protection in the event of disputes or unforeseen issues. It's essential for individuals considering TradeATF to exercise caution and carefully assess their risk tolerance when engaging with an unregulated broker.

Pros and Cons

| Pros | Cons |

| Low minimum deposit | Limited regulatory oversight |

| Wide variety of tradable assets | Limited payment methods |

| Competitive spread | Limited educational resources |

| User-friendly trading platforms | Potential for conflicts of interest |

| 24/5 customer support | Limited track record |

Pros of TradeATF:

Low minimum deposit: TradeATF has a low minimum deposit of $50, making it accessible to a wide range of traders.

Wide variety of tradable assets: TradeATF offers a wide variety of tradable assets, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Competitive spreads: TradeATF offers competitive spreads on its tradable assets.

User-friendly trading platforms: TradeATF offers user-friendly trading platforms, including MT4, MetaTrader WebTrader, and a mobile trading app.

24/5 customer support: TradeATF offers 24/5 customer support via live chat, email, and phone.

Cons of TradeATF:

Limited regulatory oversight: TradeATF is not regulated by any major financial regulator.

Limited payment methods: TradeATF only accepts a limited number of payment methods, including credit/debit cards, bank transfers, and e-wallets.

Limited educational resources: TradeATF offers limited educational resources compared to some other brokers.

Potential for conflicts of interest: TradeATF is a market maker, which means that it may trade against its clients.

Limited track record: TradeATF is a relatively new broker, so it has a limited track record.

Market Instruments

TradeATF offers a wide variety of trading instruments, including Forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Forex: Forex trading is the buying and selling of currencies. TradeATF offers a wide variety of forex pairs to trade, including major pairs like EUR/USD and USD/JPY, minor pairs like EUR/NZD and AUD/NZD, and exotic pairs like EUR/TRY and USD/MXN.

CFDs on Stocks: CFDs (contracts for difference) are a type of derivative that allow traders to speculate on the price of a stock without actually owning the stock. TradeATF offers CFDs on stocks from a variety of exchanges, including the New York Stock Exchange (NYSE), the Nasdaq Stock Market, and the London Stock Exchange (LSE).

CFDs on Indices: Indices are baskets of stocks that track a particular market or sector. TradeATF offers CFDs on indices from a variety of exchanges, including the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite.

CFDs on Commodities: Commodities are raw materials that can be traded on exchanges. TradeATF offers CFDs on commodities like gold, silver, oil, and natural gas.

Cryptocurrencies: Cryptocurrencies are digital or virtual tokens that use cryptography for security. TradeATF offers CFDs on cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Account Types

TradeATF offers two types of trading accounts: Standard, Silver, and Gold. All accounts offer attractive trading conditions and provide a wide range of base currencies to suit the preferences of different traders.

Traders can select the account type that aligns with their trading strategy and enjoy competitive spreads and high leverage for enhanced trading opportunities.

| Account Type | Opening Deposit | Leverage | Spreads | Features |

| Standard | $50 | 1:300 | 1-2 pips | Basic account with access to all trading instruments |

| Silver | $500 | 1:400 | 0.5-1 pip | Account with competitive spreads and access to educational resources |

| Gold | $5,000 | 1:500 | 0.2-0.5 pip | Premium account with tight spreads, personalized account manager, and access to exclusive analysis |

How to Open an Account?

Opening an account with TradeATF is a straightforward process that can be completed in a few simple steps. Here's a step-by-step guide on how to open an account with TradeATF:

Step 1: Visit the TradeATF Website

Begin by navigating to the official TradeATF website. Once you reach the homepage, locate the “Open Account” button, typically situated in the top right corner of the page. Clicking this button will initiate the account opening process.

Step 2: Complete the Registration FormUpon clicking the “Open Account” button, you'll be directed to a registration form. Carefully fill out the form with accurate personal information, including your full name, email address, phone number, and country of residence. Ensure that all details are entered correctly to avoid any delays in processing your application.Step 3: Verify Your IdentityTradeATF adheres to strict regulatory requirements and requires identity verification to ensure the security of its clients' funds. As part of the account opening process, you'll be prompted to upload copies of valid identification documents, such as a passport or driver's license. This step is crucial for preventing fraudulent activities and maintaining the integrity of the trading platform.Step 4: Make an Initial DepositOnce your identity verification is complete, you'll need to make an initial deposit to activate your trading account. TradeATF offers a variety of convenient deposit methods, including credit/debit cards, bank transfers, and e-wallets. Choose the method that best suits your preferences and proceed with the deposit process.Step 5: Download and Install MT4 Trading PlatformTradeATF provides the popular MetaTrader 4 (MT4) trading platform for its clients. To access and utilize the platform, you'll need to download and install it on your computer. The MT4 platform offers a range of features and tools to facilitate your trading activities.

Leverage

TradeATF offers up to 1:500 leverage on all account types. Leverage allows traders to control a larger position size with a smaller amount of margin. For example, if you have a leverage of 1:100, you can control a position of $10,000 with a deposit of $100.

