Company Summary

| CDO Markets Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | Vanuatu |

| Regulation | VFSC (Offshore regulatory) |

| Market Instruments | Forex, metals, CFDs, crypto, crypto perpetual, options, stocks |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | 0.8 pips (STP) |

| Trading Platforms | CDO TRADER platform, MT4 |

| Minimum Deposit | $100 |

| Customer Support | Telephone, email, Whatsapp, Telegram, online messaging |

What is CDO Markets?

CDO Markets is an online broker with over 15 years of experience. The broker offers a wide range of market instruments, including Forex, metals, CFDs, cryptocurrencies, crypto perpetuals, options, and stocks. With a leverage of up to 1:500, CDO Markets provides competitive trading conditions, including a minimum spread of 0.8 pips (STP) for the EUR/USD pair. Traders can use the CDO TRADER platform or MT4 to access the markets, and the minimum deposit requirement is $100.

Pros & Cons

| Pros | Cons |

| • Diverse Range of Trading Instruments | • Offshore Regulatory Status |

| • Multiple Account Types | • High Leverage Options |

| • Competitive Spreads |

CDO Markets Alternative Brokers

There are many alternative brokers to CDO Markets depending on the specific needs and preferences of the trader. Some popular options include:

- eToro - offers a user-friendly interface and a wide range of trading instruments, a good choice for beginners and those interested in social trading.

- Interactive Brokers - With its advanced trading tools, competitive pricing, and extensive range of global markets, Interactive Brokers is recommended for experienced traders who require a robust and customizable trading platform.

- TD Ameritrade - Known for its comprehensive research offerings, educational resources, and a user-friendly trading platform, TD Ameritrade is a solid choice for investors seeking a combination of investment guidance and self-directed trading options.

Is CDO Markets Safe or Scam?

CDO Markets' safety and legitimacy should be considered with caution due to its offshore regulatory status with a Retail Forex License. While the brokerage offers a range of trading instruments, account types, and trading tools, the absence of robust regulatory oversight from a reputable authority like the US SEC or UK FCA may raise concerns for some traders.

