Basic Information

United Kingdom

United Kingdom

Score

United Kingdom | 5-10 years |

United Kingdom | 5-10 years |https://argentex.com/

Website

Rating Index

Influence

D

Influence index NO.1

India2.55

India2.55 Forex License

Forex License No forex trading license found. Please be aware of the risks.

United Kingdom

United Kingdom  argentex.com

argentex.com  Ireland

Ireland

JEFFREY THOMAS ALAN PARKER

United Kingdom

Director

Start date

Status

Employed

ARGENTEX GROUP PLC(United Kingdom)

RINA LADVA

United Kingdom

Director

Start date

Status

Employed

ARGENTEX GROUP PLC(United Kingdom)

GUY RICHARD GILES RUDOLPH

United Kingdom

Director

Start date

Status

Employed

ARGENTEX GROUP PLC(United Kingdom)

| ARGENTEX Review Summary | |

| Founded | 5-10 years |

| Registered Country/Region | United Kingdom |

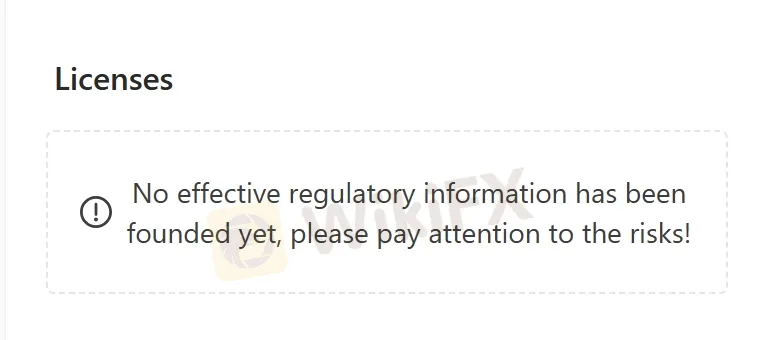

| Regulation | Unregulated |

| Services & Products | Risk management and payment solutions |

| Minimum Deposit | N/A |

| Customer Support | Phone, email, online messaging and Linkedin |

ARGENTEX is a provider of customized currency risk management and payment solutions to businesses and financial institutions. The company is listed on the London Stock Exchange and has offices located in the UK, the Netherlands, and Australia. Since 2012, they have facilitated over $200 billion in transactions on behalf of their clients, handling payments in over 140 currencies.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

| Pros | Cons |

|

|

|

|

|

|

|

- Global presence: ARGENTEX operates on a global scale, allowing them to serve clients internationally. This can be beneficial for businesses with operations or transactions in multiple countries.

- Specializing in currency risk management and payment solutions: ARGENTEX focuses specifically on currency risk management and payment solutions. This specialization means they have in-depth expertise in this field, which can be valuable for clients looking for dedicated and tailored services.

- Wide range of currencies: With the ability to transact in up to 140 currencies, ARGENTEX provides clients with a wide range of currency options, enabling them to conduct international business in various markets.

- Customized solutions: ARGENTEX provides customized solutions for their clients, taking into account their specific needs and requirements. This personalized approach can help businesses effectively manage their currency exposure and mitigate risks.

- Not regulated: One potential concern is that ARGENTEX is not regulated by financial regulatory bodies such as the Financial Conduct Authority (FCA). This lack of regulation may raise some concerns for clients who prioritize working with regulated institutions for financial services.

- Limited transparency: Detailed information on pricing, fees, and service terms are not readily available from ARGENTEX. This lack of transparency can make it difficult for potential clients to fully understand and evaluate the cost and value of their services.

ARGENTEX claims to adhere to privacy and data protection regulations, such as GDPR and the Australian Privacy Act. Adhering to these regulations shows a commitment to protecting the personal data and privacy of their users.

However, it is important to note that ARGENTEXs lack of valid regulation raises concerns about its overall safety and legitimacy. It is always recommended to conduct thorough research and exercise caution when engaging with any online platform, especially when it involves financial transactions. Consider reading reviews, checking for valid licenses, and consulting with trusted financial advisors before making any decisions.

ARGENTEX specializes in offering customized currency risk management and payment solutions for businesses and financial institutions. Here is an overview of their services and products:

ARGENTEX provides tailored currency risk management solutions to help businesses mitigate and manage their exposure to foreign exchange volatility. This includes assessing the client's risk profile, developing strategies, and implementing hedging techniques to protect against adverse currency movements.

Payment Solutions:

ARGENTEX offers efficient and cost-effective payment solutions for international transactions. They provide businesses with access to a global network of banking partners and offer competitive exchange rates, ensuring secure and timely cross-border payments.

To open an account with ARGENTEX, individuals and businesses can complete an online application form and provide a form of identification. Depending on the country of residence, additional documentation may be required, such as proof of address and extra proof of identity.

Applicants are advised to contact ARGENTEX for more information on the specific documentation needed. Once the application form and identification documents are received, the onboarding team will process the application promptly. Although occasionally additional identification documents may be required, the goal is to get clients set up as quickly as possible.

ARGENTEX's clients can be broadly categorized into four types:

Business:

ARGENTEX provides bespoke currency risk management and payment solutions to businesses of all sizes, helping them manage their exposure to foreign exchange volatility and optimize their cash flow management. Their services are aimed at businesses engaged in international trade, import/export, and cross-border payments.

Institutional:

ARGENTEX offers customized currency and accounts solutions to financial institutions, including banks, asset managers, and hedge funds. Their services are designed to help financial institutions manage their exposure to currency risk and optimize their foreign exchange operations.

HNWIs:

ARGENTEX provides a personalized currency service for high-net-worth individuals (HNWIs), allowing them to manage their foreign exchange and payment needs through a dedicated team of experts. Their services are tailored to meet the needs of HNWIs that may have international investments, property holdings, or require foreign currency for personal transactions.

Travel Companies:

ARGENTEX offers global payment and currency solutions to the travel industry, helping travel companies manage their foreign exchange requirements and optimize their cash flow management. Their services are designed to meet the needs of travel companies that may have international suppliers or require foreign currency for payments to vendors or customers.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +44 (0) 203 772 0300

Email: (Customer support ) dealing@argentex.com

Address: Argentex Group PLC, 25 Argyll Street, London, W1F 7TU, United Kingdom

Moreover, clients could get in touch with this broker through the social media, such as Linkedin.

Whats more, ARGENTEX provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information.

ARGENTEX offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

In summary, ARGENTEX operates globally and aims to provide customized solutions for businesses of all sizes. In terms of safety, ARGENTEX employs security measures to protect transactions and client data, but the lack of regulation may still be a factor to consider. It is essential for individuals and businesses to carefully assess the risks and consider their specific needs before deciding to work with ARGENTEX or any other currency risk management provider.

| Q 1: | Is ARGENTEX regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at ARGENTEX? |

| A 2: | You can contact via phone, +44 (0) 203 772 0300, email: dealing@argentex.com, online messaging and Linkedin. |

| Q 3: | What services ARGENTEX provides? |

| A 3: | It provides risk management and payment solutions. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Argentex, a London-based currency risk management and alternative banking company, has obtained an Australian Financial Services Licence (AFSL). The license, granted by the Australian Securities and Investments Commission (ASIC), allows Argentex Pty Ltd,

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now