Leverage can amplify your profits, but it can also amplify your losses. It is important to use leverage wisely and to understand the risks involved.

Spreads & Commissions

TradeATF offers competitive spreads on a variety of forex pairs, commodities, and indices. Spreads are typically variable, but they are generally tighter for more liquid instruments. For example, the average EUR/USD spread is 0.1 pips, while the average GBP/USD spread is 0.2 pips.

TradeATF offers three account types: Silver, Gold, and Platinum. Each account type has its own set of spread conditions and trading features.

| Account Type | Minimum Spread | Minimum Deposit |

| Silver | 0.2 pips | $100 |

| Gold | 0.1 pips | $500 |

| Platinum | 0.0 pips | $10,000 |

TradeATF does not charge any commissions on forex trades. However, there is a small swap fee that is charged on overnight positions. The swap fee is typically 1-2 pips per night for major forex pairs.

Overall, TradeATF offers competitive spread conditions and trading fees. There are no additional fees for any of the account types.

Here is a table summarizing the spread conditions and fees for each account type:

| Account Type | Minimum Spread | Minimum Deposit | Swap Fee | Commissions |

| Silver | 0.2 pips | $100 | 1-2 pips | None |

| Gold | 0.1 pips | $500 | 1-2 pips | None |

| Platinum | 0.0 pips | $10,000 | 1-2 pips | None |

Trading Platform

TradeATF provides traders with a choice of three distinct trading platforms, each tailored to meet diverse trading styles and preferences.

MetaTrader 4 (MT4): a widely acknowledged and versatile trading interface. MT4 is renowned for its user-friendly design, advanced charting tools, and extensive customization options. Its popularity among forex traders is attributed to its comprehensive technical analysis capabilities and robust support for automated trading through Expert Advisors (EAs).

MetaTrader WebTrader: a web-based trading platform designed to eliminate the need for software downloads. This platform provides a streamlined interface along with essential trading functionalities, making it an optimal choice for those who prefer the convenience of browser-based trading. MetaTrader WebTrader ensures accessibility from any device with an internet connection and features real-time quotes, charting tools, and order management capabilities.

Mobile Trading App: A versatile solution offering on-the-go access to forex markets. This app, compatible with both iOS and Android devices, empowers traders to monitor positions, execute trades, and manage accounts from virtually anywhere. The Mobile Trading App provides real-time market data and quotes, facilitates order placement and management directly from the mobile device, offers account monitoring and balance information, and includes technical analysis tools with charting capabilities. Its user-friendly interface ensures seamless navigation, delivering a comprehensive mobile trading experience.

Deposit & Withdrawal

TradeATF makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies.

| Method | Deposit Fee | Withdrawal Fee | Processing Time |

| Bank Wire Transfer | $30 | $45 | 3-5 business days (deposit), 5-7 business days (withdrawal) |

| Credit/Debit Card | 2.50% | N/A | 1-2 business days (deposit) |

| e-Wallets | Varies | Varies | Varies |

| Cryptocurrency | $0 | $0 | 1-2 hours |

Customer Support

TradeATF offers comprehensive customer support through various channels to assist users effectively. The customer support services include:

24/5 Live Chat:

TradeATF provides a live chat feature available 24 hours a day from Monday to Friday. This real-time support allows users to get immediate assistance and address any queries they may have.

Email:

Users can reach out to TradeATF's support team via email atSupport@global.tradeatf.com. This provides a formal channel for communication, allowing users to detail their concerns or inquiries.

Phone:

TradeATF offers phone support, allowing users to contact the customer support team directly. This direct communication channel is beneficial for resolving complex issues or seeking personalized assistance.

Twitter:

The official Twitter account of TradeATF, accessible athttps://twitter.com/TradeATF, serves as an additional platform for customer support. Users can engage with the support team, stay updated on announcements, and seek assistance via direct messages.

Facebook:

TradeATF maintains an official Facebook page athttps://www.facebook.com/TradeATF/. Users can connect with the support team through this social media platform, making it convenient for those who prefer to use Facebook for communication.

These multiple channels ensure that TradeATF users have flexibility in choosing the communication method that best suits their preferences and needs. Whether it's through live chat, email, phone, Twitter, or Facebook, TradeATF aims to provide accessible and responsive customer support.

Educational Resources

TradeATF provides a robust suite of educational resources aimed at empowering traders with knowledge and skills to enhance their trading experience. These resources encompass webinars, trading tutorials, and eBooks.Webinars: TradeATF offers live webinars, creating a dynamic platform for traders to engage with experts in real-time. These sessions cover a wide range of topics, including market analysis, trading strategies, risk management, and platform tutorials. Webinars provide an interactive learning environment, allowing participants to ask questions and gain insights directly from experienced professionals.Trading Tutorials: The trading tutorials provided by TradeATF serve as comprehensive guides for both novice and experienced traders. These tutorials cover various aspects of trading, from understanding market fundamentals to utilizing advanced technical analysis tools. The tutorials are structured to cater to different skill levels, ensuring accessibility for traders at all stages of their journey.eBooks: TradeATF enriches the educational experience with a collection of eBooks. These electronic publications delve into specific topics in-depth, offering detailed insights, strategies, and market dynamics. Whether focusing on fundamental analysis, technical indicators, or trading psychology, these eBooks provide traders with valuable resources for self-paced learning.