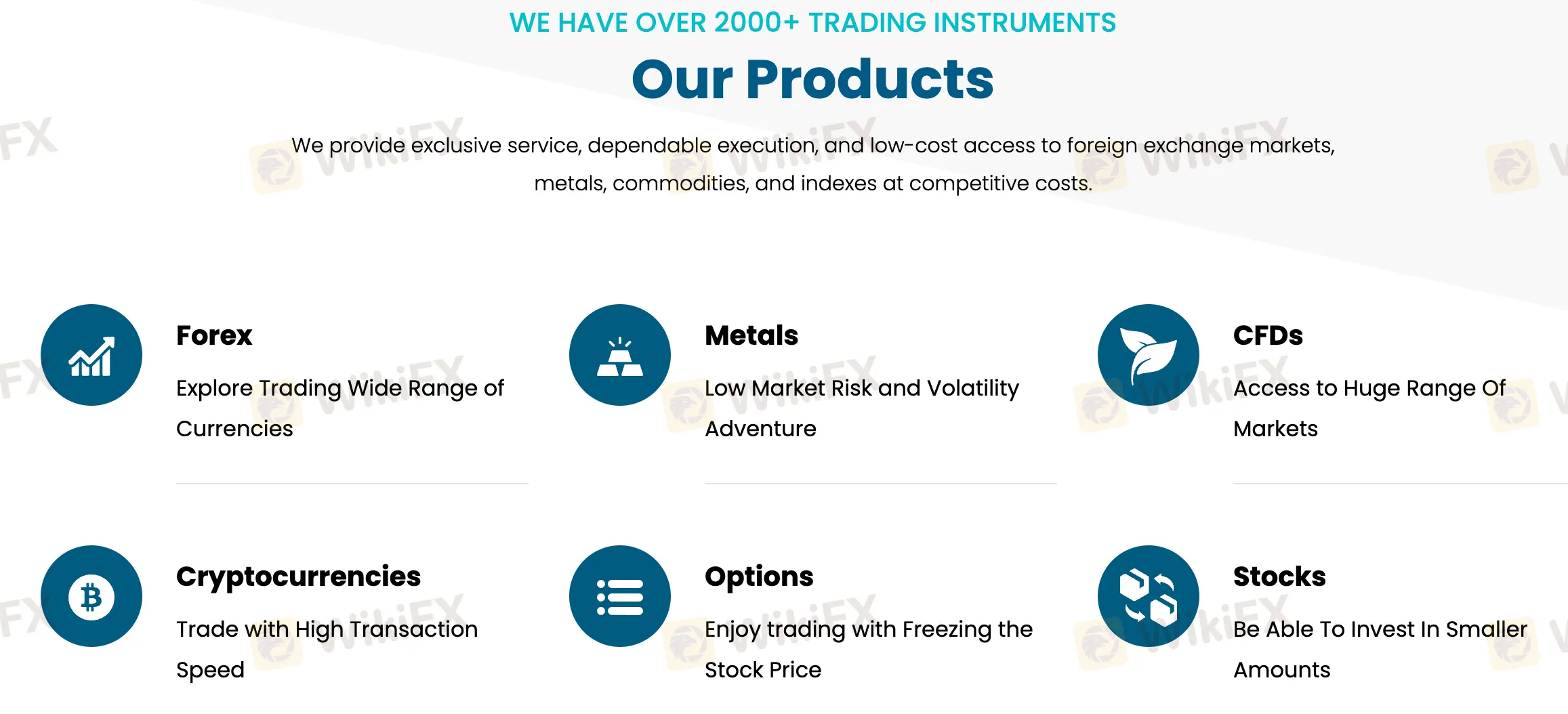

Market Instruments

CDO markets offers over 2,000+ trading instruments with exclusive service and low-cost access to foreign exchange markets, metals, commodities, and indexes at competitive costs.