By offering a diverse range of educational resources, TradeATF aims to empower traders with the knowledge and skills necessary to make informed decisions in the dynamic world of financial markets.

Conclusion

In summary, TradeATF has its merits and drawbacks. On the positive side, it offers a low minimum deposit of $50, a variety of tradable assets, competitive spreads, and user-friendly platforms. Customer support is available 24/5. However, potential concerns include the lack of major regulatory oversight, limited payment methods, fewer educational resources compared to some competitors, and the fact that TradeATF acts as a market maker, which may pose conflicts of interest. Additionally, being a newer broker, it lacks an extensive track record. Traders should weigh these factors to decide if TradeATF aligns with their preferences and risk tolerance.

FAQs

Q: What is the minimum deposit required on TradeATF?

A: The minimum deposit on TradeATF is $50, making it accessible to a wide range of traders.

Q: What types of assets can I trade on TradeATF?

A: TradeATF offers a diverse range of tradable assets, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Q: Are the spreads competitive on TradeATF?

A: Yes, TradeATF provides competitive spreads on its tradable assets.

Q: What trading platforms are available on TradeATF?

A: TradeATF offers user-friendly trading platforms, including MetaTrader 4 (MT4), MetaTrader WebTrader, and a mobile trading app.

Q: How can I contact customer support on TradeATF?

A: TradeATF offers 24/5 customer support through live chat, email, and phone.

Q: What payment methods are accepted on TradeATF?

A: TradeATF accepts a limited number of payment methods, including credit/debit cards, bank transfers, and e-wallets.

Q: Does TradeATF provide educational resources?

A: While TradeATF offers some educational resources, it may be considered limited compared to some other brokers.

Q: Is there a potential for conflicts of interest with TradeATF?

A: Yes, TradeATF operates as a market maker, which means there is a potential for conflicts of interest as they may trade against their clients.

Q: How long has TradeATF been in operation?

A: TradeATF is a relatively new broker, so it has a limited track record in the industry.

Mayaz Ahmad

Bangladesh

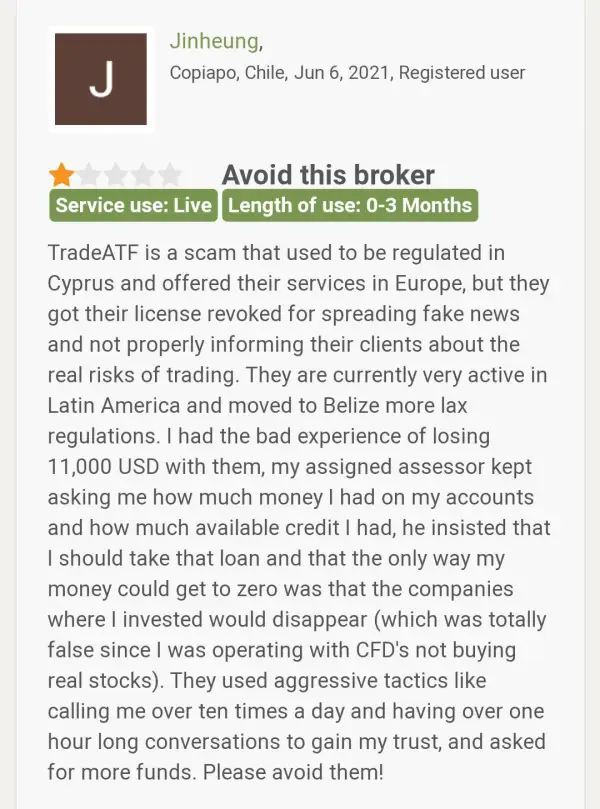

A client of TradeATF has lost a lot of money from his account and he claims this broker used to aggressively ask him to invest more money before he lost a sum of $11000. The client also informs, this broker had its license revoked in Cyprus for unethical practices.

Exposure

FX2936843563

Paraguay

I have been cheated by this broker. I dpeosited €4,719 cuz I trusted them. And they promised high returns and instant withdrawals. But when I asked for my money afte a week, there was no response. Help me

Exposure

张艳威

United States

My goodness, TradeATF's website says it will no longer provide/carry out investment services/activities and/or enter into any business transaction with any person nor accept any new clients. In a way, it's better than closing the URL without saying a word, isn't it?

Positive

FX1200429457

Colombia

How odd! When I open your website I see that this company states that it will not offer or carry out a transaction service with customers or receive new users. I think he's a con man who now wants to quit his business and run off with the money.

Positive