| Product | Available |

|---|---|

| Forex | ✅ |

| Metals | ✅ |

| CFDs | ✅ |

| Cryptocurrencies | ✅ |

| Options | ✅ |

| Stocks | ✅ |

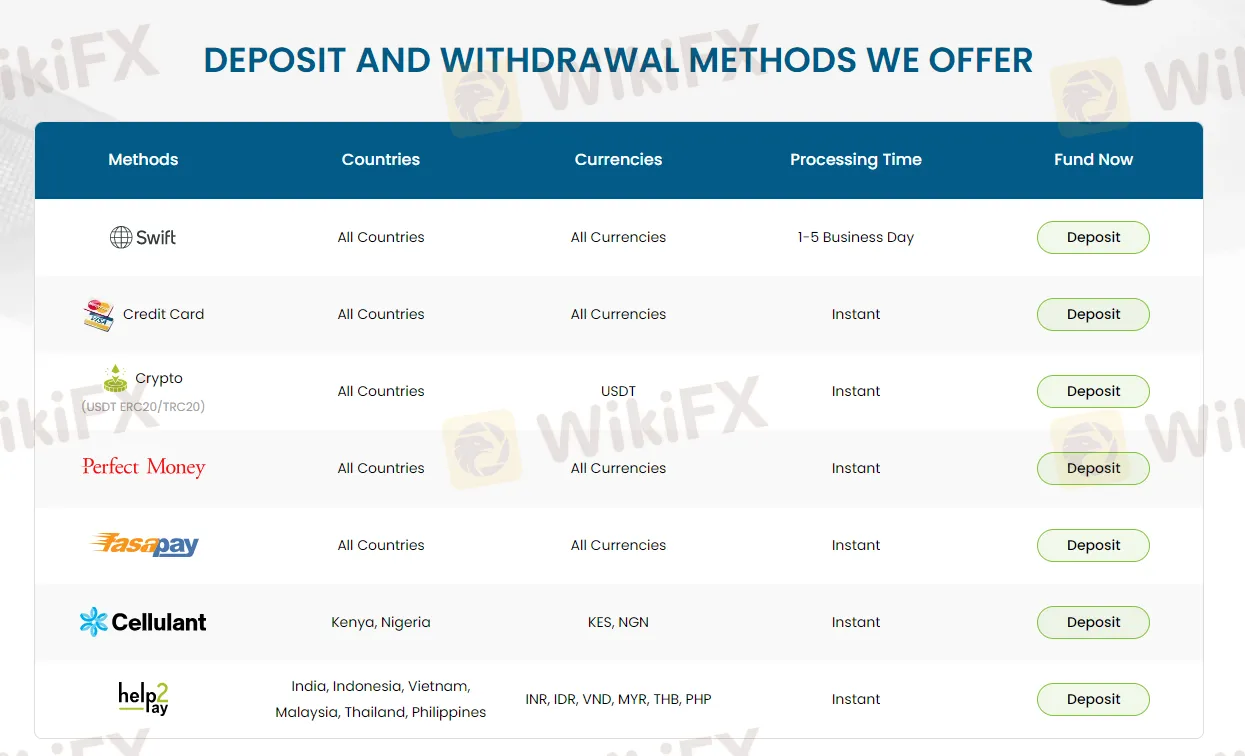

Deposit and Withdrawal Methods

| Method | Countries | Currencies | Processing Time | Action |

|---|---|---|---|---|

| SWIFT | All Countries | All Currencies | 1-5 Business Days | Deposit/Withdrawal |

| Credit Card | All Countries | All Currencies | Instant | Deposit |

| Crypto (USDT ERC20/TRC20) | All Countries | USDT | Instant | Deposit |

| Fasapay | All Countries | All Currencies | Instant | Deposit |

Deposit and Withdrawal Process

- Deposit: Log into your My CDO customer portal and go to the deposit page to fund your account easily.

- Withdrawal: To withdraw, log in to My CDO, fill out the withdrawal form, and submit your request. Withdrawals are processed quickly and efficiently.

Account Types

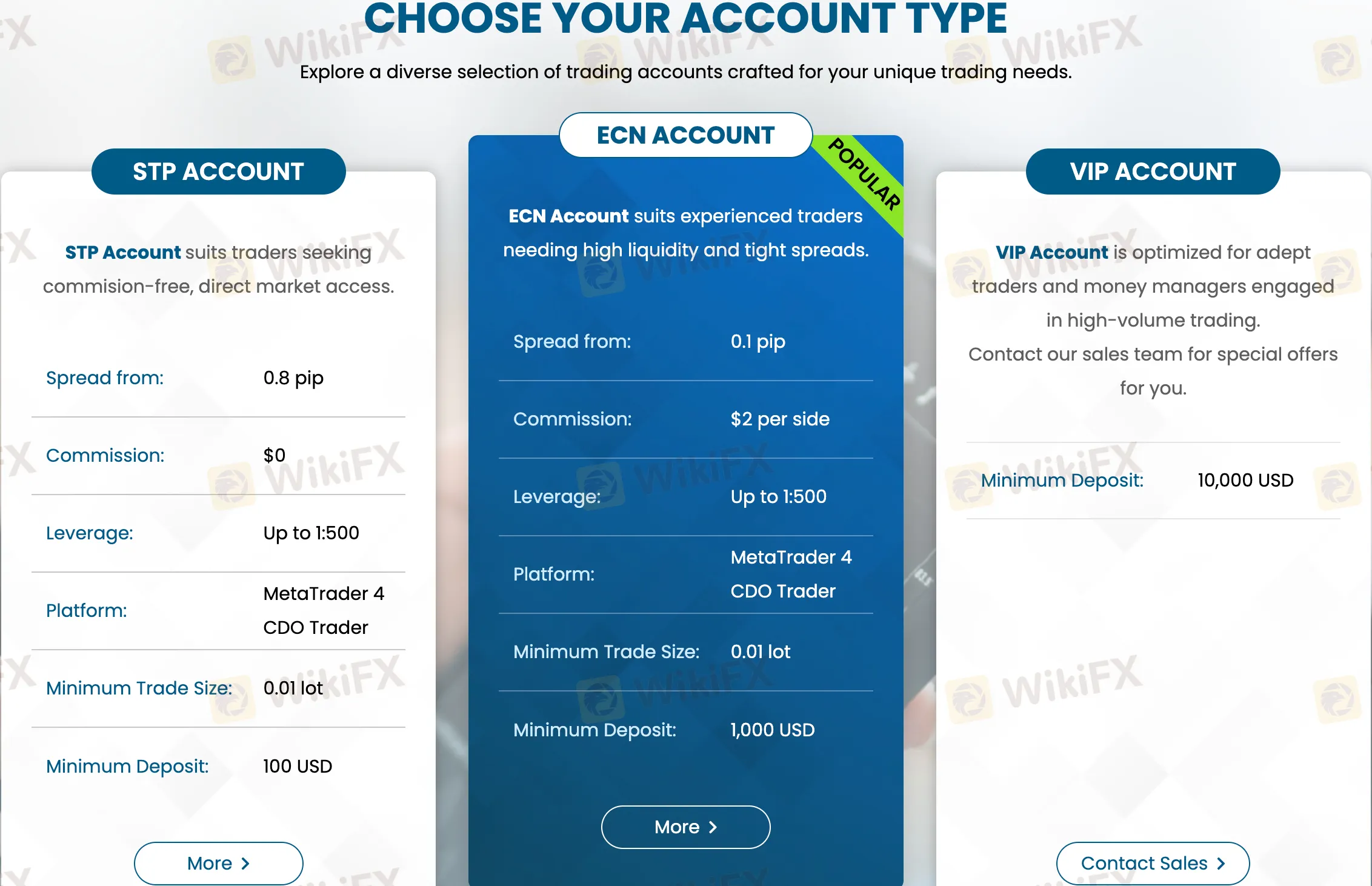

CDO Markets offers a range of account types to accommodate diverse trader preferences and experience levels.

Their STP accounts, requiring a minimum deposit of $100 USD, are ideal for those seeking simplicity and competitive spreads, as orders are processed directly to liquidity providers.

For more experienced traders, ECN accounts, with a minimum deposit of $1,000 USD, grant access to the broader market, featuring tighter spreads and a commission-based fee structure.

On the other hand, VIP accounts, requiring a minimum deposit of $10,000 USD, cater to high-net-worth individuals and professional traders by offering premium services, including personalized support, priority execution, and exclusive trading tools.

These account options enable traders to select the most suitable account based on their trading style, capital, and desired level of service.

| Account Type | Minimum Deposit |

| STP | 100USD |

| ECN | 1000USD |

| VIP | 10000USD |

Islamic Account

Saxo Bank offers Islamic accounts for clients who follow the Muslim faith. These accounts are swap-free, meaning no interest charges on overnight positions.

- Swap-Free Trading: No swap fees on overnight positions. Swap charges are refunded based on your trading volume.

- Refund Policy: At the beginning of each month, Saxo Bank calculates if youve met the required lot condition for refunding swap fees. For example, if you paid $1,000 in swaps and traded 150 lots, you would get half of the swap fees refunded.

- Account Opening: Opening an Islamic account is easy, with immediate assistance provided during the setup process.

Leverage

CDO Markets provides traders with significant leverage options for both their STP and ECN accounts, allowing for a maximum leverage of 1:500. While leverage can enhance trading opportunities, it also increases the exposure to market fluctuations, potentially leading to substantial losses if not used prudently. Traders should carefully assess their risk tolerance, trading strategies, and risk management practices when utilizing such high leverage levels to ensure they make informed and responsible trading decisions. Additionally, it's important to be aware that leverage levels may be subject to regulatory restrictions in certain jurisdictions, and traders should comply with applicable regulations and guidelines.

Spreads & Commissions

At CDO Markets, traders can benefit from competitive spreads, with STP (Straight Through Processing) accounts offering spreads starting at 0.8 pips, making them a cost-effective choice. These STP accounts come with the advantage of zero commissions, appealing to traders who prefer fee-free trading.

On the other hand, ECN (Electronic Communication Network) accounts offer even tighter spreads, beginning at 0.1 pips, ideal for those who prioritize minimal trading costs. However, ECN accounts have a commission fee of $2 per side, aligning with the common industry practice of commission-based pricing for direct market access. Traders can choose between these options based on their trading preferences, cost considerations, and strategies.

Trading Platforms

CDO Markets provides its clients with a choice of trading platforms, including the proprietary CDO TRADER platform and the widely recognized MetaTrader 4 (MT4).

CDO TRADER offers a user-friendly interface, advanced charting tools, and a range of technical indicators, making it suitable for both beginner and experienced traders.

Meanwhile, MT4 is a versatile platform known for its extensive functionality, allowing traders to access a wide variety of financial instruments, employ algorithmic trading strategies, and utilize expert advisors (EAs).

With these platform options, CDO Markets caters to the diverse needs and preferences of its clientele, offering a comprehensive trading experience.

Trading Tools

CDO Markets provides traders with a suite of valuable trading tools to enhance their decision-making and risk management capabilities.

These tools include a Forex Profit Calculator, which assists traders in estimating potential profits for their forex trades.

The Forex Margin Calculator helps traders determine the required margin for their positions, ensuring they have adequate funds to support their trades.

Additionally, the Forex Pivot Point Calculator aids in identifying key price levels, assisting traders in setting entry and exit points for their forex trades. These tools are valuable resources for traders looking to analyze and plan their forex trading strategies effectively.

Deposits & Withdrawals

CDO Markets offers a variety of convenient options for both depositing and withdrawing funds. Clients can choose from multiple methods, including Swift, Credit Card, Crypto, Perfect Money, fastpay, Cellulant, and help pay.

Swift deposits typically take 1-5 business days to process, while other payment methodsoffer the advantage of near-instantaneous transactions, ensuring that traders have quick access to their funds. This flexibility in payment options and processing times allows clients to manage their accounts efficiently and aligns with the diverse needs of traders when it comes to funding and withdrawing from their CDO Markets accounts.

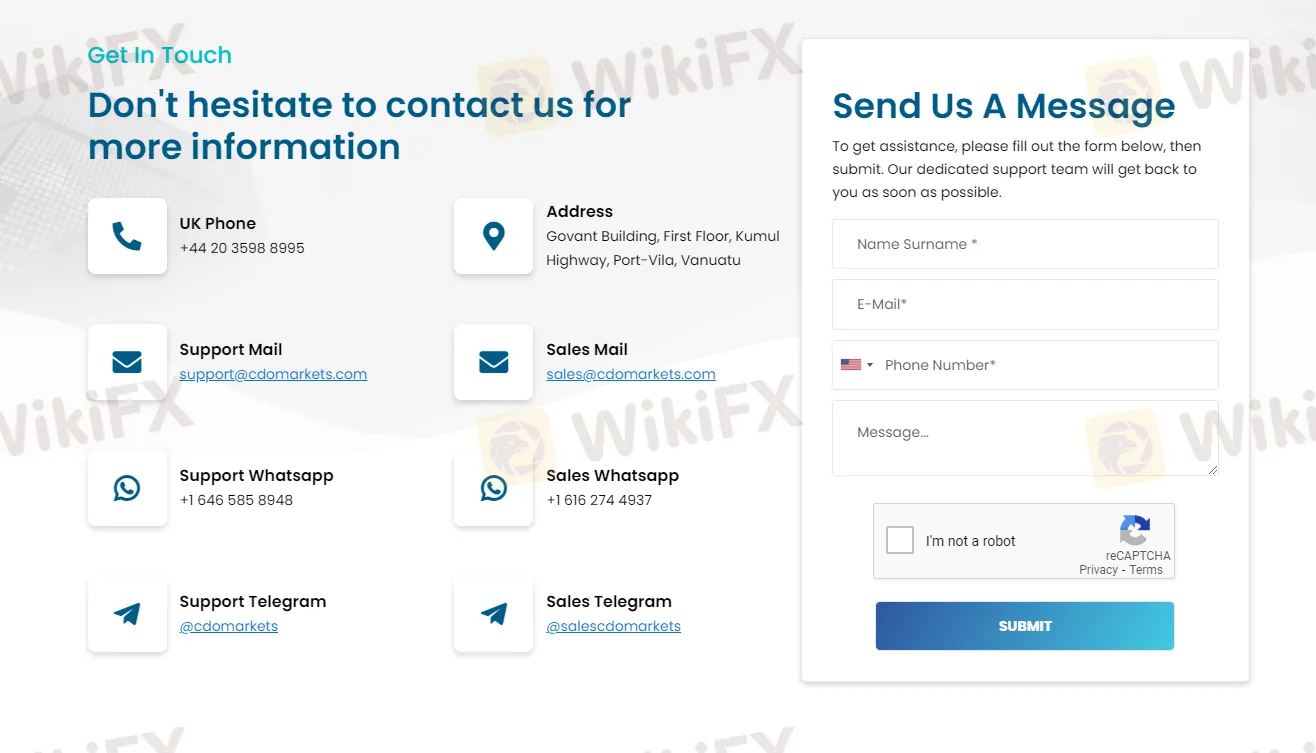

Customer Service

CDO Markets prioritizes accessible and responsive customer service, offering multiple channels for clients to seek assistance.

Clients can reach the support team via telephone at +44 20 3598 8995, email at support@cdomarkets.com, as well as through popular messaging platforms like WhatsApp and Telegram, ensuring easy and timely communication.

Additionally, an online messaging option is available for instant queries. This diverse range of customer service channels reflects CDO Markets' commitment to providing effective support and assistance to its clients.

Frequently Asked Questions (FAQs)

What is the minimum deposit requirement for a CDO Markets account?

The minimum deposit requirement for a STP account at CDO Markets is $100 USD.

What types of trading platforms are available for CDO Markets clients?

CDO Markets offers the proprietary CDO TRADER platform and MetaTrader 4 (MT4) as trading platforms for its clients.

What are the available methods for contacting CDO Markets' customer service?

CDO Markets offers customer service through telephone (+44 20 3598 8995), email (support@cdomarkets.com), WhatsApp, Telegram, and an online messaging system.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Mr. Dong25218

Australia

I love this broker, for me it is the best. It also has a wonderful academy available with great market geniuses like Don Pablo Gil with more than 40 years of experience where he explains strategies that I verify work, they are profitable and you make money a few months ago I discovered this broker and I recommend it 200%, it is also reliable, based in Spain, everything regulated and without commissions

Positive

Sok Chan

Cambodia

CDO Markets ain't the cheapest broker out there, but it's the fastest by far. They claim millisecond execution, and it's legit! No commissions on forex and CFDs, but yeah, spreads still gotta pay. Another plus? They got MT4 and inhouse platform for both computers and phones, pretty swanky. Been trading here for 6 months, mainly gold and oil CFDs. Plus, no hidden fees - withdrawals are free and usually take 1-2 days. Not bad, truly.

Positive

FXabcenter

Cambodia

CDO Markets provides manageable transaction costs, impressive customer service, and attractive offerings, including leverage up to 1:500. However, the lack of MT5 support and high investment requirement for certain account types may be off-putting to some. Despite some concerns related to it being an offshore broker, the experience so far has been positive.

Neutral

武海浩

Spain

I have been trading with this company for 1 month and so far I am satisfied and will continue to trade. Your transaction costs are within reasonable limits. The amount of spreads and commissions are not very high, which I really like. The customer service they offer is fantastic. I get a quick response and my issues are resolved quickly.

Positive

00

United States

Their spreads and customer support service are pretty good. Live chat is very fast and customer service can always give some useful suggestions kindly and patiently, which does help me a lot. The only shortcoming is that they don’t provide my favourite mt5.

Positive

项伟平

Hong Kong

Although offshore brokers are always unreliable, I tried their demo accounts, it performs well…its offerings seem so attractive, leverage up to 1:500, competitive spreads, but if you want to open an ECN account, or VIP account, you need to put more money here… I don’t know how to say, it all depends on your trading preference. I will try to open a real account here to see what is gonna happen.

Positive